Focus: GS-III Indian Economy, Industry and Infrastructure, Prelims

Why in news?

- Global stocks plunged into a bear market and oil slumped further on 12th March 2020, after stimulus efforts from the European Central Bank failed to calm investors alarmed by U.S. moves overnight to restrict travel from Europe over the spread of COVID-19.

- The price of Brent Crude (one of the main benchmarks for oil prices) has fallen from close to $52 per barrel on 6 March to $31.49 per barrel on 8 March.

- On 6 March 2020 crude oil prices crashed big time, as the cosy deal between Saudi Arabia-led the Organization of the Petroleum Exporting Countries (Opec) and Russia broke down.

- Saudi Arabia started a price war with its oil producing ally Russia last week when it slashed the official cost of crude oil to the kingdom’s buyers by the most in more than 30 years.

Current Scenario of Oil Prices in the International Market

- The Saudis, the world’s top oil exporter, are trying to destroy the shale oil industry in the US, which isn’t viable at sub-$50 per barrel and create some trouble for the Russian oil industry as well.

- While Saudi Arabia produces oil at very low rates, its government’s massive expenditure is highly dependent on high oil prices.

- As per the International Monetary Fund (IMF), the break-even price for the Saudi Arabian government to be able to meet its expenditure in 2020 is expected to be at $83.6 per barrel.

- Once we take this into account, it is easy to conclude that the Saudis cannot afford the price war for very long.

- The Russians, on the other hand, are slightly better placed.

How will this impact India?

Given that the country is the world’s third-largest crude consumer and imports close to 85% of the oil that it consumes, any fall in oil prices is a relief, as the import bill comes down.

But will the Indian consumer get to see lower petrol and diesel prices?

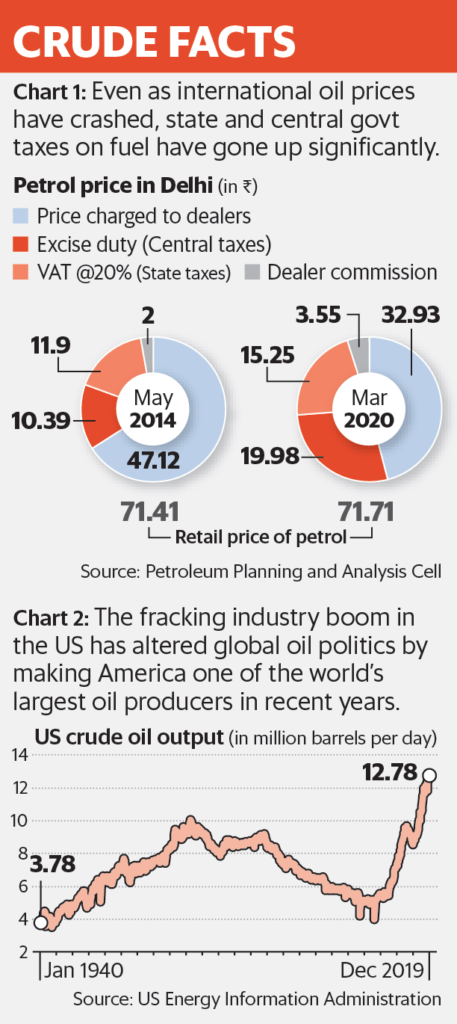

- The safe answer here is, given that state governments are facing a slowdown in tax collections, they are likely to capture some of the fall in prices by increasing the value-added tax (VAT)/sales tax they charge on petrol and diesel.

- Also, in the recent past, the central government has tended to increase the excise duty on petrol and diesel when oil prices have fallen.

Will this time be any different for Indian Consumers?

- With oil prices falling, the dollar demand for imports is going to come down and this should act in India’s favour, at a time when there is a greater pressure on the rupee

The India story

- India’s import dependency on crude oil in FY20 (April 2019 to January 2020) has shot up to 84.9%, as against 83.6% during the same period in FY19.

- Between April 2019 and January 2020, India had imported around 188.4 million tonnes of crude oil and paid $87.7 billion for it.

- The price of the Indian basket of crude oil has a fallen by 28% in a matter of days.

- There are bound to be savings on this front, at least in the short term.

- Another point that needs to be remembered here is that crude oil is bought and sold internationally in dollars.

- When an Indian company imports oil, it needs to pay for it in dollars.

- This pushes the demand for dollar vis-à-vis the rupee.

- With oil prices falling, the dollar demand for oil imports is going to come down and this should act in India’s favour at a time when there is tremendous downward pressure on the rupee.

In conclusion

- Saudis are trying to kill two birds—the US shale oil industry and the Russian oil industry—with one stone. Will they succeed? The US shale oil industry continues to remain vulnerable to low oil prices.

- Clearly, Saudi Arabia is not in a situation to sustain low oil prices for long. Given this and the fact that many US shale producers are likely to go bankrupt with the oil price falling below $50, pumping up production, at best seems like a short- to medium-term strategy for Saudi Arabia.

Brent Oil

- Brent Crude is a major trading classification of sweet light crude oil that serves as one of the two main benchmark prices for purchases of oil worldwide, the other being West Texas Intermediate.

- This grade is described as light because of its relatively low density, and sweet because of its low sulphur content.

- Brent Crude is extracted from the North Sea and comprises Brent Blend, Forties Blend, Oseberg and Ekofisk crudes (also known as the BFOE Quotation).

- The Brent Crude oil marker is also known as Brent Blend, London Brent and Brent petroleum.

- Brent is the leading global price benchmark for Atlantic basin crude oils. It is used to price two thirds of the world’s internationally traded crude oil supplies.

WTI Oil

- West Texas intermediate (WTI), also known as Texas light sweet, is a grade of crude oil used as a benchmark in oil pricing.

- This grade is described as light crude oil because of its relatively low density, and sweet because of its low sulfur content.

- It is the underlying commodity of New York Mercantile Exchange’s oil futures contracts.

- The price of WTI is often included in news reports on oil prices, alongside the price of Brent crude from the North Sea. Other important oil markers include the Dubai crude, Oman crude, Urals oil, and the OPEC reference basket.

- WTI is lighter and sweeter, containing less sulfur, than Brent, and considerably lighter and sweeter than Dubai or Oman.