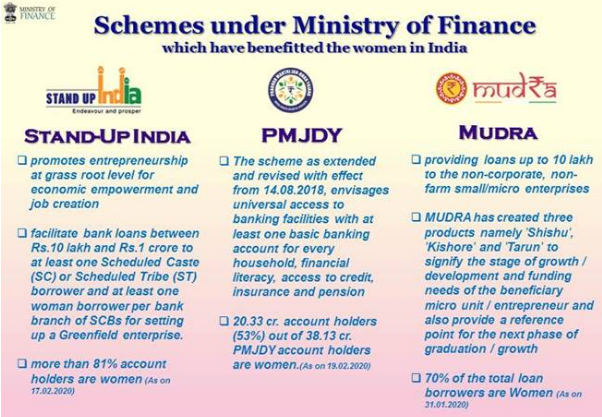

Stand Up India Scheme –

- Stand Up India Scheme was launched on 5 April 2016 to promote entrepreneurship at grass root level

- scheme seeks to leverage the institutional credit structure to reach out to the underserved sector of people such as Scheduled Caste, Scheduled Tribe and Women Entrepreneurs

- The objective of this scheme is to facilitate bank loans between Rs.10 lakh and Rs.1 crore to at least one Scheduled Caste (SC) or Scheduled Tribe (ST) borrower and at least one woman borrower per bank branch of SCBs for setting up a Greenfield enterprise.

- More than 81% account holders are Women under Stand up india scheme

Mudra- Micro Units Development & Refinance Agency

- PMMY was launched on April 8, 2015 for providing loans up to 10 lakh to the non-corporate, non-farm small/micro enterprises. These loans are classified as MUDRA loans under PMMY. These loans are given by Commercial Banks, RRBs, Small Finance Banks, MFIs and NBFCs

- Under the aegis of PMMY, MUDRA has created three products namely ‘Shishu’, ‘Kishore’ and ‘Tarun’

- 70% of the total loan borrowers are Women

PMJDY – Pradhan Mantri Jan-Dhan Yojana

PMJDY envisages universal access to banking facilities with at least one basic banking account for every adult, financial literacy, access to credit, insurance and pension

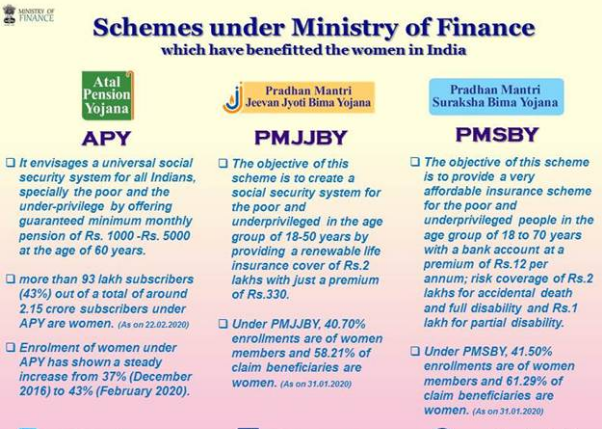

APY- Atal Pension Yojana

- Envisages a universal social security system for all Indians, specially the poor and the under-privilege by offering guaranteed minimum monthly pension of Rs. 1000 -Rs. 5000 at the age of 60 years.

- More than 93 lakh women subscribers (43%) out of a total of around 2.15 crore subscribers

PMJJBY – PM Jeevan Jyoti Bima Yojana

- Social security system for the poor and underprivileged in the age group of 18-50 years by providing a renewable life insurance cover of Rs.2 lakhs with just a premium of Rs.330.

- Under PMJJBY, 40.70% enrollments are of women members and 58.21% of claim beneficiaries are women.

PMSBY – Pradhan Mantri Suraksha Bima Yojana

- PMSBY was launched on 9th May 2015. The objective of this scheme is to provide a very affordable insurance scheme for the poor and underprivileged people in the age group of 18 to 70 years with a bank account at a premium of Rs.12 per annum; risk coverage of Rs.2 lakhs for accidental death and full disability and Rs.1 lakh for partial disability.

- Under PMSBY, 41.50% enrollments are of women members and 61.29% of claim beneficiaries are women. (As on 31.01.2020)