2019-20 — sluggish growth in Tax revenue relative to the budget estimates. Better Non-Tax revenue growth

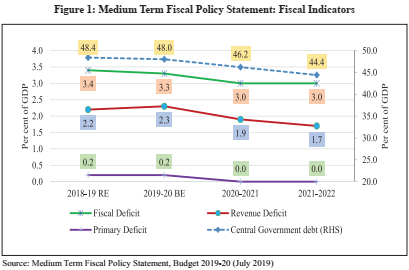

Going forward, considering the urgent priority of the Government to revive growth in the economy, the fiscal deficit target may have to be relaxed for the current year.

Government Receipts

Central government receipts can broadly be divided into Non-debt and debt receipts.

- The Non-debt receipts comprise of Tax revenue, Non-Tax revenue and Non-debt Capital receipts like recovery of loans and disinvestment receipts.

- Debt receipts mostly comprise of market borrowings and other liabilities, which the government is obliged to repay in the future.

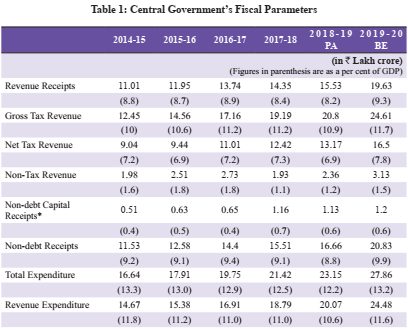

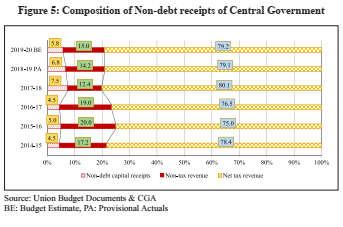

The Budget 2019-20targeted a high growth in Non-debt receipts of the Central Government, which was driven by high expected growth in Net Tax revenue and Non-Tax revenue.

TAX REVENUE

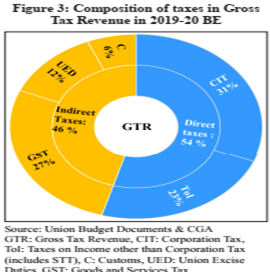

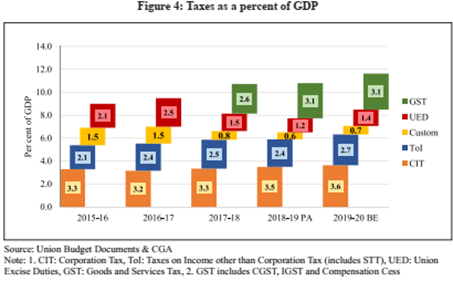

Budget 2019-20 estimated the Gross Tax Revenue (GTR) to be INR 24.61 lakh crore which is 11.7 per cent of GDP.

Direct taxes

The direct taxes, comprising mainly of corporate and personal income tax, constitute around 54 per cent of GTR. These were envisaged to grow at 11.3 per cent relative to 2018-19.

- Receipts from corporate and personal income tax have improved over the last few years. Better tax administration, widening of TDS carried over the years, anti-tax evasion measures and increase in effective taxpayers base have contributed to direct tax buoyancy.

- Widening of the tax base due to an increase in the number of indirect tax filers in the GST regime has also led to improved tax buoyancy. Going forward, sustaining improvement in tax collection would depend on the revenue buoyancy of GST.

Indirect Taxes

On the other hand, the indirect taxes were expected to grow at 7.3 per cent vis-à-vis 2018-19.

Non-Tax revenue

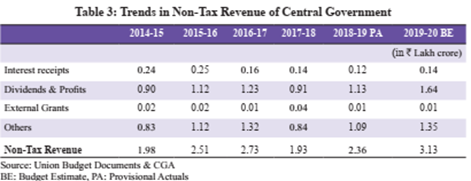

Non-Tax revenue comprises mainly of interest receipts on loans to States and Union Territories, dividends and profits from Public Sector Enterprises including a surplus of Reserve Bank of India (RBI) transferred to Government of India, receipts from services provided by the Central Government and external grants. The Budget 2019-20 aimed to raise INR 3.13 lakh crore of Non-Tax revenue, 1.5 per cent of the GDP.

Non-debt Capital receipts

Non-debt Capital receipts Non-debt Capital receipts mainly consist of recovery of loans and advances, and disinvestment receipts. The major component of Non-debt Capital receipts is disinvestment receipts that accrue to the government on the sale of public sector enterprises owned by the government (including the sale of strategic assets).

Over the last few years, the contribution of Non-debt Capital receipts has improved in the total pool of Nondebt receipts. They have been pegged at INR 1.20 lakh crore, 0.6 per cent of GDP, in 2019-20.

Expenditure

As India’s tax to GDP ratio is low, the Government faces the challenge of providing sufficient funds for investment and infrastructure expansion while staying within the bounds of fiscal prudence. Therefore, improving the composition and quality of expenditure becomes significant.

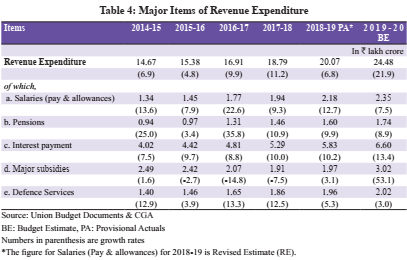

The composition of government expenditure in the last few years reveals that expenditure on defence services, salaries, pensions, interest payments, and major subsidies account for more than sixty per cent of total expenditure.

Several initiatives have been undertaken by the Ministry of Defence to improve efficiency and utilization of defence expenditure, promote self-reliance, and encourage private sector participation in the defence sector.

Expenditures on salaries, pensions, and interest payments are, generally speaking, committed in nature and therefore have limited headroom for the creation of additional fiscal space.

Budgetary expenditure on subsidies has seen significant moderation through improved targeting. There is still headroom available for further rationalization of subsidies especially food subsidy. There has been considerable restructuring and reclassification of the Central Sector and Centrally Sponsored Schemes in recent years.

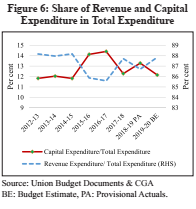

Budget 2019-20 estimated total expenditure at INR 27.86 lakh crore, comprising revenue expenditure of INR 24.48 lakh crore and capital expenditure of INR 3.39 lakh crore, which work out to be 11.6 per cent and 1.6 per cent of GDP, respectively. Analysis of Budget Estimates of expenditure in 2019-20 over 2018-19 PA suggests that Central Government budgetary expenditure is envisaged to increase by one percentage point of GDP in 2019-20. The entire increase is on revenue account with capital spending remaining unchanged as per cent of GDP.

The budgetary expenditure on major subsidies has shown a declining trend over the past years. In 2019-20 BE, the major subsidies are estimated at INR 3.02 lakh crore owing to requirements for food, fertilizer and petroleum subsidies.

The quality of expenditure is captured by the share of capital expenditure in total expenditure. Share of capital expenditure in total expenditure is envisaged to decline roughly by a percentage point in 2019-20 BE over 2018-19.

Apart from budgetary spending, Extra Budgetary Resources (EBR) have also been mobilized to finance infrastructure investment since 2016-17.

EBRs are those financial liabilities that are raised by public sector undertakings for which repayment of the entire principal and interest is done from the Central Government Budget. The government has raised EBRs of INR 88,454 crores for three years from 2016- 17 to 2018-19. It proposes to raise EBR of INR 57,004 crores in 2019-20 BE which is 0.27 per cent of GDP. These EBRs are not taken into account while calculating the Fiscal Deficit. However, they are considered in the calculations of Government Debt.

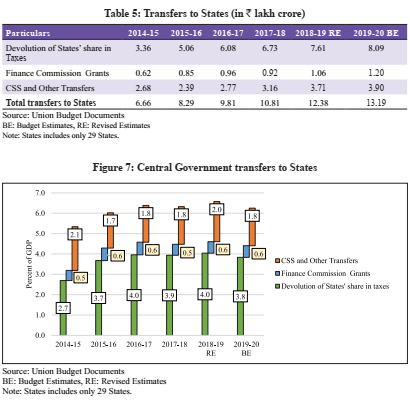

Transfer of funds to States comprises essentially of three components: share of States in Central taxes devolved to the States, Finance Commission Grants, and Centrally Sponsored Schemes (CSS), and other transfers.

- Till 2013-14, funds for CSS were routed through two channels, the Consolidated Funds of the States and directly to the State implementing agencies.

- In 2014-15, direct transfers to State implementing agencies were discontinued and all transfers to States including for the CSS were routed through the Consolidated Funds of the States.

- Both in absolute terms, and as a percentage of GDP, total transfers to States have risen between 2014-15 and 2018- 19 RE by 1.2 percentage points of GDP.

Reforms in the GST system to improve compliance

- PIN code to PIN code distance mapping in e-way bill system

- Return filing status of a GSTIN visible in public domain on the GST Portal

- Caution against a mismatch in GSTR-2A & GSTR-3B; and GSTR-1 & GSTR-3B, above a certain

- SMSs for reminders of the due date of the monthly return (On 10th, 13th, and 15th of every month) and non-filing of return.

- Free accounting & billing software provided to small taxpayers

- Questionnaire-based filing of return and showing the relevant tables to ease up the filing system

- The compliance rating score of the taxpayers available in the public domain

- Acknowledging the contribution of compliant taxpayers through certificates

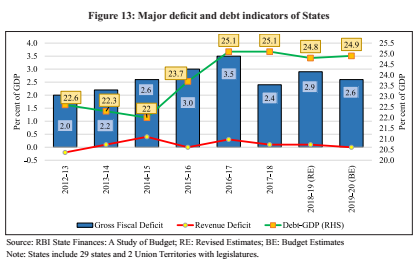

STATE FINANCES

As per 2019-20 budget estimates of the State Governments, the States’ combined own Tax revenue and own Non-Tax revenue is anticipated to grow at 11.1 per cent and 9.9 per cent respectively, which is low relative to the robust growth displayed in 2018-19 RE.

- The rising trend in revenue expenditure is driven by the rise in committed expenditure including pension and interest.

- In fact, the RBI Study on State Finances attributes the fiscal consolidation of the States in the last four to five years to the steep decline in expenditure, mainly capital, which may have adverse implications for the pace and quality of economic development, given the large welfare effects of a much wider interface with the lives of people at the federal level.

- The States have thus continued on the path of fiscal consolidation and contained the fiscal deficit within the targets set out by the FRBM Act.

- For the year 2019-20, the States have budgeted for a gross fiscal deficit of 2.6 per cent of GDP as against an estimate of 2.9 per cent in 2018-19 RE

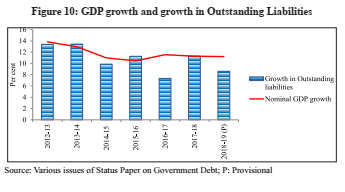

- On the other hand, the debt to GDP ratio for States has risen since 2014-15 owing to the issuance of UDAY bonds in 2015-16 and 2016-17, farm loan waivers, and the implementation of Pay Commission awards

- The Debt to GDP for States is likely to remain around 25 per cent of GDP in 2019-20, clearly making the sustainability of debt the main medium-term fiscal challenge for States.

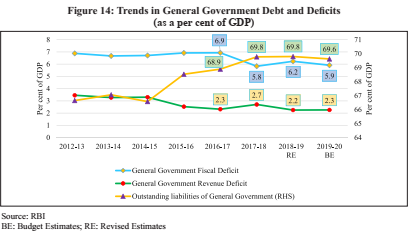

GENERAL GOVERNMENT

FINANCES

It is critical to analyse the General Government finances to get an overview of fiscal position of the Government as a whole. The General Government (Centre plus States)

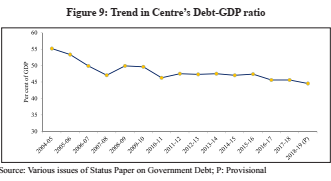

is expected to continue on the path of fiscal consolidation as the fiscal deficit of General Government is expected to decline from 6.2 per cent of GDP in 2018-19 RE to 5.9 per cent of GDP in 2019-20 BE. However the combined liabilities of Centre and States have increased to 69.8 per cent of GDP as on end-March 2019 (RE) from 68.5 per cent of GDP as on end-March 2016.

OUTLOOK

The year 2020-21 is expected to pose challenges on the fiscal front. While on one hand the outlook for global growth persists to be weak, with escalated trade tensions adding to the risk; on the other hand, the pace of recovery of growth will have implications for revenue collections.

In order to boost the sluggish demand and consumer sentiments, counter-cyclical fiscal policy may have to be adopted to create additional fiscal headroom. During the first eight months of 2019-20, the indirect tax collections have been muted. Therefore, revenue buoyancy of GST would be key to the resource position of both Central and State Governments. On the expenditure side, rationalisation of subsidies especially

food subsidy could be an important tool for expanding the headroom for fiscal manoeuvre.

The Fifteenth Finance Commission reportedly has also submitted its Interim Report and its recommendations especially on tax devolution would have implications for Central Government finances.

Finally, the geopolitical situation unfolding in West Asia is likely to have implications for oil prices and thereby on the petroleum subsidy, apart from having implications for current account balance.