- Survey says India has unprecedented opportunity to chart a China-like, labour-intensive, export trajectory.

- By integrating “Assemble in

India for the world” into Make in India, India can:

- Raise its export market share to about 3.5% by 2025 and 6% by 2030.

- Create 4 crore well-paid jobs by 2025 and 8 crores by 2030.

- The survey suggests a

strategy similar to the one used by China to grab this opportunity:

- Specialization at large

scale in labour-intensive sectors, especially network products.

- Exports of network products can provide one-quarter of the increase in value-added required for making India a $5 trillion economy by 2025.

- Focus on enabling assembling operations at a mammoth scale in network products, where production occurs across Global Value Chains (GVCs) operated by multi-national corporations

- Export primarily to markets in rich countries, like China did

- Trade policy must be an enabler.

- Specialization at large

scale in labour-intensive sectors, especially network products.

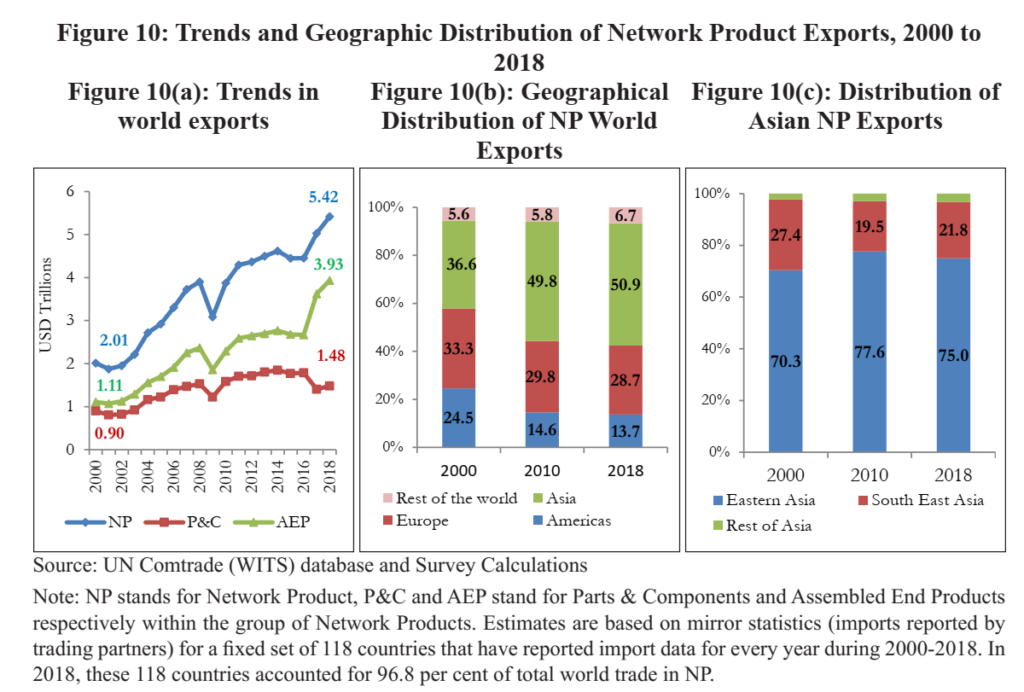

The US-China trade war is causing major adjustments in Global Value Chains (GVCs) and firms are now looking for alternative locations for their operations.

- India must focus on a group of industries, referred to as “network products”, where production processes are globally fragmented and controlled by leading Multi-National Enterprises (MNEs).

- Examples of network products include computers, electronic and electrical equipment, telecommunication equipment, road vehicles, etc.

- Survey analyses the impact of

India’s trade agreements on overall trade balance:

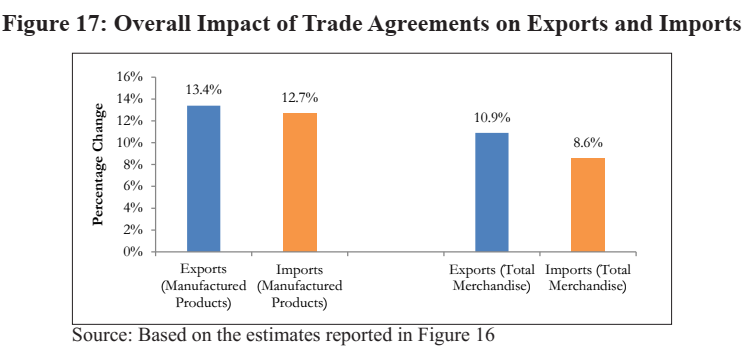

- India’s exports increased by 13.4% for manufactured products and 10.9% for total merchandise.

- Imports increased by 12.7% for manufactured products and 8.6 % for total merchandise.

- India gained a 0.7% increase in trade surplus per year for manufactured products and 2.3% per year for total merchandise.

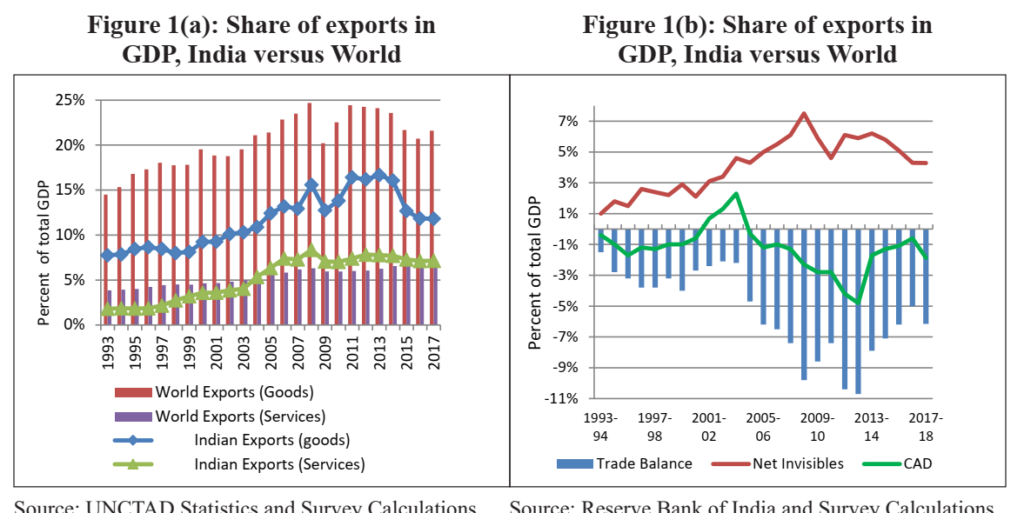

India’s export underperformance vis-à-vis china

India’s lacklustre export performance caused by

- A lack of diversification in its export basket.

- Overall, high diversification combined with low specialization implies that India is spreading its exports thinly over many products and partners, leading to its lacklustre performance compared to China.

- India’s participation in GVCs has been low compared to the major exporting nations in East and Southeast Asia.

- Also, China’s export composition shows a strong bias towards traditional labour-intensive industries and labour-intensive stages of production processes within capital-intensive industries.

If India wants to become a major exporter, it should specialize more in the areas of its comparative advantage and achieve significant quantity expansion.

Low Market Penetration in High-Income Countries

- The dominance of capital intensive products in the export basket along with a low level of participation in GVCs have resulted in a disproportionate shift in India’s geographical direction of exports from traditional rich country markets to other destinations.

- Developing countries, especially those with low levels of participation in GVCs, find it extremely difficult to export capital intensive products to the quality/brand conscious markets in richer countries.

- On the other hand, Chinese products, irrespective of whether they are capital intensive or unskilled labour intensive, are able to penetrate equally both in high income and low & middle-income countries.

- India has gained a competitive advantage in relatively low and middle-income country markets but at the cost of losing the much bigger markets in richer countries.

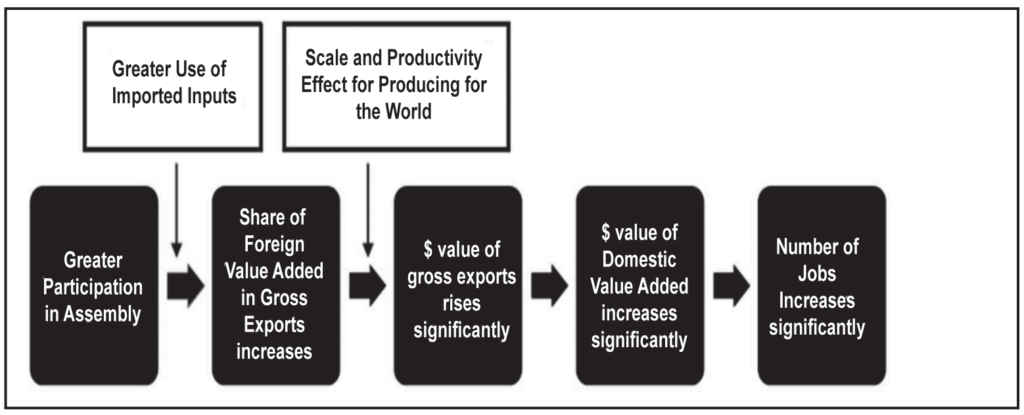

- A higher level of participation in GVCs implies that, for any given country, the share of foreign value-added in gross exports is higher than when most inputs are sourced locally.

The Conceptual Framework for Gains from “Assembling in India” as part of “Make in India”

Which industries should India specialize in for job creation?

- There exists a significant unexploited export potential in India’s traditional unskilled labour-intensive industries such as textiles, clothing, footwear, and toys.

- The GVCs in these industries

are controlled by “buyer-driven” networks — wherein

- the lead firms that are based in developed countries concentrate on higher value-added activities such as design, branding and marketing.

- The physical production is carried out, through sub-contracting arrangements, by firms in developing countries.

India has huge potential to emerge as a major hub for final assembly in a range of products, referred to as “network products”. The GVCs in these industries are controlled by leading MNEs such as Apple, Samsung, Sony, etc. within “producer-driven” networks.

- These products are not produced from start to finish within a given country; instead, countries specialize in particular tasks or stages of the good’s production sequence.

- Within the production network, each country specializes in a particular fragment of the production process;

- this specialization is based

on the country’s comparative advantage.

- Labour abundant countries, like China, specialize in low skilled labour-intensive stages of production such as assembly while the richer countries specialise in the capital and skill-intensive stages such as R&D.

Thus, the lead firms retain skill and knowledge-intensive stages of production in high-income headquarters but locate assembly related activities in low wage countries.

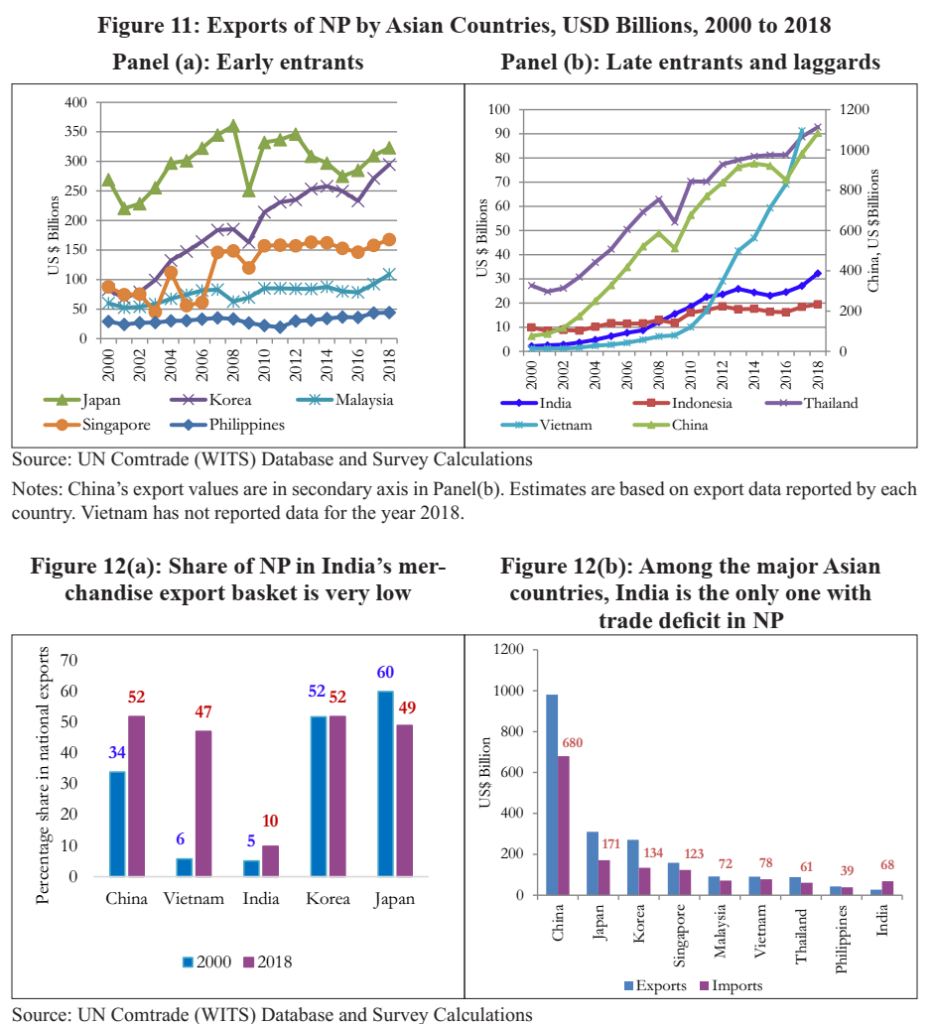

India in Comparison to East and Southeast Asia

- Even as India’s export of NP increased from about US$2 billion in 2000 to US$32 billion in2018, its participation in this market remains minuscule compared to that of other Asian countries.

- In contrast, these products account for about one-half of the total national exports of China, Japan, and Korea.

- Among the major Asian countries, India and Indonesia are the only ones with a trade deficit in NP.

Are free trade agreements beneficial?

An apprehension is that most of the FTAs that India had signed in the past had not worked in “India’s favour.” This is the mercantilist way of evaluating the gains from trade.

Basic trade theory teaches us that a country’s gains from free trade arise from the fact that it leads to a more efficient allocation of country’s resources.

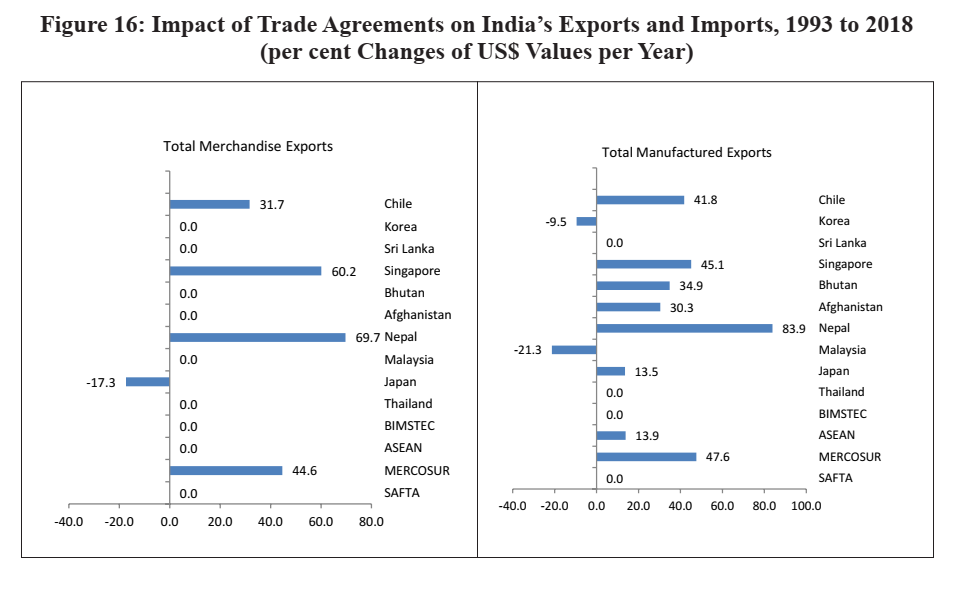

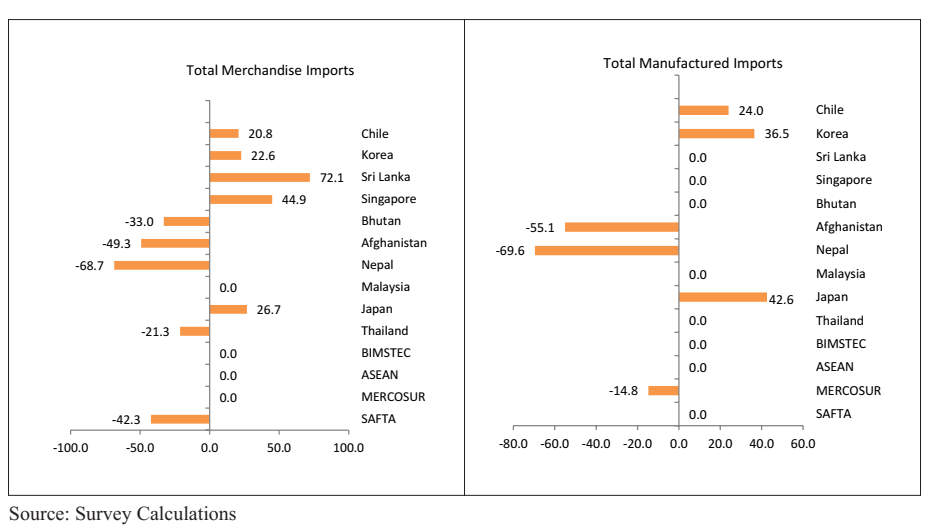

- Manufactured products from India have clearly benefitted from eight out of the fourteen trade agreements considered here. These are MERCOSUR, ASEAN, Nepal, Singapore, Chile, Bhutan, Afghanistan and Japan.

- Four of the agreements (SAFTA, BIMSTEC, Thailand and Sri Lanka) had no effect on exports of manufactured products while the bilateral agreements with Korea and Japan exerted a negative effect.

- Turning to overall merchandise exports, only four trade agreements (MERCOSUR, Nepal, Singapore, and Chile) show a positive impact.

MCQs

- The Economic Survey 2019-20 has suggested integrating ‘Assemble in India for the World’ plan into the Make in India programme. Consider the following statements about it:

1- India would create about four crore well-paid jobs by 2025 and about eight crores by 2030.

2- It can raise its export market share to about 3.5 per cent by 2025 and 6 per cent by 2030.

Which of the above statements is/are correct?

A. 1 only

B. 2 only

C. Both 1 and 2

D. Neither 1 nor 2

Ans. (C) The Economic Survey has suggested integrating ‘Assemble in India for the World’ plan into the Make in India programme so that the country can raise its export market share to about 3.5 per cent by 2025 and 6 per cent by 2030.

In the process, India would create about four crore well-paid jobs by 2025 and about eight crores by 2030.

It further said the incremental value added in the economy from the target level of exports of network products, which is expected to reach $248 billion in 2025, would make up about one-quarter of the increase required for making India a $5-trillion economy by 2025. - Which of the following is/are the member countries of the MERCOSUR trade bloc?

1- Uruguay

2- Paraguay

3- Argentina

4- Brazil

Select the correct answer using the codes given below.

A. 1 only

B. 1, 2, and 3 only

C. 3 and 4 only

D. 1, 2, 3, and 4

Ans. (D) Mercosur, officially Southern Common Market, is a South American trade bloc established by the Treaty of Asunción in 1991 and Protocol of Ouro Preto in 1994. Its full members are Argentina, Brazil, Paraguay and Uruguay. Venezuela was a full member but has been suspended since 1 December 2016.

Associate countries are Bolivia, Chile, Colombia, Ecuador, Guyana, Peru and Suriname. Observer countries are New Zealand and Mexico. - Which of the following could be the possible factors for India being favoured by multinational firms as a lucrative destination for final assembly of industrial products vis-a-vis China?

1- US-China trade war

2- Labour shortage in China

3- Wage increase in China

Select the correct answer using the codes given below.

A. 1 and 2 only

B. 2 and 3 only

C. 3 only

D. 1, 2, and 3

Ans. (D) The US-China trade war is causing major adjustments in Global Value Chains (GVCs) and firms are now looking for alternative locations for their operations. Even before the trade war began, China’s image as a low-cost location for final assembly of industrial products was rapidly changing due to labour shortages and increases in wages.

These developments present India an unprecedented opportunity to chart a similar export trajectory as that pursued by China and create unparalleled job opportunities for its youth. As no other country can match China in the abundance of its labour, India must grab the space getting vacated in labour-intensive sectors.