The Dec 17th Static Quiz 2020 Economy

Quiz-summary

0 of 5 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

Information

The Dec 17th Static Quiz 2020 Economy

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 5 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- Answered

- Review

- Question 1 of 5

1. Question

If the RBI decides to adopt an expansionist monetary policy, which of the following would it do ? (UPSC 2020 Pre)

1. Cut and optimize the Statutory Liquidity Ratio

2. Increase the Marginal Standing Facility Rate

3. Cut the Bank Rate and Repo Rate

Select the correct answer using the code given belowCorrectAns;- c) 1 and 3

Explanation;-

• As the question asked what it do that decrease the SLR, Bank and Repo Rate so that bank will circulate more money and less reserve with them.

• If the question was what it not do during then answer was 2 only i.e. b , because MSF rate should be decreased.

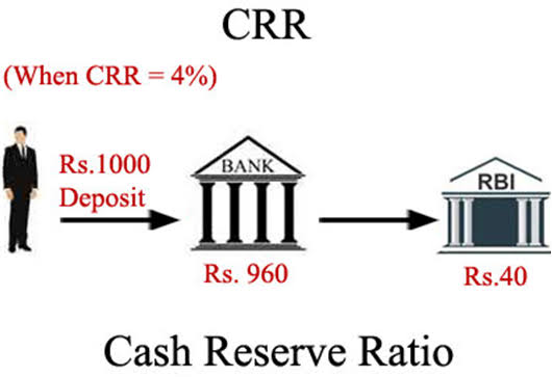

• The Expansionary monetary policy is when a central bank uses its tools to stimulate the economy.

• That increases the money supply, lowers interest rates, and increases demand.

• It boosts economic growth, it lowers the value of the currency, thereby decreasing the exchange rate.

• The Repo rate is the rate at which the central bank of a country (Reserve Bank of India in case of India) lends money to commercial banks in the event of any shortfall of funds.

• The current Repo rate is used by monetary authorities to control inflation, its present percentage now is 4%.

• The Reverse repo rate is the rate at which the central bank of a country (Reserve Bank of India in case of India) borrows money from commercial banks within the country, the current rate of reverse repo rate is 3.35%.

• The Marginal standing facility (MSF) is a window for banks to borrow from the Reserve Bank of India in an emergency situation when inter-bank liquidity dries up completely. Under MSF, banks can borrow funds up to one percentage of their net demand and time liabilities (NDTL), the current rate MSF percentage is 4.65%.IncorrectAns;- c) 1 and 3

Explanation;-

• As the question asked what it do that decrease the SLR, Bank and Repo Rate so that bank will circulate more money and less reserve with them.

• If the question was what it not do during then answer was 2 only i.e. b , because MSF rate should be decreased.

• The Expansionary monetary policy is when a central bank uses its tools to stimulate the economy.

• That increases the money supply, lowers interest rates, and increases demand.

• It boosts economic growth, it lowers the value of the currency, thereby decreasing the exchange rate.

• The Repo rate is the rate at which the central bank of a country (Reserve Bank of India in case of India) lends money to commercial banks in the event of any shortfall of funds.

• The current Repo rate is used by monetary authorities to control inflation, its present percentage now is 4%.

• The Reverse repo rate is the rate at which the central bank of a country (Reserve Bank of India in case of India) borrows money from commercial banks within the country, the current rate of reverse repo rate is 3.35%.

• The Marginal standing facility (MSF) is a window for banks to borrow from the Reserve Bank of India in an emergency situation when inter-bank liquidity dries up completely. Under MSF, banks can borrow funds up to one percentage of their net demand and time liabilities (NDTL), the current rate MSF percentage is 4.65%. - Question 2 of 5

2. Question

Which of the following statements regarding Cash Reserve Ratio are correct?

1. The banks will get interest on the money that is with the RBI under the CRR requirements.

2. The CRR is a qualitative measure that RBI uses to control InflationCorrectAns;- d) Neither 1 nor 2

Explanation;-

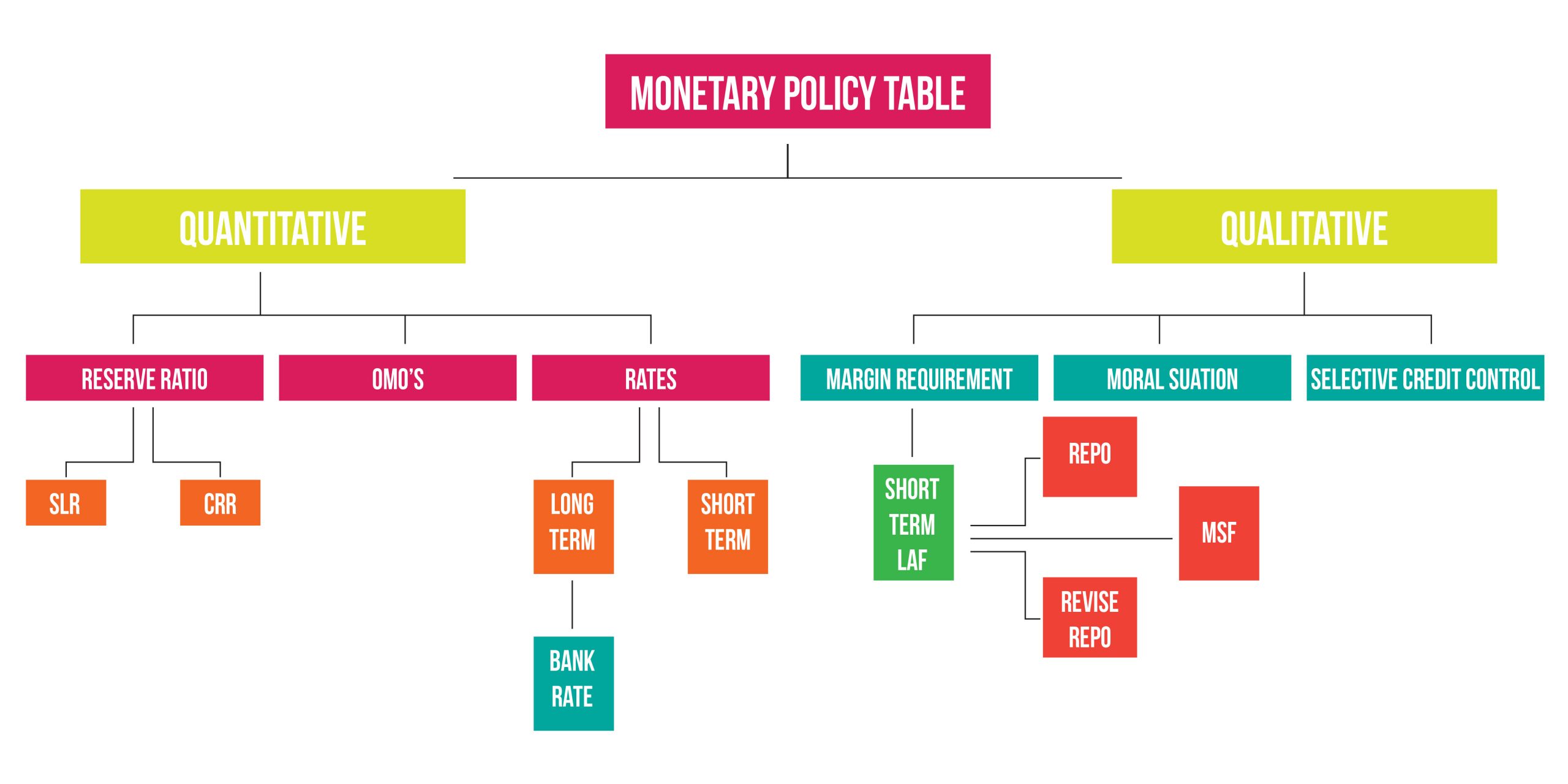

• Both the statemnets are incorrect the Banks won’t get any interest on maintaining the CRR with them in the name of RBI, the 2nd statement is wrong because the CRR is a quantitative measure not qualitative of monetary policy as shown in the below image.

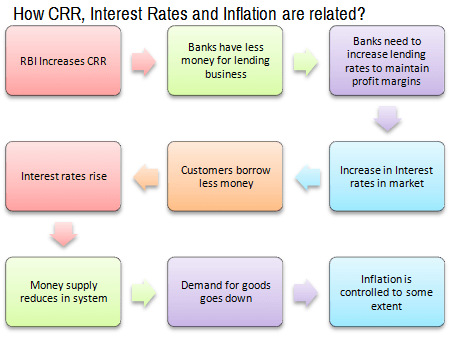

• The Cash Reserve Ratio (CRR) is the amount of funds that banks have to maintain with the Reserve Bank of India (RBI) at all times. If the central bank decides to increase the CRR, the amount available with the banks for disbursal comes down.

• The RBI uses the CRR to drain out excessive money from the system.

• The current rate of CRR is 4% of NDTL. Incorrect

IncorrectAns;- d) Neither 1 nor 2

Explanation;-

• Both the statemnets are incorrect the Banks won’t get any interest on maintaining the CRR with them in the name of RBI, the 2nd statement is wrong because the CRR is a quantitative measure not qualitative of monetary policy as shown in the below image.

• The Cash Reserve Ratio (CRR) is the amount of funds that banks have to maintain with the Reserve Bank of India (RBI) at all times. If the central bank decides to increase the CRR, the amount available with the banks for disbursal comes down.

• The RBI uses the CRR to drain out excessive money from the system.

• The current rate of CRR is 4% of NDTL.

- Question 3 of 5

3. Question

Among the following tools of monetary policy, which one is the most widely used tool?

CorrectAns;- a) Open Market Operations

Explanation;-

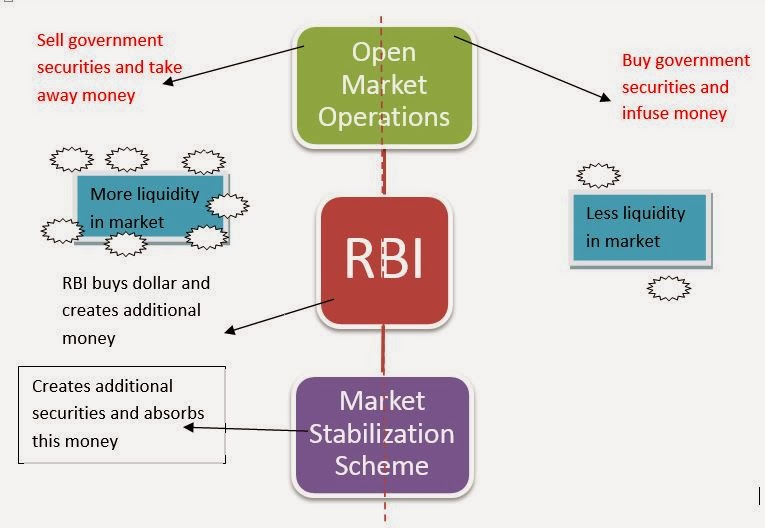

• The Open market operations are flexible, and thus, the most frequently used tool of monetary policy.

• The discount rate is the interest rate charged by Federal Reserve Banks to depository institutions on short-term loans.

• The open market operations involve the buying and selling of government securities.

• The open market operations are flexible, and thus, the most frequently used tool of monetary policy. Incorrect

IncorrectAns;- a) Open Market Operations

Explanation;-

• The Open market operations are flexible, and thus, the most frequently used tool of monetary policy.

• The discount rate is the interest rate charged by Federal Reserve Banks to depository institutions on short-term loans.

• The open market operations involve the buying and selling of government securities.

• The open market operations are flexible, and thus, the most frequently used tool of monetary policy.

- Question 4 of 5

4. Question

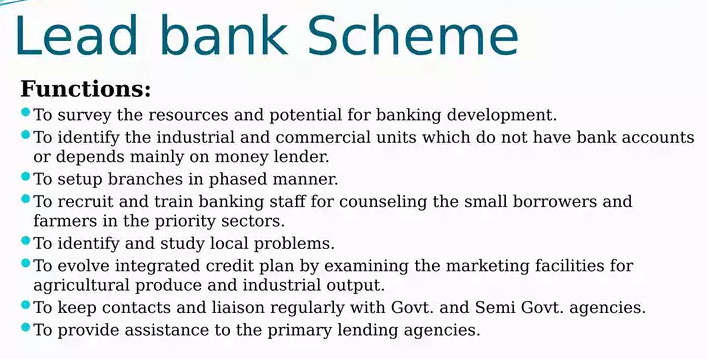

The basic aim of Lead Bank Scheme is that (UPSC Pre 2012)

CorrectAns;- c) individual banks should adopt particular districts for intensive development

Explanation;-

• The basic aim of Lead Bank Scheme is that there should be stiff competition among the various nationalized banks and big banks should try to open offices in each district. Incorrect

IncorrectAns;- c) individual banks should adopt particular districts for intensive development

Explanation;-

• The basic aim of Lead Bank Scheme is that there should be stiff competition among the various nationalized banks and big banks should try to open offices in each district.

- Question 5 of 5

5. Question

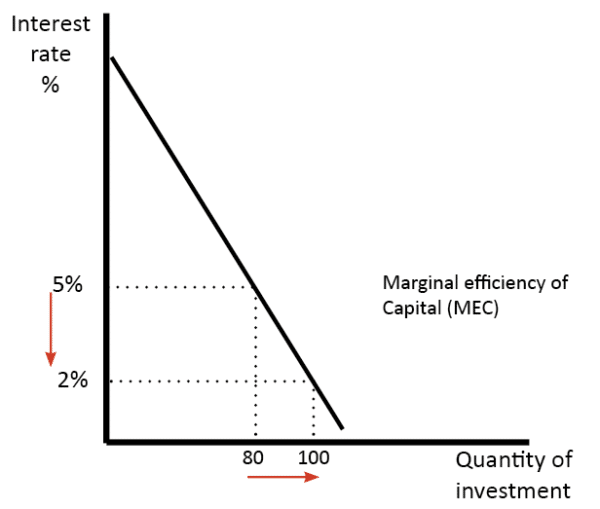

If the interest rate is decreased in an economy, it will

CorrectAns;- c) increase the investment expenditure in the economy

Explanation;-

• The relationship between interest rate and investment Expenditure is illustrated by the investment curve of the economy.

• The curve has downward slope, indicating that a drop in interest rate, causes the investment-spending to rise. Incorrect

IncorrectAns;- c) increase the investment expenditure in the economy

Explanation;-

• The relationship between interest rate and investment Expenditure is illustrated by the investment curve of the economy.

• The curve has downward slope, indicating that a drop in interest rate, causes the investment-spending to rise.