Static Quiz 14 April 2022

Quiz-summary

0 of 5 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

Information

Static Quiz 14 April 2022 for UPSC Prelims

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 5 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- Answered

- Review

- Question 1 of 5

1. Question

Which of the following statements are correctly matched?

1. Progressive Tax = is a tax imposed so that the tax rate is fixed, with no change as the taxable base amount increases or decreases.

2. Regressive Tax = is a tax in which the tax rate increases as the taxable amount increases.

3. Proportional Tax= is a tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases.

CorrectAns; – d) None of the above

Explanation; –

· All are incorrectly matched

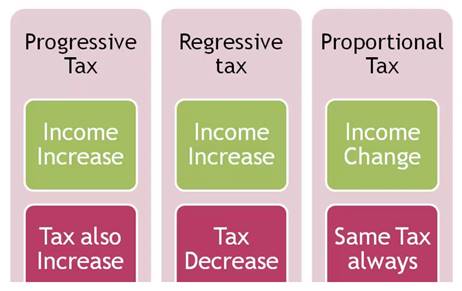

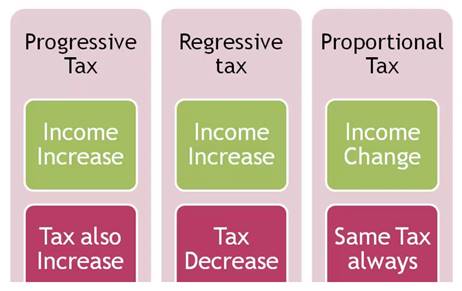

About Proportional Tax

· A proportional tax is a tax imposed so that the tax rate is fixed, with no change as the taxable base amount increases or decreases. The amount of the tax is in proportion to the amount subject to taxation.

About Regressive Tax

· A regressive tax is a tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases. “Regressive” describes a distribution effect on income or expenditure, referring to the way the rate progresses from high to low, so that the average tax rate exceeds the marginal tax rate.

About Progressive Tax

· A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term progressive refers to the way the tax rate progresses from low to high, with the result that a taxpayer’s average tax rate is less than the person’s marginal tax rate. Incorrect

IncorrectAns; – d) None of the above

Explanation; –

· All are incorrectly matched

About Proportional Tax

· A proportional tax is a tax imposed so that the tax rate is fixed, with no change as the taxable base amount increases or decreases. The amount of the tax is in proportion to the amount subject to taxation.

About Regressive Tax

· A regressive tax is a tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases. “Regressive” describes a distribution effect on income or expenditure, referring to the way the rate progresses from high to low, so that the average tax rate exceeds the marginal tax rate.

About Progressive Tax

· A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term progressive refers to the way the tax rate progresses from low to high, with the result that a taxpayer’s average tax rate is less than the person’s marginal tax rate.

- Question 2 of 5

2. Question

Which of the following are the direct taxes in India?

1. Sales Tax

2. Capital Gains Tax

3. Corporate TaxCorrectAns; – b) Only 2 and 3

Explanation; –

About Direct Tax in India

• A direct tax can be defined as a tax that is paid directly by an individual or organization to the imposing entity (generally government).

• A direct tax cannot be shifted to another individual or entity.

• The individual or organization upon which the tax is levied is responsible for the fulfillment of the tax payment.

• The Central Board of Direct Taxes deals with matters related to levying and collecting Direct Taxes and formulation of various policies related to direct taxes.

• A taxpayer pays a direct tax to a government for different purposes, including real property tax, personal property tax, income tax or taxes on assets, FBT, Gift Tax, Capital Gains Tax, etc.About Indirect Taxes in India

• An indirect tax is a tax collected by an intermediary from the person who bears the ultimate economic burden of the tax. The intermediary later files a tax return and forwards the tax proceeds to government with the return.

• There are 7 main types of indirect taxes in India.

However, after the implementation of GST, these taxes are streamlined into one singular tax to reduce hassles of compliance. Incorrect

IncorrectAns; – b) Only 2 and 3

Explanation; –

About Direct Tax in India

• A direct tax can be defined as a tax that is paid directly by an individual or organization to the imposing entity (generally government).

• A direct tax cannot be shifted to another individual or entity.

• The individual or organization upon which the tax is levied is responsible for the fulfillment of the tax payment.

• The Central Board of Direct Taxes deals with matters related to levying and collecting Direct Taxes and formulation of various policies related to direct taxes.

• A taxpayer pays a direct tax to a government for different purposes, including real property tax, personal property tax, income tax or taxes on assets, FBT, Gift Tax, Capital Gains Tax, etc.About Indirect Taxes in India

• An indirect tax is a tax collected by an intermediary from the person who bears the ultimate economic burden of the tax. The intermediary later files a tax return and forwards the tax proceeds to government with the return.

• There are 7 main types of indirect taxes in India.

However, after the implementation of GST, these taxes are streamlined into one singular tax to reduce hassles of compliance.

- Question 3 of 5

3. Question

Which of the following taxation terms are correctly matched?

1. Tax Elasticity = is an indicator to measure efficiency and responsiveness of revenue mobilization in response to growth in the Gross domestic product or National income.

2. Tax Buoyancy = refers to changes in tax revenue in response to changes in tax rate.CorrectAns; – d) None of the above

Explanation; –

· Both the statemensts are incorrectly matched.

About Tax Elasticity

· Tax elasticity refers to changes in tax revenue in response to changes in tax rate.

About Tax Buoyancy

· Tax buoyancy is one of the key indicators to assess the efficiency of a government’s tax system.

· Generally, as the economy achieves faster growth, the tax revenue of the government also goes up.

· Tax buoyancy explains this relationship between the changes in government’s tax revenue growth and the changes in GDP.

· In other words, it measures the responsiveness of tax mobilization to economic growth.

· Tax buoyancy depends largely on; –

1. the size of the tax base

2. the friendliness of the tax administration

3. the reasonableness and simplicity of the tax ratesIncorrectAns; – d) None of the above

Explanation; –

· Both the statemensts are incorrectly matched.

About Tax Elasticity

· Tax elasticity refers to changes in tax revenue in response to changes in tax rate.

About Tax Buoyancy

· Tax buoyancy is one of the key indicators to assess the efficiency of a government’s tax system.

· Generally, as the economy achieves faster growth, the tax revenue of the government also goes up.

· Tax buoyancy explains this relationship between the changes in government’s tax revenue growth and the changes in GDP.

· In other words, it measures the responsiveness of tax mobilization to economic growth.

· Tax buoyancy depends largely on; –

1. the size of the tax base

2. the friendliness of the tax administration

3. the reasonableness and simplicity of the tax rates - Question 4 of 5

4. Question

Which of the following statements best describes Tax incidence?

1. is an economic term for understanding the division of a tax burden between stakeholders, such as buyers and sellers or producers and consumer’s.

2. Tax incidence can also be related to the price elasticity of supply and demand.CorrectAns; – c) Both 1 and 2

Explanation; –

• Both the statements are correct about Tax Incidence.

• Tax incidence (or incidence of tax) is an economic term for understanding the division of a tax burden between stakeholders, such as buyers and sellers or producers and consumers.

• Tax incidence is the study of who bears the burden of tax.

• Regardless of who pays the tax directly to the govt. buyers and sellers both bear some of the tax incidence.

• Tax incidence can also be related to the price elasticity of supply and demand.

IncorrectAns; – c) Both 1 and 2

Explanation; –

• Both the statements are correct about Tax Incidence.

• Tax incidence (or incidence of tax) is an economic term for understanding the division of a tax burden between stakeholders, such as buyers and sellers or producers and consumers.

• Tax incidence is the study of who bears the burden of tax.

• Regardless of who pays the tax directly to the govt. buyers and sellers both bear some of the tax incidence.

• Tax incidence can also be related to the price elasticity of supply and demand.

- Question 5 of 5

5. Question

With reference to India’s decision to levy an equalization tax of 6% on online advertisement services offered by non-resident entities, which of the following statements is/are correct?

1. It is introduced as a part of the Income Tax Act.

2. Non-resident entities that offer advertisement services in India can claim a tax credit in their home country under the “Double Taxation Avoidance Agreements”.

Select the correct answer using the code given below:CorrectAns;- d) Neither 1 nor 2

Explanation;-

• Both the statements are incorrect

• The Equalization Levy was introduced in 2016 on business transaction for online marketing in which any Indian pays a sum of more than 1 lakh to non-residents entities such as google and Facebook etc.,

• As the levy was not introduced as part of the Income Tax Act but as a separate legislation under the Finance Bill, global firms that offer such services in india cannot claim a tax credit in their home country the double taxation avoidance agreement .IncorrectAns;- d) Neither 1 nor 2

Explanation;-

• Both the statements are incorrect

• The Equalization Levy was introduced in 2016 on business transaction for online marketing in which any Indian pays a sum of more than 1 lakh to non-residents entities such as google and Facebook etc.,

• As the levy was not introduced as part of the Income Tax Act but as a separate legislation under the Finance Bill, global firms that offer such services in india cannot claim a tax credit in their home country the double taxation avoidance agreement .