Static Quiz 03 September 2022

Quiz-summary

0 of 5 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

Information

Static Quiz 03 September 2022 for UPSC Prelims

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 5 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- Answered

- Review

- Question 1 of 5

1. Question

Which of the following statements about Non-Performing Assests (NPA) are incorrect?

1. A non-performing loan is a loan that is in default or close to being in default.

2. Many loans become non-performing after being in default for 180 days, but this can depend on the contract terms.CorrectAns;- b) Only 2

Explanation;-

• As question asked to choose incorrect the 2nd statement is incorrect because it is after 90 days it will be NPA not 180 days.

About NPA

• A non-performing loan is a loan that is in default or close to being in default. Many loans become non-performing after being in default for 90 days, but this can depend on the contract terms.

• According to International Monetary Fund npl is as follows;-1. Payments of interest and principal are past due by 90 days or more.

2. At least 90 days of interest payments have been capitalized, refinanced or delayed by agreement.

3. Payments are less than 90 days overdue, but there are other good reasons to doubt that payments will be made in full”.• By bank regulatory definition, non-performing loans consist of:-

1. other real estate owned which is taken by foreclosure or a deed in lieu of foreclosure,

2. loans that are 90 days or more past due and still accruing interest, and

3. loans which have been placed on nonaccrual (i.e., loans for which interest is no longer accrued and posted to the income statement).• In India, non-performing loans are common in the agricultural sector where the farmers can’t pay back the loan or the interest amount mainly as a result of losses due to floods or drought.

• Generally NPL problems are resolved in two ways:-

1. Centralization – This happens when all the concerned parties including the banks, regulators and government get together to find solutions.

This generally takes the form of a central organization/agency such as an Asset Management Company.

2. Decentralization – This approach involves steps taken by the affected banks. The decentralized approach is common for bad loans arising from bad lending. In this approach, the banks are left alone to manage their own bad loans by giving them incentives, legislative powers, or special accounting or fiscal advantages.IncorrectAns;- b) Only 2

Explanation;-

• As question asked to choose incorrect the 2nd statement is incorrect because it is after 90 days it will be NPA not 180 days.

About NPA

• A non-performing loan is a loan that is in default or close to being in default. Many loans become non-performing after being in default for 90 days, but this can depend on the contract terms.

• According to International Monetary Fund npl is as follows;-1. Payments of interest and principal are past due by 90 days or more.

2. At least 90 days of interest payments have been capitalized, refinanced or delayed by agreement.

3. Payments are less than 90 days overdue, but there are other good reasons to doubt that payments will be made in full”.• By bank regulatory definition, non-performing loans consist of:-

1. other real estate owned which is taken by foreclosure or a deed in lieu of foreclosure,

2. loans that are 90 days or more past due and still accruing interest, and

3. loans which have been placed on nonaccrual (i.e., loans for which interest is no longer accrued and posted to the income statement).• In India, non-performing loans are common in the agricultural sector where the farmers can’t pay back the loan or the interest amount mainly as a result of losses due to floods or drought.

• Generally NPL problems are resolved in two ways:-

1. Centralization – This happens when all the concerned parties including the banks, regulators and government get together to find solutions.

This generally takes the form of a central organization/agency such as an Asset Management Company.

2. Decentralization – This approach involves steps taken by the affected banks. The decentralized approach is common for bad loans arising from bad lending. In this approach, the banks are left alone to manage their own bad loans by giving them incentives, legislative powers, or special accounting or fiscal advantages. - Question 2 of 5

2. Question

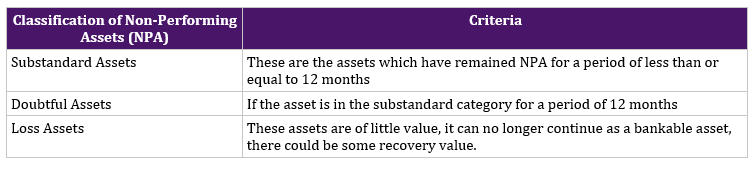

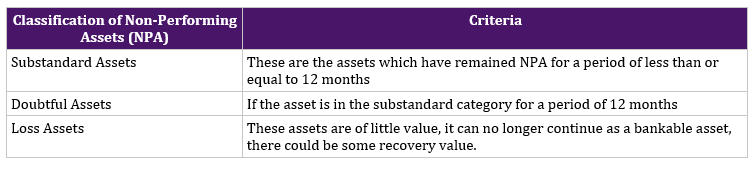

Which of the following about types of Non-Performing Assets are incorrect?

1. Substandard Assets = If the asset is in the substandard category for a period of 12 months

2. Doubtful Assets = These assets are of little value, it can no longer continue as a bankable asset, there could be some recovery value.

3. Loss Assets = These are the assets which have remained NPA for a period of less than or equal to 12 monthsCorrectAns;- d) All of the above

Explanation;-

• As question asked to choose incorrect statement all are incorrectly matched.

• Based on different parameters the Non Performing Assets are classified into different types.

• The below table gives the different classification of Non Performing Assets:- Incorrect

IncorrectAns;- d) All of the above

Explanation;-

• As question asked to choose incorrect statement all are incorrectly matched.

• Based on different parameters the Non Performing Assets are classified into different types.

• The below table gives the different classification of Non Performing Assets:-

- Question 3 of 5

3. Question

Which of the following are the impacts are the Non-Performing Assets ?

1. Banks won’t have sufficient funds for other development projects which will impact the economy

2. To maintain a profit margin, banks will be forced to decrease interest rates.

3. Due to the curb in further investments, it may lead to the rise of unemployment.CorrectAns;- c) Only 1 and 3

Explanation;-

• The 2nd statement is incorrect because it is forced to increase interest rates.

Impacts of Non-Performing Assets (NPA)

• Think of nonperforming assets as dead weight on the balance sheet.

1. Banks won’t have sufficient funds for other development projects which will impact the economy

2. To maintain a profit margin, banks will be forced to increase interest rates.

3. Due to the curb in further investments, it may lead to the rise of unemployment.IncorrectAns;- c) Only 1 and 3

Explanation;-

• The 2nd statement is incorrect because it is forced to increase interest rates.

Impacts of Non-Performing Assets (NPA)

• Think of nonperforming assets as dead weight on the balance sheet.

1. Banks won’t have sufficient funds for other development projects which will impact the economy

2. To maintain a profit margin, banks will be forced to increase interest rates.

3. Due to the curb in further investments, it may lead to the rise of unemployment. - Question 4 of 5

4. Question

Which of the following are the initiatives taken by Government of India and RBI to control Non-Performing Assests?

1. Debt Recovery Tribunal (DRT)

2. Asset Reconstruction Companies

3. Credit Information BureauCorrect• All the above initiatives are taken to control NPA

Incorrect• All the above initiatives are taken to control NPA

- Question 5 of 5

5. Question

Which of the following about Insolvency and Bankruptcy Code, 2016?

1. Bankruptcy is a situation where individuals or companies are unable to repay their outstanding debt.

2. The Insolvency and Bankruptcy Code, 2016 is the bankruptcy law of India which seeks to consolidate the existing framework by creating a single law for insolvency and bankruptcy.

3. The Insolvency and Bankruptcy Code, 2015 was introduced in Lok Sabha in December 2015.CorrectAns;- b) Only 2 and 3

Explanation;-

• The 1st statement is incorrect because Insolvency is a situation where individuals or companies are unable to repay their outstanding debt.

About Insolvency and Bankruptcy Code, 2016

• Insolvency and Bankruptcy Code, 2016 provides a time-bound process for resolving insolvency in companies and among individuals.

• Insolvency is a situation where individuals or companies are unable to repay their outstanding debt.

• Bankruptcy, on the other hand, is a situation whereby a court of competent jurisdiction has declared a person or other entity insolvent, having passed appropriate orders to resolve it and protect the rights of the creditors. It is a legal declaration of one’s inability to pay off debts.

• The Government implemented the Insolvency and Bankruptcy Code (IBC) to consolidate all laws related to insolvency and bankruptcy and to tackle Non-Performing Assets (NPA), a problem that has been pulling the Indian economy down for years.

• The Code is quite different from the earlier resolution systems as it shifts the responsibility to the creditor to initiate the insolvency resolution process against the corporate debtor.

• The recently proposed amendments aim to remove bottlenecks, streamline the corporate insolvency resolution process, and protect the last mile funding in order to boost investment in financially distressed sectors.

• Ring-fencing the companies resolved under the IBC from regulatory actions during past management can make the IBC process attractive for investors and acquirers.About Objectives of IBC

• To consolidate and amend all existing insolvency laws in India.

• To simplify and expedite the Insolvency and Bankruptcy Proceedings in India.

• To protect the interest of creditors including stakeholders in a company.

• To revive the company in a time-bound manner.

• To promote entrepreneurship.

• To get the necessary relief to the creditors and consequently increase the credit supply in the economy.

• To work out a new and timely recovery procedure to be adopted by the banks, financial institutions or individuals.

• To set up an Insolvency and Bankruptcy Board of India.

• Maximization of the value of assets of corporate persons.Salient features of the Insolvency and Bankruptcy Code, 2016

• Covers all individuals, companies, Limited Liability Partnerships (LLPs) and partnership firms.

• Adjudicating authority:

• National Company Law Tribunal (NCLT) for companies and LLPs

• Debt Recovery Tribunal (DRT) for individuals and partnership firmsIncorrectAns;- b) Only 2 and 3

Explanation;-

• The 1st statement is incorrect because Insolvency is a situation where individuals or companies are unable to repay their outstanding debt.

About Insolvency and Bankruptcy Code, 2016

• Insolvency and Bankruptcy Code, 2016 provides a time-bound process for resolving insolvency in companies and among individuals.

• Insolvency is a situation where individuals or companies are unable to repay their outstanding debt.

• Bankruptcy, on the other hand, is a situation whereby a court of competent jurisdiction has declared a person or other entity insolvent, having passed appropriate orders to resolve it and protect the rights of the creditors. It is a legal declaration of one’s inability to pay off debts.

• The Government implemented the Insolvency and Bankruptcy Code (IBC) to consolidate all laws related to insolvency and bankruptcy and to tackle Non-Performing Assets (NPA), a problem that has been pulling the Indian economy down for years.

• The Code is quite different from the earlier resolution systems as it shifts the responsibility to the creditor to initiate the insolvency resolution process against the corporate debtor.

• The recently proposed amendments aim to remove bottlenecks, streamline the corporate insolvency resolution process, and protect the last mile funding in order to boost investment in financially distressed sectors.

• Ring-fencing the companies resolved under the IBC from regulatory actions during past management can make the IBC process attractive for investors and acquirers.About Objectives of IBC

• To consolidate and amend all existing insolvency laws in India.

• To simplify and expedite the Insolvency and Bankruptcy Proceedings in India.

• To protect the interest of creditors including stakeholders in a company.

• To revive the company in a time-bound manner.

• To promote entrepreneurship.

• To get the necessary relief to the creditors and consequently increase the credit supply in the economy.

• To work out a new and timely recovery procedure to be adopted by the banks, financial institutions or individuals.

• To set up an Insolvency and Bankruptcy Board of India.

• Maximization of the value of assets of corporate persons.Salient features of the Insolvency and Bankruptcy Code, 2016

• Covers all individuals, companies, Limited Liability Partnerships (LLPs) and partnership firms.

• Adjudicating authority:

• National Company Law Tribunal (NCLT) for companies and LLPs

• Debt Recovery Tribunal (DRT) for individuals and partnership firms