Introduction

- Various institutions have assessed India’s growth prospects for 2020-21 ranging from 0.8% (Fitch) to 4.0% (Asian Development Bank).

- This wide range indicates the extent of uncertainty and tentative nature of these forecasts.

- The International Monetary Fund (IMF) has projected India’s growth at 1.9%, China’s at 1.2%, and the global growth at (-) 3.0%.

The actual growth outcome for India would depend on:

- the speed at which the economy is opened up;

- the time it takes to contain the spread of virus,

- the government’s policy support.

Growth prospects

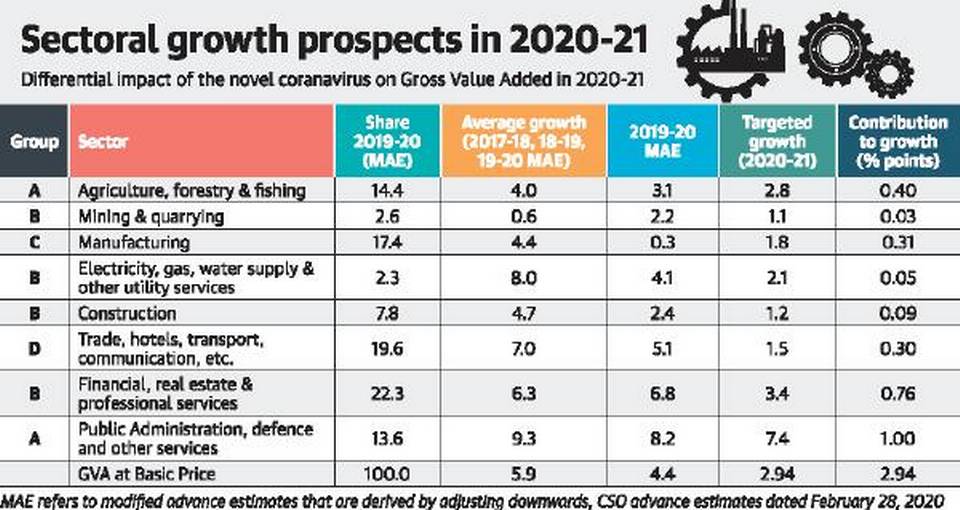

- In 2019-20, which would serve as the base year, India may show (Gross Value Added) GVA growth of about 4.4%

- GVA is divided into eight broad sectors, and although all sectors have been disrupted, some may be affected less than the others.

We divide the output sectors in four groups:

Group A – Agriculture and allied sectors, and Public administration, Defence and other services.

- In the case of agriculture, rabi crop is currently being harvested and a good monsoon is predicted later in the year.

- Despite some labour shortage issues, this sector may show near-normal performance.

- The public and defence services have been nearly fully active, with the health services at the forefront of the COVID-19 fight.

- For the group A sectors, it may be possible to achieve 90% of the 2019-20 growth performance.

Group B – Mining and Quarrying, Electricity, Gas, Water supply and other Utility services, Construction, and Financial, Real estate and Professional services.

- These four sectors may suffer average disruption showing 50% of 2019-20 growth performance.

Group C – Manufacturing.

- Manufacturing has suffered significant growth erosion in 2019-20. It is feasible to stimulate this sector by supporting demand.

Group D – Trade, Hotels, Transport, Storage and Communications.

- This sector may be able to show 30% of 2019-20 growth performance.

GVA Forecast

- Considering these four groups together, a GVA growth of 2.9% is estimated for 2020-21.

- Realising this requires strong policy support, particularly for the manufacturing sector which has a weight of 17.4%.

- It is also based on the assumption that the Indian economy may move on to positive growth after the first quarter.

- In the first quarter, GVA growth will be negative.

Calibrating policy support

- Monetary policy initiatives undertaken so far include a reduction in the repo rate to 4.4%, the reverse repo rate to 3.75%, and cash reserve ratio to 3%.

- The Reserve Bank of India has also opened several special financing facilities.

- These actions will have a positive impact on output only after the lockdown is lifted.

- These measures need to be supplemented by an appropriate fiscal stimulus.

- With lower petroleum prices, fertilizer and petroleum subsidies may be reduced.

- These expenditure cuts are contemplated to keep the fiscal deficit under some control.

On fiscal deficit

Fiscal stimulus can be of three types:

- Relief expenditure for protecting the poor and the marginalised

- Demand-supporting expenditure for increasing personal disposable incomes or government’s purchases of goods and services, including expanded health-care expenditure imposed by the novel coronavirus

- Bailouts for industry and financial institutions.

The Centre’s budgeted fiscal deficit of 3.5% of GDP may have to be enhanced substantially to make up for the shortfall in budgeted revenues; account for a lower than projected nominal GDP for 2020-21, and provide for a stimulus.

Thus, the Centre’s fiscal deficit may increase to 6.0% of GDP.

Expenditure on construction of hospitals, roads and other infrastructure and purchase of health-related equipment and medicines require prioritisation.

Financing of the fiscal deficit poses a major challenge this year.

-Source: The Hindu