Focus: GS-II Social Justice, GS-III Indian Economy

Why in news?

NITI Aayog and MicroSave Consulting organised an international webinar to discuss and share lessons from India’s successful cash support payments to the most vulnerable during the Covid-19 pandemic.

Highlights

- A robust digital financial infrastructure in India was key in successfully making direct transfers to targeted groups in a timely manner and making vital financial assistance available to the vulnerable during the pandemic.

- The Pradhan Mantri Jan Dhan Yojana (PMJDY) enabled a direct connection of the government with the people.

- PMJDY successfully enabled zero-cost, zero-balance bank accounts and of the 380 million PMJDY bank accounts opened to date, over 50% are in the names of women.

- One National One Card system is a step in the right direction, and we must tread that path while continuing to focus on financial literacy and bolstering cybersecurity.

Proof of India’s Digital Financial Infrastructure robustness

- Almost a billion Unified Payments Interface (UPI) and over 400 million Aadhaar Enabled Payment System (AePS) transactions were recorded in a month.

- 65% of India’s population have personal bank accounts in public sector banks.

- The foundational layers: building digital infrastructure, targeted G2P transfer initiatives, PFMS linkage and NPCI’s role in enabling digital payments – are key to the building of India’s robust Digital Financial Infrastructure.

Aadhaar Enabled Payment System (AePS)

- Aadhaar Enabled Payment System is a payment service empowering a bank customer to use Aadhaar as his/her identity to access his/ her respective Aadhaar enabled bank account and perform basic banking transactions like balance enquiry, cash deposit, cash withdrawal, remittances through a Business Correspondent.

- Aadhaar enabled Payment system is easy to use, safe and secure payment platform to avail benefits by using Aadhaar number & fingerprints.

- Aadhaar enabled Payment system is based on the demographic and biometric/iris information of an individual, it eliminates the threat of any fraud and non-genuine activity.

- Aadhaar enabled Payment System facilitate disbursements of Government entitlements like NREGA, Social Security pension, Handicapped Old Age Pension etc. of any Central or State Government bodies, using Aadhaar authentication.

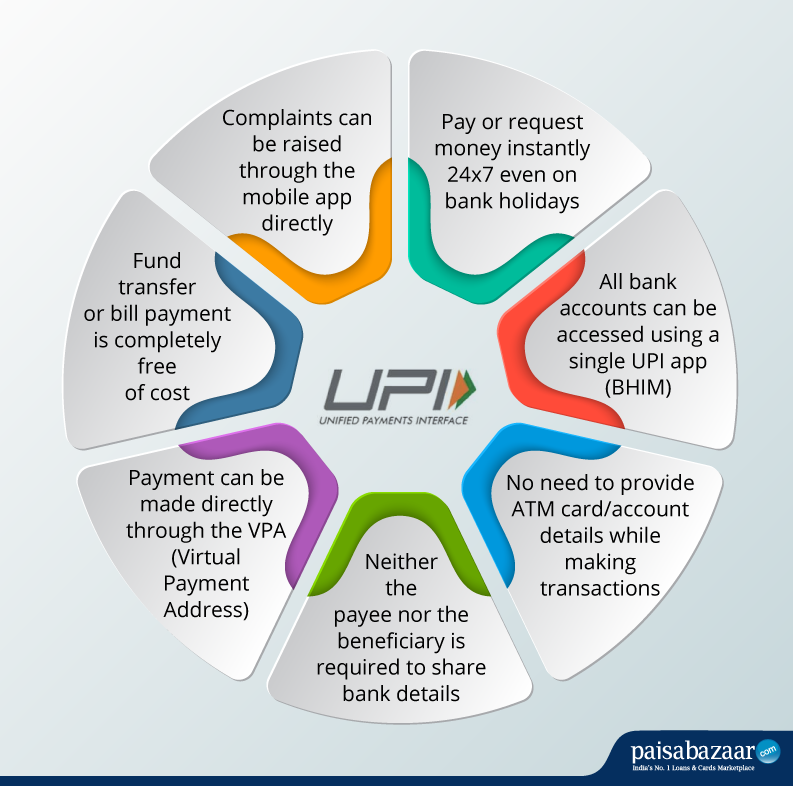

Unified Payments Interface (UPI)

- Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood.

- Advantages of UPI Includes – Immediate money transfer through mobile device round the clock 24*7 and 365 days.

- UPI Enables Single mobile application for accessing different bank accounts with Single Click 2 Factor Authentication – Aligned with the Regulatory guidelines yet provides for a very strong feature of seamless single click payment.

- It also features Virtual address of the customer for Pull & Push providing for incremental security with the customer not required to enter the details such as Card no, Account number; IFSC etc.