Context:

- The most recent growth estimates of the National Statistical Office show that after a steep contraction in the first quarter of 2020, growth accelerated steadily afterwards. This would have assured a recovery had we not experienced the second wave of the pandemic that came with the current financial year 2021.

- Overlapping State-level lockdowns that started in April 2021 is lasting for almost as long the nationwide lockdown of 2020, hence, output may well have contracted in the beginning of 2021. So, though recovery will eventually come, it could be W-shaped rather than V-shaped.

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, Fiscal Policy, Macroeconomics Theories)

Mains Questions:

“Public spending is key for economic recovery in India post the economic setback caused by the lockdowns to control the spread of the Covid-19 Pandemic.” Discuss and suggest reforms along conventional macroeconomic lines. (15 Marks)

Dimensions of the Article:

- What is economic cycle and its stages?

- What is Fiscal Policy?

- Cyclicality of the fiscal policy

- What is pro-cyclical fiscal policy?

- What is counter-cyclical fiscal policy?

- Basics of Reforms for Countering Economic Slowdown

- The Current Situation and Steps that were taken

- Public spending is the key

- MMT vs Conventional debate for Raising Money for Public Spending

- Conventional Macro-economics

- Modern Monetary Theory (MMT)

- Concern of Hyperinflation by the lines of MMT and the arguments

What is economic cycle and its stages?

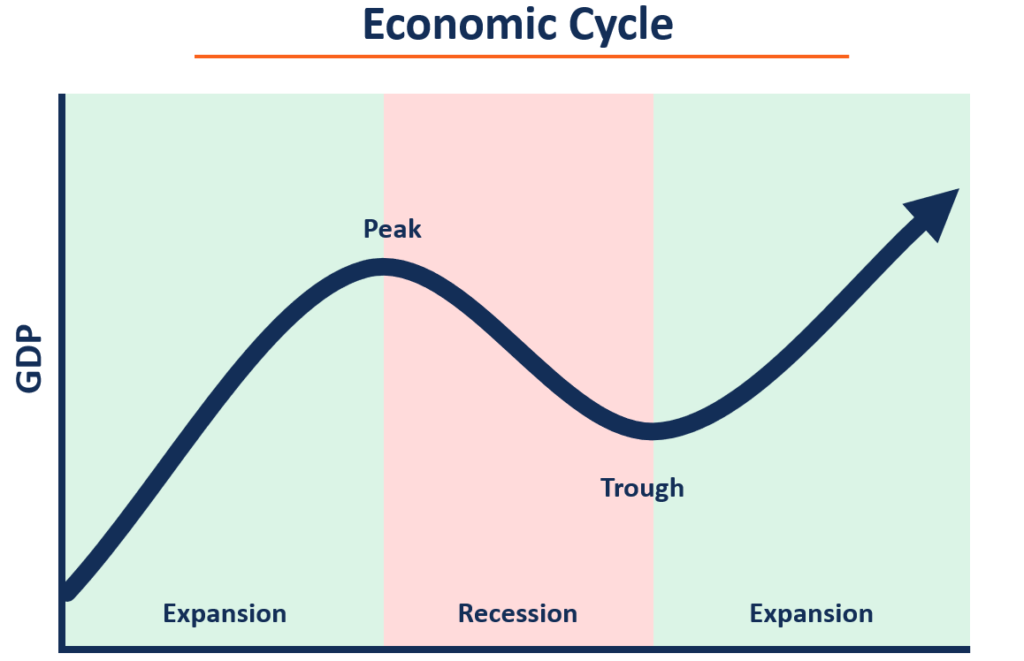

- The economic cycle is the fluctuating state of an economy from periods of economic expansion and contraction. It is usually measured with the Gross Domestic Product (GDP) of a country or region. Other economic factors, such as employment rates, consumer spending, and interest rates, can also be used to determine the stage of the economic cycle.

- The economic cycle is also known as the business cycle, and it is the fluctuating state of a market-based economy. An economy is a term that describes a set of production and consumption activities that determine how resources ought to be allocated. Supply and demand pressures influence the economy through different variables, such as global economic conditions, trade balances, productivity, inflation rates, interest rates, and exchange rates. The variables, in aggregate, shape the economy and the state of the economic cycle.

Stages of Economic cycle

- Expansion: During the expansion phase, an economy will experience strong growth, and interest rates will generally be lower but will begin to increase as the expansion matures. The overall production level increases, and inflation rates begin to rise as the expansion matures.

- The Peak: The peak is reached when the growth of an economy reaches a plateau or maximum rate. It is usually characterized by higher inflation that needs to be corrected.

- Recession: According to National Bureau of Economic Research (NBER) in the United States “During a recession, a significant decline in economic activity spreads across the economy and can last from a few months to more than a year”.

- The Trough: The trough is characterized as a low point in the economy from which it can re-enter an expansionary phase.

What is Fiscal Policy?

- Fiscal policy deals with the government policy concerning changes in the taxation and expenditure overheads and components, while Monetary policy, deals with the changes in the factors and instruments that affect the supply of money in the economy and the rate of interest.

- Fiscal policy is result of several component policies or mix of policy instruments. These include, policy on taxation, subsidy, welfare expenditure, etc; investment or disinvestment strategies; and debt or surplus management.

- Fiscal policy is an important constituent of the overall economic framework of a country and is therefore intimately linked with its general economic policy strategy.’

Cyclicality of the fiscal policy

- Cyclicality of the fiscal policy simply refers to a change in direction of government expenditure and taxes based on economic conditions. These pertain to decisions by policymakers based on the fluctuations in economic growth.

- There are two types of cyclical fiscal policies – counter-cyclical and pro-cyclical.

What is pro-cyclical fiscal policy?

- In a pro-cyclical fiscal policy, the government reinforces the business cycle by being expansionary during good times and contractionary during recessions. Pursuing a pro-cyclical fiscal policy is generally regarded as dangerous. It could raise macroeconomic volatility, depress investment in real and human capital, hamper growth and harm the poor, say economists.

What is counter-cyclical fiscal policy?

- Counter-cyclical fiscal policy refers to the steps taken by the government that go against the direction of the economic or business cycle.

- Thus, in a recession or slowdown, the government increases expenditure and reduces taxes to create a demand that can drive an economic boom. The survey gives a colourful example of ancient Indian kings building palaces during droughts to drive home this point. On the other hand, during a boom in the economy, counter-cyclical fiscal policy aims at raising taxes and cutting public expenditure to control inflation and debt.

How does counter-cyclical fiscal policy work?

- An expansion in government expenditure cushions the contraction in output by offsetting the decline in consumption and investment.

- Higher government spending builds confidence in tough times. Through this policy, governments are able to show their commitment to sound fiscal management, said the survey.

- This in turn gives confidence to the private sector that the economy will not fluctuate too much. It helps businessmen overcome risk aversion and brings animal spirits in the economy.

Basics of Reforms for Countering Economic Slowdown

- Since 1991, the term ‘reforms’ has been used to mean both policy changes that remove restrictions on private sector activity in certain areas and those that increase profits in existing lines of production.

- Thus, to counter the economic slowdown, we need two-pronged strategy

- Increase the Private sector Investment

- Adoption of Counter cyclical fiscal policy by the Government.

The Current Situation and Steps that were taken

- Recent examples of increasing the private sector investment include allowing greater private sector participation in defence as part of the Atmanirbhar Bharat Abhiyaan launched in 2020, liberalization of FDI norms in a number of sectors such as Defence, Insurance, Coal Mining etc., and also the New Public Sector Enterprise policy introduced by the government.

- Presently for the private sector, entry into a new area or undertaking investment in an existing activity may not appear profitable given their expectation of the state of the economy in the near future, upon which their revenue will depend.

- In February 2021, believing that the peak of the epidemic had been crossed, the government reverted to its principal macroeconomic pre-occupation, namely fiscal consolidation or the paring down of the fiscal deficit. Accordingly, it raised its budgeted expenditure in 2021 by less than 1% of the 2020 Budget.

- The onset of the second wave of COVID-19 in April 2021 has thrown the economic policy calculations of the government out of gear and as economy had contracted in 2020-21 itself, with a possible further contraction of the economy, to continue with the frigid fiscal stance would be disastrous.

Public spending is the key

- Raising public spending is one of the moves left for bringing on a recovery, but it requires us to accept a higher than budgeted deficit.

- India’s public debt is low by comparison with the OECD countries, and debt financing remains an option.

- Even if money financing is adopted, it need not cause accelerating inflation as some predict. Experience in India suggests otherwise. However, studies do show that any economic expansion would be inflationary if the production of food does not respond adequately. The focus must be on the food supply and not the money supply.

MMT vs Conventional debate for Raising Money for Public Spending

- Presently, the Government borrows money from the market (Banks, Financial Institutions etc.) through the issuance of Government securities (G-Secs) such as Treasury Bills and dated Securities.

- However, if the Government borrows the same money from the RBI by issuing the G-Secs, it is referred to as Monetization of Deficit.

- Presently, such monetization of deficit is taking place in India indirectly through the Open Market Operations.

Conventional Macro-economics

- According to this view, the Government should impose the taxes and use the same taxes in order to meet its various expenses such as Education, Health, Infrastructure etc.

- The Government should try to meet its expenses entirely from its taxes. It should not unnecessarily resort to borrowings. Even if it has to borrow money, it has to borrow money from the Market and not the Central Bank.

- At the same time, there should be limit on the overall borrowings of the Government. The higher borrowings can have an adverse impact on the economy; hence, the Government has to keep its Fiscal Deficit and Public Debt under control.

Modern Monetary Theory (MMT)

- The Modern Monetary theory says that households and private sector cannot create their own money and hence there is a possibility that they can run out of money and default on their loan obligations – but a government is a sovereign entity that has the power of printing currency notes (power of creating its own money) and since, it can create money whenever it wants to, it can never default on its repayment obligation.

- So, this theory suggests that the Central Bank of the Country should print the currency notes whenever the Government needs money. The Government should then use this borrowed money to spend on certain productive assets which can lead to increase in employment opportunities and GDP growth rate.

Concern of Hyperinflation by the lines of MMT and the arguments

- Historically, when countries have simply printed money it leads to periods of rising prices — there’s too many resources chasing too few goods. Often, this means every day goods become unaffordable for ordinary citizens as the wages they earn quickly become worthless.

- In a famous instance known as “hyperinflation” in Germany during the 1920s, citizens were pictured taking wheelbarrows full of cash to shops to pay for basic goods. Spiralling prices then were more to do with the punishing reparations payments than money printing but it illustrates the problem.

- In Zimbabwe during the 2000s, monthly inflation reached as high as 80 billion percent according to some estimates, due to the policy of rapidly printing more money. The local currency was eventually abandoned in favour of the US dollar

MMT Arguments

- Increase in the Public Debt should not be a cause of concern since the Central Bank can print the currency notes and repay back its debt obligations. For example, post the 2008 Global Financial crisis, some of the developed economies have continued to borrow money in order to fund their stimulus packages without worrying about the higher Public Debt. A case in point is Japan. The Public debt in Japan has increased to almost 250% of its GDP. Yet, the higher borrowings have not led to higher inflation rates.

- The borrowed money should be used in the productive assets such as creation of infrastructure, boosting employment opportunities etc. This would ensure that the increased demand in the economy is met by increased supply. In order words, the money should be spent in such a way that it leads to increase in both demand and supply.

- The Government has to use the tool of tax rates in order to keep inflation under control. For example, the tax rates should be reduced during the recession. While, the tax rates should be increased during higher rate of Inflation.

-Source: The Hindu