Context:

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) kept interest rates on hold for the seventh straight time.

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, Monetary Policy, Inflation)

Dimensions of the Article:

- About the recent Monetary Policy Committee’s decisions

- Inflation target hiked by the MPC

- Back to Basics: What is the MPC?

About the recent Monetary Policy Committee’s decisions

- The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) on Friday kept the key policy rate — Repo rate, or the RBI’s lending rate to banks — unchanged at four per cent for the seventh time in a row.

- The MPC has also kept the reverse repo rate — RBI’s borrowing rate from banks — unchanged at 3.35 per cent.

- The MPC has also raised the inflation target for fiscal 2001-22 but maintained the growth forecast at 9.5 per cent (pegged Q1 growth at 21.4% followed by 7.3% in Q2, 6.3% in Q3 and 6.1% in Q4).

- The six-member MPC panel, headed by RBI Governor voted in favour keeping key policy rates unchanged and decided to continue with an accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of Covid-19 on the economy, while ensuring that inflation remains within the target going forward.

- The RBI panel says the nascent and hesitant recovery in the economy — which faced rough weather due to the Covid second wave and lockdowns in states — needs to be nurtured through fiscal, monetary and sectoral policy levers.

- Elevated inflation level and delayed recovery in the economy would have prompted the panel to keep rates steady. Interest rates in the banking system are expected to remain stable in the next couple of months.

- Although RBI retained its policy stance, it raised the amount of variable rate reverse repo (VRRR) auctions by ₹2 trillion to drain excess liquidity from the banking system.

- The RBI Governor said that these enhanced VRRR auctions should not be misread as a reversal of the accommodative policy stance as the amount absorbed after the fixed rate reverse repo is expected to remain more than Rs. 4 trillion at the end of September 2021.

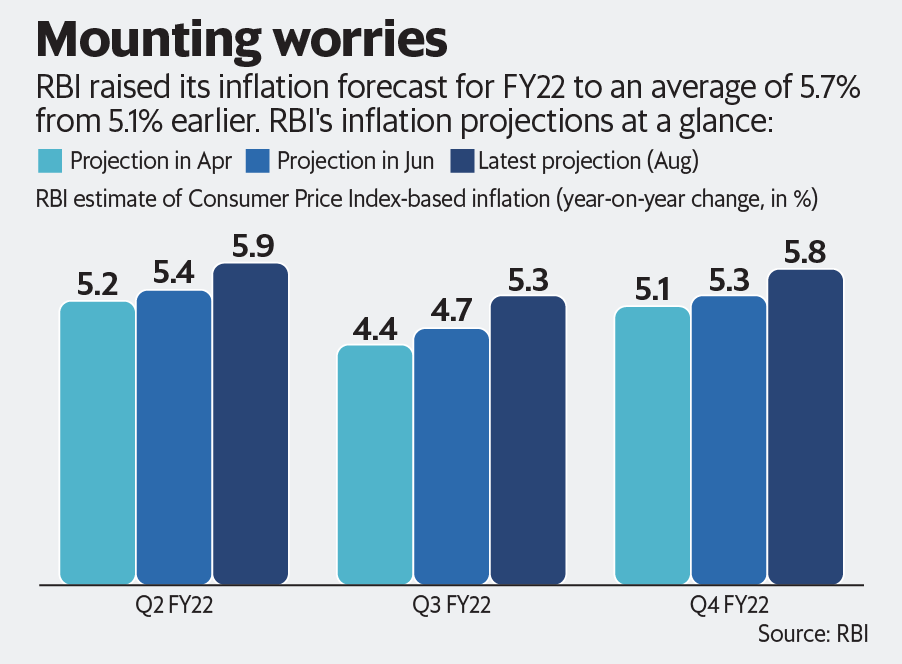

Inflation target hiked by the MPC

- The RBI panel has hiked the inflation target for fiscal 2021-22 to 5.7 per cent from 5.1 per cent projected earlier.

- Although the target is below the RBI’s upper band of inflation target of 6 per cent, input prices are rising across manufacturing and services sectors and weak demand and efforts towards cost cutting are tempering the pass-through to output prices.

- With crude oil prices at elevated levels, a calibrated reduction of the indirect tax component of pump prices by the Centre and states can help to substantially lessen cost pressures.

- The combination of elevated prices of industrial raw materials, high pump prices of petrol and diesel with their second-round effects, and logistics costs continue to impinge adversely on cost conditions for manufacturing and services, although weak demand conditions are tempering the pass-through to output prices and core inflation.

Back to Basics: What is the MPC?

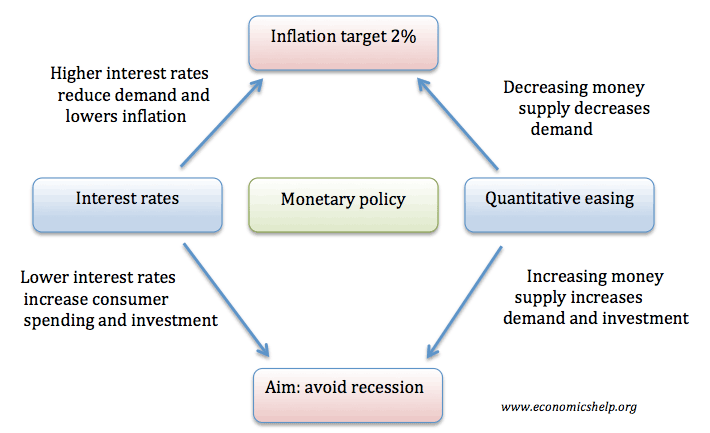

The Monetary Policy Committee (MPC) is the body of the RBI, headed by the Governor, responsible for taking the important monetary policy decisions about setting the repo rate. Repo rate is ‘the policy instrument’ in monetary policy that helps to realize the set inflation target by the RBI (at present 4%).

Membership of the MPC

- The Monetary Policy Committee (MPC) is formed under the RBI with six members.

- Three of the members are from the RBI while the other three members are appointed by the government.

- Members from the RBI are the Governor who is the chairman of the MPC, a Deputy Governor and one officer of the RBI.

- The government members are appointed by the Centre on the recommendations of a search-cum-selection committee which is to be headed by the Cabinet Secretary.

Objectives of the MPC

- Monetary Policy was implemented with an initiative to provide reasonable price stability, high employment, and a faster economic growth rate. The major four objectives of the Monetary Policy are mentioned below:

- To stabilize the business cycle.

- To provide reasonable price stability.

- To provide faster economic growth.

- Exchange Rate Stability.

- Average inflation overshooting the upper tolerance level or remaining below the lower tolerance level for any three consecutive quarters constitutes a failure to achieve the inflation target.

- In such an event, the Reserve Bank of India (RBI) is required to send a report to the Centre, stating the reasons for the failure to achieve the inflation target, the remedial actions it proposes to initiate, and an estimate of the time-period within which it expects to achieve the inflation target through the corrective steps proposed.

-Source: The Hindu