Context:

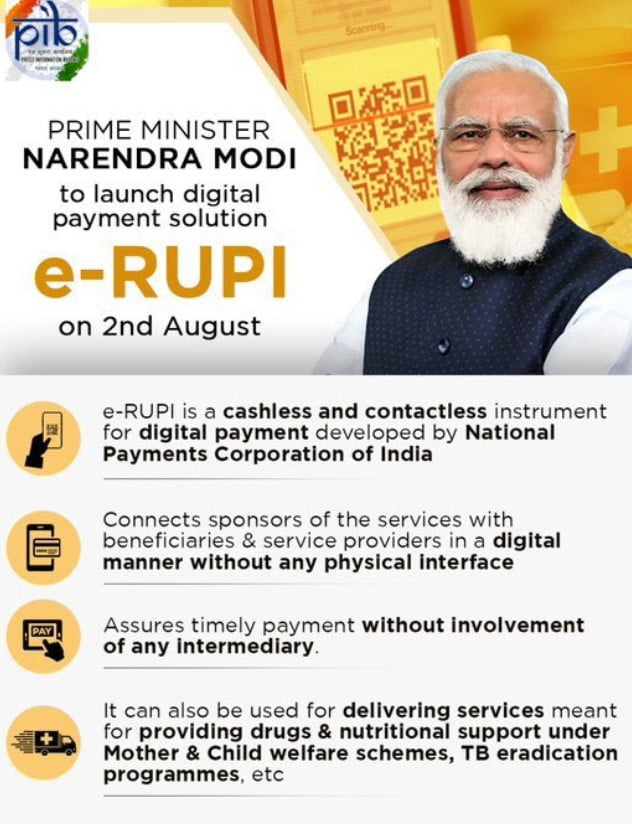

Prime Minister Narendra Modi launched digital payment solution e-RUPI, a person and purpose specific cashless digital payment solution, via videoconference.

Relevance:

Prelims, GS-III: Science and Technology (IT & Computers), GS-III: Indian Economy (Mobilization of Resources, Growth and Development of Indian Economy)

Dimensions of the Article:

- About e-RUPI

- How will these vouchers be issued?

- What are the use cases of e-RUPI?

- What are the plans for a central bank digital currency (CBDC)?

- Does India have appetite for a digital currency?

About e-RUPI

- e-RUPI is a cashless and contactless digital payments medium, which will be delivered to mobile phones of beneficiaries in form of an SMS-string or a QR code.

- This will essentially be like a prepaid gift-voucher that will be redeemable at specific accepting centres without any credit or debit card, a mobile app or internet banking.

- e-RUPI will connect the sponsors of the services with the beneficiaries and service providers in a digital manner without any physical interface.

How will these vouchers be issued?

- The system has been built by NPCI on its UPI platform, and has onboarded banks that will be the issuing entities.

- Any corporate or government agency will have to approach the partner banks, which are both private and public-sector lenders, with the details of specific persons and the purpose for which payments have to be made.

- The beneficiaries will be identified using their mobile number and a voucher allocated by a bank to the service provider in the name of a given person would only be delivered to that person.

What are the use cases of e-RUPI?

- According to the government, e-RUPI is expected to ensure a leak-proof delivery of welfare services.

- It can also be used for delivering services under schemes meant for providing drugs and nutritional support under Mother and Child welfare schemes, TB eradication programmes, drugs & diagnostics under schemes like Ayushman Bharat Pradhan Mantri Jan Arogya Yojana, fertiliser subsidies etc.

- The government also said that even the private sector can leverage these digital vouchers as part of their employee welfare and corporate social responsibility programmes.

- The government is already working on developing a central bank digital currency and the launch of e-RUPI could potentially highlight the gaps in digital payments infrastructure that will be necessary for the success of the future digital currency.

- In effect, e-RUPI is still backed by the existing Indian rupee as the underlying asset and specificity of its purpose makes it different to a virtual currency and puts it closer to a voucher-based payment system.

- Also, the ubiquitousness of e-RUPI in the future will depend on the end-use cases.

What are the plans for a central bank digital currency (CBDC)?

- The Reserve Bank of India had recently said that it has been working towards a phased implementation strategy for central bank digital currency or CBDC — digital currencies issued by a central bank that generally take on a digital form of the nation’s existing fiat currency such as the rupee.

- RBI deputy governor T Rabi Sankar said that CBDCs “are desirable not just for the benefits they create in payments systems, but also might be necessary to protect the general public in an environment of volatile private VCs.

- Although CBDCs are conceptually similar to currency notes, the introduction of CBDC would involve changes to the enabling legal framework since the current provisions are primarily synced for currency in paper form.

Does India have appetite for a digital currency?

According to the RBI, there are at least four reasons why digital currencies are expected to do well in India:

- One, there is increasing penetration of digital payments in the country that exists alongside sustained interest in cash usage, especially for small value transactions.

- Two, India’s high currency to GDP ratio, according to the RBI, “holds out another benefit of CBDCs”. Three, the spread of private virtual currencies such as Bitcoin and Ethereum may be yet another reason why CBDCs become important from the point of view of the central bank.

-Source: The Hindu