CONTENTS

- Index of Eight Core Industries

- PM SVANidhi

Index of Eight Core Industries

Context:

The combined Index of Eight Core Industries (ICI) increased by 7.8 per cent (provisional) in November 2023 as compared to the Index of November 2022. The production of Coal, Electricity, Fertilizers, Natural Gas, Refinery Products and Steel recorded positive growth in November 2023.

Relevance:

GS III- Indian Economy

About Index of Eight Core Industries:

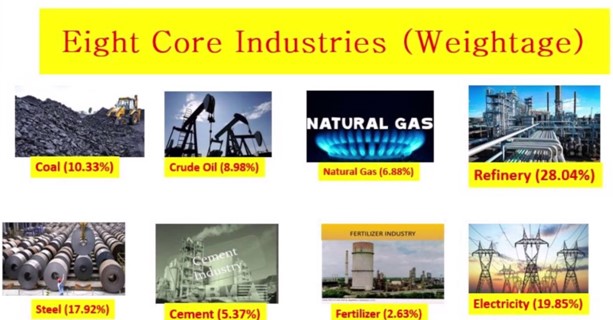

- The Eight Core Industries comprise 40.27% of the weight of items included in the Index of Industrial Production (IIP).

Released by: The Office of the Economic Adviser, Department for Promotion of Industry and Internal Trade

Base year: 2011-12

Below image attached Eight Core Industries based on their weightage.

Index of Industrial Production (IIP):

- The Index of Industrial Production (IIP) is an index that shows the growth rates in different industry groups of the economy in a fixed period of time.

- It is compiled and published monthly by the Central Statistical Organization (CSO), Ministry of Statistics and Programme Implementation (MOSPI).

- The Central Statistics Office (CSO) revised the base year of the all-India Index of Industrial Production (IIP) from 2004-05 to 2011-12 on 12 May 2017.

- IIP is a composite indicator that measures the growth rate of industry groups classified under broad sectors, namely, Mining, Manufacturing, and Electricity.

- Use-based sectors, namely Basic Goods, Capital Goods, and Intermediate Goods.

Significance of IIP:

- IIP is the only measure on the physical volume of production.

- It is used by government agencies including the Ministry of Finance, the Reserve Bank of India, etc., for policy-making purposes.

- IIP remains extremely relevant for the calculation of the quarterly and advance GDP estimates.

PM SVANidhi

Context:

PM SVANidhi benefits over 57 lakh street vendors across country.

Relevance:

GS II- Government policies and interventions

Dimensions of the Article:

- PM Street Vendor’s Atmanitbhar Nidhi (PM SVANidhi)

- PM SVANidhi and SIDBI

- Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE)

- Performance of the Scheme on 3-year Completion

PM Street Vendor’s Atmanitbhar Nidhi (PM SVANidhi)

- PM SVANidhi is a Special Micro-Credit Facility.

- PM SVANidhi was launched by the Ministry of Housing and Urban Affairs for providing affordable Working Capital loan to street vendors to resume their livelihoods that have been adversely affected due to Covid-19 lockdown.

- Under the Scheme, the vendors can avail a working capital loan of up to Rs. 10,000, which is repayable in monthly instalments in the tenure of one year.

- The scheme promotes digital transactions through cash back incentives.

- Beneficiaries: 50 lakh Street Vendors.

- The Government of India has extended the PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi) Scheme beyond March, 2022 with the following provisions:

- Extension of lending period till December 2024;

- Introduction of 3rd loan of upto ₹50,000 in addition to 1st & 2nd loans of ₹10,000 and ₹20,000 respectively.

- To extend ‘SVANidhi Se Samriddhi’ component for all beneficiaries of PM SVANidhi scheme across the country

The eligible vendors are identified as per following criteria:

- Street vendors in possession of Certificate of Vending / Identity Card issued by Urban Local Bodies (ULBs);

- The vendors, who have been identified in the survey but have not been issued Certificate of Vending / Identity Card;

- Street Vendors, left out of the ULB led identification survey or who have started vending after completion of the survey and have been issued Letter of Recommendation (LoR) to that effect by the ULB / Town Vending Committee (TVC); and

- The vendors of surrounding development/ peri-urban / rural areas vending in the geographical limits of the ULBs and have been issued Letter of Recommendation (LoR) to that effect by the ULB / TVC.

PM SVANidhi and SIDBI

- Small Industries Development Bank of India (SIDBI) is the Implementation Agency for PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi)

- SIDBI will also manage the credit guarantee to the lending institutions through Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

- SIDBI will leverage the network of lending Institutions like Non-Bank Finance Companies (NBFCs), Co-operative Banks etc., for the Scheme implementation.

Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE)

- The Ministry of Micro, Small and Medium Enterprises, GoI and Small Industries Development Bank of India (SIDBI), established a Trust named Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) to implement the Credit Guarantee Fund Scheme for Micro and Small Enterprises.

- Beneficiaries: New and existing Micro and Small Enterprises engaged in manufacturing or service activity excluding Educational Institutions, Agriculture, Self Help Groups (SHGs), Training Institutions etc., are eligible.

- Fund and non-fund based (Letters of Credit, Bank Guarantee etc.) credit facilities up to Rs 200 lakh per eligible borrower are covered under the guarantee scheme provided they are extended on the project viability without collateral security or third-party guarantee.