CONTENTS

- Electoral Bonds

- Index of Eight Core Industries

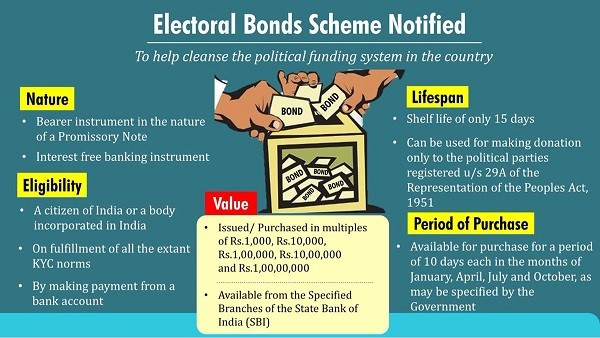

Electoral Bonds

Focus: GS II- Polity and Governance

Why in News?

The government has approved the issuance of the 27th tranche of electoral bonds that will open for sale on July 3.

What are Electoral Bonds?

- An electoral bond is like a promissory note that can be bought by any Indian citizen or company incorporated in India from select branches of State Bank of India.

- The citizen or corporate can then donate the same to any eligible political party of his/her choice.

- The bonds are similar to bank notes that are payable to the bearer on demand and are free of interest.

- An individual or party will be allowed to purchase these bonds digitally or through cheque.

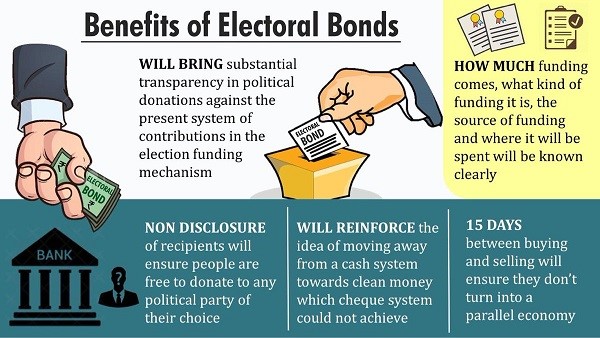

Why have they attracted criticism?

- The central criticism of the electoral bonds scheme is that it does the exact opposite of what it was meant to do: bring transparency to election funding.

- For example, critics argue that the anonymity of electoral bonds is only for the broader public and opposition parties.

- The fact that such bonds are sold via a government-owned bank (SBI) leaves the door open for the government to know exactly who is funding its opponents.

- This, in turn, allows the possibility for the government of the day to either extort money, especially from the big companies, or victimise them for not funding the ruling party — either way providing an unfair advantage to the party in power.

- Further, one of the arguments for introducing electoral bonds was to allow common people to easily fund political parties of their choice but more than 90% of the bonds have been of the highest denomination (Rs 1 crore).

- Moreover, before the electoral bonds scheme was announced, there was a cap on how much a company could donate to a political party: 7.5 per cent of the average net profits of a company in the preceding three years. However, the government amended the Companies Act to remove this limit, opening the doors to unlimited funding by corporate India, critics argue.

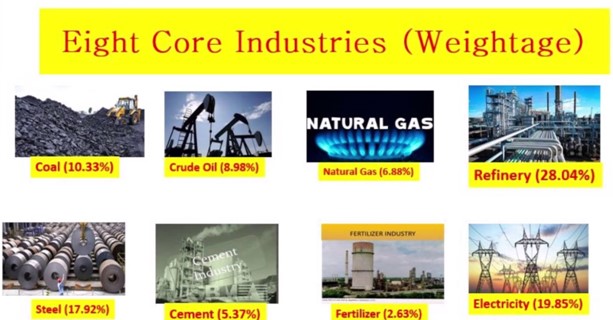

Index of Eight Core Industries

Focus: GS III- Indian Economy

Why in News?

The combined Index of Eight Core Industries (ICI) increased by 4.3 per cent (provisional) in May 2023 as compared to the Index of May 2022.

About Index of Eight Core Industries:

- The Eight Core Industries comprise 40.27% of the weight of items included in the Index of Industrial Production (IIP).

Released by: The Office of the Economic Adviser, Department for Promotion of Industry and Internal Trade

Base year: 2011-12

Below image attached Eight Core Industries based on their weightage.

Index of Industrial Production (IIP):

- The Index of Industrial Production (IIP) is an index that shows the growth rates in different industry groups of the economy in a fixed period of time.

- It is compiled and published monthly by the Central Statistical Organization (CSO), Ministry of Statistics and Programme Implementation (MOSPI).

- The Central Statistics Office (CSO) revised the base year of the all-India Index of Industrial Production (IIP) from 2004-05 to 2011-12 on 12 May 2017.

- IIP is a composite indicator that measures the growth rate of industry groups classified under broad sectors, namely, Mining, Manufacturing, and Electricity.

- Use-based sectors, namely Basic Goods, Capital Goods, and Intermediate Goods.

Significance of IIP:

- IIP is the only measure on the physical volume of production.

- It is used by government agencies including the Ministry of Finance, the Reserve Bank of India, etc., for policy-making purposes.

- IIP remains extremely relevant for the calculation of the quarterly and advance GDP estimates.