Contents

- SECI, a CPSU, conducts e-Reverse Auction for RE projects

- Section 6 of the Income-tax Act, 1961

- Shramik Special trains

SECI, A CPSU, CONDUCTS E-REVERSE AUCTION FOR RE PROJECTS

Focus: GS-III Industry and Infrastructure

Why in news?

- The Indian Renewable Energy (RE) sector has witnessed history today, as the e-Reverse Auction(e-RA) for 400 MW RE (Renewable Energy) Projects with Round the Clock (RTC) supply, was concluded at an astounding first year tariff of Rs.2.90/kWh.

- The bidding was conducted by Solar Energy Corporation of India Ltd., a Central PSU under Ministry of New and Renewable Energy.

- MNRE makes a new beginning towards firm, schedulable & affordable RTC supply through 100% RE power.

Highlights

- What makes the tariff a historic one, is the fact that this tender provides for a Round the Clock energy supply from 100% RE based energy generation sources, such as wind and solar PV, combined with storage.

- This tariff offers a much better proposition for the Disocms to meet their energy demand through 100% RE supply.

- The developer will be provided a maximum time period of 24 months from the Effective Date of PPA.

- There was no ceiling tariff for the Projects, and the developers are free to set up the project on a Pan-India basis.

- The projects under this tender will be set up under the Build-Own-Operate model.

- The tender therefore achieves a major milestone towards the MNRE’s and SECI’s efforts in realizing a firm, assured schedulable RE power supply model, which may inevitably, replace a conventional project, at a more viable tariff.

Renewable Energy in India

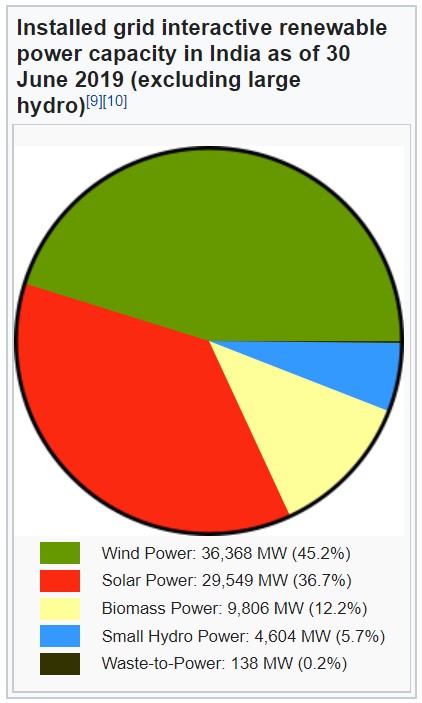

- As of 31 March 2020, 35.86% of India’s installed electricity generation capacity is from renewable sources, generating 21.22% of total utility electricity in the country.

- In the Paris Agreement, India has committed to an Intended Nationally Determined Contributions target of achieving 40% of its total electricity generation from non-fossil fuel sources by 2030.

- Government of India has also set a target for installation of Rooftop Solar Projects (RTP) of 40 GW by 2022 including installation on rooftop of houses.

- India was the first country in the world to set up a ministry of non-conventional energy resources (Ministry of New and Renewable Energy MNRE), in the early 1980s.

- Hydroelectricity is administered separately by the Ministry of Power and not included in MNRE targets.

- India’s public sector undertakings the Solar Energy Corporation of India is responsible for the development of solar energy industry in India.

- India is the 7th largest producer of hydroelectric power in the world.

- India is an ideal environment for Biomass production given its tropical location and abundant sunshine and rains and the country’s vast agricultural potential provides huge agro-residues which can be used to meet energy needs.

SECTION 6 OF THE INCOME-TAX ACT, 1961

Focus: GS-III Indian Economy

What is Section 6 of the Income-Tax Act, 1961

Section 6 of the Income-tax Act, 1961 (the Act) contains provisions relating to residency of a person.

The status of an individual is dependent on the period for which the person is in India during a year – to decide as to whether he is resident in India or a non-resident or not ordinarily resident.

How the Concern Regarding Residency Arises?

- There are individuals who had come on a visit to India during the previous year 2019-20 for a particular duration and intended to leave India.

- If they leave India before the end of the previous year, they will be maintaining their status as non-resident or not ordinary resident in India.

- Due to declaration of the lockdown and suspension of international flights owing to outbreak of Novel Corona Virus (COVID-19), they are required to prolong their stay in India.

- Concerns have been expressed that they may involuntarily end up becoming Indian residents without any intention to do so.

In order to avoid genuine hardship in such cases, the CBDT has provided clarifications in a circular. Basically, these clarifications are exemptions to people who were stuck in India due to the quarantine / lockdown from being considered as Indian residents without willing to do so.

Income Tax Act

- James Wilson who became India’s first finance (British) member, had introduced the first modern Income Tax Act in 1860.

- The Income Tax Act is a comprehensive statute that focuses on the different rules and regulations that govern taxation in the country.

- It provides for levying, administering, collecting and recovering income tax for the Indian government.

Budget and Income Tax Act

- The Government of India presents finance budget every year in the month of February.

- The finance budget brings various amendments in income tax act,1961 including tax slabs rates.

- The amendments are generally applicable to the next following financial year beginning from 1 April unless otherwise specified.

- Such amendments become part of the income tax act after the approval of the president of India.

SHRAMIK SPECIAL TRAINS

Focus: GS-II Social Justice

Why in news?

Subsequent to the Ministry of Home Affairs order regarding movement of migrant workers, pilgrims, tourists, students and other persons stranded at different places by special trains, Indian Railways had decided to operate “Shramik Special” trains.

About “Shramik Special” Trains

- “Shramik Special” trains started running from May 1 (Labour Day).

- These special trains will run from point to point on the request of both the concerned State Governments as per the standard protocols for sending and receiving such stranded persons.

- In these Shramik Special Trains, maximum around 1200 passengers can travel observing social distancing.

- Passengers shall be brought to the railway station in batches in sanitized buses following the social-distancing rules. It is mandatory for every passenger to wear face cover.

- Proper screening of passengers is ensured before boarding the train. Passengers who are found asymptomatic (showing no symptoms) would be allowed to travel.

- During the journey, passengers are given free meals and water.