Contents

- Vanchit Ikai Samooh aur Vargon ki Aarthik Sahayta (VISVAS) Yojana

VANCHIT IKAI SAMOOH AUR VARGON KI AARTHIK SAHAYTA (VISVAS) YOJANA

Focus: GS2 ;Welfare schemes for vulnerable sections of the population by the Centre and States and the performance of these schemes; mechanisms, laws, institutions and Bodies constituted for the protection and betterment of these vulnerable sections.

Why in News?

Implementation of Interest subvention Scheme of Ministry of Social Justice & Empowerment, Government of India –Vanchit Ikai Samooh aur Vargon ki Aarthik Sahayta (VISVAS) Yojana for financial empowerment of economically marginalized OBC/SC SHGs & Individuals got a major boost with signing of Memorandum of Agreements (MoAs) by National Backward Classes Finance & Development Corporation (NBCFDC) and National Scheduled Castes Finance and Development Corporation (NSFDC) with Punjab National Bank, a premier and leading Public Sector Bank.

About VISVAS Yojana

- The National Backward Classes Finance & Development Corporation (NBCFDC) and National Scheduled Castes Finance and Development Corporation (NSFDC) under M/O Social Justice & Empowerment entered in to MoA With Central Bank of India for implementation of Vanchit Ikai Samooh aur Vargon ki Aarthik Sahayta (VISVAS) Yojana.

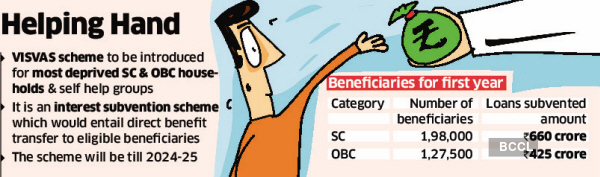

- It is an Interest subvention Scheme of Ministry of Social Justice & Empowerment for financial empowerment of economically marginalized OBC/SC SHGs & Individuals.

- The scheme will benefit OBC/SC SHGs with loans/borrowings up to Rs.4.00 Lakh and OBC/SC individuals with loan/borrowing up to Rs.2.00 Lakh with a quick interest subvention benefit of 5% directly into the standard accounts of borrowing SHGs/beneficiaries.

The Objectives of VISVAS Yojana

- Under this scheme, interest subvention will be provided to Self Help Groups with 100% OBC members and OBC individuals who have taken loan for various income generating activities from those Lending Institutions who have signed MoA with NBCFDC.

The Eligibility of VISVAS Yojana

- Members of Backward Classes, as notified by Central Government/State Governments from time to time.

- Applicant’s annual family income should be less than Rs. 3.00 Lakh.

- SHGs must be registered with NRLM/NULM/NABARD with more than two years of credit history

- SHGs/Individuals must have made all repayments timely to be eligible for Interest Subvention

- All OBC Antoday Anna Yojana (AAY) card holders, and OBC individuals facing three or more Deprivations in terms of SECC-2011, as per records available at the relevant BDO Office shall be eligible for Interest Subvention.

- All OBC beneficiaries involved in Agricultural activities and getting coverage under the PM Kisan shall be eligible for coverage under Interest Subvention

The Salient Features of VISVAS Yojana

(i) Maximum loan limit (for SHG) : Rs. 4.00 Lakh

(ii) Maximum loan limit (for individual) : Rs. 2.00 Lakh

(iii)Maximum Subvention Amount : @5% p.a.

The Mode of payment of Subvention of VISVAS Yojana

- Through Direct Transfer of Subvention Amount into operating account of SHG or Individual.

The Period of Scheme of VISVAS Yojana

- It is valid for 2020-21 as of now.

- Further extension contingent on the evaluation of the Scheme by way of its impact assessment.