Contents

- 1 CRORE HOUSES SANCTIONED UNDER PMAY(U)

- FINANCE MINISTER LAUNCHES eBक्रय ALONG WITH OTHER ANNOUNCEMENTS

- 125 CRORE RESIDENTS OF INDIA HAVE AADHAAR

- QUALITY MANDATE IN HIGHER EDUCATIONAL INSTITUTIONS

1 CRORE HOUSES SANCTIONED UNDER PMAY(U)

Why in News?

- Minister of State(I/C) for Housing & Urban Affairs has informed that out of a validated demand of 1.12 Cr houses in urban areas, 1 Cr houses have already been sanctioned.

- Further, a total of 57 Lakh houses are in various stages of construction of which, nearly 30 Lakh houses have been completed.

Details

- Pradhan Mantri Awas Yojana (Urban), PMAY (U), is one of the largest affordable housing programmes in the world.

- PMAY (U) has achieved 10 times more in a span of 4.5 years as compared to JnNURM Scheme

- Ministry of Housing & Urban Affairs has informed that the Mission has covered a range of social groups which comprises of around 5.8 Lakh senior citizens, 2 Lakh construction workers, 1.5 Lakh domestic workers, 1.5 Lakh artisans, 0.63 Lakh differently-abled (Divyang), 770 transgender and 500 leprosy patients as of now.

- Empowerment of women is an inbuilt design of the scheme where the ownership of the house is in the name of female head of household or in the joint name.

- In order to supplement the additional requirement of providing the Central Assistance, over and above the budgetary support, Government has made a provision for raising Extra Budgetary Resources (EBR) and created an Affordable Housing Fund (AHF) in the National Housing Bank (NHB).

- Government has identified many alternative and innovative technologies through a Global Housing Technology Challenge- India. This will usher a paradigm shift in the construction technology in India and will propel in a host of economic activities.

- The Ministry has launched angikaar- a campaign for change management. The campaign address and enables beneficiaries to adapt to life transformation that comes with shifting to a newly constructed house.

- The campaign has also converged with other government schemes like Ayushman Bharat and Ujjawala so that beneficiaries can avail the benefits of these schemes.

FINANCE MINISTER LAUNCHES eBक्रय ALONG WITH OTHER ANNOUNCEMENTS

Why in News?

- The Union Finance Minister, on 28th December 2019, discussed banking issues with chiefs of Public Sector Banks (PSBs), chief executive of Indian Banks’ Association and representatives of leading private sector banks.

- To enable online auction by banks of attached assets transparently and cleanly for improved realisation of value – eBक्रय, a common e-auction platform was launched today by the Finance Minister. The platform is equipped with property search features and navigational links to all PSB e-auction sites, provides single-window access to information on properties up for e-auction as well as facility for comparison of similar properties, and also contains photographs and videos of uploaded properties.

Announcements made

- Steps for enhancing digital transactions

- Business establishments with annual turnover of more than Rs. 50 crore shall offer low cost digital modes of payment ( such as BHIM UPI, UPI QR Code, Aadhaar Pay, Debit Cards, NEFT, RTGS etc.) to their customers, and no charge or Merchant discount rates (MDR) shall be imposed on customers as well as merchants.

- Banks restored to health for

lending

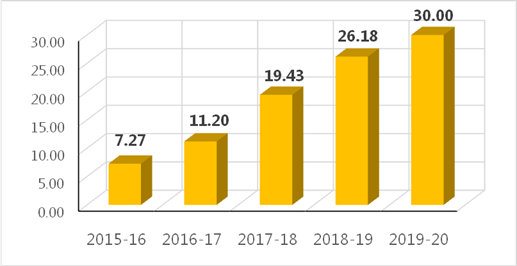

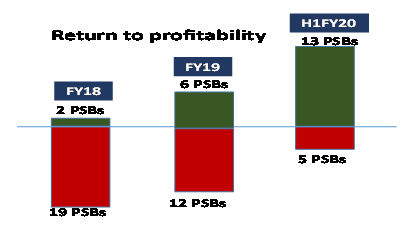

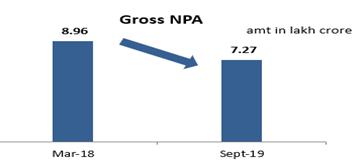

- Extensive reforms carried out by the Government have restored banks to health, with the gross NPAs of PSBs declining from Rs. 8.96 lakh crore in March 2018 to Rs. 7.27 lakh crore in September 2019, their provision coverage ratio rising to their highest level in seven years, and banks returning to profitability, with as many as 13 banks reporting profits in H1FY20.

- Robust banks to lend without

undue apprehensions

- Bankers were assured that prudent commercial decision-making would be protected.

- Credit outreach by banks

- In order to address the working capital needs of MSMEs on account of stress arising from delayed payments, PSBs are offering up to 25% enhancement in working capital limits for standard MSME accounts as a Standby Line of Credit and have launched a MSME Outreach Initiative for restructuring of stressed standard assets as needed on priority and in a timely manner, besides providing new term loans, payment solutions for delayed receivables, bill discounting and trade finance.

- Support to NBFCs and HFCs by

PSBs

- Post IL&FS default, aided significantly by Government support, assets of NBFCs have grown by 12.83%

- Similarly, 76 out of 101 HFCs with 82% of market share have shown a positive asset growth of 18% post IL&FS default

- Thus, the NBFC/HFC sector post IL&FS default, is now stabilizing and good NBFCs/HFCs are able to raise funds from market even at times at rates less than the pre-IL&FS rates.

125 CRORE RESIDENTS OF INDIA HAVE AADHAAR

Why in News?

- The Unique Identification Authority of India (UIDAI) announced a new milestone achieved by the Aadhaar project – crossing of the 125 crore mark.

- The achievement comes along with the rapidly increasing use of Aadhaar as the primary identity document by the Aadhaar holders.

- Also, residents are more inclined on keeping their details in Aadhaar updated.

Background

- Section 2(a) of The Aadhaar Act, 2016, defines Aadhar as:

- Aadhaar card is basically an identification document issued by the UIDAI after it records and verifies every resident Indian citizen’s details including biometric and demographic data.

- A number is issued to an individual which is unique and valid for the life time and cannot be reissued to any other individual.

- It may be accepted as a proof of Identity however it is not a conclusive proof of citizenship in respect of an Aadhar number individual.

- Aadhar is issued by Government Of India which delegates its power to UIDAI.

- The main objective of aadhar is to ensure good governance and for efficient transparent and targeted delivery of subsidies, benefits and services to the individual.

QUALITY MANDATE IN HIGHER EDUCATIONAL INSTITUTIONS

Why in News?

- Union Human Resource Development Minister launched the 5 documents developed by University Grants Commission(UGC) covering the 5 verticals of Quality Mandate in New Delhi today.

- These five documents cover evaluation reforms, eco-friendly and sustainable university campuses, human values & professional ethics, faculty induction and academic research integrity.

Details

- To improve the quality in Higher Educational Institutions the UGC has adopted the Higher Education Quality Improvement Programme Mandate.

- The quality mandate aims at evolving higher education system to equip country’s next generation with vital skills, knowledge and ethics for leading a rewarding life.

- Recognising the need to discuss and streamline the process that helps to infuse the culture ofhuman values and ethics in educational institutions, UGC has also developed a policyframework- “MulyaPravah – Guidelines for Inculcation of Human values and ProfessionalsEthics in Higher Educational Institutions”.