Contents

- Financial Stability and Development Council (FSDC)

- Instant PAN through Aadhaar based e-KYC

- Delimitation Commission

FINANCIAL STABILITY AND DEVELOPMENT COUNCIL (FSDC)

Focus: GS-III Indian Economy

Why in news?

Union Minister for Finance & Corporate Affairs chaired the 22nd Meeting of the Financial Stability and Development Council (FSDC) on 28th May 2020.

Highlights

- The meeting reviewed the current global and domestic macro-economic situation, financial stability and vulnerabilities issues, major issues likely to be faced by banks and other financial institutions as also regulatory and policy responses, Liquidity / Solvency of NBFCs/HFCs/MFIs and other related issues.

- There is a need to keep a continuous vigil by Government and all regulators on the financial conditions that could expose financial vulnerabilities in the medium and long-term.

Financial Stability and Development Council (FSDC)

- Financial Stability and Development Council (FSDC) is an apex-level body constituted by the government of India.

- FSDC is Neither a Statutory Body or Constitutional Body.

- The FSDC was set up to strengthen and institutionalise the mechanism for maintaining financial stability, enhancing inter-regulatory coordination and promoting financial sector development.

- The Council deals, inter-alia, with issues relating to financial stability, financial sector development, inter–regulatory coordination, financial literacy, financial inclusion and macro prudential supervision of the economy including the functioning of large financial conglomerates.

FSDC Composition

The Council is chaired by the Union Finance Minister

Members:

- Governor Reserve Bank of India (RBl),

- Finance Secretary and/ or Secretary, Department of Economic Affairs (DEA),

- Secretary, Department of Financial Services (DFS),

- Secretary, Ministry of Corporate Affairs,

- Secretary, Ministry of Electronics and Information Technology,

- Chief Economic Advisor, Ministry of Finance,

- Chairman, Securities and Exchange Board of India (SEBI),

- Chairman, Insurance Regulatory and Development Authority (IRDA),

- Chairman, Pension Fund Regulatory and Development Authority (PFRDA),

- Chairman, Insolvency and Bankruptcy Board of India (IBBI)

INSTANT PAN THROUGH AADHAAR BASED E-KYC

Focus: GS-II Governance

Why in news?

In line with the announcement made in the Union Budget, Union Minister for Finance & Corporate Affairs launched the facility for instant allotment of PAN (on near to real time basis).

Features of the e-PAN Facility

- This facility is free of cost and is available for a limited period on first-come, first-served basis for valid Aadhaar holders.

- It was introduced because of increasing number of people applying for PAN.

- This facility is only for resident individuals and not for Hindu Undivided Family (HUF), firms, trusts and companies.

Allotment Process

- The allotment process is paperless and an electronic PAN (e-PAN) is issued to the applicants free of cost.

- The instant PAN applicant is required to access the e-filing website of the Income Tax Department to provide her/his valid Aadhaar number and then submit the OTP received on her/his Aadhaar registered mobile number.

- On successful completion of this process, a 15-digit acknowledgment number is generated.

Permanent Account Number (PAN)

- Permanent Account Number (PAN) is a ten-digit alphanumeric number issued by the Income Tax Department.

- PAN enables the department to link all transactions of the “person” with the department. These transactions include tax payments, TDS/TCS credits, returns of income, specified transactions, correspondence, and so on.

- PAN, thus, acts as an identifier for the “person” with the tax department.

- It is mandatory to quote PAN on return of income, all correspondence with any income tax authority.

- From 1 January 2005 it has become mandatory to quote PAN on challans for any payments due to Income Tax Department.

DELIMITATION COMMISSION

Focus: GS-II Governance, Indian Polity

Why in news?

The Delimitation Commission had a meeting on 28th May 2020, to review the progress of direction given by the Commission in its first meeting.

Delimitation Commission

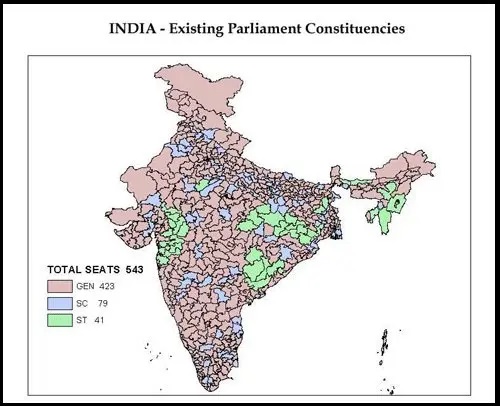

- The Delimitation commission (or Boundary commission) of India is a commission established by the Government of India under the provisions of the Delimitation Commission Act.

- Hence, Delimitation Commission is a Statutory Body.

- The Delimitation Commission Act was enacted in 1952.

- Delimitation Commissions have been set up four times — 1952, 1963, 1973 and 2002 under the Acts of 1952, 1962, 1972 and 2002.

Important Points about the Delimtation Commission:

- The Delimitation Commission is appointed by the President of India and works in collaboration with the Election Commission of India.

- The main task of the commission is redrawing the boundaries of the various assembly and Lok Sabha constituencies based on a recent census.

- The representation from each State is NOT CHANGED during this exercise.

- However, the number of SC and ST seats in a state are changed in accordance with the census.

- The present delimitation of constituencies has been done on the basis of 2001 census under the provisions of Delimitation Act, 2002.

- The Commission is a powerful and independent body whose orders cannot be challenged in any court of law.

- The orders are laid before the Lok Sabha and the respective State Legislative Assemblies. However, modifications are NOT permitted.

Present Delimitation Commission of 2002

- On 4 January 2008, the Cabinet Committee on Political Affairs (CCPA) decided to implement the order from the Delimitation Commission.

- All future elections in India for states covered by the commission will be held under the newly formed constituencies.

- The present delimitation of parliamentary constituencies has been done on the basis of 2001 census figures under the provisions of Delimitation Act, 2002.

- However, the Constitution of India was specifically amended in 2002 not to have delimitation of constituencies till the first census after 2026.

- Thus, the present constituencies carved out on the basis of 2001 census shall continue to be in operation till the first census after 2026.

Composition of Delimitation Commission

- Retired Supreme Court judge

- Chief Election Commissioner

- Respective State Election Commissioners

In case of difference of opinion among members of the Commission, the opinion of the majority prevails.

What is Delimitation?

- Delimitation literally means the act or process of fixing limits or boundaries of territorial constituencies in a country or a province having a legislative body.

- Delimitation is necessary in order to:

- Provide equal representation to equal segments of a population,

- Enabling fair division of geographical areas so that one political party doesn’t have an advantage over others in an election, and

- Follow the principle of “One Vote One Value”.

Constitutional Provisions on Delimitation

- Under Article 82, the Parliament enacts a Delimitation Act after every Census.

- Under Article 170, States also get divided into territorial constituencies as per Delimitation Act after every Census. Once the Act is in force, the Union government sets up a Delimitation Commission.

- According to Article 81 of the Constitution — as it stood before the Constitution (Forty-second Amendment) Act, 1976 — the Lok Sabha was to comprise of not more than 550 members.

- Clause (2) of Article 81 provided that the number of seats in the House of the People that shall be allotted to each State – are in such manner that the ratio between the number if seats and the population of the State is, so far as practicable, the same for all States.

- Further, clause (3) defined the expression “population” for the purposes of Article 81 to mean the population as ascertained at the last preceding Census of which the relevant figures have been published.

Suspension of Delimitation

- The union government had suspended delimitation in 1976 until after the 2001 census so that states’ family planning programs would not affect their political representation in the Lok Sabha.

- States which took a lead in population control faced the prospect of their number of seats getting reduced and States which had higher population figures stood to gain by increase in the number of seats in Lok Sabha.

- To allay this apprehension, through Forty-second Amendment the government froze the total Parliamentary and Assembly seats in each state till 2001 Census.

- This was done mainly due to wide discrepancies in family planning among the states and thus giving time to states with higher fertility rates to implement family planning to bring the fertility rates down.

- The constitution was again amended (84th amendment to Indian Constitution) in 2002 to continue the freeze on total number of seats in each state till 2026.

New Numbers:

- When the first Census figure will be available after 2026 — that is, in 2031 — a fresh delimitation will have to done which will dramatically alter the present arrangement of seat allocation to the States in Parliament.

- We might need a new building for Parliament altogether due to the likely increase in number of seats in both Houses after the lifting of the freeze imposed by the Constitution (Forty-second Amendment) Act, 1976, which is due in 2026.