Contents

- 15th Finance Commission holds meeting with its Advisory Council

- IFFCO is playing vital role to support Government

- ITAT holds hearing through video conferencing

- IIT Delhi develops Probe-free COVID-19 detection assay

- Magnetic nanoparticle-based RNA extraction kit

15TH FINANCE COMMISSION HOLDS MEETING WITH ITS ADVISORY COUNCIL

Focus: GS-II Governance, GS-III Indian Economy, Prelims

Why in news?

The Fifteenth Finance Commission (XVFC) had online meetings with its Advisory Council on 23-24 April, 2020 and discussed various issues confronting the Commission now.

What transpired in the meeting?

- In the meeting all of them were unanimous to suggest that the projections of real GDP growth made before March 2020 need to be relooked into entirely, and, revised downwards considerably.

- Once the lockdown of the economy is released, the recovery can only be expected to be gradual, depending on the ability of the workforce to get back to work soon, restoration of supplies of intermediates and cash flows and, of course, the demand for output.

- Therefore, the full magnitude of the economic impact of COVID will only be clear only over a course of time.

- The Advisory Council also felt that the magnitude of the impact of these developments on public finances is uncertain, but will certainly be significant. Governments will have substantial expenditure burden on account of health, support to poor and other economic agents.

- The Council Members felt that the shortfall in tax and other revenues will be large due to subdued economic activity.

- Hence, fiscal response to the crisis should be much more nuanced. It is important not just to look at the size of fiscal response but also carefully at its design.

- The Council apprised the Finance Commission of the different suggestions floating around in terms of public expenditure support to the economy.

Important considerations:

- Small scale enterprises were cash-starved even prior to the onset of COVID. As their activity levels and cash flows are affected, it is important that a support mechanism be devised to help them overcome this problem.

- Non-banking financial companies are also affected by the slowdown. In order to avoid bankruptcies and deepening of NPAs in the financial sector, measures should be appropriately designed. Measures like partial loan guarantee may help. The Reserve Bank of India will have a key role in ensuring that financial institutions are well-capitalized.

- The finances of the Central and State Governments need to be watched carefully. As of now, adequate provision for ways and means advances can largely help governments to manage cash-flow mismatches. As we move ahead, we need to think of options for financing the additional deficit. It is important to ensure that the State governments get access to adequate funds to undertake their fight against the pandemic.

- The Council also felt that it is likely that different States may come out of the severity of the impact of the pandemic in different stages. Hence, the revival of activity in different States will be at varied pace.

Finance Commission

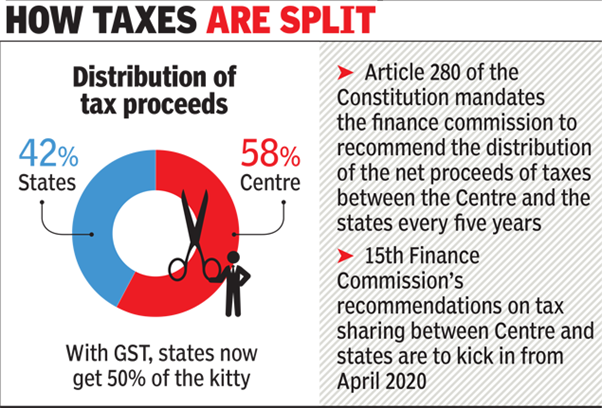

- The Finance Commission (FC) is constituted by the President of India every fifth year under Article 280 of the Constitution.

- Finance Commission is a constitutional body.

- It was formed to define the financial relations between the central government of India and the individual state governments.

- FC determines the method and formula for distributing the tax proceeds between the Centre and states, and among the states.

- The Finance Commission also decides the share of taxes and grants to be given to the local bodies in states. This part of tax proceeds is called Finance Commission Grants, which is a part of the Union budget.

- The Finance Commission (Miscellaneous Provisions) Act, 1951 additionally defines the terms of qualification, appointment and disqualification, the term, eligibility and powers of the Finance Commission.

- The Finance Commission consists of a chairman and four other members, who are appointed by the President of India.

- There have been fifteen commissions to date, the most recent was constituted in 2017.

Fifteenth Finance Commission

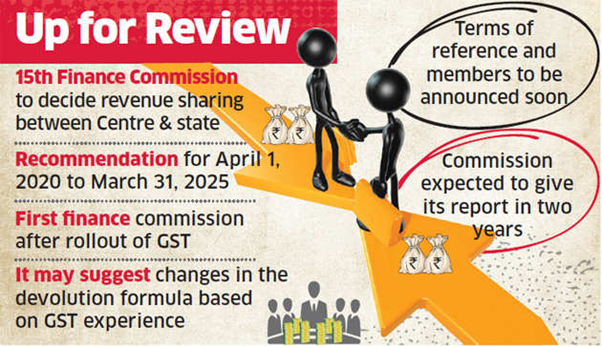

- The Fifteenth Finance Commission (XV-FC or 15-FC) is an Indian Finance Commission constituted in November 2017 and is to give recommendations for devolution of taxes and other fiscal matters for five fiscal years, commencing 2020-04-01.

- The main tasks of the commission were to “strengthen cooperative federalism, improve the quality of public spending and help protect fiscal stability”.

IFFCO IS PLAYING VITAL ROLE TO SUPPORT GOVERNMENT

Focus: GS-III Industry and Infrastructure, Agriculture, Prelims

Why in news?

IFFCO, a leading fertilizer cooperative body under the Ministry of Chemicals and Fertilizers, is playing a vital role by helping Government to combat COVID-19 pandemic and mitigate the impact of the outbreak.

Ministry has said that Fertilizer companies are already working with full capacity to supply adequate quantity of fertilizers to the farming community for upcoming Kharif season.

IFFCO

- IFFCO is large scale fertiliser cooperative federation in India which is registered as Multistate Cooperative Society.

- It is one of India’s biggest cooperative society which is wholly owned by Indian Cooperatives.

- It was founded in 1967 with just 57 cooperatives and at present it has amalgamation of over 36,000 Indian Cooperatives with diversified business interests ranging from General Insurance to Rural Telecom apart from its core business of manufacturing and selling fertilisers.

- IFFCO’s main Aim is to augment the incremental incomes of farmers by helping them to increase their crop productivity through the balanced use of energy efficient fertilisers; maintain the environmental health; and to make cooperative societies economically and democratically strong for professionalised services to the farming community to ensure an empowered rural India.

ITAT HOLDS HEARING THROUGH VIDEO CONFERENCING

Focus: GS-III Indian Economy, Prelims

Why in news?

A division bench of the Income Tax Appellate Tribunal (ITAT) through web-based video conferencing platform, heard and disposed of an urgent stay petition on 24th April 2020. It was the first time ever that hearing was done through video conferencing.

The ITAT benches based in 27 locations are equipped to hold similar hearings through VC on petitions made by assesses or revenue department on urgent matters as and when exigencies arise.

ITAT

- ITAT is a quasi-judicial institution set up in January, 1941 and specializes in dealing with appeals under the Direct Taxes Acts.

- It was setup under section 5A of the Income Tax Act, 1922.

- It was the first experiment in tribunalization in the history of India. ITAT is referred to as ‘Mother Tribunal’ being the oldest Tribunal in the country.

- It is second appellate authority under the direct taxes and first independent forum in its appellate hierarchy.

- It functions under the Department of Legal Affairs in the Ministry of Law and Justice, and is kept away from any kind of control by the Ministry of Finance.

- The orders passed by the ITAT are final, an appeal lies to the High Court only if a substantial question of law arises for determination.

IIT DELHI DEVELOPS PROBE-FREE COVID-19 DETECTION ASSAY

Focus: GS-III Science and Technology

Why in news?

Team of scientists from IIT Delhi developed the COVID 19 probe – free Real-time PCR Diagnostic Kit.

Details

- This is the first probe-free assay for COVID-19 approved by ICMR and it will be useful for specific and affordable high throughput testing.

- The assay has been validated at ICMR with a sensitivity and specificity of 100%. This makes IITD the first academic institute to have obtained ICMR approval for a real-time PCR-based diagnostic assay.

- This assay can be easily scaled up as it does not require fluorescent probes. The team is targeting large scale deployment of the kit at affordable prices with suitable industrial partners as soon as possible.

- The kit will not only empower healthcare services but also support the government in the time of crisis.

Assay

An assay is an analysis done to determine: The presence of a substance and the amount of that substance.

An assay is an investigative (analytic) procedure in laboratory medicine, pharmacology, environmental biology and molecular biology for qualitatively assessing or quantitatively measuring the presence, amount, or functional activity of a target entity (the analyte).

MAGNETIC NANOPARTICLE-BASED RNA EXTRACTION KIT

Focus: GS-III Science and Technology

Why in news?

Chitra Magna, an innovative RNA extraction kit, has been developed by Sree Chitra Tirunal Institute for Medical Sciences and Technology (SCTIMST), an Institution of National Importance under the Department of Science and Technology.

Background

- SARS-COV-2, the causative virus of COVID-19 pandemic, is an RNA virus- a long single-stranded polymeric substance present in all living cells that carries the genetic information of the organism necessary for life.

- One of the critical steps in detecting this virus is by confirming the presence of the RNA of the virus in the sample taken from the throat or nose.

- The sample collected is transported under specified conditions in a viral transport medium to the testing laboratory.

Details about the extraction kit

- The protocol for the kit uses magnetic nanoparticles to capture and concentrate the RNA from the patient sample.

- This is of significant advantage because even if some viral RNA disintegrates during storage and transportation of the patient samples, all of it is captured by the magnetic bead-based extraction technology.

- The magnetic nanoparticle beads bind to the viral RNA and, when exposed to a magnetic field, give a highly purified and concentrated level of RNA.

- As the yield of PCR or LAMP test is dependent on getting an adequate quantity of viral RNA, this innovation enhances the chances of identifying positive cases.

- Chitra Magna can be used to extract high purity RNA from patient samples not only for LAMP testing but also for the RT-PCR test.

- The first step of isolating high quality and high concentration of RNA without degradation is critical to the outcome of the PCR or LAMP test in which RNA is converted to DNA.