Contents

- Operation Greens Scheme.

- Viability Gap Funding.

- Tax-Terrorism.

- Maulana Azad and Acharya Kripalani.

- Input Tax Credit.

OPERATION GREENS SCHEME

Focus: GS 3; Food processing and related industries in India- scope’ and significance, location, upstream and downstream requirements, supply chain management.

Why in News?

The MOFPI Provides 50% Subsidy on air Transportation from North-Eastern and Himalayan States.

About Operation Greens Scheme

- The Operation Greens is a project approved by the Ministry of Food Processing Industries (MOFPI) with the target to stabilize the supply of tomato, onion and potato crops (TOP crops) in India, as well as to ensure their availability around the country, year-round without price volatility.

- In the budget speech of Union Budget 2018-19, a new Scheme “Operation Greens” was announced on the line of “Operation Flood”, with an outlay of Rs.500 crore to promote Farmer Producers Organizations (FPOs ), agri-logistics, processing facilities and professional management.

- Accordingly, the Ministry has formulated a scheme for integrated development of Tomato, Onion and Potato (TOP) value chain.

- The Operation Green TOP Scheme is a “Central Sector Scheme” under implementation of Ministry of Food Processing and Industry (MOFPI).

- The Ministry of Food Processing Industries (MoFPI) has recently extended the Operation Greens Scheme from Tomato, Onion and Potato (TOP) to all fruits & vegetables (TOTAL) for a period of six months on pilot basis as part of Aatmanirbhar Bharat Abhiyan, regarding the same things explained in the below attached image.

Objectives Of Operation TOP Green Scheme

- Enhancing value realisation of TOP farmers by targeted interventions to strengthen TOP production clusters and their FPOs, and linking/connecting them with the market.

- The Price stabilisation for producers and consumers by proper production planning in the TOP clusters and introduction of dual use varieties.

- Reduction in post-harvest losses by creation of farm gate infrastructure, development of suitable agro-logistics, creation of appropriate storage capacity linking consumption centres.

- Increase in food processing capacities and value addition in TOP value chain with firm linkages with production clusters.

- The Setting up of a market intelligence network to collect and collate real time data on demand and supply and price of TOP crops.

Strategies for Operation Green Scheme

- The scheme will have two-pronged strategy of Price stabilisation measures (for short term) and Integrated value chain development projects (for long term).

Short term Price Stabilisation Measures

- The NAFED will be the Nodal Agency to implement price stabilisation measures.

- The MoFPI will provide 50% of the subsidy on the following two components

- Transportation of Tomato Onion Potato(TOP) Crops from production to storage

- Hiring of appropriate storage facilities for TOP Crops.

- Market Intelligence and Early Warning System (MIEWS)

- The MIEWS Dashboard and Portal is a platform for monitoring prices of tomato, onion and potato (TOP) and for generating alerts for intervention under the terms of the Operation Greens scheme.

- The portal would disseminate all relevant information related to TOP crops such as Prices and Arrivals, Area, Yield and Production, Imports and Exports, Crop Calendars, Crop Agronomy, etc in an easy to use visual format.

Long Term Integrated value chain development projects

- Formation and Capacity Building of FPOs

- Quality Production

- Post-harvest processing facilities – At Farm Level

- Post-harvest processing facilities – At Main Processing Site

- Agri-Logistics

- Marketing/Consumption Points

VIABILITY GAP FUNDING

Focus: GS 3;Investment models.

Why in News?

Cabinet approves Continuation and Revamping of the Scheme for Financial Support to Public Private Partnerships in Infrastructure Viability Gap Funding VGF Scheme

About Viability Gap Fund (VGF)

- The VGF is a government support in the form of contribution of some of the construction cost, given in cash to a PPP project that already economically viable but has not had a financial feasibility.

- The VGF can be given when there is no other alternative to make the PPP project financially feasible.

- The Funds for VGF will be provided from the government’s budgetary allocation, sometimes it is also provided by the statutory authority who owns the project asset.

- The VGF grants will be available only for infrastructure projects where private sector sponsors are selected through a process of competitive bidding.

- The VGF grant will be disbursed at the construction stage itself but only after the private sector developer makes the equity contribution required for the project.

- The Local Government can contribute to the provision of this support after obtaining the approval of Local Parliament.

The Benefits of VGF are as follows;-

- Reduces the project cost to be borne by private parties.

- Increases the financial feasibility of PPP projects that attract interest and participation of the private sector.

- Increases the certainty of the procurement of project company in accordance with the quality and the planned timeline.

- Delivers public service at an affordable tariff for the community.

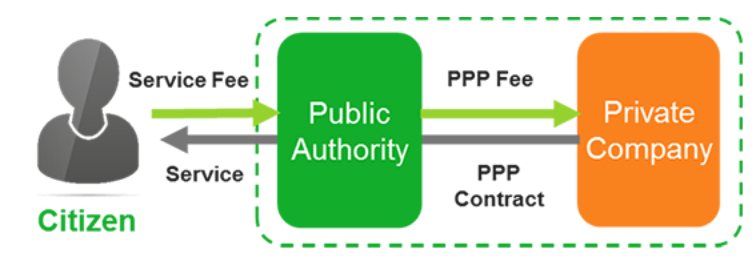

About Public-Private Partnerships (PPP)

- The Public-private partnerships involve collaboration between a government agency and a private sector company

- It can be used to finance, build, and operate projects, such as public transportation networks, parks, and convention centers.

- The Financing a project through a public-private partnership can allow a project to be completed sooner or make it a possibility in the first place.

- The Public-private partnerships often involve concessions of tax or other operating revenue, protection from liability, or partial ownership rights over nominally public services and property to private sector, for-profit entities.

Above image depicts the PPP Model

TAX – TERRORISM

Focus: GS 3;Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Why in News?

India has Moved from Tax-Terrorism to Tax-Transparency: Prime Minister

About Tax Terrorism

- The ‘Tax terrorism’ refers to use of tax laws and legal machinery by state to create inconvenience or harassment for corporates and entrepreneurs.

- The Taxing eco system in india provides favorable ground for this as follows

Retrospective tax laws

- The IT department has often demanded huge sum of taxes retrospectively with matters ending in courts like cases of Vodafone an cairn, frequent court dispute is truly demoralizing.

Ambiguity in tax laws

- The ambiguity leads to different interpretation even by experts causing tax dispute.

- The Ambiguity regarding meaning and applicability of capital gain tax was at the centre of Vodafone controversy.

- Complexity and multiplicity of tax laws (both direct and indirect) creates confusion opening door for both tax evasion and high handedness by tax officials.

- Although GST is a big relief, the draconian General Anti Avoidance Rule (GAAR) proposed in the past with unrestrained power to tax officials was a concern.

- The Long drawn, multi tier and expensive court processes makes them a part of tax terrorism.

- All such practices create an environment of confusion and uncertainty, whereas entrepreneurs prefer stability and simplicity avoiding friction with authority.

Consequences of Tax Terrorism

- Affects Ease of doing business

- Non-compliance

- Predictability and stability lacks and hurting investor confidence

- Impact on Make in India

- Growth rates

- Industrial production

- Especially for MSMEs

Way Forward

- The promise by the government to end tax terrorism has generated hope and expediency shown in rolling out of GST and not filing appeal in higher court against Vodafone and shell cases are welcome development, but institutional actions are needed to generate confidence among entrepreneurs and increase investment.

MAULANA AZAD AND ACHARYA KRIPALANI

Focus: GS 3;Modern Indian history from about the middle of the eighteenth century until the present significant events, personalities, issues.

Why in News?

PM pays tributes to Maulana Azad and Acharya Kripalani on their Jayanti

About Maulana Abul Kalam Azad

- The National Education Day of India is celebrated every year on 11 November to commemorate the birth anniversary of Maulana Abul Kalam Azad, the first education minister of independent India.

- Born on 11 November 1888 and died on 22 February 1958.

- He was senior Muslim leader of Indian National Congress during Indian independence movement.

- He is commonly remembered as Maulana Azad (word Maulana is honorific meaning ‘Our Master’) and he had adopted Azad (Free) as his pen name.

- In 1923, at age of 35, he became youngest person to serve as President of Indian National Congress.

- He served as Congress president from 1940 to 1945, during which Quit India rebellion was launched.

- He also worked for Hindu-Muslim unity through the Al-Hilal newspaper.

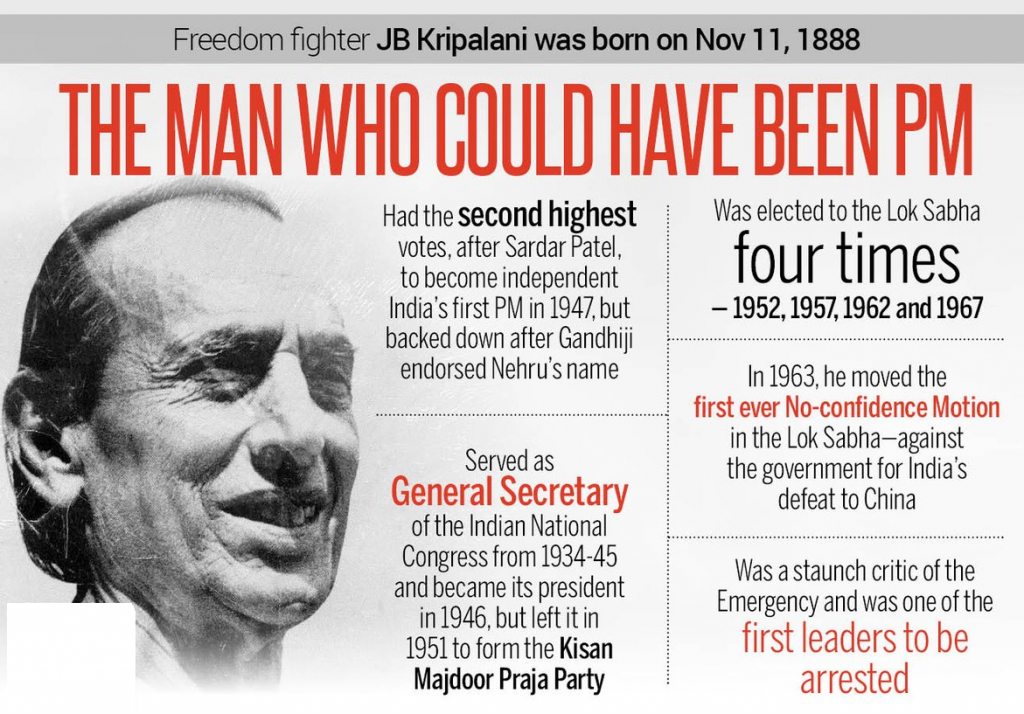

About Acharya Kripalani

- The Jivatram Bhagwant’s Kripalani, also called Acharya Kripalani, (born November 11, 1888, Hyderabad, India [now in Pakistan]died March 19, 1982, Ahmadabad), prominent Indian educator, social activist, and politician in both pre- and post-independence India,

- The Kripalani Ji who was a close associate of Mohandas K Gandhi and a longtime supporter of his ideology.

- The Acharya kripalani ji wife was famous the Sucheta Kripalani, the India’s 1st women Chief Minister.

- He was a leading figure in the Indian National Congress (Congress Party) during the 1930s and 40s and later was a founder of the Praja Socialist Party (PSP).

- He grew close to Gandhi ji and at one point, he was one of Gandhi’s most ardent disciples.

- He had served as the General Secretary of the INC for almost a decade.

- He had experience working in the field of education and was made the president to rebuild the INC.

- The disputes between the party and the Government over procedural matters affected his relationship with the colleagues in the Government.

- The Kripalani was a familiar figure to generations of dissenters, from the Non cooperation movements of the 1920s to the Emergency of the 1970s.

INPUT TAX CREDIT

Focus: GS 3;Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Why in News?

Directorate General of GST Intelligence, Mumbai, arrests four persons for passing on and availing fictitious Input Tax Credit

About Input Tax Credit.

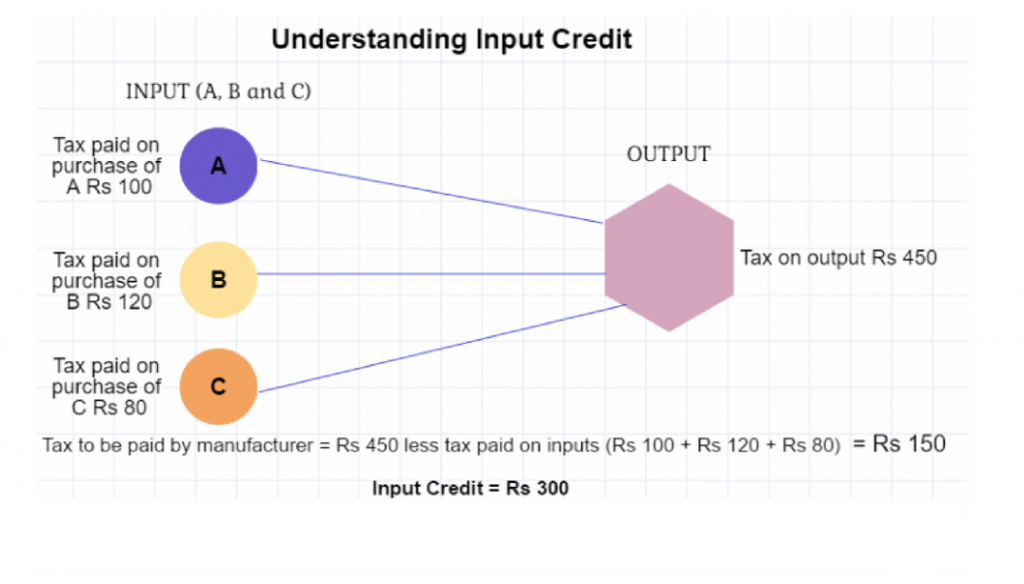

- The Input Tax Credit (ITC) is the tax that a business pays on a purchase and that it can use to reduce its tax liability when it makes a sale. In other words, businesses can reduce their tax liability by claiming credit to the extent of GST paid on purchases.

- The Goods and Services Tax (GST) is an integrated tax system where every purchase by a business should be matched with a sale by another business. This makes flow of credit across an entire supply chain a seamless process.

- The Input credit means at the time of paying tax on output, you can reduce the tax you have already paid on inputs.

- For E.g., Say, you are a manufacturer , tax payable on output (FINAL PRODUCT) is Rs 450, tax paid on input (PURCHASES) is Rs 300, Now you can claim INPUT CREDIT of Rs 300 and you only need to deposit Rs 150 in taxes, as shown in the below attached image.

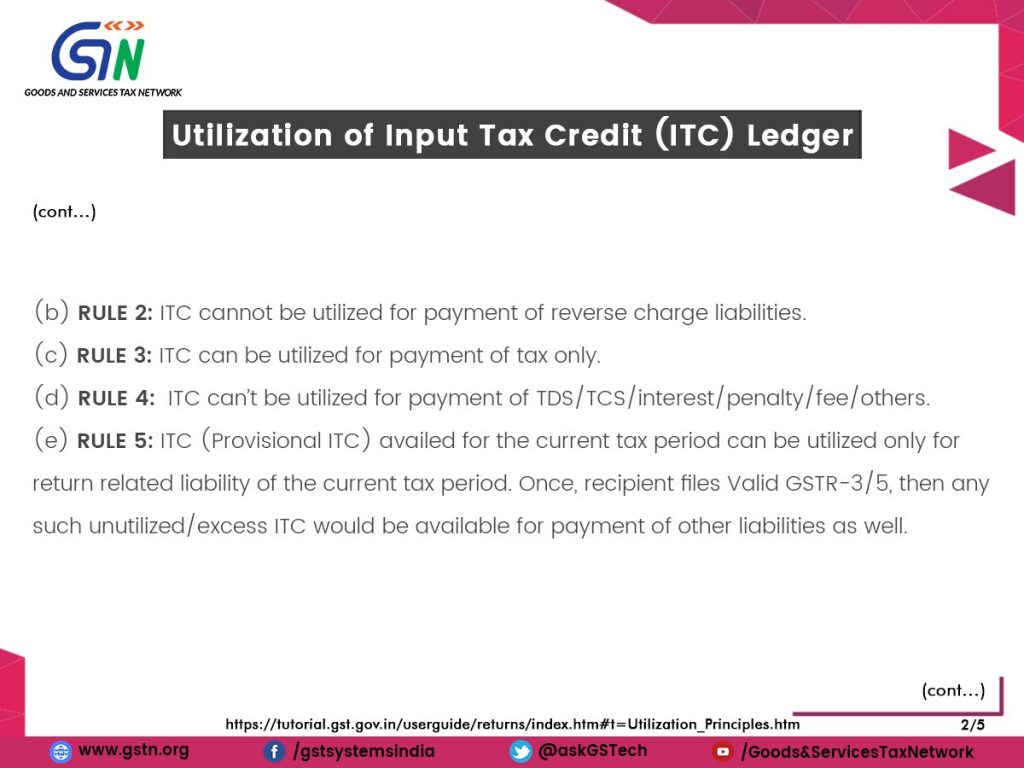

As per above image of Input Tax Credit(ITC) utilization in Rule 3 it can be utilized for Payment of Tax.