Context:

As the world’s third-largest oil importer and consumer, India is running out of options as the relentless surge in international oil prices make it imperative to pass them on to consumers.

Relevance:

GS-III: Indian Economy (International Trade, Mobilization of Resources, Growth and Development of Indian Economy)

Dimensions of the Article:

- Why are crude oil prices rising?

- How are high crude oil prices impact India?

- Diversifying India’s Oil Imports

Why are crude oil prices rising?

- Crude oil prices have been rising steadily since the beginning of 2021 when Brent Crude was trading at about $52 per barrel buoyed both by hopes of improving demand due to economic recoveries across geographies as well as supply cuts by key oil-producing countries.

- The Organisation of Petroleum Exporting Countries extended supply cuts made in 2020 when crude oil prices had reached a low of under $19 per barrel through the first five months of 2021.

- Saudi Arabia notably made an additional voluntary production cut of 1 million barrels per day between February and April 2021 of which only 250,000 barrels of production has been restored in May and 750,000 barrels of production is set to be restored over June and July 2021.

- Experts have noted however that the gradual withdrawal of cuts is unlikely to have any significant impact on prices as demand for petroleum products increases as demand increases spurred by increasing economic activity.

- A potential breakthrough in international efforts for a new Iran nuclear deal which would see international sanctions on Iranian oil removed would also not have a major impact on oil prices according to OPEC which expects that any increase in crude oil production from Iran would happen gradually and would not destabilise crude oil prices.

How are high crude oil prices impact India?

- Rising crude oil prices have contributed to petrol and diesel prices rising to record high levels across the country.

- The price of petrol and diesel has been hiked by more than R. 10 per litre since the beginning of the year 2021 and has only been increasing since 2021.

- Officials at oil marketing companies have however noted that even current record-high prices are lower than what refiners should be charging in line with international prices and that prices are set to rise further unless there is a cut on levies on autofuels or a fall in crude oil prices.

- The prices of petrol and diesel are benchmarked to a 15-day rolling average of the international prices of the petroleum products.

- India and Oil Imports

- India is heavily dependent on crude oil and LNG imports with over 82% import dependence for crude oil and more than 45% for natural gas/LNG.

- India generated more than 35 million tons of petroleum products from indigenous crude oil production whereas the consumption of petroleum products is more than 200 million tons. Similarly, India generated 30 bcm natural gas locally against the consumption of almost 60 bcm (double).

- LNG price is linked to the prevailing crude oil price in global markets.

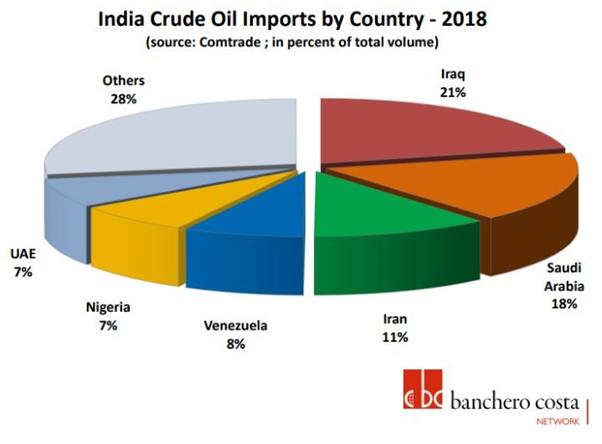

- India is the third biggest oil importer after US and China in 2018 and expected to occupy second place surpassing the US in 2019.

Diversifying India’s Oil Imports

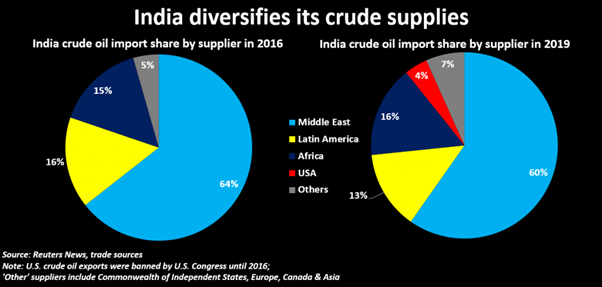

- India’s imports of Middle Eastern oil plunged to a four-year low in 2019.

- India imports about almost 85% of its oil needs and traditionally relies on the Middle East for the majority of its supplies, however, the region’s share of India’s crude shrank to 60% in 2019.

- The reason being: a record output from the United States and countries like Russia offered opportunities for importers to tap other sources.

-Source: The Hindu