Focus: GS-III Indian Economy

Why in news?

National Payments Corp. of India (NPCI) has capped the number of Unified Payments Interface (UPI) transactions that payment apps such as Google Pay and PhonePe and their partner banks can execute

Why was this done?

The capping of UPI payments is an attempt to limit the damage to the payments ecosystem in case one of their systems collapses.

Details

- NPCI said that payment apps will hit the limit if they exceed 50% of all UPI transactions in the first year of the implementation of the rules, 40% in the second year and 33% from third year onwards.

- NPCI will trigger warnings to payment apps and sponsor banks if they near the threshold. In case of a breach of the mandated threshold, NPCI will start penalising payment firms and banks, and ask them to stop onboarding new customers with immediate effect.

Impact

- This move is expected to hurt payment apps such as Google Pay, which commands a 42% market share, and Flipkart-owned PhonePe, which has a 35% share, the most.

- It is also likely to influence WhatsApp’s payment offering, which has been running pilots for over two years and is awaiting approval from the RBI.

- UPI is a completely open and interoperable ecosystem by design and there is no barrier to entry to new entrants at all, with new players entering every day.

Unified Payments Interface (UPI)

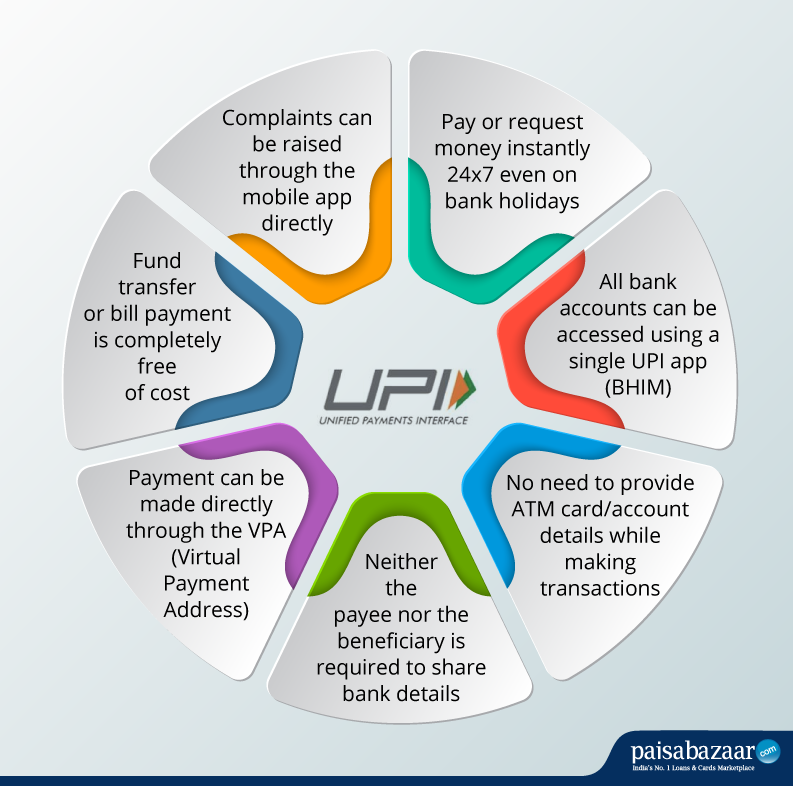

- Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood.

- Advantages of UPI Includes – Immediate money transfer through mobile device round the clock 24*7 and 365 days.

- UPI Enables Single mobile application for accessing different bank accounts with Single Click 2 Factor Authentication – Aligned with the Regulatory guidelines yet provides for a very strong feature of seamless single click payment.

- It also features Virtual address of the customer for Pull & Push providing for incremental security with the customer not required to enter the details such as Card no, Account number; IFSC etc.

-Source: Hindustan Times