Why in news?

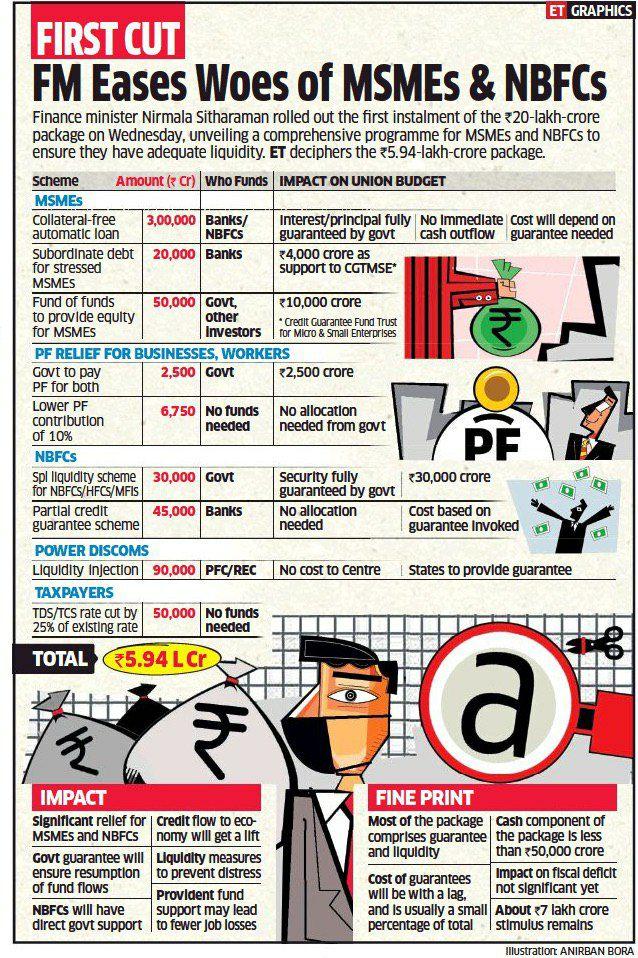

- The Union Finance Minister on 13th May 2020, announced a Rs. 3 lakh crore collateral free loan scheme for businesses, especially micro, small and medium enterprises (MSMEs), as part of a Rs. 20-lakh-crore economic stimulus package to deal with the COVID-19 pandemic.

- The rates of tax deduction at source (TDS) and tax collection at source (TCS) have been cut by 25% for the next year.

- This is the first tranche of the Atmanirbhar Bharat Abhiyan announced by Prime Minister Narendra Modi on 12th May 2020 as a ₹20 lakh crore economic package.

Click Here to read about the “Aatmanirbhar Bharat” Announcement by the PM

Other Changes Announced:

Deadline for the Income tax returns for financial year 2019-20 was pushed to November 30, 2020.

Statutory provident fund (PF) payments have been reduced from 12% to 10% for both employers and employees from June – August.

What gets how much attention?

MSMEs

- MSMEs will get the bulk of the funding, with Rs. 3 lakh crores out of the announced Rs. 20 Lakh Crores, given as emergency credit line to ensure that 45 lakh MSME units will have access to working capital for resuming business activities and safeguarding jobs.

- (The definition of an MSME is being expanded to allow for higher investment limits and the introduction of turnover-based criteria.)

- MSMEs usually have little collateral to offer for getting bank credit.

- For non-defaulting small businesses with outstanding debt of as much as ₹25 crore and sales of up to ₹100 crore, Indian Government has offered extra working capital finance of 20%.

- The MSME units will not have to provide any guarantee or collateral of their own.

NBFCs

- NBFCs, housing finance companies and microfinance institutions will get a Rs. 30,000 crore investment scheme, and an expanded partial credit guarantee scheme worth ₹45,000 crore, of which the first 20% of losses will be borne by the Centre.

- Under the scheme, banks will be allowed to invest, through primary or secondary market transactions, in investment-grade debt papers issued by NBFCs, HFCs and MFIs.

Power Distribution Companies, Real estate Projects

- Power distribution companies will receive a Rs. 90,000 crore liquidity injection, to help them cope up with the unprecedented cash flow crisis.

- Contractors will get a six-month extension from all Central agencies, and also get partial bank guarantees to ease their cash flows.

- Registered real estate projects will get a six-month extension.

Low-Income Organised Workers

- Employee Provident Fund (EPF) support, provided to low-income organised workers in small units under the PMGKY is being extended for another three months and is expected to provide liquidity relief of ₹2,500 crore.

- Mandatory EPF contributions are also being reduced from 12% to 10% for both employees and employers in all other establishments.

Why is important concentrate on MSMEs?

- India’s 63 million MSMEs accounted for 29% of the country’s gross domestic output in FY17, according to official data.

- They account for about 45% of manufacturing output; more than 40% of exports and employ about 111 million people.

- Helping them restart is key to addressing the pain of job losses across the country and to restore demand for goods and services amid fears of a contraction in the economy.

Full guarantee may push banks to lend

- Banks being reluctant to lend is evident from over Rs. 8 lakh crores being parked by these lenders with the RBI’s reverse repo window.

- Risk-averse banks may now have the appetite to resume lending perations, with the government deciding to provide full guarantee for the loans extended by them to borrowers to kick start the economy.

- This 100% credit guarantee will mean that banks do not have to make any provision for the loans, that is, they do not have to set aside capital in case the account turns non-performing.

Landslide changes in MSME sector expected

- MSMEs, including stressed ones, are being given financial support both in terms of loans and equity support for revival after the recent setbacks and activity paralysis suffered due to a series of lockdowns.

- MSMEs will now be able to grow without fear of disqualification due to exceeding either volume of investment or turnover.

- This would definitely motivate MSMEs to grow without the need for creating more entities or such adjustments.

- The government has taken a very pragmatic step by formally recognising the period of lockdown as ‘Force Majeure’ and thus avoid any possibility of conflict relating to contract completion dates and consequent delay in related claims.

- The definition change to MSMEs will have an important effect on both supply chain partners as well as distribution partners.

-Source: The Hindu, ET, ToI, Livemint