Focus: GS-II Governance, Indian Polity ,Prelims

Why in news?

The Finance bill was hurriedly passed in the Lok Sabha without the customary discussion or reply by the Union finance minister and duly returned by the Rajya Sabha as the country headed for a lockdown to fight the coronavirus crisis.

What to expect from the Finance Bill?

- The government created room to raise the excise duty on petrol and diesel by as much as ₹8 each to take advantage of the low oil price regime.

- The Government also relaxed controversial tax residence proposals in the Finance Bill 2020 approved by Parliament on 23rd March 2020, in a modified form.

- The bill also gave tax relief to shareholders who receive dividends. The earlier version of the bill had abolished dividend distribution tax on companies and made dividends taxable in the hands of the recipient. The amendments now clarify that dividends received by the shareholders after 1 April shall not be taxed if DDT has been paid as per the earlier law.

- The Finance Bill also widens the ambit of the “equalisation levy” introduced in 2016 on payments made to non-resident service providers for online advertisements or digital advertising space or facilities.

- The Finance Bill also proposed a more progressive personal income tax rate for people who do not avail of any tax incentives.

What is a Finance Bill? How does it become an Act?

- As per Article 110 of the Constitution of India, the Finance Bill is a Money Bill.

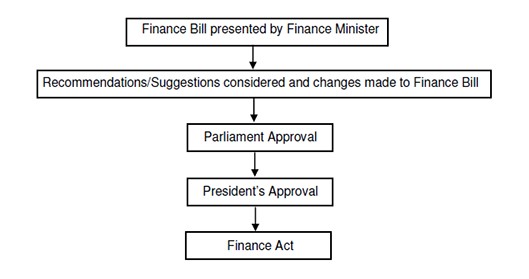

- The Finance Bill is a part of the Union Budget, stipulating all the legal amendments required for the changes in taxation proposed by the Finance Minister.

- Keep in mind that the Finance Bill is an umbrella legislation.

- This Bill encompasses all amendments required in various laws pertaining to tax, in accordance with the tax proposals made in the Union Budget.

- The Finance Bill, as a Money Bill, needs to be passed by the Lok Sabha — the lower house of the Parliament.

- Post the Lok Sabha’s approval, the Finance Bill becomes Finance Act.

Difference between a Money Bill and the Finance Bill

| A Money Bill has to be introduced in the Lok Sabha as per Section 110 of the Constitution. Then, it is transmitted to the Rajya Sabha for its recommendations. The Rajya Sabha has to return the Bill with recommendations in 14 days. However, the Lok Sabha can reject all or some of the recommendations. | In the case of a Finance Bill, Article 117 of the Constitution categorically lays down that a Bill pertaining to sub-clauses (a) to (f) of clause (1) shall not be introduced or moved except with the President’s recommendation. Also, a Bill that makes such provisions shall not be introduced in the Rajya Sabha. |

Who decides the Bill is a Finance Bill?

- The Speaker of the Lok Sabha is authorised to decide whether the Bill is a Money Bill or not.

- The Speaker’s decision shall be deemed to be final.

Why Finance Bill is needed?

- The Union Budget proposes many tax changes for the upcoming financial year, even if not all of those proposed changes find a mention in the Finance Minister’s Budget speech. These proposed changes pertain to several existing laws dealing with various taxes in the country.

- The Finance Bill seeks to insert amendments into all those laws concerned, without having to bring out a separate amendment law for each of those Acts.

- For instance, a Union Budget’s proposed tax changes may require amending the various sections of the Income Tax law, Stamp Act, Money Laundering law, etc. The Finance Bill overrides and makes changes in the existing laws wherever required.