Focus: GS-III Indian Economy

Why in news?

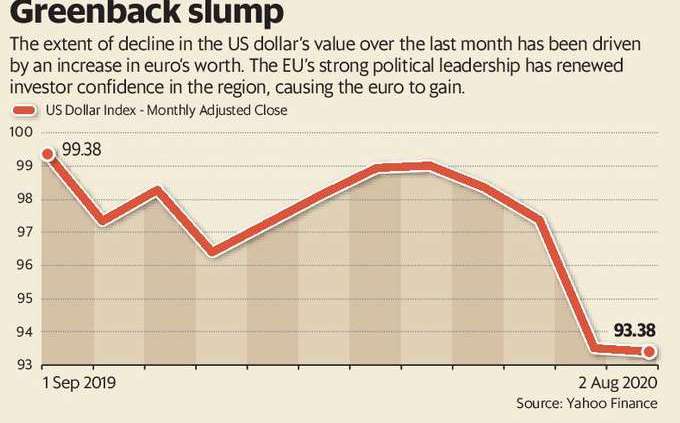

- The US dollar has registered its worst performance in a decade by dropping nearly 5%.

- This has resulted in fresh speculation regarding the end of the greenback’s hegemony as the default international currency.

What are the reasons for weakness in dollar?

- The recent decline in the US dollar even as the treasury bills’ prices remained close to highs indicate the expectation of low growth in the foreseeable future because of the ongoing coronavirus pandemic.

- There are concerns that a fresh round of monetary stimulus and the economic impact of the pandemic would result in interest levels remaining low for a significant period of time.

- Many investors have their doubts regarding the inflationary impact of such a stimulus and have moved towards other currencies and gold.

Doesn’t it gain during a downturn?

- Generally, during a period of an economic slump, the US dollar gains as investors look for safe assets.

- This was observed during the 2008-09 financial crisis when the dollar gained, even as investors rushed for safe assets.

Why is it that the US dollar is not a safe asset anymore?

- A decline in the US dollar’s value illustrates optimism regarding global economic growth.

- A decline in the value shows the confidence of investors in parking money in riskier assets.

- The inherent weakness of the US economy is driving investors towards other countries, which have contained the pandemic and its economic impact.

- There has been a steady increase in the price of gold as investors rushed to buy the safe asset.

- In contrast, even the Euro has gained with the Dollar declining against the Euro (maybe due to EU’s strong policy response to covid).

Is this the end of the US dollar’s hegemony?

- Recent political developments have undermined the credibility of US institutions to provide for a stable global currency, but the US dollar’s hegemony is far from over.

- Moreover, most central banks hold dollar reserves for intervention in foreign markets.

- The dollar is likely to be an integral part of the global financial system, at least for now.

- However, the inability to respond to covid has eroded the credibility of several institutions, which poses a long-term threat to the US dollar.

-Source: Livemint