Context:

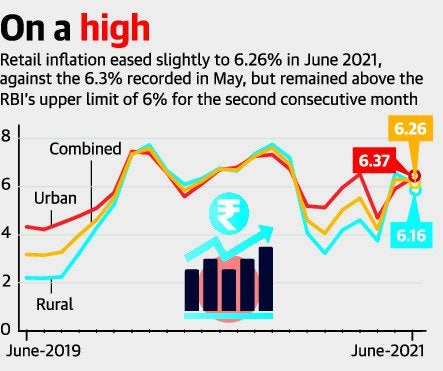

After touching a six-month high in May 2021, India’s retail inflation was virtually unchanged in June 2021.

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, Fiscal Policy, Taxation)

Dimensions of the Article:

- What is Inflation?

- Types of Inflation based on rate of Increase

- About the Latest inflation data

What is Inflation?

- Inflation refers to the consistent rise in the prices of most goods and services of daily or common use, such as food, clothing, housing, recreation, transport, consumer staples, etc. Inflation measures the average price change in a basket of commodities and services over time.

- A moderate level of inflation is required in the economy to ensure that production is promoted. Excess Inflation is indicative of the decrease in the purchasing power of a unit of a country’s currency. This could ultimately lead to a deceleration in economic growth.

- In India, inflation is primarily measured by two main indices — WPI (Wholesale Price Index) and CPI (Consumer Price Index) which measure wholesale and retail-level price changes, respectively.

Types of Inflation based on rate of Increase

There are four main types of inflation, categorized by their speed. They are creeping, walking, galloping, and hyperinflation.

I. Creeping Inflation

- Creeping or mild inflation is when prices rise 3% a year or less. According to the Federal Reserve, when prices increase 2% or less, it benefits economic growth.

- This kind of mild inflation makes consumers expect that prices will keep going up. That boosts demand. Consumers buy now to beat higher future prices. That’s how mild inflation drives economic expansion.

II. Walking Inflation

- When prices rise by more than 3% but less than 10% per annum (i.e., between 3% and 10% per annum), it is called as Walking Inflation.

- It is harmful to the economy because it heats-up economic growth too fast.

- People start to buy more than they need to avoid tomorrow’s much higher prices. This increased buying drives demand even further so that suppliers can’t keep up and neither can the wages. As a result, common goods and services are priced out of the reach of most people.

III. Galloping Inflation

- When inflation rises to 10% or more (i.e., prices rise by double- or triple-digit inflation rates like 30% or 400% or 999% per annum), it wreaks absolute havoc on the economy. It is also referred as jumping inflation.

- Money loses value so fast that business and employee income can’t keep up with costs and prices.

- Foreign investors avoid the country, depriving it of needed capital. The economy becomes unstable, and government leaders lose credibility.

IV. Hyperinflation

- Hyperinflation refers to a situation where the prices rise at an alarming high rate – i.e., more than 50% a month.

- The prices rise so fast that it becomes very difficult to measure its magnitude. However, in quantitative terms, when prices rise above 1000% per annum (quadruple or four-digit inflation rate), it is termed as Hyperinflation.

- Most examples of hyperinflation occur when governments print money to pay for wars.

- Examples of hyperinflation include Germany in the 1920s, Zimbabwe in the 2000s, and Venezuela in the 2010s.

- During a worst-case scenario of hyperinflation, value of national currency (money) of an affected country reduces almost to zero. Paper money becomes worthless and people start trading either in gold and silver or sometimes even use the old barter system of commerce.

V. Chronic Inflation

- If creeping inflation persist (continues to increase) for a longer period of time then it is often called as Chronic or Secular Inflation.

- Chronic Creeping Inflation can be either Continuous (which remains consistent without any downward movement) or Intermittent (which occurs at regular intervals).

- It is called chronic because if an inflation rate continues to grow for a longer period without any downturn, then it possibly leads to Hyperinflation.

VI. Moderate Inflation

- Concept of Creeping and Walking inflation clubbed together are called Moderate Inflation.

- When prices rise by less than 10% per annum (single digit inflation rate), it is known as Moderate Inflation.

- It is a stable inflation and not a serious economic problem.

VII. Running Inflation

- A rapid acceleration in the rate of rising prices is referred as Running Inflation.

- When prices rise by more than 10% per annum, running inflation occurs.

- Though economists have not suggested a fixed range for measuring running inflation, we may consider price rise between 10% to 20% per annum (double digit inflation rate) as a running inflation.

About the Latest inflation data

- For the second month in a row India’s retail inflation was virtually unchanged remaining above 6% which is out of the central bank’s comfort zone.

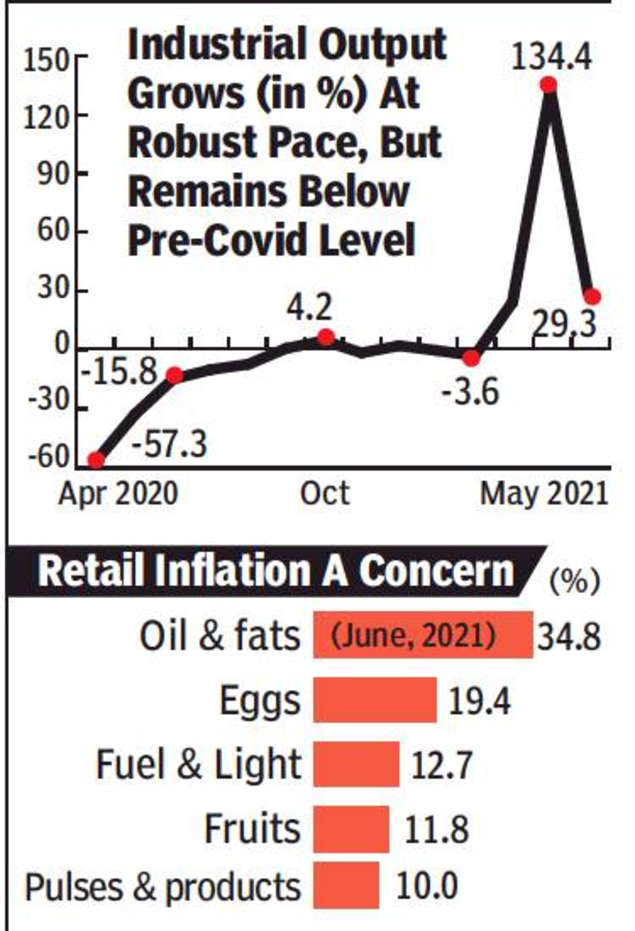

- Growth impulses remained fragile with the second COVID-19 wave hurting the recovery momentum.

- With petroleum product prices continuing to soar, fuel and light inflation hit more than 12% in June 2021 and Food inflation, which had flared up from just 2% in April to 5% in May, rose further, led by almost a 35% inflation rate for oils and fats.

- Economists expect the Reserve Bank of India (RBI) to revisit its inflation estimate of 5.1% for 2021-22 and stressed that lack of fiscal policy action to cool prices could precipitate a faster unwinding of RBI’s growth-supporting approach to interest rates.

- Persistently sticky retail prices for fuel and food translated into little respite for citizens, as inflation measured by the Consumer Price Index (CPI) declined by just four basis points (1 basis point equals 0.01%) from May 2021.

- Beyond the monthly swings, inflation continues to stay above the mid-point (4%) of the inflation target since late 2019. If the CPI inflation remains entrenched above the 6% upper threshold from July-August 2021, a preponement of rate normalization by the RBI can’t be ruled out.

-Source: The Hindu