Context:

The Reserve Bank of India (RBI) and the Monetary Authority of Singapore (MAS) announced a project to link their respective fast payment systems — Unified Payments Interface (UPI) and PayNow which will facilitate instant low-cost cross border fund transfer.

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, Monetary Policy, Inflation)

Dimensions of the Article:

- What is Unified Payments Interface (UPI)?

- About the India-Singapore linking of UPI and PayNow

- India–Singapore relations

What is Unified Payments Interface (UPI)?

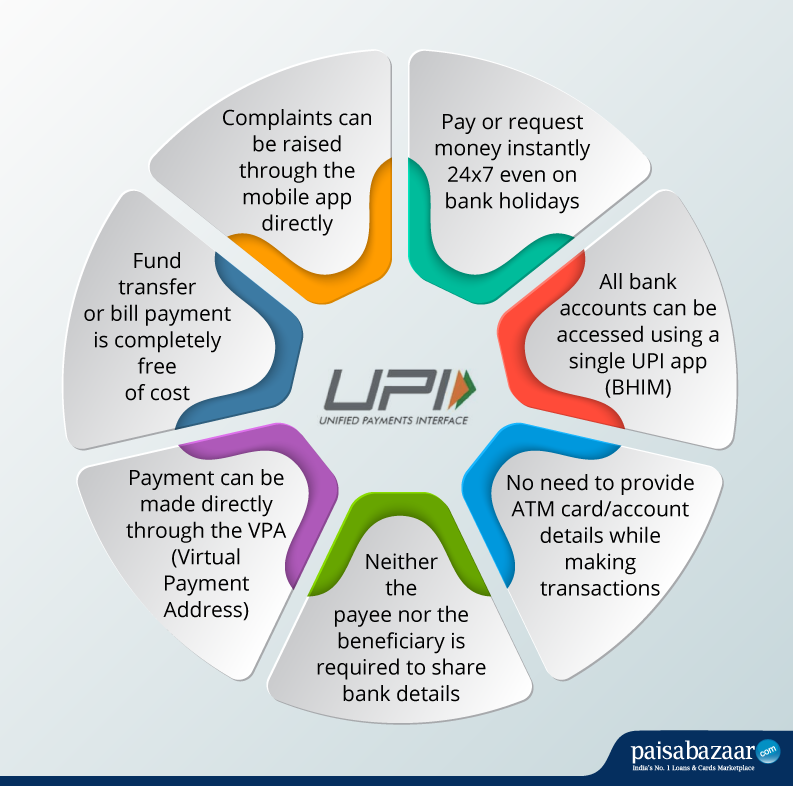

- Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood.

- Advantages of UPI Includes – Immediate money transfer through mobile device round the clock 24*7 and 365 days.

- UPI Enables Single mobile application for accessing different bank accounts with Single Click 2 Factor Authentication – Aligned with the Regulatory guidelines yet provides for a very strong feature of seamless single click payment.

- It also features Virtual address of the customer for Pull & Push providing for incremental security with the customer not required to enter the details such as Card no, Account number; IFSC etc.

About the India-Singapore linking of UPI and PayNow

- The project to link the fast payment systems of both the countries was announced by Reserve Bank of India (RBI) and Monetary Authority of Singapore (MAS).

- This linked payment interface is expected to be operationalised by July 2022.

- Linked interface will help in making instant, low-cost fund transfers on a reciprocal basis without onboarding onto the other payment system.

- The linkage will be a significant milestone for the development of infrastructure for cross-border payments between both the countries. It will also align with the \ G20’s financial inclusion priorities to provide for faster, cheaper and more transparent cross-border payments.

What is PayNow?

- PayNow is the fast payment system of Singapore, enabling peer-to-peer funds transfer service. It is available for retail customers with the help of participating banks & Non-Bank Financial Institutions (NFIs) in Singapore. It provides the users to send and receive instant funds from one bank or e-wallet account to another by using their mobile number, Singapore NRIC/FIN, or VPA.

India–Singapore relations

- India-Singapore relations have traditionally been strong and friendly, with the two nations enjoying extensive cultural and commercial relations.

- India and Singapore share long-standing cultural, commercial and strategic relations, with Singapore being a part of the “Greater India” cultural and commercial region.

- Following its independence in 1965, Singapore was concerned with China-backed communist threats as well as domination from Malaysia and Indonesia and sought a close strategic relationship with India, which it saw as a counterbalance to Chinese influence and a partner in achieving regional security.

- Although the rival positions of both nations over the Vietnam War and the Cold War caused consternation between India and Singapore, their relationship expanded significantly in the 1990s; Singapore was one of the first to respond to India’s “Look East” Policy of expanding its economic, cultural and strategic ties in Southeast Asia to strengthen its standing as a regional power

- Ethnic Indians constitute about 9.1% or around 3.5 lakhs of the resident population of 3.9 million in Singapore. More than 500,000 people of Indian origin live in Singapore.

- Singapore is India’s 2nd largest trade partner among ASEAN countries.

- The India–Singapore Comprehensive Economic Cooperation Agreement, also known as the Comprehensive Economic Cooperation Agreement or simply CECA, is a free trade agreement between Singapore and India to strengthen bilateral trade- signed in 2005.

- Singapore had always been an important strategic trading post, giving India trade access to the Far East.

- Singapore participates in Indian Ocean Naval Symposium (IONS) and multilateral Exercise MILAN hosted by Indian Navy.

- Singapore’s membership of Indian Ocean Rim Association (IORA) and India’s membership of ADDM+ (ASEAN Defence Ministers’ Meeting – Plus) provides a platform for both countries to coordinate positions on regional issues of mutual concern.

- Both the countries successfully conducted the 27th edition of Singapore-India Maritime Bilateral Exercise (SIMBEX) and also participated in the second edition of the Singapore-India-Thailand Maritime Exercise (SITMEX), both held in November 2020.

-Source: The Hindu