Context:

Amid tensions with Saudi Arabia over oil production cuts, India has asked its State refiners to review contracts they enter into for buying crude oil from the Middle East nation and negotiate more favourable terms.

Relevance:

GS-III: Indian Economy (International Trade, Mobilization of Resources, Growth and Development of Indian Economy)

Dimensions of the Article:

- Background to the Tensions with Saudi Arabia regarding oil imports

- Issues with OPEC Producers

- About Organization of the Petroleum Exporting Countries (OPEC)

- India and Oil Imports

- Diversifying India’s Oil Imports

Background to the Tensions with Saudi Arabia regarding oil imports

- When oil prices started to rise in February 2021, India wanted Saudi Arabia to relax output controls but the Kindgom ignored its calls.

- Saudi Arabia and other OPEC (Organization of the Petroleum Exporting Countries) producers have been the mainstay suppliers of crude oil for India. But their terms have often been loaded against the buyers.

- OPEC is a permanent intergovernmental organization of 13 oil-exporting developing nations that coordinates and unifies the petroleum policies of its Member countries.

- This has led to the Indian government now pressing for diversification of the supply base.

- Keen to break producers’ cartel dictating pricing and contractual terms, the government has told Indian Oil Corporation (IOC), Bharat Petroleum Corporation Limited (BPCL) and Hindustan Petroleum Corporation Limted (HPCL) to look for oil supplies from outside the Middle East region and use collective bargaining power to get favourable terms.

Issues with OPEC Producers

- Indian firms buy two-third of their purchases on term or fixed annual contracts.

- These term contracts provide assured supplies of the contracted quantity but the pricing and other terms favour only the supplier.

- The buyer has to indicate at least six weeks in advance of their intention to lift quantity out of the annual term contract in any month and has to pay an average official price announced by the producer.

- While buyers have an obligation to lift all of the contracted quantity, Saudi Arabia and other producers have the option to reduce supplies in case OPEC decides to keep production artificially lower to boost prices.

About Organization of the Petroleum Exporting Countries (OPEC)

- The Organization of the Petroleum Exporting Countries is an intergovernmental organization of 14 nations, founded in 1960 in Baghdad by the first five members (Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela), and headquartered since 1965 in Vienna, Austria.

- As of 2018, the 14 member countries accounted for an estimated 44 percent of global oil production and almost 82% of the world’s “proven” oil reserves, giving OPEC a major influence on global oil prices that were previously determined by the so-called “Seven Sisters” grouping of multinational oil companies.

- The stated mission of the organization is to “coordinate and unify the petroleum policies of its member countries and ensure the stabilization of oil markets, in order to secure an efficient, economic and regular supply of petroleum to consumers, a steady income to producers, and a fair return on capital for those investing in the petroleum industry.”

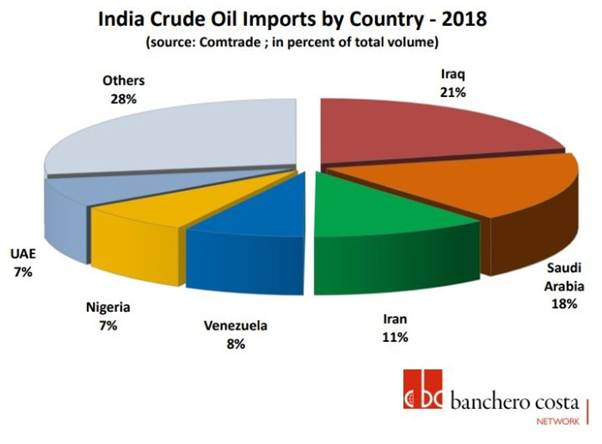

India and Oil Imports

- India is heavily dependent on crude oil and LNG imports with over 82% import dependence for crude oil and more than 45% for natural gas/LNG.

- India generated more than 35 million tons of petroleum products from indigenous crude oil production whereas the consumption of petroleum products is more than 200 million tons. Similarly, India generated 30 bcm natural gas locally against the consumption of almost 60 bcm (double).

- LNG price is linked to the prevailing crude oil price in global markets.

- India is the third biggest oil importer after US and China in 2018 and expected to occupy second place surpassing the US in 2019.

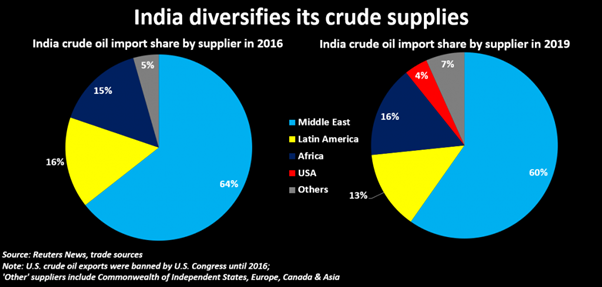

Diversifying India’s Oil Imports

- India’s imports of Middle Eastern oil plunged to a four-year low in 2019.

- India imports about almost 85% of its oil needs and traditionally relies on the Middle East for the majority of its supplies, however, the region’s share of India’s crude shrank to 60% in 2019.

- The reason being: a record output from the United States and countries like Russia offered opportunities for importers to tap other sources.

Way Forward

- India needs pricing flexibility as well as the certainty of supply even during times when production falls due to any reason. Besides, choice of time of supply and flexibility on quantity (ability to reduce or increase) is what India should be looking at.

- Indian refiners can look to reduce the quantity they buy through term contracts and instead buy more from the spot or current market. Buying from the spot market would ensure that India can take advantage of any fall in prices on any day and book quantities.

- State-owned refineries have also been asked to coordinate buying and also explore joint strategy with private refiners such as Reliance Industries and Nayara Energy.

-Source: The Hindu