Focus: GS 3 ;Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Why in News?

Measures taken by the Government on the fronts of FDI policy reforms, investment facilitation and ease of doing business have resulted in increased FDI inflows into the country.

About Foreign Direct Investment;-

- Foreign Direct Investment (FDI) is a major driver of economic growth and an important source of non-debt finance for the economic development of India.

- It has been the endeavor of the Government to put in place an enabling and investor friendly FDI policy. The intent all this while has been to make the FDI policy more investor friendly and remove the policy bottlenecks that have been hindering the investment inflows into the country.

- The steps taken in this direction during the last six years have borne fruit as is evident from the ever increasing volumes of FDI inflows being received into the country. Continuing on the path of FDI liberalization and simplification, Government has carried out FDI reforms across various sectors.

What is FDI?;-

- An FDI is an investment in the form of a controlling ownership in a business in one country by an entity based in another country.

- It is thus distinguished from a foreign portfolio investment by a notion of direct control.

- FDI may be made either “inorganically” by buying a company in the target country or “organically” by expanding the operations of an existing business in that country.

- Broadly, FDI includes “mergers and acquisitions, building new facilities, reinvesting profits earned from overseas operations, and intra company loans”.

- In a narrow sense, it refers just to building a new facility, and lasting management interest.

For the period of last 6 years (2014-15 to 2019-20);-

- Total FDI inflow grew by 55%, i.e. from US$ 231.37 billion in 2008-14 to US$ 358.29 billion in 2014-20.

- FDI equity inflow also increased by 57% from US$ 160.46 billion during 2008-14 to US$ 252.42 billion (2014-20).

Financial Year 2020-21 (April to August, 2020);-

- During April to August, 2020, total FDI inflow of US$ 35.73 billion is received. It is the highest ever for first 5 months of a financial year and 13% higher as compared to first five months of 2019-20 (US$ 31.60 billion).

- FDI equity inflow received during F.Y. 2020-21 (April to August, 2020) is US$ 27.10 billion. It is also the highest ever for first 5 months of a financial year and 16% more compared to first five months of 2019-20 (US$ 23.35 billion).

FDI Routes in India;-

Foreign investment was introduced in 1991 under Foreign Exchange Management Act (FEMA), driven by then FM Manmohan Singh.

There are three routes through which FDI flows into India. They are described in the following table:

| Category 1 | Category 2 | Category 3 |

| 100% FDI permitted through Automatic Route | Up to 100% FDI permitted through Government Route | Up to 100% FDI permitted through Automatic + Government Route |

Automatic route: By this route, FDI is allowed without prior approval by Government or RBI.

Government route: Prior approval by the government is needed via this route. The application needs to be made through Foreign Investment Facilitation Portal, which will facilitate the single-window clearance of FDI application under Approval Route.

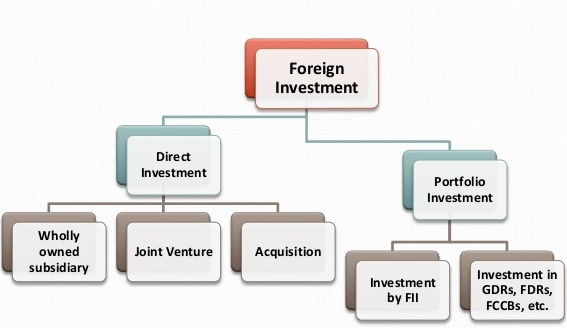

Types of Foreign Direct Investment explained in below image through flow chart;-

Full forms of above mentioned terms in FDI types flow chart;-

- Global Depository Receipts (GDR)

- Foreign Depository Receipts (FDR)

- Foreign Currency Convertible Bonds (FCCB)

- Foreign institutional investors (FII)

Trade vs FDI;-

- Trade just helps the country fulfil its requirements of those goods and services (G&S) that may not available in the country.

- Investments provide the capital to build infrastructure that can plug the G&S deficit, even, sell it to other markets.

- Trade just provides entry of G&S.

- FDI inflow is a route for transferring capabilities, technology, building linkages, business capabilities etc.

- FDI helps generate employment, public assets, tax revenues and develop markets, none of this is contributed by the trade of merchandise.

- Foreign investment does have an adverse impact on domestic markets in the short-run by crowding out domestic competition or investment.

- In fact, attracting FDI in employment-intensive sectors can create positive economic and social spillovers.

- Possibilities to increase exports often arise from companies with significant levels of FDI.

- Foreign investor exposes itself to regulatory, economic and geo-political risks of the country.

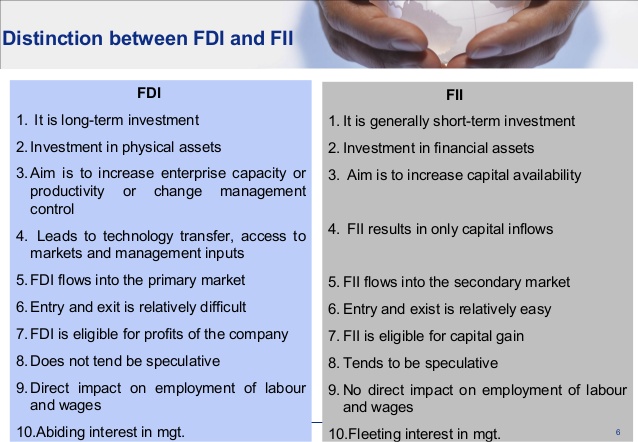

Difference between FDI Vs FII in below image;-

Above some terms meaning in FDI vs FII Difference ;-

Primary Market;-

A primary market is a market where buyers and sellers negotiate and transact directly without any intermediaries or resellers. Regarding financial markets, the primary market is also often referred to as the new issue market as it is the place where the issuing of new securities transpires.

Secondary Market;-

This is the market wherein the trading of securities is done. Secondary market consists of both equity as well as debt markets. Securities issued by a company for the first time are offered to the public in the primary market, are some of the key products available in a secondary market.

Equity;-

Equity is the amount of capital invested or owned by the owner of a company. The equity is evaluated by the difference between liabilities and assets recorded on the balance sheet of a company. This account is also known as owners or stockholders or shareholders equity

The advantages and disadvantages of FDI in India;-

Advantages of Foreign Direct Investment;-

Economic Development Stimulation.

Foreign direct investment can stimulate the target country’s economic development, creating a more conducive environment for you as the investor and benefits for the local industry.

Easy International Trade.

Commonly, a country has its own import tariff, and this is one of the reasons why trading with it is quite difficult. Also, there are industries that usually require their presence in the international markets to ensure their sales and goals will be completely met. With FDI, all these will be made easier.

Employment and Economic Boost.

Foreign direct investment creates new jobs, as investors build new companies in the target country, create new opportunities. This leads to an increase in income and more buying power to the people, which in turn leads to an economic boost.

Development of Human Capital Resources.

One big advantage brought about by FDI is the development of human capital resources, which is also often understated as it is not immediately apparent.

Human capital is the competence and knowledge of those able to perform labor, more known to us as the workforce. The attributes gained by training and sharing experience would increase the education and overall human capital of a country.

Its resource is not a tangible asset that is owned by companies, but instead something that is on loan. With this in mind, a country with FDI can benefit greatly by developing its human resources while maintaining ownership.

Tax Incentives.

Parent enterprises would also provide foreign direct investment to get additional expertise, technology and products. As the foreign investor, you can receive tax incentives that will be highly useful in your selected field of business.

Resource Transfer.

Foreign direct investment will allow resource transfer and other exchanges of knowledge, where various countries are given access to new technologies and skills.

Disadvantages of Foreign Direct Investment;-

Hindrance to Domestic Investment.

As it focuses its resources elsewhere other than the investor’s home country, foreign direct investment can sometimes hinder domestic investment.

Risk from Political Changes.

Because political issues in other countries can instantly change, foreign direct investment is very risky. Plus, most of the risk factors that you are going to experience are extremely high.

Negative Influence on Exchange Rates.

Foreign direct investments can occasionally affect exchange rates to the advantage of one country and the detriment of another.

Higher Costs.

If you invest in some foreign countries, you might notice that it is more expensive than when you export goods. So, it is very imperative to prepare sufficient money to set up your operations.

Economic Non-Viability.

Considering that foreign direct investments may be capital-intensive from the point of view of the investor, it can sometimes be very risky or economically non-viable.

Expropriation.

Remember that political changes can also lead to expropriation, which is a scenario where the government will have control over your property and assets.

Conclusion;-

- The Department of Promotion of Industry and Internal trade (DPIIT) should work out a clear process and precise regulations to decide what is an acceptable investment.

- India should welcome investment in enhancing the country’s productive capacity regardless of where it comes from, except, of course, in sectors where control of that production capacity has a bearing on national security.

- There is a need for India to develop new legal and institutional tools. As the ones employed by US and EU member states such as data protection laws or revised mergers and acquisitions rules, and institutional bodies.

- Without the appropriate legal and regulatory sanction, India might experience reciprocal measures.

- India should take advantage of trade wars of major economies and attract investments by providing better facilities and improve the ease of doing business.

- In order to protect India’s unicorn, there is need to devise a scheme of preferential or special shares which a unicorn can issue to foreign investor.

- These shares will preserve the decision making by Indian innovators, while also providing them access to foreign capital.

- At this crucial juncture of economics, where the world is witnessing another economic crisis, India needs to expand its overseas economic engagements, even while remaining sensitive to its overall economic sustainability needs.

Extra Info;-

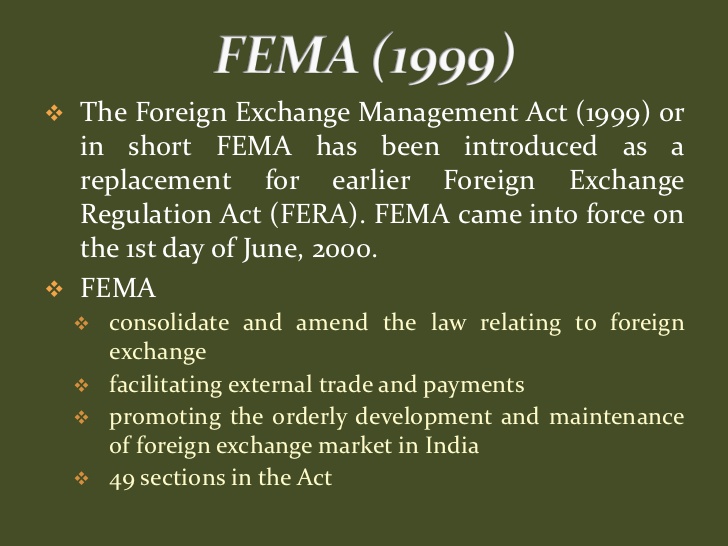

About Foreign Exchange Management Act (FEMA) in below image;-

Foreign Exchange Management Act, 1999 (FEMA) came into force by an act of Parliament.

It was enacted on 29 December 1999. This new Act is in consonance with the frameworks of the World Trade Organisation (WTO). It also paved the way for the Prevention of Money Laundering Act, 2002 which came into effect from July 1, 2005.

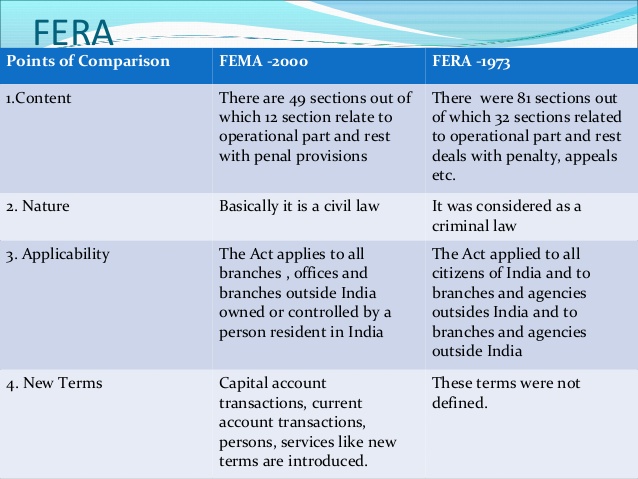

Difference between FERA and FEMA in below image;-

About FII’s;-

Foreign institutional investors (FIIs) are those institutional investors which invest in the assets belonging to a different country other than that where these organizations are based.