Context:

- Union Labour and Employment Minister said that casual and contractual employees of municipal corporations in the country would be covered under the Employees’ State Insurance (ESI) Act, 1948.

- Municipal bodies tend to employ a “large number of casual and contractual workers”, who are left out of the social security net as they are not regular employees. The extension of ESI benefits would help in betterment of these workers who are a vulnerable lot.

Relevance:

Prelims, GS-II: Social Justice (Welfare Schemes, Government Policies and Initiatives)

Dimensions of the Article:

- Employees’ State Insurance Scheme

- Employee’s State Insurance Corporation (ESIC)

Employees’ State Insurance Scheme

The Employees’ State Insurance Scheme is an integrated measure of Social Insurance embodied in the Employees’ State Insurance Act and it is designed to accomplish the task of protecting ’employees’ as defined in the Employees’ State Insurance Act, 1948 against the impact of incidences of sickness, maternity, disablement and death due to employment injury and to provide medical care to insured persons and their families.

Benefits of ESI

- The benefits under ESI scheme are categorized under two categories:

- Cash benefits (which includes sickness, maternity, disablement (temporary and permanent), funeral expenses, rehabilitation allowance, vocational rehabilitation and medical bonus) and,

- Non-cash benefits through medical care.

- Complete medical care and attention are provided by the scheme to the employee registered under the ESI Act, 1948 at the time of his incapacity, restoration of his health and working capacity.

- During absenteeism from work due to illness, maternity or factories accidents which result in loss of wages complete financial assistance is provided to the employees to compensate for the wage loss.

- The scheme provides medical care to family members also.

Financing ESI

- The ESI Scheme is financed by contributions from employers and employees.

- The rate of contribution by employer is 4.75% of the wages payable to employees.

- The employees’ contribution is at the rate of 1.75% of the wages payable to an employee.

- Employees, earning less than Rs. 137/- a day as daily wages, are exempted from payment of their share of contribution.

Beneficiaries

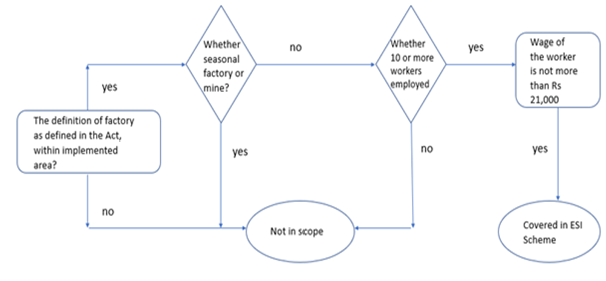

- The ESI Scheme applies to factories and other establishment’s viz. Road Transport, Hotels, Restaurants, Cinemas, Newspaper, Shops, and Educational/Medical Institutions wherein 10 or more persons are employed.

- However, in some States threshold limit for coverage of establishments is still 20.

- Employees of the aforesaid categories of factories and establishments, drawing wages upto Rs.15,000/- a month, are entitled to social security cover under the ESI Act.

- ESI Corporation has also decided to enhance wage ceiling for coverage of employees under the ESI Act from Rs.15,000/- to Rs.21,000/-.

Employee’s State Insurance Corporation (ESIC)

- Employee’s State Insurance Corporation (ESIC) is a Statutory Body set up under the Employees’ State Insurance (ESI) Act, 1948, which is responsible for the administration of ESI Scheme.

- As it is a legal entity, the corporation can raise loans and take measures for discharging such loans with the prior sanction of the central government and it can acquire both movable and immovable property and all incomes from the property shall vest with the corporation.

- The corporation can set up hospitals either independently or in collaboration with state government or other private entities, but most of the dispensaries and hospitals are run by concerned state governments.

-Source: The Hindu