CONTENTS

- Analysing Local Environmental Footprints

- RBI’s Proposed Framework to Administer Project Financing

Analysing Local Environmental Footprints

Context:

While climate change is a global issue, problems like water scarcity and air pollution are often localized or regional. For instance, excessive water usage in one area may not directly impact water scarcity in another. Therefore, focusing on local environmental issues is vital, emphasizing the importance of understanding household environmental footprints.

Relevance:

- GS2- Health

- GS3- Environmental Pollution and Degradation

Mains Question:

What is the significance of evaluating household environmental footprints? Do these footprints show an increase as one analyses households that are richer and affluent? Analyse. (15 Marks, 250 Words).

Distribution of Household Environmental Footprints in India:

- A recent study titled “Water, Air Pollution, and Carbon Footprints of Conspicuous/Luxury Consumption in India” highlights the environmental impact of affluent individuals who consume beyond basic needs.

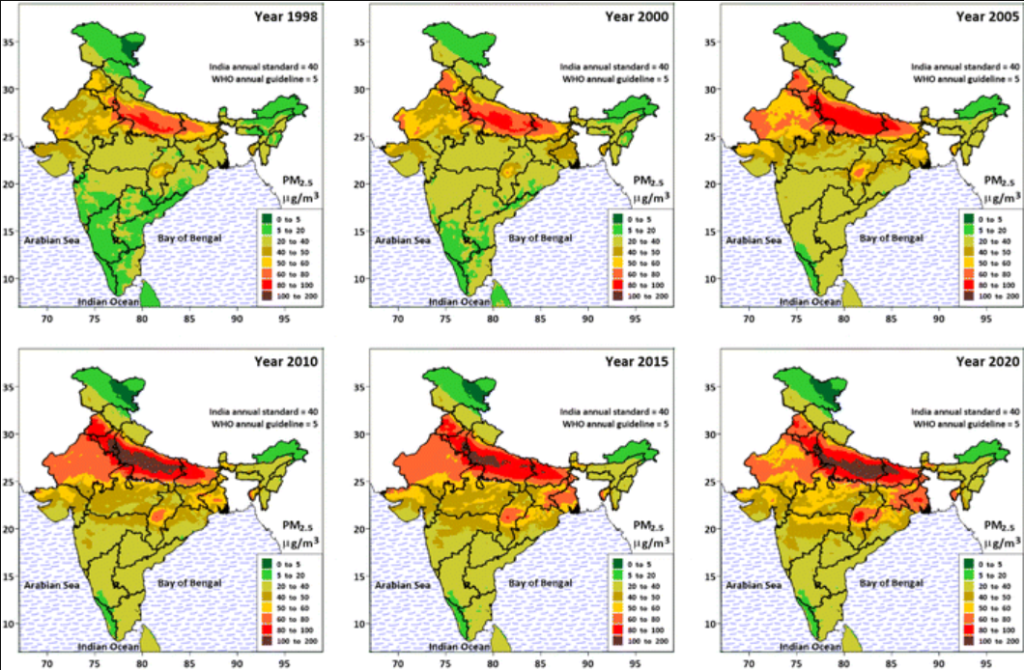

- This study investigates the CO2, water, and particulate matter (PM2.5) footprints linked to luxury consumption choices among Indian households across various economic classes.

- It compares these luxury consumption footprints with those from non-luxury consumption. The luxury consumption category includes items such as dining out, vacations, furniture, and social events.

How were Environmental Impacts Assessed in this Study?

- The study used an input/output analysis of the entire economy to map different components of household consumption to the resources or materials involved in their production.

- This approach allowed the researchers to capture and aggregate the indirect or embedded environmental impacts at each production stage.

- For example, the water footprint quantified water usage throughout the various stages of producing different goods and services, as well as direct household water use.

- The PM2.5 footprint included both embedded emissions and direct emissions from household activities such as using fuelwood, kerosene, and vehicular fuels.

- Similarly, the CO2 footprint captured both embedded and direct CO2 emissions associated with household consumption.

What were the Key Findings?

- The study found that environmental footprints for water, air pollution, and CO2 increase as households move from poorer to richer economic classes. Specifically, the richest 10% of households have footprints approximately double the overall average across the population.

- A significant increase in footprints is seen from the ninth to the tenth decile, with the air pollution footprint increasing the most by 68%, the water footprint increasing the least by 39%, and CO2 emissions rising by 55%.

- This indicates that Indian consumers, especially those in the top decile, are in a ‘take-off’ stage, with substantial increases in consumption-related environmental footprints primarily among the wealthiest segment.

- The increased footprints in the tenth decile are mainly due to higher expenditure on luxury consumption items.

What are the Key Contributors?

- The study identifies several key contributors to the rise in environmental footprints, particularly among the wealthiest households.

- Eating out and restaurants significantly increase all three types of footprints in the top decile households. Additionally, the consumption of fruits and nuts drives the water footprint up in the 10th decile.

- The presence of fuels like firewood in the consumption baskets of poorer households contrasts with the impacts of modern energy transitions.

- While moving from biomass to LPG reduces direct footprints, the affluent lifestyle choices lead to a rise in PM2.5 and CO2 footprints.

- The average per capita CO2 footprint of the top decile in India, at 6.7 tonnes per capita per year, is higher than the global average of 4.7 tonnes in 2010 and the 1.9 tonnes CO2eq/cap required to meet the Paris agreement target of 1.5°C.

- Although still below the average levels in the U.S. or U.K., this disparity highlights the need for policymakers to address elite lifestyles to align with sustainability goals.

What are the Implications?

- The study underscores that while global climate change efforts focus on reducing global environmental footprints, local and regional environmental issues, often exacerbated by luxury consumption, disproportionately affect marginalized communities.

- For example, water scarcity and air pollution impact marginalized groups more severely, while affluent sections can afford protective measures like air-conditioned cars and air purifiers.

Conclusion:

This emphasizes the need for multi-footprint analysis to address environmental justice concerns and ensure equitable sustainability efforts. Policymakers should prioritize reducing the consumption levels of affluent households to achieve sustainability goals and mitigate the local and regional impacts of luxury consumption.

RBI’s Proposed Framework to Administer Project Financing

Context:

To enhance the current regulatory framework governing long-gestation period financing for infrastructure, non-infrastructure, and commercial real estate projects, the RBI released draft regulations for public consultation earlier this month. Feedback on the draft regulations is invited until June 15.

Relevance:

GS3-

- Government Policies and Interventions

- Growth and Development

- Infrastructure

Mains Question:

Infrastructure projects typically have extended gestation periods, increasing the likelihood of not being financially viable. Discuss how does the RBI’s proposed framework on project financing aims to address this effectively. (10 Marks, 150 Words).

What is the Purpose of the Framework?

- Infrastructure projects typically have extended gestation periods, increasing the likelihood of not being financially viable.

- These projects, depending on their scale and technology, often require long-term loans. They also face numerous challenges, such as delays and cost overruns.

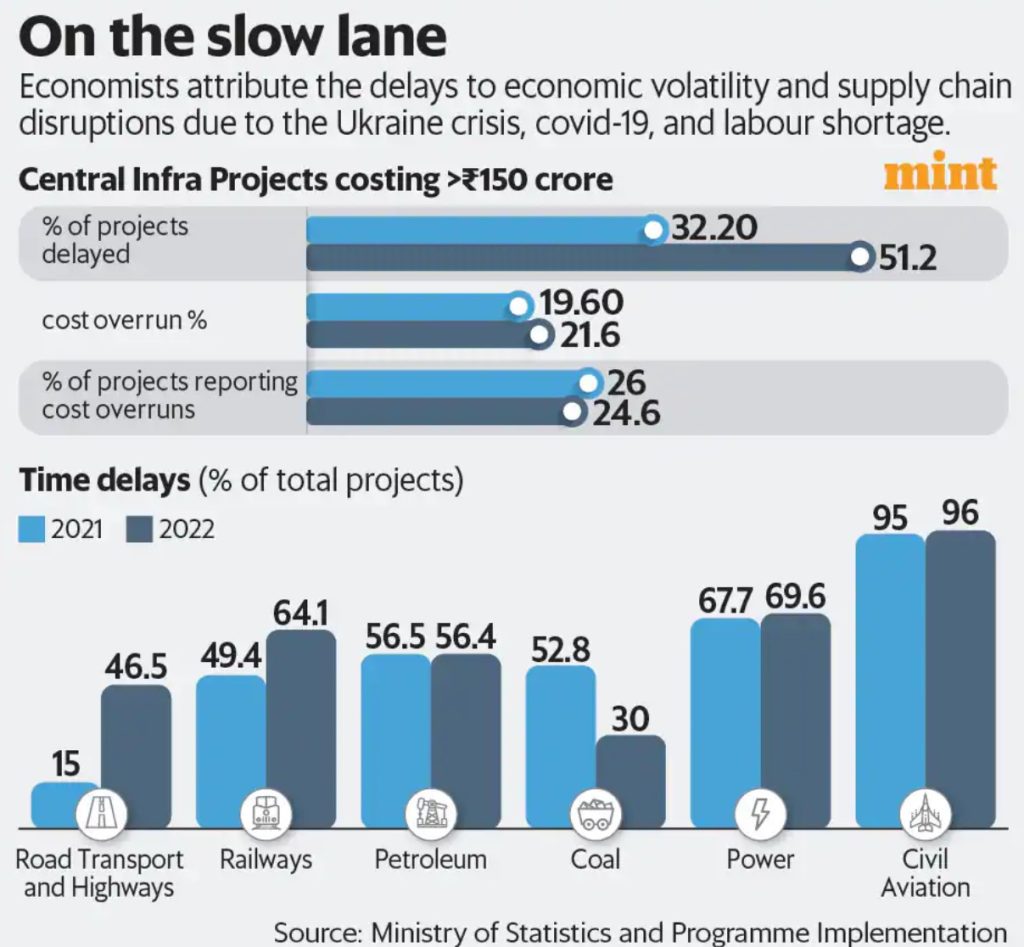

- According to the Ministry of Statistics and Programme Implementation’s review in March, out of 1,837 projects, 779 were delayed, and 449 experienced cost overruns.

- The delays were primarily due to issues like land acquisition, securing forest/environment clearances, and changes in project scope and size.

- These factors deter banks, as they impact the risk assessment and pricing of such projects on their financial books.

What are the Key Revisions?

- The RBI aims to prevent credit events, such as defaults, extensions of the original Date of Commencement of Commercial Operations (DCCO), the need for additional debt, or a reduction in the project’s Net Present Value (NPV).

- One significant revision involves ‘provisioning,’ which means setting aside funds in advance to cover potential losses.

- The new framework suggests that during the construction phase (before DCCO), a general provision of 5% should be maintained on all existing and new exposures, an increase from the previous 0.4%.

- According to CareEdge Ratings, this higher provisioning requirement could reduce the bidding interest from infrastructure developers in the medium term. This 5% provisioning will be implemented gradually.

What about Prudential Conditions?

- The framework requires all mandatory pre-requisites to be in place before financial closure (the finalization of financial conditions).

- This includes environmental, regulatory, and legal clearances relevant to the project. The DCCO must be clearly defined.

- Financial disbursements will be made, and progress in equity infusion agreed upon, based on stages of project completion.

- Banks must appoint an independent engineer or architect to certify the project’s progress.

Can Repayment Norms be Revised?

- Yes, the framework allows for revising repayment norms. However, it stipulates that the original or revised repayment tenure, including the moratorium period, must not exceed 85% of the project’s economic life.

- The proposed framework also sets criteria for evaluating changes in the repayment schedule due to an increase in project outlay resulting from an expanded scope and size of the project.

- Such revisions must occur before the DCCO, after lenders have satisfactorily reassessed the project’s viability, and if the risk in project cost, excluding any cost overrun, is 25% or more of the original outlay.

- Additionally, the framework introduces guidelines for triggering a standby credit facility, to be sanctioned at financial closure to cover cost overruns caused by delays.

Conclusion:

Ratings agency ICRA noted that the higher provisioning requirements for projects under implementation could affect the near-term profitability of non-banking financial companies and infrastructure financing companies. However, in their recent earnings calls, the State Bank of India (SBI), Union Bank of India, and Bank of Baroda expressed confidence that the proposal would not have any significant impact on them.