Contents:

- For Liberty, By Law

- The Fed’s Rate Reduction: A Lifeline for Developing Economies?

For Liberty, By Law

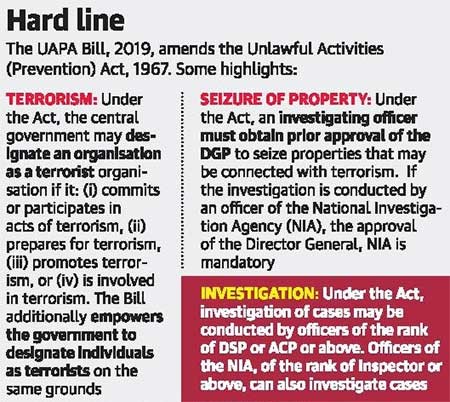

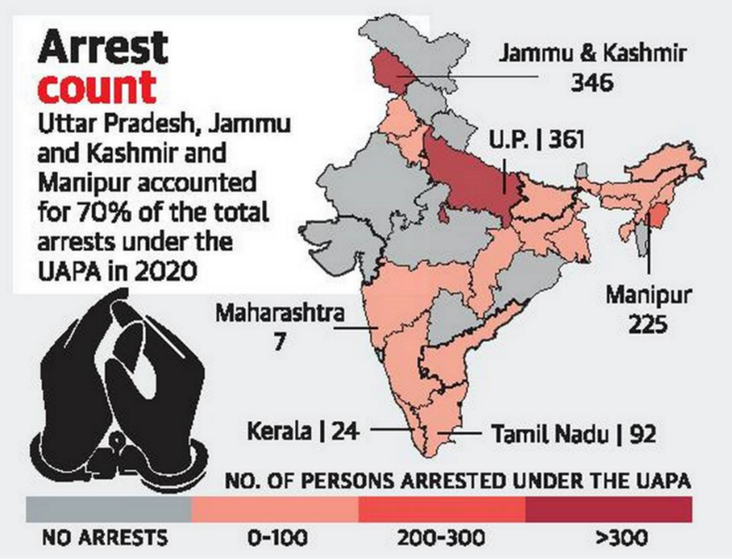

Context: The Supreme Court of India has, in recent decisions, reiterated the constitutional right to personal liberty by emphasizing the importance of bail as a fundamental safeguard. A recent case examined the limits of restrictive statutory provisions on personal liberty, focusing on laws like the Prevention of Money Laundering Act (PMLA) and the Unlawful Activities (Prevention) Act (UAPA), where stringent conditions make bail difficult.

Relevance: General Studies Paper II (Polity and Constitution)

Mains Question: How has the Supreme Court of India upheld the principle of personal liberty in recent decisions regarding bail? Discuss the balance between statutory restrictions and constitutional rights.

- Historical Perspective of Article 21:

- The right to life and personal liberty, enshrined under Article 21 of the Indian Constitution, has long been considered a sacrosanct principle. During the Constituent Assembly debates, members like K.M. Munshi and T.T. Krishnamachari stressed the need to protect personal liberty from becoming a “plaything of laws.”

- These debates laid the foundation for ensuring that any restrictions on personal liberty, including pretrial detention, must be just, fair, and reasonable.

- Recent Supreme Court Decisions:

- A landmark judgment by a division bench of Justices B.R. Gavai and K.V. Viswanathan in July emphasized the role of the judiciary in safeguarding personal liberty. The case questioned whether a person could be denied bail under stringent laws like the PMLA and UAPA despite procedural delays and slow investigations.

- The Court ruled that constitutional guarantees must prevail over statutory restrictions. It observed that “liberty is sacrosanct” and cannot be curtailed simply because of restrictive provisions in penal statutes. The bench added that an accused cannot be kept behind bars indefinitely, especially when due process is compromised.

- Implications of the Ruling:

- This ruling aligns with the principle that the right to bail must be a default rule, with detention being the exception. When personal liberty is at stake, courts must weigh the severity of the offense against procedural lapses and delays.

- Importantly, this decision challenges the increasingly onerous restrictions on bail, particularly under special laws like the PMLA, where the threshold for granting bail is high. Courts are now leaning toward the principle that denial of bail should be an exception only under compelling circumstances.

- The Role of Due Process and Personal Liberty:

- Due process has emerged as a central theme in the Court’s jurisprudence. Article 21’s protection of liberty is seen as a guarantee against arbitrary detention, ensuring that individuals cannot be deprived of their liberty without fair judicial review.

- The Court’s reaffirmation of bail as a fundamental right ensures that arbitrary or prolonged detention under special laws can be reviewed by the judiciary, thereby preventing misuse of the law.

- Looking Ahead: Constitutional Supremacy Over Statutory Provisions:

- The judgment underscores the Court’s role as a custodian of constitutional rights. It places a premium on judicial intervention when statutory provisions threaten to undermine personal liberty.

- As India marks the 75th anniversary of its Constitution, the importance of maintaining constitutional supremacy in legal interpretation is more crucial than ever. Personal liberty, as a cornerstone of human rights, must be protected not just by the letter of the law, but by its spirit.

Additional Data:

- Article 21: Right to life and personal liberty.

- Bail Decisions: The Court has increasingly favored granting bail unless there are compelling reasons to deny it, particularly under laws like the PMLA and UAPA.

Conclusion:

Recent rulings by the Supreme Court of India have reinforced the primacy of personal liberty under Article 21, particularly in cases where restrictive laws impede the right to bail. These decisions emphasize that constitutional guarantees must always prevail over statutory provisions, ensuring that due process is upheld and that no individual is unjustly detained.

The Fed’s Rate Reduction: A Lifeline for Developing Economies?

Context: The U.S. Federal Reserve has recently cut its benchmark interest rate for the first time in four years, marking a significant policy pivot. This move comes after the Fed had kept interest rates at their highest levels in over two decades to combat inflation, primarily in response to the COVID-19 pandemic-driven inflation surge. The rate reduction is expected to have widespread implications, especially for emerging market economies (EMEs).

Relevance: General Studies Paper III (Economy)

Mains Question: Analyze the impact of the U.S. Federal Reserve’s rate reduction on emerging market economies. How will this decision affect developing countries, particularly India?

- The Federal Reserve’s Rate Cut:

- On Wednesday, the Federal Reserve cut its interest rate by half a percentage point, the first rate reduction in more than four years. This policy change comes after a series of rate hikes since 2022, meant to control inflation, which had spiked due to supply chain disruptions and other factors linked to the pandemic.

- The decision was explained by Fed Chairman Jerome Powell, who pointed out that a recalibration was needed to ensure continued economic growth and to stabilize inflation around 2%.

- Impact on Emerging Markets:

- The rate hikes over the past two years led to a strong U.S. dollar, which posed significant challenges for emerging market economies (EMEs), particularly in Africa and Latin America. A strong dollar increases the cost of servicing foreign debt, making it difficult for these countries to maintain investments in crucial public infrastructure and services.

- With the Federal Reserve’s pivot, EMEs are expected to see a revival of capital flows as foreign portfolio investors, encouraged by the lower interest rates in the U.S., move capital to higher-yielding markets in developing economies. India, for example, is likely to benefit from increased foreign investment in its debt markets.

- Implications for Inflation and Capital Flows:

- Shaktikanta Das, the Governor of the Reserve Bank of India, highlighted that the Fed’s previous rate hikes had led to inflationary pressures in EMEs due to the strong U.S. dollar. As the dollar strengthened, the cost of importing goods rose, leading to higher input costs and consumer inflation in many developing economies.

- With the recent rate cut, these pressures could ease, leading to stabilization in currency exchange rates and reducing inflation in EMEs. Moreover, foreign portfolio investments (FPI) into countries like India are expected to increase, improving liquidity in financial markets.

- Broader Economic Relief for Developing Economies:

- In regions like Latin America and Africa, the cost of servicing foreign debt has become unsustainable, leading to reduced investments in public infrastructure and essential services. The International Monetary Fund (IMF) has raised concerns about how high borrowing costs are impacting these countries’ economic growth.

- The Fed’s rate cut could bring relief, as borrowing costs decline, allowing these nations to redirect funds towards development projects and poverty alleviation programs.

- Risks and Global Economic Uncertainty:

- While the Fed’s rate cut is viewed positively, global economic uncertainties remain. Factors such as the ongoing Russia-Ukraine conflict, rising oil prices, and geopolitical tensions in the Middle East could still impact the global economic outlook. The Fed’s move may offer temporary relief, but sustained recovery will depend on how these issues unfold in the coming months.

Additional Data:

- Fed’s Benchmark Rate: Reduced by half a percentage point.

- Impact on EMEs: Lower debt servicing costs, improved foreign capital flows.

Conclusion:

The U.S. Federal Reserve’s rate reduction could offer significant relief to emerging market economies, especially those burdened by high foreign debt and inflationary pressures. Countries like India stand to gain from increased foreign capital inflows, while others may find room to invest in public infrastructure and services. However, global uncertainties continue to pose risks to the long-term impact of this policy change.