Contents:

- One Nation, One Election: A Threat to Federalism and Political Accountability?

- Ensuring Fair Tax Distribution: The Finance Commission’s Role in Addressing High-Performing States’ Concerns

One Nation, One Election: A Threat to Federalism and Political Accountability?

Context: The idea of One Nation, One Election (ONOE), promoted by the ruling government, advocates simultaneous elections for the Lok Sabha and all state legislative assemblies. While proponents argue that it could reduce election costs and increase administrative efficiency, critics argue that it threatens federalism and undermines the democratic process.

Relevance: General Studies Paper II (Polity and Governance)

Mains Question: Analyze the potential benefits and drawbacks of implementing the One Nation, One Election (ONOE) system in India. What are the implications for federalism and democratic accountability?

- Proposed Benefits of One Nation, One Election:

- The ONOE proposal aims to reduce the recurring costs and administrative burden associated with conducting elections multiple times across the year. By holding simultaneous elections, the system could lead to efficient resource utilization and reduce the impact of the Model Code of Conduct (MCC), which freezes governance activities during election periods.

- Additionally, it is argued that fewer elections could result in more stable governance, allowing governments to focus on long-term policies without being distracted by frequent electoral cycles.

- Concerns Regarding Federalism and Accountability:

- However, critics like Manoj Kumar Jha, in the article, argue that the ONOE plan could harm federalism by centralizing political power. In a system where both national and state elections are held simultaneously, national issues may overshadow local issues. This could lead to a dilution of state autonomy in deciding their own political trajectories.

- Furthermore, the concentration of power may weaken regional parties, pushing smaller states and minority groups to the margins of political discourse.

- Democracy and Frequent Elections:

- One of the primary concerns is that frequent elections are essential to keeping the government accountable to the people. Regular elections allow voters to express dissatisfaction with state or local governance and demand course corrections.

- The reduction in electoral frequency could weaken the checks and balances on political representatives. Governments may feel less pressure to address immediate concerns, knowing they are not facing elections frequently.

- Practical Challenges and Alternatives:

- Implementing ONOE would require major constitutional amendments to synchronize the terms of the state assemblies with the Lok Sabha, which may face logistical and legal hurdles.

- Rather than overhauling the election system, reforms could focus on making elections more efficient, such as tightening the MCC guidelines or using technology to streamline the electoral process.

- Political Consequences:

- A major concern is the potential for majoritarian dominance under ONOE. With simultaneous elections, the political party with strong national appeal may dominate state elections as well, leading to less political diversity. This could undermine the electoral voice of smaller states, regional parties, and marginalized communities, reducing their ability to influence local governance issues.

Additional Data:

- Electoral Costs: Conducting separate elections for Lok Sabha and state assemblies increases costs significantly.

- Federalism Concerns: Synchronizing elections would require changes to the terms of state assemblies, potentially infringing on state autonomy.

Conclusion:

The One Nation, One Election proposal, while offering administrative benefits, raises significant concerns about federalism, political accountability, and the future of regional parties in India. A more measured approach, focused on improving the efficiency of the current electoral system, may be more appropriate for maintaining the delicate balance of power between the Union and the States.

Ensuring Fair Tax Distribution: The Finance Commission’s Role in Addressing High-Performing States’ Concerns

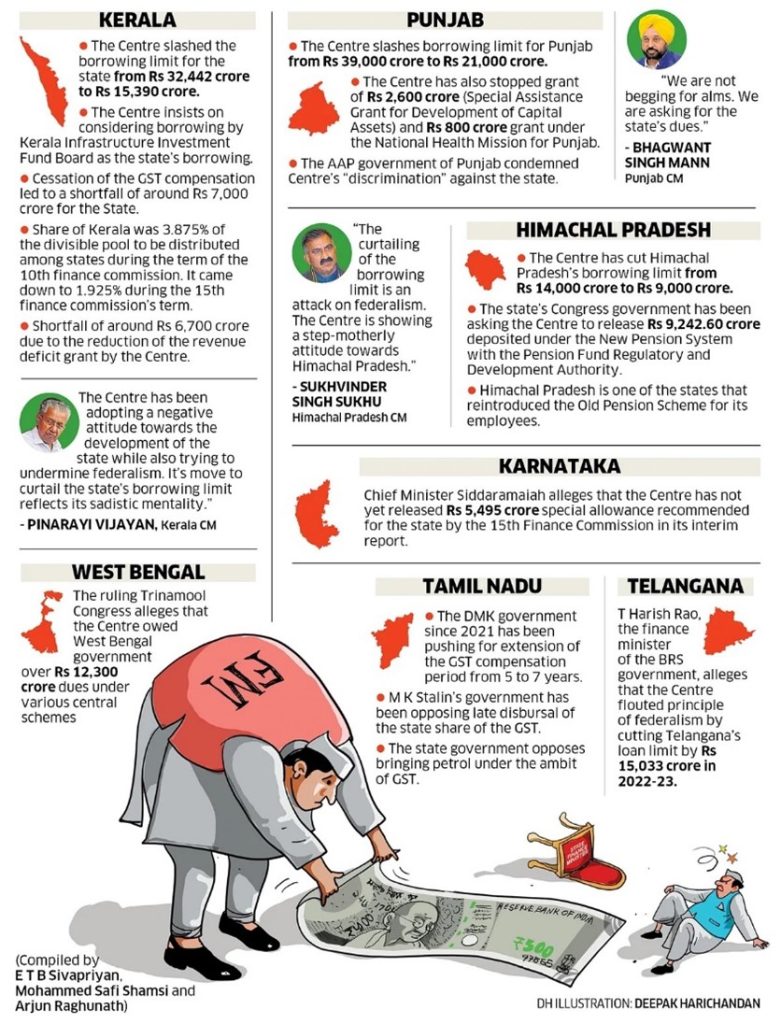

Context: The Finance Ministers of five opposition-ruled states have raised concerns regarding the 15th Finance Commission’s recommendation, which allocates 41% of taxes to the states. These ministers are calling for an increase to 50%, along with capping the central government’s cesses and surcharges, which further limit states’ ability to collect taxes. This discussion comes at a crucial time when several states, particularly high-performing ones like Karnataka, Maharashtra, and Tamil Nadu, are feeling the pinch of restricted tax collections under the GST framework.

Relevance: General Studies (GS) Paper II (Polity and Governance)

Mains Question: Discuss the challenges faced by high-performing states under the current tax devolution framework. How can the Finance Commission address these concerns to promote a more equitable fiscal relationship between the Centre and States?

- Current Tax Devolution Framework:

- The 15th Finance Commission recommended that 41% of central taxes be devolved to states. However, high-performing states argue that this is insufficient, given their economic contributions and developmental needs.

- States like Gujarat, Karnataka, Maharashtra, and Tamil Nadu contribute significantly to India’s GDP and tax revenues, but receive lower per capita allocations, leading to fiscal strain.

- Impact of Cesses and Surcharges:

- Cesses and surcharges, levied by the central government, are not part of the divisible tax pool. This means that states receive no share of these revenues, even though they contribute to the overall tax burden on citizens.

- Opposition states argue that cesses have increased dramatically over the years, further reducing their ability to manage local finances and developmental projects.

- Challenges with GST and Central Schemes:

- Since the introduction of the GST, states have lost much of their autonomy to collect taxes. High-performing states, in particular, have felt this more acutely, as their tax revenues are now limited by the uniform tax structure.

- States like Kerala and Tamil Nadu have expressed frustration over inadequate allocations for central projects, such as Bengaluru’s Suburban Rail Project and Kerala’s Vizhinjam Port. These projects are critical for regional development, but they have received insufficient funding under the current central schemes.

- Environmental and Developmental Needs:

- Climate-related disasters, such as flooding in Tamil Nadu and landslides in Kerala, highlight the need for greater fiscal flexibility for states. The current framework does not provide adequate funds for contingency planning and disaster mitigation, which are becoming more pressing due to climate change.

- High-performing states require tailor-made policies that address their unique industrial, social, and environmental needs. The Finance Commission must ensure that states are not penalized for better economic performance, but instead supported in maintaining their growth.

- Suggestions for Reform:

- The 16th Finance Commission, whose recommendations are due by October 2025, must take a more equitable approach to tax devolution. States are asking for an increase in the divisible pool to 50%, as well as a cap on cesses and surcharges to ensure that all taxes are shared fairly between the Centre and the states.

- There is also a need for greater fiscal autonomy for states, allowing them to design and implement policies suited to their specific developmental needs, especially in areas like infrastructure and disaster management.

Additional Data:

- 41% of central taxes currently devolved to states.

- High-performing states like Karnataka and Tamil Nadu have seen reduced tax collections under the GST framework.

Conclusion:

The current tax devolution framework under the 15th Finance Commission has created challenges for high-performing states, which are unable to meet their growing developmental and fiscal needs. The 16th Finance Commission has an opportunity to rectify this imbalance by increasing the share of taxes devolved to states, capping cesses and surcharges, and providing greater autonomy in fiscal matters. A truly federal and participative fiscal structure will ensure that all states, regardless of their economic standing, can thrive and contribute to India’s overall growth.