Contents

- On rewarding Good Samaritans on road

- Global minimum tax deal Explained

On rewarding Good Samaritans on road

Context:

The Ministry of Road Transport and Highways (MoRTH) has come up with a new scheme to award Good Samaritans who save the lives of road accident victims with a cash prize.

Relevance:

GS-II: Social Justice and Governance (Government Policies and Initiatives)

Dimensions of the Article:

- Who is a Good Samaritan?

- Why is there a need for a scheme to promote good Samaritans?

- How does the new scheme work?

- Concern with the implementation of the scheme

Who is a Good Samaritan?

- According to MoRTH, a Good Samaritan is a person who, in good faith, without expectation of payment or reward and without any duty of care or special relationship, voluntarily comes forward to administer immediate assistance or emergency care to a person injured in an accident, or crash, or emergency medical condition, or emergency situation.

Why is there a need for a scheme to promote good Samaritans?

Statistics on Road Accidents

- According to a study conducted by the Ministry of Road Transport and Highways, 1,51,113 persons were killed and 4,51,361 injured in road accidents across the country in 2019.

- NHs and State Highways, which account for about 5% of the total road length, claimed 61% of the deaths related to accidents.

- Around 35,606 deaths were reported on the NHs, which come under the National Highway Authority of India (NHAI).

- In 2020, the National Crime Records Bureau data show 1,33,715 lives were lost in 1,20,716 cases attributed to negligence relating to road accidents.

Why did the Govt come up with such a scheme?

- A chapter was added in 2020 in the Motor Vehicles Act which discussed in detail Good Samaritans and their role in society.

- People however were not able to accept this in spite of assurance from the government that there would be no harassment and legal complications.

- Therefore, the Ministry’s move seeks to overcome restraint by rewarding socially-minded individuals who offer immediate assistance and rush a victim with certain kinds of injuries to the hospital, with ₹5,000 and a certificate of recognition for saving a life.

How does the new scheme work?

- Any individual who has saved the life of a victim of a serious accident involving a motor vehicle by administering immediate assistance and rushing to the hospital within the Golden Hour of the accident to provide medical treatment would be eligible for the award.

- The amount of award for the Good Samaritan(s) would be ₹5,000 per incident.

- On receipt of communication from the Police Station/Hospital, District Level Appraisal Committee shall review and approve the proposals on a monthly basis.

- The Appraisal Committee at the District Level comprising District Magistrate, SSP, Chief Medical and Health Officer, RTO (Transport Department) of the concerned District would sanction and send the cases to the concerned State/UT Transport Department for making the payment to the Good Samaritans.

- State governments are responsible for the plan, with the Centre providing an initial grant, but the Union Transport Ministry will give its own award of ₹1 lakh each to the 10 best Good Samaritans in a year.

Concern with the implementation of the scheme

- The Centre has notified the National Road Safety Board, with a mandate to formulate standards on, among other things, safety and trauma management, to build capacity among traffic police, and put crash investigation on a scientific footing.

- Yet, the implementation is not according to the expectation primarily because the state police forces generally appear to favour a populist approach of least engagement and Bureaucracies at the regional level may also engage in corruption.

-Source: The Hindu

Global minimum tax deal Explained

Context:

- A global deal to ensure big companies pay a minimum tax rate of 15% and make it harder for them to avoid taxation has been agreed by 136 countries according to the Organisation for Economic Cooperation and Development (OECD).

- The OECD said four countries – Kenya, Nigeria, Pakistan and Sri Lanka – had not yet joined the agreement, but that the countries behind the accord together accounted for over 90% of the global economy.

Relevance:

GS-III: Indian Economy (Economic Growth and Development, Foreign Trade and related issues, Inclusive growth and issues therein), GS-II: International Relations

Dimensions of the Article:

- Trend in Corporate Tax rates globally

- Base Erosion Profit Shifting (BEPS)

- The regressive tax structure

- About the Global Minimum Corporate Tax Rate proposal

- The necessity of the Global Minimum Corporate Tax according to U.S.

- What are the targets of minimum corporate tax rate?

- What are the problems with the plan?

- Where does India stand on minimum corporate tax?

- How would a minimum corporate tax deal work?

- What happens next after the recent agreement on Minimum corporate tax?

- What will be the economic impact?

Trend in Corporate Tax rates globally

- When the Soviet Bloc collapsed in 1990, nations in east Europe were badly hit and needed capital infusion to overcome their economic woes. To attract global capital, they cut their tax rates sharply. This resulted in a ‘race to the bottom’. Nations in Europe were forced to cut their tax rates one after the other to not only attract capital but also to prevent capital from leaving their shores. This had global implications.

- Nations became short of resources and cut back expenditures on public services and encouraged privatisation. Governments lacked resources for education, health and civic amenities. The developing countries followed suit even though private markets do not cater to the poor. Thus, disparities increased within nations.

- Presently, governments need resources to help people through transfer of incomes, provision of more public services and also prevent business failures. But their resources have been adversely impacted by the economic downturn. Consequently, fiscal deficits have reached record high levels. In the pre-pandemic era, such levels of deficit would have led to the tanking of the stock markets but now they are booming in anticipation of demand being pumped in by these high deficits. The result is a massive increase in inequality between those who have gained in the stock markets and those who have lost employment and incomes.

Base Erosion Profit Shifting (BEPS)

- The world experienced Base Erosion Profit Shifting (BEPS). Namely, companies shifted their profits to low tax jurisdictions, especially, the tax havens. For instance, many of the most profitable companies like Google and Facebook are accused of shifting their profits to Ireland and other tax havens and paying little tax.

- EU has levied fines on Google and Apple for such practices. Former U.S. President Barack Obama in 2009 had said that the U.S. was losing $100 billion in taxes due to such practices.

- Since all the OECD countries have suffered due to cuts in tax rates and BEPS, initiatives have been taken to check these practices. But they will not succeed unless there is agreement among all the countries.

- Any country facing economic adversity can cut its tax rates to attract capital and force others to follow suit.

- India has also cut its tax rates since the 1990s. Most recently in 2019 the corporation tax rate was cut drastically to match those prevailing in Southeast Asia. Such cuts have implications for both inequality as well as for funding the schemes for the poor and the quality of public services.

The regressive tax structure

- Another implication of the reductions in direct tax rates has been that governments have increasingly depended on the regressive indirect taxes for revenue generation.

- Value-Added Tax and Goods and Services Tax have been increasingly used to get more revenues. This impacts the less well-off proportionately more and is inflationary.

- Direct taxes tend to lower the post-tax income inequality. The rising inequalities result in shortage of demand in the economy and to its slowing down which then requires more investment and that calls for more concessions to capital.

- However, that does not guarantee revival because investment in response to a tax cut is uncertain. Instead, increased government expenditures are sure to raise demand.

About the Global Minimum Corporate Tax Rate proposal

- The US proposal envisages a 21% minimum corporate tax rate, coupled with cancelling exemptions on income from countries that do not legislate a minimum tax to discourage the shifting of multinational operations and profits overseas.

- The US views a Global Minimum Corporate Tax Rate as an attempt to reverse a “30-year race to the bottom” in which countries have resorted to slashing corporate tax rates to attract multinational corporations (MNCs).

- The proposal for a minimum corporate tax is tailored to address the low effective rates of tax shelled out by some of the world’s biggest corporations, including digital giants such as Apple, Alphabet and Facebook, as well as major corporations such as Nike and Starbucks.

- These companies typically rely on complex webs of subsidiaries to hoover profits out of major markets into low-tax countries such as Ireland or Caribbean nations such as the British Virgin Islands or the Bahamas, or to central American nations such as Panama.

The necessity of the Global Minimum Corporate Tax according to U.S.

- The proposal aims to somewhat offset any disadvantages that might arise from the proposed increase in the US corporate tax rate.

- The proposed increase to 28% from 21% would partially reverse the previous cut in tax rates on companies from 35% to 21% by way of a 2017 tax legislation.

- The increase in corporation tax comes at a time when the pandemic is costing governments across the world, and is also timed with the US’s push for a USD 2.3 trillion infrastructure upgrade proposal.

- A global compact on this issue, at the time of pandemic, will work well for the US government and for most other countries in western Europe, even as some low-tax European jurisdictions such as the Netherlands, Ireland and Luxembourg and some in the Caribbean rely largely on tax rate arbitrage to attract MNCs.

- The plan to peg a minimum tax on overseas corporate income seeks to potentially make it difficult for corporations to shift earnings offshore.

- However, a global minimum rate would essentially take away a tool that countries use to push policies that suit them. A lower tax rate is a tool they can use to alternatively push economic activity.

What are the targets of minimum corporate tax rate?

- Apart from low-tax jurisdictions, the proposal for a minimum corporate tax are tailored to address the low effective rates of tax shelled out by some of the world’s biggest corporations, including digital giants such as Apple, Alphabet and Facebook, as well as major corporations such as Nike and Starbucks.

- These companies typically rely on complex webs of subsidiaries to hoover profits out of major markets into low-tax countries such as Ireland or Caribbean nations such as the British Virgin Islands or the Bahamas, or to central American nations such as Panama.

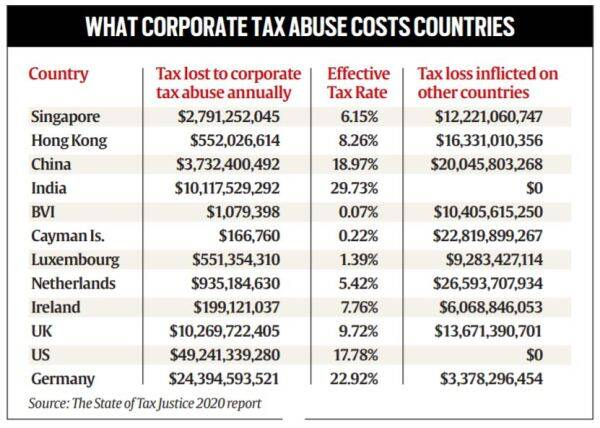

- The US Treasury loses nearly $50 billion a year to tax cheats, according to the Tax Justice Network report, with Germany and France also among the top losers.

- India’s annual tax loss due to corporate tax abuse is estimated at over $10 billion, according to the report.

What are the problems with the plan?

- Apart from the challenges of getting all major nations on the same page, especially since this impinges on the right of the sovereign to decide a nation’s tax policy, the proposal has other pitfalls.

- A global minimum rate would essentially take away a tool that countries use to push policies that suit them.

- For instance, in the backdrop of the pandemic, IMF and World Bank data suggest that developing countries with less ability to offer mega stimulus packages may experience a longer economic hangover than developed nations.

- A lower tax rate is a tool they can use to alternatively push economic activity. Also, a global minimum tax rate will do little to tackle tax evasion.

Where does India stand on minimum corporate tax?

- In a bid to revive investment activity, Indian Finance Minister in 2019 announced a sharp cut in corporate taxes for domestic companies to 22% and for new domestic manufacturing companies to 15%.

- The Taxation Laws (Amendment) Act, 2019 resulted in the Income-Tax Act, 1961 to provide for the concessional tax rate of 22% for existing domestic companies subject to certain conditions including that they do not avail of any specified incentive or deductions.

- Also, existing domestic companies opting for the concessional taxation regime will not be required to pay any Minimum Alternate Tax.

How would a minimum corporate tax deal work?

- The global minimum tax rate would apply to overseas profits of multinational firms with 750 million euros ($868 million) in sales globally.

- Governments could still set whatever local corporate tax rate they want, but if companies pay lower rates in a particular country, their home governments could “top up” their taxes to the 15% minimum, eliminating the advantage of shifting profits.

- A second track of the overhaul would allow countries where revenues are earned to tax 25% of the largest multinationals’ so-called excess profit – defined as profit in excess of 10% of revenue.

What happens next after the recent agreement on Minimum corporate tax?

- Following the October 2021 agreement on the technical details, the next step is for finance ministers from the Group of 20 economic powers to formally endorse the deal, paving the way for adoption by G20 leaders at an end October 2021 summit.

- Nonetheless, questions remain about the US position which hangs in part on a domestic tax reform the Biden administration wants to push through the US Congress.

- The agreement calls for countries to bring it into law in 2022 so that it can take effect by 2023, an extremely tight timeframe given that previous international tax deals took years to implement. Countries that have in recent years created national digital services taxes will have to repeal them.

What will be the economic impact?

- The OECD, which has steered the negotiations, estimates the minimum tax will generate $150 billion in additional global tax revenues annually.

- Taxing rights on more than $125 billion of profit will be additionally shifted to the countries where they are earned from the low tax countries where they are currently booked.

- Economists expect that the deal will encourage multinationals to repatriate capital to their country of headquarters, giving a boost to those economies.

- However, various deductions and exceptions baked into the deal are at the same time designed to limit the impact on low tax countries like Ireland, where many US groups base their European operations.

-Source: Indian Express