Contents

- What explains the surge in FDI inflows?

What explains the surge in FDI inflows?

Context:

Total foreign direct investment (FDI) inflow in 2020-21 is $81.7 billion, up 10% over the previous year 2020, reported a recent Ministry of Commerce and Industry press release.

Relevance:

GS-III: Indian Economy (Growth & Development of Indian Economy, Mobilization of Resources, Capital Market)

Dimensions of the Article:

- About Foreign Direct Investment

- FDI Routes in India

- About the Current surge in FDI Inflows

About Foreign Direct Investment

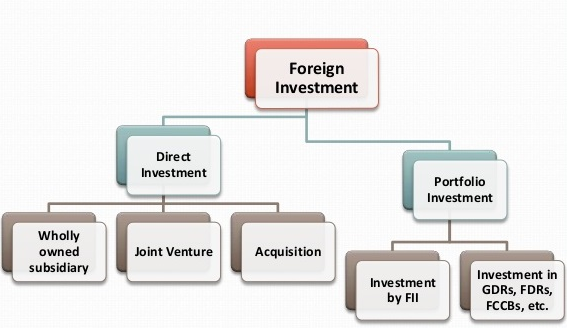

- Foreign Direct Investment (FDI) is an investment in the form of a controlling ownership in a business in one country by an entity based in another country. It is thus distinguished from a Foreign Portfolio Investment by a notion of direct control.

- FDI may be made either “inorganically” by buying a company in the target country or “organically” by expanding the operations of an existing business in that country.

- Broadly, FDI includes “mergers and acquisitions, building new facilities, reinvesting profits earned from overseas operations, and intra company loans”. In a narrow sense, it refers just to building a new facility, and lasting management interest.

FDI in India

- Foreign Direct Investment (FDI) is a major driver of economic growth and an important source of non-debt finance for the economic development of India.

- It has been the endeavor of the Government to put in place an enabling and investor friendly FDI policy. The intent all this while has been to make the FDI policy more investor friendly and remove the policy bottlenecks that have been hindering the investment inflows into the country.

- The steps taken in this direction during the last six years have borne fruit as is evident from the ever-increasing volumes of FDI inflows being received into the country. Continuing on the path of FDI liberalization and simplification, Government has carried out FDI reforms across various sectors.

FDI Routes in India

- Foreign investment was introduced in 1991 under Foreign Exchange Management Act (FEMA), driven by then FM Manmohan Singh.

- There are three routes through which FDI flows into India. They are described in the following table:

| Category 1 | Category 2 | Category 3 |

| 100% FDI permitted through Automatic Route | Up to 100% FDI permitted through Government Route | Up to 100% FDI permitted through Automatic + Government Route |

- Automatic route: By this route, FDI is allowed without prior approval by Government or RBI.

- Government route: Prior approval by the government is needed via this route. The application needs to be made through Foreign Investment Facilitation Portal, which will facilitate the single-window clearance of FDI application under Approval Route.

Global Depository Receipts – GDR

Foreign Depository Receipts – FDR

Foreign Currency Convertible Bonds – FCCB

Foreign institutional investors – FII

About the Current surge in FDI Inflows

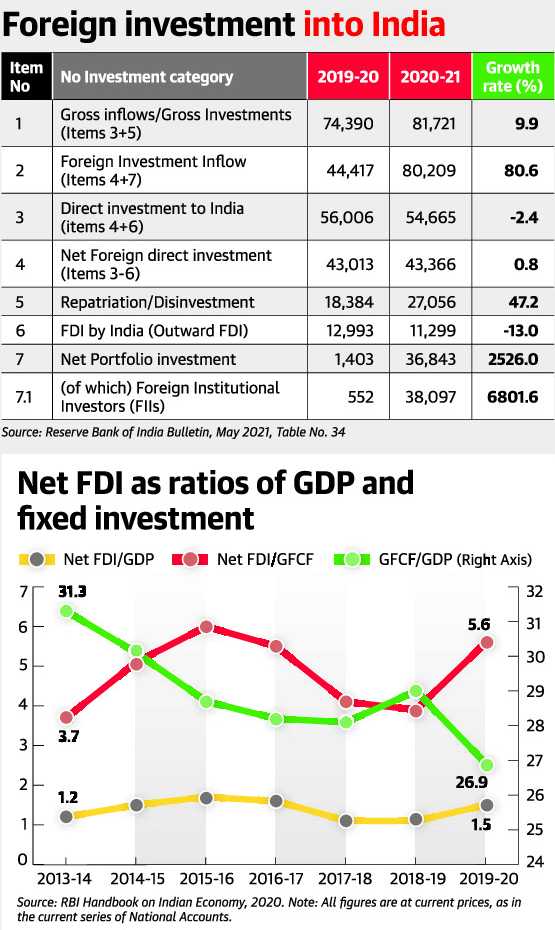

- Total foreign direct investment (FDI) inflow in 2020-21 is $81.7 billion, up 10% over the FDI in 2020.

- It further added, “Measures taken by the Government on the fronts of Foreign Direct Investment (FDI) policy reforms, investment facilitation and ease of doing business have resulted in increased FDI inflows into the country.”

What accounts for gross inflow?

- “Gross inflows/gross investment” in the RBI report is the same as “total FDI inflow” in the press release, identical to the Commerce Ministry’s estimate.

- The gross inflow consists of:

- Direct investment to India

- Repatriation/disinvestment

- The disaggregation shows that “direct investment to India” has declined by 2.4%.

- Hence, an increase of 47% in “repatriation/disinvestment” entirely accounts for the rise in the gross inflows. In other words, there is a wide gap between gross FDI inflow and direct investment to India.

- Similarly, measured on a net basis (that is, “direct investment to India” net of “FDI by India” or, outward FDI from India), direct investment to India has barely risen (0.8%) in 2020-21 over the previous year 2020.

- The reason for the headline number of 10% rise in gross inflow entirely on account of “Net Portfolio Investment”, shooting up from $1.4 billion in 2019-20 to $36.8 billion in 2020-2021. (That is a whopping 2,526% rise.)

- Further, within the net portfolio investment, foreign institutional investment (FIIs) has boomed by an astounding 6,800% to $38 billion in 2020-21, from a mere half a billion dollars in 2019-2020.

- FDI inflow, in theory, is supposed to bring in additional capital to augment potential output (taking managerial control/stake). In contrast, foreign portfolio investment, as the name suggests, is short-term investment in domestic capital (equity and debt) markets to realise better financial returns (that is, higher dividend/interest rate plus capital gains). But the conceptual distinctions have blurred in official reporting, showing an outsized role of FDI and its growth in India.

- Thus, the surge in total FDI inflow during the pandemic year is entirely explained by booming short-term FIIs in the capital market – and not adding to fixed investment and employment creation.

-Source: The Hindu