Contents

- Limited Liability Partnership (Amendment) Bill 2021

- Commission for Air Quality Management in NCR Bill

- Deposit Insurance & Credit Guarantee Corporation Bill

- Report on rights abuse in J&K and Kashmir militancy

- RTE entitlements to be paid through cash transfer

- Funds allotted for ongoing MPLADS projects lapse

Limited Liability Partnership (Amendment) Bill 2021

Context:

The Rajya Sabha passed the Limited Liability Partnership (Amendment) Bill 2020 which seeks to amend the Limited Liability Partnership Act of 2008.

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, Inclusive Growth), GS-II: Governance (Government Interventions and policies)

Dimensions of the Article:

- What is Limited Liability Partnership (LLP)?

- Limited Liability Partnership (Amendment) Bill, 2021

- What can be changed regarding LLPs in the future?

What is Limited Liability Partnership (LLP)?

- A Limited Liability Partnership (LLP) is a hybrid model of a partnership firm and a company in which some or all partners (depending on the jurisdiction) have limited liabilities.

- In an LLP, each partner is not responsible or liable for another partner’s misconduct or negligence.

- The partners in an LLP are liable only to their extent of agreed contribution to the capital. They are not liable to any unauthorised actions of the other partners.

- In a traditional partnership firm, all the partners are liable for any action taken by any partner and the liability is unlimited. However, in an LLP, the liability extent of any partner is determined by the amount of capital that has been invested by him/her.

- LLP is governed by Limited Liability Partnership Act, 2008 and Companies Act while traditional partnership is governed by Indian Partnership Act, 1932.

- An LLP has a separate legal entity and is liable to the full extent of its assets (liability of partners is limited) while a traditional partnership firm does not have any kind of separate legal entity.

- Foreign Nationals can become partners in LLP, whereas in traditional partnership firms, foreign nationals can’t become the partner.

- In a partnership firm, there is professional expertise but the risk-taking capacity often gets undermined due to high liabilities on the partners. The LLP provides an alternative solution to it because it combines the benefits of professional expertise and the risk-taking capacity of the partners and gives them the viable options.

Limited Liability Partnership (Amendment) Bill, 2021

- The Limited Liability Partnership (Amendment) Bill 2021 makes amendments to the Limited Liability Partnership (LLP) Act, 2008 to bring an equal playing field for Limited Liability Partnerships (LLPs), compared to large companies which come under the Companies Act, 2013.

- The Bill aims to facilitate the Ease of Doing Business and encourage startups across the country.

- The bill proposes the creation of a class of small LLPs which will be subject to fewer compliances, reduced fee/additional fee, and smaller penalties in the civil defaults – to encourage entrepreneurs.

- The bill seeks to decriminalise 12 of the existing 24 penal provisions, 21 compoundable offences and 3 non-compoundable ones under the LLP Act by omitting those offences which are more appropriate to be dealt with under other laws.

- Offences that relate to minor/ less serious compliance issues, involving predominantly objective determinations, are proposed to be shifted to the In-House Adjudication Mechanism (IAM) framework instead of being treated as criminal offences.

- The threshold contribution for the partners for the LLPs have been enhanced from Rs. 25 lacs to around Rs. 5 crores and the turnover size from 40 lacs to 50 crores.

- The amendment allows the LLPs to issue fully secured Non-Convertible Debentures from investors regulated by SEBI or the RBI – this will facilitate the enhanced capability of raising capital and financing operations of LLPs.

- The accounting standards and auditing standards for LLPs have been introduced to bring standardisation in the procedures as the LLPs were not enjoying the kind of standard accounting systems that their counterpart companies are enjoying under the provisions of the Companies Act, 2013.

What can be changed regarding LLPs in the future?

- Even if its partners qualify for ’angel investors’ in their individual capacity, the LLP might not be eligible for it as LLPs have to meet certain criteria to be eligible for an angel investor. Norms can be eased to enable LLPs access to angel investors become easier.

- Currently, no two NRIs can form an LLP in India as one of the partners has to be an Indian resident. Further, the Foreign Direct investment (FDI) in an LLP can only happen through the government route and therefore, the time required to form this partnership is much more. These norms can be eased to support foreign funding for LLPs as well.

- An LLP does not allow to issue Employee Stock Ownership Plan (ESOP). This restriction can be removed as ESOPs are used as a tool to retain the key personnel of the company.

-Source: The Hindu

Commission for Air Quality Management in NCR Bill

Context:

The Parliament approved a Bill that seeks to set up a commission for air quality management in the National Capital Region and its adjoining areas.

Relevance:

GS-III: Environment and Ecology (Environmental Pollution, Pollution Control Measures, Conservation of Environment and Ecology), GS-II: Governance (Government Policies and Interventions)

Dimensions of the Article:

- CAQM in National Capital Region and Adjoining Areas Bill, 2021

- About the Commission for Air Quality Management (CAQM)

- Powers and Functions of the CAQM

- Criticisms of the CAQM

- About the recent changes in Delhi’s Air quality

Commission for Air Quality Management in National Capital Region and Adjoining Areas Bill, 2021

- The Commission for Air Quality Management in National Capital Region and Adjoining Areas Bill, 2021 provides for the constitution of a Commission for better co-ordination, research, identification, and resolution of problems related to air quality in the National Capital Region (NCR) and adjoining areas.

- Adjoining areas have been defined as areas in Haryana, Punjab, Rajasthan, and Uttar Pradesh, adjoining the National Capital Territory of Delhi and NCR, where any source of pollution may cause adverse impact on air quality in the NCR.

- Sources of air pollution particularly in the NCR consist of a variety of factors which are beyond the local limits. Therefore, a special focus is required on all sources of air pollution which are associated with different economic sectors, including power, agriculture, transport, industry, residential and construction.

- Since air pollution is not a localised phenomenon, the effect is felt in areas even far away from the source, thus creating the need for regional-level initiatives through inter-State and inter-city coordination in addition to multi-sectorial synchronisation.

- The Bill has taken into consideration the concerns of the farmers following several rounds of negotiations, after they had raised concerns of stiff penalties and possible jail terms for stubble burning.

About the Commission for Air Quality Management (CAQM)

- The Commission for Air Quality Management (CAQM) will be a Statutory body which will have Three sub-committees to assist the commission:

- Sub-committee on monitoring and identification,

- Sub-committee on safeguarding and enforcement and

- Sub-committee on research and development.

- The CAQM will be chaired by a government official of the rank of Secretary or Chief Secretary. The chairperson will hold the post for three years or until s/he attains the age of 70 years.

- The CAQM will also will have members from several Ministries as well as representatives from the stakeholder States and experts from the Central Pollution Control Board (CPCB), Indian Space Research Organisation (ISRO) and Civil Society.

- The erstwhile Environment Pollution (Prevention and Control) Authority, or EPCA had been dissolved to make way for the Commission.

- The Commission will supersede bodies such as the central and state pollution control boards of Delhi, Punjab, Haryana, UP and Rajasthan.

Powers and Functions of the CAQM

The CAQM will:

- Have the powers to issue directions to these state governments on issues pertaining to air pollution.

- Entertain complaints as it deems necessary for the purpose of protecting and improving the quality of the air in the NCR and adjoining areas.

- Lay down parameters for control of air pollution.

- Be in charge of identifying violators, monitoring factories and industries and any other polluting unit in the region, and will have the powers to shut down such units.

- Have the powers to overrule directives issued by the state governments in the region, that may be in violation of pollution norms.

Criticisms of the CAQM

- The Commission is set to have a large number of members from the central government, which may not go down well with the states, as the States, on the other hand have much lesser representation and voice.

- States may not be happy with the overarching powers being vested in the Commission. Political differences may also play a part in the functioning of the Commission.

- The Commission is said to take the issue of air pollution out of the purview of the judiciary even as the old laws have not even been implemented completely.

About the recent changes in Delhi’s Air quality

- Delhi’s air typically worsens in October-November and improves by March-April every year due to weather amongst other reasons.

- Current weather conditions are not unfavourable, unlike in winter. Hence, apart from local emissions, the deterioration in air quality is being attributed to an increase in fire counts, mostly due to burning of wheat crop stubble in northern India.

- Fires were also spotted Lahore, Gujranwala and Hafizabad in Pakistan which can contribute to deterioration of air quality.

- Deteriorating air quality is worrying amid an increasing number of novel coronavirus disease (COVID-19) and deaths. Medical experts have, from time to time, raised concerns about how high pollution levels can worsen the situation and aggravate respiratory conditions of the public.

-Source: The Hindu

Deposit Insurance & Credit Guarantee Corporation Bill

Context:

The Rajya Sabha passed the Deposit Insurance and Credit Guarantee Corporation (Amendment) Bill amid opposition uproar.

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, Banking), GS-II: Governance (Government Policies and Interventions)

Dimensions of the Article:

- Deposit Insurance and Credit Guarantee Corporation (DICGC) Bill, 2021

- Deposit Insurance and Credit Guarantee Corporation (DICGC)

- How does DICGC manage deposit insurance?

Deposit Insurance and Credit Guarantee Corporation (DICGC) Bill, 2021

The Deposit Insurance and Credit Guarantee Corporation (Amendment) Bill, 2021 proposes three key changes that could vastly improve the working of deposit insurance as it stands today. This was deemed necessary in the wake of failure of banks such as Punjab and Maharashtra Co-operative (PMC) Bank, Yes Bank and Lakshmi Vilas Bank due to low level of insurance against the deposits held by customers in Indian banks.

Key provisions of the DICGC bill, 2021

- The Bill makes changes to the deposit insurance laws of the country according to which up to Rs 5 lakh of funds will be provided to an account holder within 90 days in the event of a bank being put under moratorium by the RBI. Previously, account holders had to get their insured deposits had to wait for years till the restructuring or liquidation of a distressed lender.

- The deposit insurance premium has also been raised by 20% effective immediately and maximum premium limit by 50%. This premium is paid by the various banks to the DICGC.

- Currently, as premium for insurance cover, banks pay 10 paisa on every Rs 100 worth deposits to the DICGC. This is being raised to 12 paisa on every Rs 100.

- With the bank being put under moratorium, in the first 45 days, DICGC will collect all deposit accounts related information’s. Then in the next 45 days, the information will be reviewed and depositors will be repaid within 90 days.

Deposit Insurance and Credit Guarantee Corporation (DICGC)

- Deposit Insurance and Credit Guarantee Corporation (DICGC) is a wholly owned subsidiary of Reserve Bank of India.

- It was established on 15 July 1978 under the Deposit Insurance and Credit Guarantee Corporation Act, 1961. Hence, it is a Statutory body.

- It was established for the purpose of providing insurance of deposits and guaranteeing of credit facilities.

- DICGC insures all bank deposits, such as saving, fixed, current, recurring deposit for up to the limit of Rs. 500,000 of each deposits in a bank.

How does DICGC manage deposit insurance?

- DICGC charges 10 paise per ₹ 100 of deposits held by a bank (which is set to be increased to 12 paise by the 2021 law). The premium paid by the insured banks to the Corporation is paid by the banks and is not to be passed on to depositors.

- DICGC last revised the deposit insurance cover to ₹ 1 lakh on May 1, 1993, raising it from ₹ 30,000 since 1980. The protection cover of deposits in Indian banks through insurance is among the lowest in the world.

- The Damodaran Committee on ‘Customer Services in Banks’ (2011) had recommended a five-time increase in the cap to ₹5 lakh due to rising income levels and increasing size of individual bank deposits.

- Banks, including regional rural banks, local area banks, foreign banks with branches in India, and cooperative banks, are mandated to take deposit insurance cover with the DICGC.

- The DICGC does not deal directly with depositors.

- The RBI (or the Registrar), on directing that a bank be liquidated, appoints an official liquidator to oversee the winding up process.

- Under the DICGC Act, the liquidator is supposed to hand over a list of all the insured depositors (with their dues) to the DICGC within three months of taking charge.

- The DICGC is supposed to pay these dues within two months of receiving this list.

- In FY19, it took an average 1,425 days for the DICGC to receive and settle the first claims on a de-registered bank.

-Source: The Hindu

Report on rights abuse in J&K and Kashmir militancy

Context:

In their latest report, former Supreme Court (SC) judge and former Kashmir interlocutor, who head the Forum for Human Rights in J&K, have warned that “human rights abuses will continue unchecked till J&K remains under a Lieutenant-Governor administration and without an elected government”.

Relevance:

GS-II: Polity and Constitution (Centre-State relations), GS-II: Governance (Government Policies & Interventions)

Dimensions of the Article:

- About the latest report of the Forum for Human Rights in J&K

- About Kashmir militancy as J&K passes 2 years as UT

- Jammu & Kashmir Reorganisation Act, 2019

About the latest report of the Forum for Human Rights in J&K

- Most of the rights violations, including arbitrary detentions, prohibition on assembly, remain valid still – even as Jammu and Kashmir completes two years as a Union Territory (UT).

- Close to 1,000 people are still in prison, including minors and elected legislators.

- The report says that the J&K administration added a new vigilantism against government employees, whose social media content is now subject to police scrutiny for ‘anti-national activities’, potentially leading to dismissal. Eighteen government employees have already been dismissed

- The report also pointed out that the ceasefire agreement between Indian and Pakistani Directors-General of Military Operations (DGMOs) “restricted infiltration by armed groups and raised hopes that a wider peace process might follow”.

- Notably, the J&K High Court has shown renewed commitment to the rights to bail and fair and speedy trial, coupled with scrutiny of the possible misuse of draconian legislation, such as the Public Safety Act (PSA) and the Unlawful Activities Prevention Act (UAPA). Nevertheless, the J&K administration continues to oppose bail and stifle dissent on increasingly bizarre grounds.

- The report recommended release of all remaining political detainees and repeal of the PSA and other preventive detention legislation.

- The report called for involvement of local communities in facilitating the return of Kashmiri Pandits.

About Kashmir militancy as J&K passes 2 years as UT

- As Jammu and Kashmir completes two years as a Union Territory (UT), militancy remains a major challenge to the security apparatus amid growing fears that the Taliban takeover of Afghanistan is likely to flip the striking capabilities of the militant outfits, especially the Jaish-e-Muhammad (JeM) and the Harkat-ul-Mujahideen (HuM).

- Though more than 60% recruits hail from districts in south Kashmir, there is growing recruitment in capital Srinagar, where frequency of militant attacks saw a major spur in 2021, and in north Kashmir as well.

- In a sustained pressure maintained by the security agencies by launching multiple anti-militancy operations every day, at least 89 militants were killed in J&K so far, including the top brass of most of the militant outfits operating in the Valley.

- However, a fresh list of 10 local militants released by the J&K police again highlighted that local militants continue to command and control the outfits such as the Hizbul Mujahideen, the Lashkar-e-Taiba and the The Resistance Front (TRF) in the Valley.

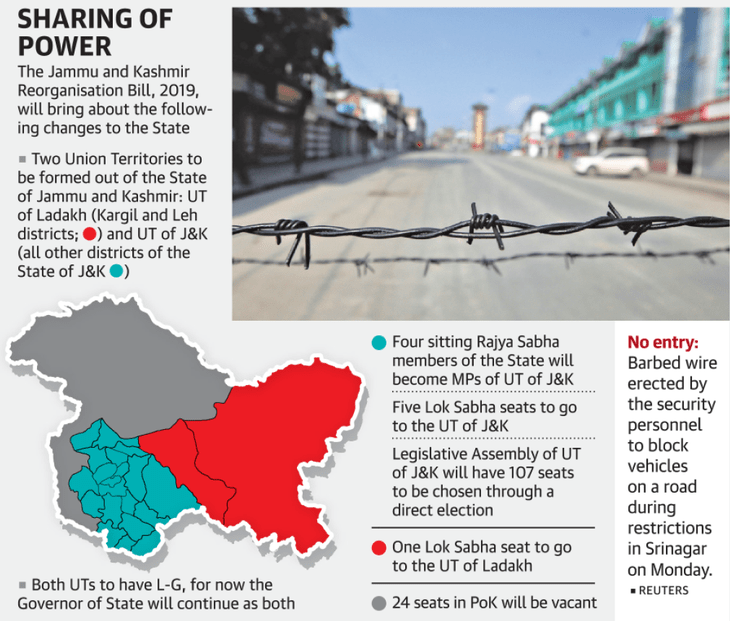

Jammu & Kashmir Reorganisation Act, 2019

- The Jammu and Kashmir Reorganisation Bill, 2019 was introduced in Rajya Sabha on August 5, 2019 by the Minister of Home Affairs, Mr. Amit Shah.

- The Bill provides for reorganisation of the state of Jammu and Kashmir into the Union Territory of Jammu and Kashmir and Union Territory of Ladakh.

- The Bill reorganises the state of Jammu and Kashmir into: (i) the Union Territory of Jammu and Kashmir with a legislature, and (ii) the Union Territory of Ladakh without a legislature.

- The Union Territory of Ladakh will comprise Kargil and Leh districts, and the Union Territory of Jammu and Kashmir will comprise the remaining territories of the existing state of Jammu and Kashmir.

- The Union Territory of Jammu and Kashmir will be administered by the President, through an administrator appointed by him known as the Lieutenant Governor.

- The Union Territory of Ladakh will be administered by the President, through a Lieutenant Governor appointed by him.

- The High Court of Jammu and Kashmir will be the common High Court for the Union Territories of Ladakh, and Jammu and Kashmir. Further, the Union Territory of Jammu and Kashmir will have an Advocate General to provide legal advice to the government of the Union Territory.

- The Legislative Council of the state of Jammu and Kashmir will be abolished. Upon dissolution, all Bills pending in the Council will lapse.

-Source: The Hindu

RTE entitlements to be paid through cash transfer

Context:

The Centre plans to pay students their Right to Education entitlements in the form of cash transfers, as part of a revamp and extension of its flagship Samagra Shiksha scheme that was approved by the Cabinet.

Relevance:

GS-II: Social Justice and Governance (Welfare Schemes, Government Policies and Interventions)

Dimensions of the Article:

- About Samagra Shiksha Scheme

- Features of the Samagra Shiksha Scheme

- About the recent Decisions taken regarding RTE entitlements

About Samagra Shiksha Scheme

- Samagra Shiksha is an integrated scheme for school education extending from pre-school to class XII to ensure inclusive and equitable quality education at all levels of school education.

- It subsumes the three Schemes of Sarva Shiksha Abhiyan (SSA), Rashtriya Madhyamik Shiksha Abhiyan (RMSA) and Teacher Education (TE).

- The main emphasis of the Scheme is on improving the quality of school education by focussing on the two T’s – Teacher and Technology.

- The Scheme is being implemented as a Centrally Sponsored Scheme by the Ministry of Education. The fund sharing pattern for the scheme between Centre and States is at present in the ratio of 90:10 for the North-Eastern States and the Himalayan States and 60:40 for all other States and Union Territories with Legislature. It is 100% centrally sponsored for Union Territories without Legislature.

- The vision of the Scheme is to ensure inclusive and equitable quality education from pre-school to senior secondary stage in accordance with the Sustainable Development Goal (SDG) for Education.

- SDG-4.1: Aims to ensure that all boys and girls complete free, equitable and quality primary and secondary education leading to relevant and effective learning outcomes. SDG 4.5: Aims to eliminate gender disparities in education and ensure equal access to all levels of education.

Features of the Samagra Shiksha Scheme

- Universalizing access to quality school education by expansion of schooling facilities in the uncovered areas through up-gradation of schools up-to senior secondary level

- Ensuring availability of adequate infrastructure to ensure that schools conform to the prescribed norms

- Annual Grant of Rs. 5,000 to Rs. 20,000/- per school for strengthening of Libraries

- Composite school grant of Rs. 25,000-1 Lakh to be allocated on the basis of school enrolment, out of which at-least 10% is to be spent on Swachhta Action Plan

- Annual Grant for sports equipments at the cost of Rs. 5000-25000 per school

- Allocation for children with Special Needs (CwSN) of Rs. 3,500 per child per annum including a stipend of Rs. 200 per month for CWSN girls to be provided from Classes I to XII

- Allocation for uniforms at the rate of Rs. 600 per child per annum at elementary level

- Allocation for textbooks at the rate of Rs. 250/400 per child per annum at elementary level

- Running and Upgradation of Kasturba Gandhi Balika Vidyalayas (KGBVs) from Class 6-8 to Class 6-12

- Strengthening Teacher Education Institutions like SCERTs and DIETs to improve the quality of teachers

- Enhanced use of digital technology in education through smart classrooms, digital boards and DTH channels

- Support States & UTs for implementation of provisions of RTE Act, including reimbursement under Section 12(1)(c) of the Act

- Setting up of residential schools and hostels for difficult areas and for children in difficult circumstances.

About the recent Decisions taken regarding RTE entitlements

- The Samagra Shiksha scheme, which has been extended till March 2026, will have a financial outlay of almost 3 lakh crore Rs. and several new initiatives on early childhood education, foundational literacy and numeracy and language education.

- The government has decided that in order to enhance the direct outreach of the scheme, all child-centric interventions will be provided directly to the students through (direct benefit transfer) DBT mode on an IT-based platform over a period of time.

- This DBT would include RTE entitlements such as textbooks, uniforms and transport allowance. However, it is not clear whether the tuition fees for students in the economically weaker section quota in private schools would also be paid directly to students as a cash transfer.

- The stipend for children with special needs will be paid in DBT [or direct benefit transfer] mode as well.

- Another new component is the NIPUN Bharat initiative for foundational literacy and numeracy, which will get an annual provision of ₹500 per child for learning materials, ₹150 per teacher for manuals and resources and ₹10-20 lakh per district for assessment.

- As part of digital initiatives, there is a provision for ICT labs and smart classrooms, including support for digital boards, virtual classrooms and DTH channels which have become more important in the wake of the COVID-19 pandemic.

- The pandemic is likely to cause more school dropouts as well, so it is important that Samagra Shiksha now includes a provision to support out of school children from age 16 to 19 with funding of ₹2000 per grade to complete their education via open schooling.

- In an Olympic year, the Samagra Shiksha scheme announced an incentive of up to ₹25000 for schools that have two medal-winning students at the Khelo India school games at the national level.

-Source: The Hindu

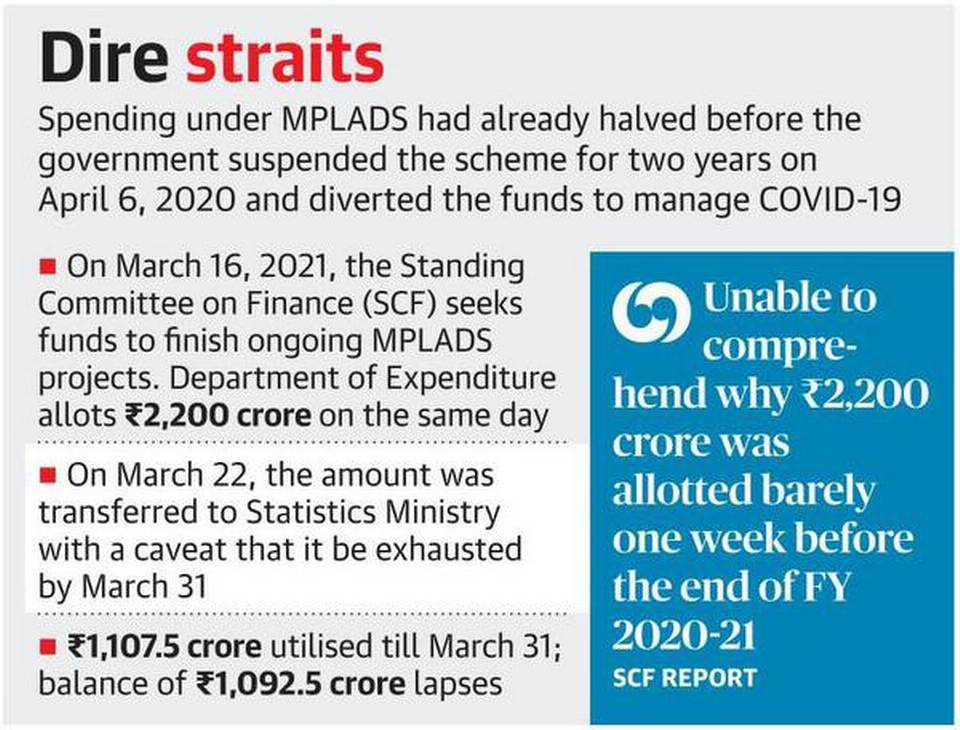

Funds allotted for ongoing MPLADS projects lapse

Context:

Virtually half of a belated Rs. 2,200 crore allotted for completing ongoing MPLADS projects in 2020-21 simply lapsed.

Relevance:

GS-II: Social Justice and Governance (Central Sector Schemes, Government Policies & Interventions)

Dimensions of the Article:

- Members of Parliament Local Area Development (MP-LAD)

- Features of MPLADS scheme

- Release of Funds under MPLADS

- About the recent issue regarding lapse of funds

Members of Parliament Local Area Development (MP-LAD)

- Members of Parliament Local Area Development Scheme (MPLADS) is an ongoing Central Sector Scheme which was launched in 1993-94.

- The Scheme enables the Members of Parliament to recommend works for creation of durable community assets based on locally felt needs to be taken up in their constituencies in the area of national priorities namely drinking water, education, public health, sanitation, roads etc.

- Nodal Ministry: The Ministry of Statistics and Programme Implementation has been responsible for the policy formulation, release of funds and prescribing monitoring mechanism for implementation of the Scheme.

Features of MPLADS scheme

The annual MPLADS fund entitlement per MP constituency is Rs. 5 crore.

- MPs are to recommend every year, works costing at least 15 per cent of the MPLADS entitlement for the year for areas inhabited by Scheduled Caste population and 7.5 per cent for areas inhabited by S.T. population.

- In order to encourage trusts and societies for the betterment of tribal people, a ceiling of Rs. 75 lakhs is stipulated for building assets by trusts and societies subject to conditions prescribed in the scheme guidelines.

- Lok Sabha Members can recommend works within their Constituencies and Elected Members of Rajya Sabha can recommend works within the State of Election (with select exceptions).

- Nominated Members of both the Rajya Sabha and Lok Sabha can recommend works anywhere in the country.

- All works to meet locally felt infrastructure and development needs, with an emphasis on creation of durable assets in the constituency are permissible under MPLADS as prescribed in the scheme guidelines.

- Expenditure on specified items of non-durable nature are also permitted as listed in the guidelines.

Release of Funds under MPLADS

- Funds are released in the form of grants in-aid directly to the district authorities.

- The funds released under the scheme are non-lapsable.

- The liability of funds not released in a particular year is carried forward to the subsequent years, subject to eligibility.

Execution of works:

- The MPs have a recommendatory role under the scheme. They recommend their choice of works to the concerned district authorities who implement these works by following the established procedures of the concerned state government.

- The district authority is empowered to examine the eligibility of works sanction funds and select the implementing agencies, prioritise works, supervise overall execution, and monitor the scheme at the ground level.

About the recent issue regarding lapse of funds

- The Finance Ministry granted “barely a week” to the Ministry of Statistics and Programme Implementation (MoSPI) to release the funds because of which Half of the Rs. 2,200 crore allotted for completing ongoing MPLADS projects in 2020-21 simply lapsed virtually – inviting the ire of the Standing Committee on Finance.

- The resultant funding crunch would have hit several local area development projects under implementation across the country, especially in the five States that went to polls this year as no funds were released for these States and constituencies citing the Model Code of Conduct.

- Spending under the Members of Parliament Local Area Development Scheme (MPLADS) had already halved before the government suspended the scheme for two years in April 2020 and diverted the funds for managing the COVID-19 pandemic.

- On March 2021, an SCF report on the Statistics Ministry’s demands for grants pointed out that many MPLADS projects that began earlier were “left unfinished midway despite the sanction letters being issued and funds for the same were withheld”, citing the suspension of the scheme.

- The Finance Ministry has also asked the Statistics Ministry to further tighten the scheme’s guidelines by September 2021, so that “if a work sanctioned by an MP is not used for five years, it will automatically lapse even if there is a committed liability for the work to be completed”. Currently, funds released to district authorities under MPLADS is not lapsable, while funds not released by the government in a particular year are carried forward.

-Source: The Hindu