Contents

- Government notifies new rules to clear retro tax mess

- Minister on licences for new sugar factories and ethanol

- Panel set up to implement Assam Accord

- ‘Pandora Papers’ expose offshore assets of heads of state

- Indian Astronomical Observatory (IAO) Hanle

- NGRI proposes landslip warning system

- A tiny plant that can ‘digest’ low density plastic sheets

Government notifies new rules to clear retro tax mess

Context:

Setting the stage for a closure of the retrospective tax disputes over indirect transfer of assets situated in India, the government notified new rules under the Income Tax Act for specifying the process to be followed by affected taxpayers to settle long-brewing disputes.

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, Fiscal Policy, Taxation), GS-II: Governance (Government Policies and Interventions)

Dimensions of the Article:

- What is retrospective taxation?

- Why the need for retrospective taxation?

- Provisions of the The Taxation Laws (Amendment) Act, 2021

- About the Income-Tax (31st Amendment) Rules, 2021

What is retrospective taxation?

- Retrospective taxation allows a country to pass a rule on taxing certain products, items or services and deals and charge companies from a time behind the date on which the law is passed.

- Countries use this route to correct any anomalies in their taxation policies that have, in the past, allowed companies to take advantage of such loopholes.

- Apart from India, many countries including the US, the UK, the Netherlands, Canada, Belgium, Australia and Italy have retrospectively taxed companies, which had taken the benefit of loopholes in the previous law.

What is the need for retrospective taxation?

- Under the IT Act, non-residents are required to pay tax on the income accruing through or arising from any business connection, property, asset, or source of income situated in India.

- The amendments made by the 2012 Act clarified that if a company is registered or incorporated outside India, its shares will be deemed to be or have always been situated in India if they derive their value substantially from the assets located in India. As a result, the persons who sold such shares of foreign companies before the enactment of the Act (i.e., May 28, 2012) also became liable to pay tax on the income earned from such sale.

- Cairn Energy’s case:

- The latest move to amend the law is being seen as a strategic rethink coming in response to the government having suffered reverses in its arbitration case against Cairn Energy and the latter securing an order to freeze Indian assets in Paris last month.

- The Arbitral tribunal, which had its seat in the Hague, has asked India to pay Cairn an award of $1,232.8 million plus interest and $22.38 million towards arbitration and legal costs.

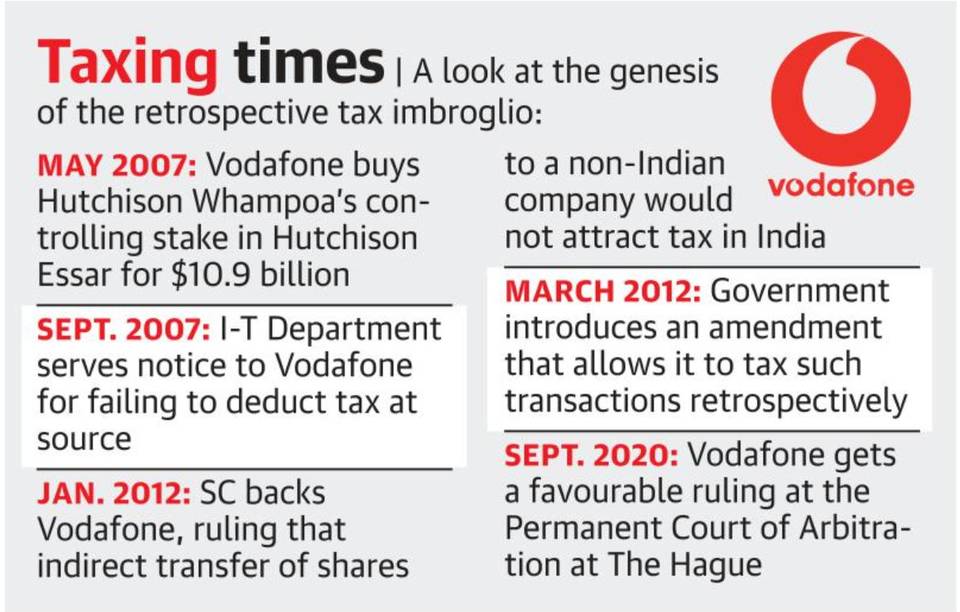

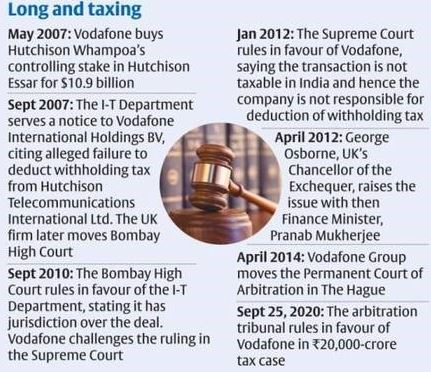

- Vodafone case In May 2007:

- Vodafone had bought a 67% stake in Hutchison Whampoa for $11 billion. This included the mobile telephony business and other assets of Hutchison in India.

- In September that year, the India government for the first time raised a demand of Rs 7,990 crore in capital gains and withholding tax from Vodafone, saying the company should have deducted the tax at source before making a payment to Hutchison.

- Vodafone challenged the demand notice in the Bombay High Court, which ruled in favour of the Income Tax Department. Subsequently, Vodafone challenged the High Court judgment in the Supreme Court, which in 2012 ruled that Vodafone Group’s interpretation of the Income Tax Act of 1961 was correct and that it did not have to pay any taxes for the stake purchase.

- The same year, the then Finance Minister, circumvented the Supreme Court’s ruling by proposing an amendment to the Finance Act, thereby giving the Income Tax Department the power to retrospectively tax such deals.

- Vodafone Group then invoked Clause 9 of the Bilateral Investment Treaty (BIT) signed between India and the Netherlands in 1995.

- In its ruling, the arbitration tribunal also said that now since it had been established that India had breached the terms of the agreement, it must now stop efforts to recover the said taxes from Vodafone.

Provisions of the The Taxation Laws (Amendment) Act, 2021

- The Act proposes to nullify this tax liability imposed on such persons provided they fulfil certain conditions. These conditions are:

- if the person has filed an appeal or petition in this regard, it must be withdrawn or the person must submit an undertaking to withdraw it

- if the person has initiated or given notice for any arbitration, conciliation, or mediation proceedings in this regard, the notices or claims under such proceedings must be withdrawn or the person must submit an undertaking to withdraw them

- the person must submit an undertaking to waive the right to seek or pursue any remedy or claim in this regard, which may otherwise be available under any law in force or any bilateral agreement.

- The Bill provides that if a concerned person fulfils the above conditions, all assessment or reassessment orders issued in relation to such tax liability will be deemed to have never been issued. Further, if a person becomes eligible for refund after fulfilling these conditions, the amount will be refunded to him, without any interest.

Issue related to amendment:

The Bill allows for the refund only of the principal amount in these cases, not the interest. However, considering that in some of these cases, the interest component is sizeable, will these companies avail the offer.

About the Income-Tax (31st Amendment) Rules, 2021

- Union Finance Minister had introduced the Taxation Laws (Amendment) Bill in the Lok Sabha to nullify the retrospective tax clauses that were introduced in 2012 and had issued DRAFT rules to resolve the pending tax disputes.

- Following this, the recently released Income-Tax (31st Amendment) Rules, 2021, introduce a new portion pertaining to ‘indirect transfer prior to May 28, 2012 of assets situated in India’.

- As per the conditions laid down under this new rule, firms disputing retrospective tax demands will have to:

- withdraw all legal proceedings including arbitration, mediation efforts and waive all rights to claim costs or attach Indian assets

- and also indemnify the government on costs and liabilities from any action pursued by other interested parties (including shareholders) in future.

- They would also have to give an undertaking that such initiatives will not be reopened.

-Source: The Hindu

Minister on Licences for new sugar factories and ethanol

Context:

Urging farmers in Maharashtra and other parts of the country to focus on producing ethanol from sugarcane juice instead of sugar, Union Minister of Road Transport and Highways said there was a pressing need to stop issuing fresh licenses to set up sugar factories in the State and elsewhere.

Relevance:

GS-III: Environment and Ecology (Conservation of Environment, Environmental Pollution & Degradation), GS-III: Agriculture (Agricultural Pricing and Marketing)

Dimensions of the Article:

- Sugar Industry in India

- Issues with the Sugarcane Industry

- Highlights of what the minister said about Sugar industry

- What is Ethanol fuel?

- Ethanol Blended Petrol Programme (EBP)

- Roadmap for Ethanol Blending in India by 2025

- Advantages of Ethanol Blending

Sugar Industry in India

- India is the world’s largest consumer of sugar.

- India is the world’s largest producer of sugarcane and second largest producer of sugar after Cuba.

- Some 50 million farmers and millions of more workers, are involved in sugarcane farming.

- Sugar industry is broadly distributed over two major areas of production- Uttar Pradesh, Bihar, Haryana and Punjab in the north and Maharashtra, Karnataka, Tamil Nadu and Andhra Pradesh in the south.

- The major sugar producing states are Maharashtra, Uttar Pradesh and Karnataka in India.

- Uttar Pradesh is the highest sugarcane producing State in the sub-tropical zone.

- South India has tropical climate which is suitable for higher sucrose content giving higher yield per unit area as compared to north India.

- Khatauli’s Triveni Sugar Mill is the largest in Asia in terms of scale of production and storage capacity.

Issues with the Sugarcane Industry

- Sugarcane has to compete with several other food and cash crops like cotton, oil seeds, rice, etc. This affects the supply of sugarcane to the mills and the production of sugar also varies from year to year causing fluctuations in prices leading to losses in times of excess production due to low prices.

- India’s yield per hectare is extremely low as compared to some of the major sugarcane producing countries of the world. For example, India’s yield is only 64.5 tonnes/hectare as compared to 90 tonnes in Java and 121 tonnes in Hawaii.

- Sugar production is a seasonal industry with a short crushing season varying normally from 4 to 7 months in a year. It causes financial loss and seasonal employment for workers and lack of full utilization of sugar mills.

- The average rate of recovery of sugar from sugarcane in India is less than ten per cent which is quite low as compared to other major sugar producing countries.

- High cost of sugarcane, inefficient technology, uneconomic process of production and heavy excise duty result in high cost of manufacturing.

Highlights of what the minister said about Sugar industry

- Sugar producing is a loss-making enterprise today. If the economic cycle goes in reverse gear, then farmers will not get any money for their produce, banks will crash and sugar factories will shut. Hence, the focus should be converting sugarcane juice to ethanol.

- The government is ready to buy ethanol, which is a green fuel. In this way, all petrol vehicles will run on ethanol in the future and the farmer, too, will be able to make money.

- If farmers converted to producing ethanol, then the imports would greatly reduce from the ₹12 lakh crore to an estimated ₹5 lakh crore.

- India had produced 310 lakh tonnes of sugar as against its requirement of only 240 lakh tonnes. – Producing 70 lakh tonnes in excess is not good as the scenario in the international market is no better (The price in Brazil was Rs. 22 per Kg compared to India that managed to keep the price at 31 Rs.)

- As the Central government has already given permission for ethanol pumps, all sugar factories in Maharashtra must start an ethanol pump in their premise.

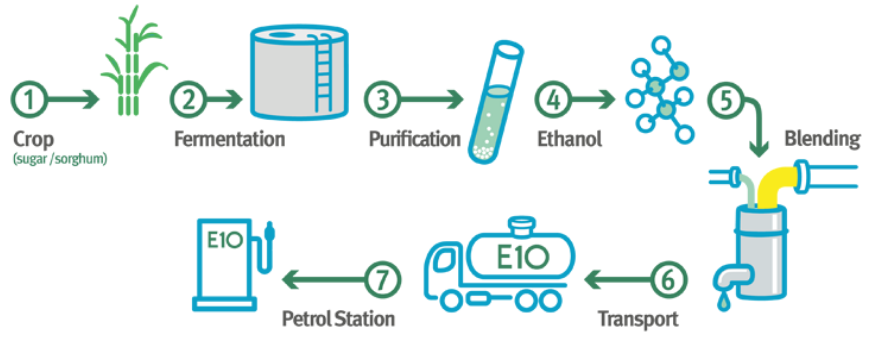

What is Ethanol fuel?

- Ethanol fuel is ethyl alcohol, the same type of alcohol found in alcoholic beverages, used as fuel.

- It is most often used as a motor fuel, mainly as a biofuel additive for gasoline.

- Ethanol is commonly made from biomass such as corn or sugarcane.

- Bioethanol is a form of renewable energy that can be produced from agricultural feedstocks.

- It can be made from very common crops such as hemp, sugarcane, potato, cassava and corn.

- There has been considerable debate about how useful bioethanol is in replacing gasoline.

- Concerns about its production and use relate to increased food prices due to the large amount of arable land required for crops, as well as the energy and pollution balance of the whole cycle of ethanol production, especially from corn.

Ethanol Blended Petrol Programme (EBP)

- Ethanol Blended Petrol (EBP) programme was launched in 2003- and this initiative is pursued aggressively in the last 4 to 5 years to reduce import dependence of crude oil as well as mitigate environmental pollution.

- The Ethanol Blending Programme (EBP) seeks to achieve blending of Ethanol with motor sprit with a view to reducing pollution, conserve foreign exchange and increase value addition in the sugar industry enabling them to clear cane price arrears of farmers.

- Although the Government of India decided to launch EBP programme in 2003 for supply of 5% ethanol blended Petrol, it later scaled up blending targets from 5% to 10% under the Ethanol Blending Programme (EBP).

- The Government of India has also advanced the target for 20% ethanol blending in petrol (also called E20) to 2025 from 2030.

- Currently, 8.5% of ethanol is blended with petrol in India.

Roadmap for Ethanol Blending in India by 2025

- The central government has released an expert committee report on the Roadmap for Ethanol Blending in India by 2025 that proposes a gradual rollout of ethanol-blended fuel to achieve E10 fuel supply by April 2022 and phased rollout of E20 from April 2023 to April 2025.

- The Ministry of Petroleum & Natural Gas (MoP&NG) had instituted an Expert Group to study the issues such as pricing of ethanol, matching pace of the automobile industry to manufacture vehicles with new engines with the supply of ethanol, pricing of such vehicles, fuel efficiency of different engines etc.

Advantages of Ethanol Blending

- Use of ethanol-blended petrol decreases emissions such as carbon monoxide (CO), hydrocarbons (HC) and nitrogen oxides (NOx).

- The unregulated carbonyl emissions, such as acetaldehyde emission were, however, higher with E10 and E20 compared to normal petrol. However, these emissions were relatively lower.

- Increased use of ethanol can help reduce the oil import bill. India’s net import cost stands at USD 551 billion in 2020-21. The E20 program can save the country USD 4 billion (Rs 30,000 crore) per annum.

- The oil companies procure ethanol from farmers that benefits the sugarcane farmers.

- Further, the government plans to encourage use of water-saving crops, such as maize, to produce ethanol, and production of ethanol from non-food feedstock.

-Source: The Hindu

Panel set up to implement Assam Accord

Context:

The Assam government set up an eight-member sub-committee to examine and prepare a framework for the implementation of all clauses of the Assam Accord of 1985.

Relevance:

GS-II: Polity and Governance (Government Policies and Interventions, Issues arising due to the design and implementation of policies), GS-II: Polity and Governance (Citizenship)

Dimensions of the Article:

- What is the Assam Accord?

- The key issue: Clause 6 of the accord

- Issues

- Bezbarauah committee:

What is the Assam Accord?

- The Assam Accord is a tripartite accord signed between the Government of India, State Government of Assam and the leaders of the Assam Movement in 1985.

- This accord led to the conclusion of a six-year agitation that was launched by the All Assam Students’ Union (AASU) in 1979, demanding the identification and deportation of illegal immigrants from Assam.

- The demand was for detection and deportation of migrants who had illegally entered Assam after 1951 – however, the accord sets a cut-off of midnight of 24th March 1971, for the detection of illegal foreigners in Assam.

The key issue: Clause 6 of the accord

- Clause 6 of the Assam Accord says that constitutional, legislative and administrative safeguards, as may be appropriate, shall be provided to protect, preserve and promote the cultural, social, linguistic identity and heritage of the Assamese people.

- The committee chaired by Biplab Kumar Sarma was constituted to define ‘Assamese People’ and institute safeguards for them.

- This committee’s report proposed January 1951 as the cut-off date for any Indian citizen residing in Assam to be defined as an Assamese for the purpose of implementing Clause 6. The report also sought reservation for Assamese in Parliament, state assembly, local bodies and quotas in government jobs.

- The report also recommended the regulation of entry of people from other states into Assam, which include the implementation of an Inner Line Permit (ILP) regime in the state.

- The report also talks about issues related to land and land rights, linguistic, cultural and social rights and protection of the state’s resources and biodiversity.

Issues

- According to the recommendations, people who migrated between 1951 and 1971, including large sections of post-Partition refugees, would be Indian citizens under the Assam Accord and the National Register of Citizens (NRC), but they would not be eligible for safeguards meant for “Assamese people” under Clause 6 of the Accord.

- East Bengal migrants who entered Assam before 1951 would be considered Assamese.

- There is no mechanism to prove that a person has been in Assam prior to 1951. The 1951 NRC is not available in several parts of the state and the current NRC being made uses 1971 as a cut-off.

Bezbarauah committee:

- The High-Level Committee (HLC) for implementation of Clause 6 of Assam Accord headed by M.P. Bezbarauah, IAS (Retd.), includes eminent Assamese persons from different fields. (The HLC will be serviced by the North-East Division of Union Ministry of Home Affairs.)

- The Mandates of the Committee are:

- To examine the effectiveness of actions taken since 1985 to implement Clause 6 of the Assam Accord.

- To assess the appropriate level of reservation of seats in Assam Legislative Assembly and local bodies for the Assamese people.

- To recommend the appropriate level of reservations in employment under the Government of Assam for the Assamese people.

- To suggest measures to protect cultural, social, linguistic identity and heritage of the Assamese people.

- The Committee will submit its report within 6 months from the date of notification.

-Source: The Hindu

‘Pandora Papers’ expose offshore assets of heads of state

Context:

More than a dozen heads of state and government, including the King of Jordan and the Czech Prime Minister, have hidden millions in offshore tax havens, according to the so-called “Pandora Papers” investigation published by the International Consortium of Investigative Journalists (ICIJ) media consortium.

Relevance:

GS-III: Internal Security Challenges (Money Laundering), GS-II: International Relations

Dimensions of the Article:

- About the ‘Pandora Papers’ Investigation

- What is a Tax Haven?

- Legislations in India: Fugitive Economic Offenders Act

- Prevention of Money Laundering Act (PMLA), 2002

- Extra information: British Virgin Islands (Top Tax Haven)

About the ‘Pandora Papers’ Investigation

- The “Pandora Papers” investigation — involving some 600 journalists from media is based on the leak of some 12 million documents from 14 financial services companies around the world.

- Some 35 current and former leaders are featured in the documents analyzed by the ICIJ – facing allegations ranging from corruption to money laundering and global tax avoidance.

- In total, the ICIJ found links between almost 1,000 companies in offshore havens and 336 high-level politicians and public officials, including country leaders, cabinet ministers, ambassadors and others.

- More than two-thirds of the companies were set up in the British Virgin Islands.

- The ICIJ stresses that in most countries it is NOT illegal to have assets offshore or to use shell companies to do business across national borders.

- The documents notably expose how King Abdullah II created a network of offshore companies and tax havens to amass a $100 million property empire from Malibu to London. Also, members of Pakistan Prime Minister Imran Khan’s inner circle, are said to secretly own companies and trusts holding millions of dollars.

What is a Tax Haven?

- A tax haven is a country that offers foreign businesses and individuals minimal or no tax liability for their bank deposits in a politically and economically stable environment. They have tax advantages for corporations and for the very wealthy, and obvious potential for misuse in illegal tax avoidance schemes.

- Characteristics of tax haven countries generally include no or low taxes, minimal reporting of information, lack of transparency obligations, lack of local presence requirements, and marketing of tax haven vehicles.

- Companies and wealthy individuals may use tax havens legally as a means of stashing money earned abroad while avoiding higher taxes in their home countries.

- Tax havens may also be used illegally to hide money from tax authorities at home.

- As of 2021, the worst countries helping offenders evade taxes are: the British Virgin Islands, the Cayman Islands, and Bermuda.

Legislations in India: Fugitive Economic Offenders Act

- The Fugitive Economic Offenders Act, 2018 seeks to confiscate properties of economic offenders who have left the country to avoid facing criminal prosecution or refuse to return to the country to face prosecution.

- A Fugitive Economic Offender (FEO) is a person against whom an arrest warrant has been issued for committing an offence listed in the Act and the value of the offence is at least Rs. 100 crore.

- Some of the offences listed in the act are:

- Counterfeiting government stamps or currency.

- Cheque dishonour.

- Money laundering.

- Transactions defrauding creditors.

Prevention of Money Laundering Act (PMLA), 2002

- According to the Prevention of Money Laundering Act (PMLA) 2002, Money laundering is concealing or disguising the identity of illegally obtained proceeds so that they appear to have originated from legitimate sources. It is frequently a component of other, much more serious, crimes such as drug trafficking, robbery or extortion.

- Money laundering is punishable with rigorous imprisonment for a minimum of 3 years and a maximum of 7 years and Fine under the PMLA.

- The Enforcement Directorate (ED) is responsible for investigating offences under the PMLA.

- The Financial Intelligence Unit – India (FIU-IND) is the national agency that receives, processes, analyses and disseminates information related to suspect financial transactions.

- After hearing the application, a special court (designated under the Prevention of Money Laundering Act PMLA, 2002) may declare an individual as a fugitive economic offender and also confiscate properties which are proceeds of crime, Benami properties and any other property, in India or abroad.

- The authorities under the PMLA, 2002 will exercise powers given to them under the Fugitive Economic Offenders Act. These powers will be similar to those of a civil court, including the search of persons in possession of records or proceeds of crime, the search of premises on the belief that a person is an FEO and seizure of documents.

Extra information: British Virgin Islands (Top Tax Haven)

- The British Virgin Islands (BVI) are a British Overseas Territory in the Caribbean, to the east of Puerto Rico and the U.S. Virgin Islands and north-west of Anguilla.

- The islands are geographically part of the Virgin Islands archipelago and are located in the Leeward Islands of the Lesser Antilles and part of the West Indies.

- About 16 of the more than 50 islands and cays in the British Virgin Islands are inhabited – The capital, Road Town, is on Tortola (population: 35 thousand+) the largest island.

- British Virgin Islanders are British Overseas Territories citizens and since 2002 are British citizens as well.

- The British Virgin Islands enjoys one of the more prosperous economies of the Caribbean region and is widely known to be a tax haven due to its opaque banking system.

-Source: The Hindu

Indian Astronomical Observatory (IAO) Hanle

Context:

The Indian Astronomical Observatory (IAO) located at Hanle near Leh in Ladakh is becoming one of the globally promising observatory sites, according to a recent study.

Relevance:

Prelims, GS-III: Science and Technology

Dimensions of the Article:

- About IAO at Hanle

- About Global Relay of Observatories Watching Transients Happen (GROWTH)

About IAO at Hanle

- India’s first robotic telescope set up as a part of the international GROWTH program, is located at the Indian Astronomical Observatory (IAO) at Hanle in Ladakh.

- The telescope is a joint project of the Bangalore-based Indian Institute of Astrophysics (IIA) and the Indian Institute of Technology Bombay (IITB).

- Called GROWTH-India, the facility at Hanle is part of a multi-country collaborative initiative known as Global Relay of Observatories Watching Transients Happen (GROWTH) to observe transient events in the universe.

- The telescope also has the badge of being housed in the one of the world’s highest astronomical observatories at 4,500 meters.

- It is becoming one of the globally promising observatory sites due to its advantages of more clear nights, minimal light pollution, background aerosol concentration, extremely dry atmospheric condition and uninterrupted monsoon.

- Night observations at IAO Hanle from 2m-Himalayan Chandra Telescope (HCT) are possible throughout the year without any interruption due to monsoon

About Global Relay of Observatories Watching Transients Happen (GROWTH)

- The GROWTH program is a 5-year project, funded by the National Science Foundation (NSF) (a United States government agency).

- It is an international collaborative network of astronomers and telescopes dedicated to the study of short-lived cosmic transients (energetic flashes of light from explosive deaths of massive stars, white dwarf detonations, etc.) and near-earth asteroids.

- The primary focus is on the:

- Search for explosions in the optical regime whenever Laser Interferometer Gravitational-wave Observatory (LIGO) group detects a Binary Neutron Star merger.

- Study of nearby young supernova explosions.

- Study of nearby asteroids.

-Source: The Hindu

NGRI proposes landslip warning system

Context:

The Council of Scientific And Industrial Research -National Geophysical Research Institute (CSIR-NGRI) has launched an ‘Environmental Seismology’ group to develop a ‘Landslide and Flood Early Warning System’ for the Himalayan region.

Relevance:

GS-III: Disaster and Management (Natural and Anthropogenic Disasters, Disaster Management in India), GS-I: Geography (Important Geophysical phenomena), GS-III: Science and Technology

Dimensions of the Article:

- What are Landslides?

- 2 Primary varieties of Landslides in India

- Why are Landslides more frequent in the Himalayas than in the Western Ghats?

- Geographical distribution of floods in India

- About Increased Flood risks in Bihar and Nepal (Himalayan) region

- NGRI’s Landslide and Flood Early Warning System

What are Landslides?

Landslides are physical mass movement of soil, rocks and debris down the mountain slope because of heavy rainfall, earthquake, gravity and other factors.

Why do Landslides Occur?

- Base of the huge mountains eroded by rivers or due to mining activities or erosion agents resulting in steep slopes.

- Increased industrialisation leading to climate change and weather disturbances.

- Change in river flow due to construction of dams, barriers, etc.

- Loose soil cover and sloping terrain.

2 Primary varieties of Landslides in India

I- Himalayas

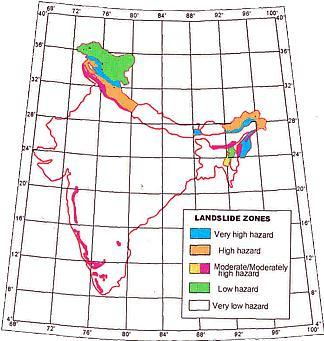

- India has the highest mountain chain on earth, the Himalayas, which are formed due to collision of Indian and Eurasian plate, the northward movement of the Indian plate towards China causes continuous stress on the rocks rendering them friable, weak and prone to landslides and earthquakes.

- The Northeastern region is badly affected by landslide problems causing recurring economic losses worth billions of rupees.

II- Western Ghats

- A different variety of landslides, characterized by a lateritic cap (Laterite is a soil and rock type rich in iron and aluminium , and is commonly considered to have formed in hot and wet tropical areas), pose constant threat to the Western Ghats in the South, along the steep slopes overlooking the Konkan coast besides Nilgiris, which is highly landslide prone.

The problem needs to be tackled for mitigation and management for which hazard zones have to be identified and specific slides to be stabilized and managed in addition to monitoring and early warning systems to be placed at selected sites.

Zone Map

Himalayas of Northwest and Northeast India and the Western Ghats are two regions of high vulnerability and are landslide prone.

Why are Landslides more frequent in the Himalayas than in the Western Ghats?

In the Himalayas, Landslides are very frequent because:

- Heavy snowfall in winter and melting in summer induces debris flow, which is carried in large quantity by numerous streams and rivers – which results in increases chances of Landslides.

- Himalayas are made of sedimentary rocks which can easily be eroded – hence, erosions contribute to more landslides.

- Drifting of Indian plate causes frequent earthquakes and resultant instability in the region.

- Man-made activities like grazing, construction and cultivation abet soil erosion and risks of landslides.

- Himalayas not yet reached its isostatic equilibrium which destabilizes the slopes causing landslides.

- Diurnal changes of temperature are much more in northern India than in southern slopes – weakening the rocks and increasing mass wasting and erosion.

In the Wester Ghats, Landslides are comparatively less frequent because:

- Western Ghats are eroded, denuded, aged, mature, worn out by exogenic forces and have a much lower height – hence, occurrence of Landslides is lesser.

- The Western Ghats are on more stable part of Indian plate, hence, there is a lesser occurrence of earthquakes and landslides.

- While steep slope on western side with high rainfall creates idea condition for landslide but gentle eastern slope with low rainfall and rivers in senile stage, counters the condition.

- Moving of Indian plates doesn’t affect the Western Ghats much (as they are old block mountains), hence the reduced number of landslides.

- Small & swift flowing streams of western side and big matured rivers on eastern side (like Krishna, Godavari, etc) cannot carry large amount of debris.

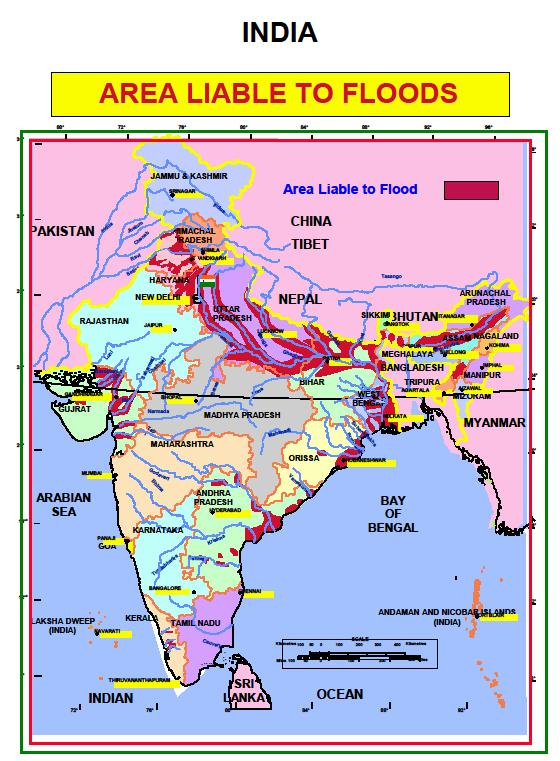

Geographical distribution of floods in India

- Rashtriya Barh Ayog (National Flood Commission) identified 40 million hectares of land as flood-prone in India.

- Historically, Bihar has been known to be India’s most flood-prone State. The Flood Management Improvement Support Centre (FMISC), Department of Water Resources, Government of Bihar estimates that 76% of the population in north Bihar faces the recurring threat of flood devastation.

- Assam, West Bengal and Bihar are among the high flood-prone states of India.

- Most of the rivers in the northern states like Punjab and Uttar Pradesh, are also vulnerable to occasional floods.

- States like Rajasthan, Gujarat, Haryana and Punjab are also getting inundated in recent decades due to flash floods. This is partly because of the pattern of the monsoon and partly because of blocking of most of the streams and river channels by human activities.

- Sometimes, Tamil Nadu experiences flooding during November – January due to the retreating monsoon.

About Increased Flood risks in Bihar and Nepal (Himalayan) region

- A large part of north Bihar, adjoining Nepal, is drained by a number of rivers that have their catchments in the steep and geologically nascent Himalayas.

- Originating in Nepal, the high discharge and sediment load in the Kosi, Gandak, Burhi Gandak, Bagmati, Kamla Balan, Mahananda and Adhwara Group wreak havoc in the plains of Nepal’s Tarai and Bihar. About 65% of the catchment area of these rivers falls in Nepal/Tibet and only 35% of the catchment area lies in Bihar.

- A study indicated that the plains of North Bihar have recorded the highest number of floods during the last 30-years. In the years 1978, 1987, 1998, 2004 and 2007, Bihar witnessed high magnitudes of flood.

- Flood of 2004 demonstrates the severity of the flood problem when a vast area of almost 24 thousand Sq Km was badly affected by the floods of Bagmati, Kamla & Adhwara groups of rivers causing loss of about 800 human lives, even when Ganga, the master drain was flowing low.

NGRI’s Landslide and Flood Early Warning System

- CSIR-National Geophysical Research Institute (NGRI) has launched an ‘Environmental Seismology’ group to develop a ‘Landslide and Flood Early Warning System’ for the Himalayan region based on real-time monitoring with dense seismological networks, coupled with satellite data, numerical modelling and geomorphic analysis.

- This warning system would enable a crucial warning several hours prior, which will save precious human lives and property in future during such events.

- The need for such an early warning system was necessitated following February 2021’s rockslide flood disaster in Chamoli (Uttarakhand), where a steep glacier on the Nandadevi peak in Garhwal Himalaya got detached, causing a major avalanche and inducing flash floods in the Rishi Ganga and Alaknanda rivers.

- Teleseismic signals from the beginning of this event were recorded at different stations on a regional seismic network up to 100 km from the disaster and demonstrated the potential for these far-away monitoring stations to be useful for early warning according to the research study.

- While a seismic network designed for earthquake detection may not be ideal for the monitoring of geomorphic events, an evaluation of the expected anthropogenic (man-made) and environmental noise levels should be carried out before locating stations for geomorphic event detection.

-Source: The Hindu

A tiny plant that can ‘digest’ low density plastic sheets

Context:

Researchers from University of Madras and Presidency College, Chennai, have isolated an alga species that shows promise as an agent of biodegradation of plastic sheets.

Relevance:

Prelims, GS-III: Environment and Ecology (Environmental Pollution and Degradation), GS-III: Science and Technology

Dimensions of the Article:

- About Plastic pollution in India

- About the discovered alga species that can digest plastic

About Plastic pollution in India

- India generates 9.46 million tonnes of plastic waste annually (according to a study by Un-Plastic Collective (UPC)) of which 40% plastic waste goes uncollected (as per the environment ministry).

- [A Central Pollution Control Board (CPCB) report (2018-19) puts the total annual plastic waste generation in India at only 3.3 million metric tonnes per year, which is still humongous.]

- Hence, only 60% of the plastic used in India is collected and recycled and a large proportion of Plastic waste is continuing to accumulate and leading to adverse environmental impacts.

- 43% of the plastic products produced are used for packaging, with a majority of them being single-use – hence, they end up being discarded and accumulated as waste very easily.

- The usual means of disposal of plastic waste involves incineration, land-filling and recycling. These methods have limitations and also sometimes produce side-effects that are hazardous to the environment. Hence there has been growing emphasis on biodegradation methods that are safe and environment friendly.

- Plastic is a huge problem as it is so cheap and convenient that it has replaced all other materials from the packaging industry leading to production at unprecedented levels – but it takes hundreds of years to disintegrate.

About the discovered alga species that can digest plastic

- The alga identified is microalga Uronema africanum Borge which is a species of microalgae that is commonly found in Africa, Asia and Europe.

- The microalga was found to produce enzymes, hormones, toxins such as cyanotoxins and some polysaccharides which were able to slowly degrade polyethylene into monomers which will not have harmful effect in the atmosphere.

- The researchers are planning to collaborate with industry to take up this technology in to a pilot scale and finally large-scale study.

- The development gains significance given that the identified algae could be used as an agent of biodegradation of plastic sheets (Low-density polyethylene is highly resistant to degradation) and thus it offers a solution to Plastic pollution in India.

-Source: The Hindu