Contents

- Norms for ‘faceless’ appeal scheme eased: Income-Tax dept.

- A Year of important Reforms for Ministry of Textiles -2021

- Arunachal Apatani textile: GI Tag sought

- Centre notifies Consumer Protection (Direct Selling) Rules, 2021

- Defence Ministry notifies positive indigenisation list of subsystems

Norms for ‘faceless’ appeal scheme eased: Income-Tax dept.

Context:

The Income Tax department has brought in changes to the existing faceless appeal scheme, easing the process for taxpayers wanting a personal hearing through video conference while appealing against a tax demand by the department.

Relevance:

GS-II: Governance (E-Governance, Government Policies & Interventions), GS-III: Indian Economy (Economic Development, Taxation)

Dimensions of the Article:

- About the easing of norms for ‘faceless’ appeal scheme

- Transparent Taxation – Honouring the Honest (T2-H2)

- Faceless Tax Assessment

- Criticism of Faceless Tax Assessment and Appeal System

- E-Assessment v/s Faceless Assessment

- About Central Board of Direct Taxes (CBDT)

About the easing of norms for ‘faceless’ appeal scheme

- The Central Board of Direct Taxes (CBDT) notified the ‘Faceless Appeal Scheme, 2021’ and said that the Commissioner (Appeals) shall allow the request for personal hearing via video conference and communicate the date and time of hearing to the appellant via the National Faceless Appeal Centre.

- However, a person would not be permitted to appear before the Income-Tax authority either personally or through an authorised representative in connection with any proceedings under this scheme.

- Under the previous ‘Faceless Appeal Scheme, 2020, a taxpayer’s request for a personal hearing for making oral submissions, required the approval of the Chief Commissioner or the Director General of I-T.

Transparent Taxation – Honouring the Honest (T2-H2)

- The Transparent Taxation – Honouring the Honest [T2-H2] is an extension of E-assessment scheme 2019 launched by Government of India.

- The new platform will be having Faceless Assessments, Faceless Appeal and Taxpayer Charter.

- Government has acknowledged that the country can move forward and can develop when the life of honest taxpayer is made easy and the launch of Taxpayer’s Charter is to ensure fair, courteous, and rational behaviour to the honest taxpayers.

- The issue of tax harassment by officers has gained a lot of attention in India and the government introduced faceless income tax assessment to reduce the scope for corruption and overreach by officials.

- The CBDT has given a framework and put in place a system in the form of this platform using technology such as data analytics and AI, a transparent efficient and accountable tax system.

Faceless Tax Assessment

- The Faceless Assessment aims to eliminate human interface between the taxpayer and the income tax department and the selection of a taxpayer is possible through systems using analytics and Artificial Intelligence.

- Faceless assessment is administered through separate units within the tax department each of which has a specific and important role in the process, viz assessment units, verification units, technical units and review units. All these units work closely with the National e-assessment Centre (NeAC) and Regional e-assessment Centre (ReAC).

- The scheme brings greater flexibility for taxpayers and professionals representing before tax authorities. It has resulted in substantial time savings on account of travel to the tax office, waiting time over there, etc.

Faceless Appeal System

Under the Faceless Appeal system, appeals will be randomly allotted to any officer in the country. The identity of the officer deciding the appeal will remain unknown.

Dispute Resolution Committee:

- In Budget 2021, the Minister of Finance has proposed the formation of a Dispute Resolution Committee (DRC) in order to provide quicker relief to taxpayers in tax disputes.

- The DRC will cater to small taxpayers having a taxable income of up to Rs. 50 lakh and a disputed income of up to Rs. 10 lakh.

Criticism of Faceless Tax Assessment and Appeal System

- In a joint letter sent to the Central Board of Direct Taxes (CBDT) in 2021, representatives of the Income Tax Employees Federation and the Income Tax Gazetted Officers’ Association voiced their displeasure.

- Concerns were raised but tax officials that faceless tax assessment may reduce tax collection and raise pressure on officers that are under stress to meet lofty tax targets for the current fiscal year.

E-Assessment v/s Faceless Assessment

- In E-assessment the assessee will be aware of the assessing officer who will be carrying out the assessment proceedings.

- In Faceless Assessment, the assessee will not be aware of assessing officer who will be doing his tax assessment.

- The e-assessment was more of one assessing officer carrying out the assessment whereas in faceless assessment there will be a team of assessing officers who will be carrying out the assessment.

About Central Board of Direct Taxes (CBDT)

- The Central Board of Direct Taxes (CBDT) is a Statutory Body functioning under the Central Board of Revenue Act, 1963.

- It is official Financial action task force unit.

- CBDT is a part of the Department of Revenue in the Ministry of Finance, Government of India.

Composition of CBDT

The CBDT Chairman and Members of CBDT are selected from Indian Revenue Service (IRS), a premier civil service of India, whose members constitute the top management of Income Tax Department.

The Central Board of Direct Taxes consists of a Chairman, and six members that deal with the following:

- Income Tax & Revenue

- Administration

- Legislation & Computerization

- Audit and Judicial

- Investigation

- Transaction Processing System (TPS) & System

Functions of CBDT:

- CBDT is responsible for administration of the direct tax laws through Income Tax Department.

- The officials of the Board in their ex-officio capacity also function as a Division of the Ministry dealing with matters relating to levy and collection of direct taxes.

- CBDT provides essential inputs for policy and planning of direct taxes in India as well.

- It deals with matters related to levying and collecting Direct Taxes.

- Formulation of various policies.

- Supervision of the entire Income Tax Department

- Suggests legislative changes in Direct Tax Enactments

- Suggests changes in tax rates

- Proposes changes in the taxation structure in line with the Government policies.

-Source: The Hindu

A Year of important Reforms for Ministry of Textiles -2021

Context:

2021 was a year of game changing reforms for the Ministry of Textiles as the Government approved Setting up of 7 Pradhan Mantri Mega Integrated Textile Region and Apparel (MITRA) Parks, announced Production Linked Incentive (PLI) Scheme for Textiles and more in the year 2021.

Relevance:

GS-III: Industry and Infrastructure (Textile Industry, Government Policies and Initiatives, Industrial Policy)

Dimensions of the Article:

- Significance of Textile Sector in India

- About PM Mega Investment Textiles Parks (PM MITRA) scheme

- About the PLI Scheme for textiles sectors

- Rebate of State and Central Taxes and Levies (RoSCTL)

- Amended Technology Upgradation Fund Scheme (ATUFS)

- Samarth Scheme for Textile Sector

- Technical Textiles

- Silk Samagra

- Jute-ICARE

- Integrated Wool Development Programme (IWDP)

- North-East Region Textile Promotion Scheme (NERTPS)

- PowerTex India

- Scheme for Integrated Textile Parks (SITP)

Significance of Textile Sector in India

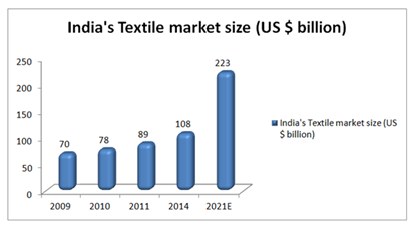

- The Textile Sector accounts for 7% of India’s manufacturing output, 2% of GDP, 12% of exports and employs directly and indirectly about 10 crore people.

- Owing to the abundant supply of raw material and labour, India is the largest producer of cotton (accounting for 25% of the global output) and second-largest producer of textiles and garments and man-made fibres (polyester and viscose).

- India has the unique advantage of the entire value chain for textile production present within the country vis-à-vis other competing nations which have to import fibre, yarn and fabric to meet their requirement for garment production.

- With direct and indirect employment of close to 105 million people, this industry is the second largest employment generator in the country, next only to agriculture.

- More significantly, women constitute 70% of the workforce in garment manufacturing and about 73% in Handloom.

- The domestic textile and apparel production is approx US$ 140 Bn including US$ 40 Bn of Textiles and Apparel export.

- Availability of almost all types of raw materials, existence of total value chain, young demography of India, entrepreneurial mindset of industry leaders, continuous support of Government, technology up gradation, focus on innovation and strong presence of support industries contribute to helping this sector grow at a healthy pace.

About PM Mega Investment Textiles Parks (PM MITRA) scheme

- The PM Mega Investment Textiles Parks (PM MITRA) scheme was launched in 2020 with a plan to establish Seven textile parks which will have a world-class infrastructure over three years.

- These parks will also have plug-and-play facilities (business facilities will be available ready-made) to help create global champions in exports in the textile sector.

Aims and Significance of MITRA

- The Mega Investment Textiles Parks (MITRA) Scheme aims to enable the textile industry to become globally competitive and boost exports.

- The scheme also aims to boost employment generation within the textile sector and also attract large investment.

- The scheme was launched in addition to the Production Linked Incentive (PLI) Scheme.

- The scheme will create a level-playing field for domestic manufacturers in the international textiles market.

- It will also pave the way for India to become a global champion of textiles exports across all segments.

- MITRA will lead to increased investments and enhanced employment opportunities with the support from the Production Linked Incentive (PLI) scheme.

About the PLI Scheme for textiles sectors

- Production Linked Incentive (PLI) Scheme for Textiles is specially focused at high value and expanding MMF and Technical Textiles segments of Textiles Value Chain. Incentives worth Rs. 10,683crore will be provided over five years for manufacturing notified products of MMF Apparel, MMF Fabrics and segments/products of Technical Textiles in India.

Expected Benefits

- The scheme could aid in the creation of 7.5 lakh direct jobs. The textile sector is an employment intensive sector and the investment in the textile sector would have a multiplier effect on the Indian economy especially in job creation.

- Two-thirds of India’s textile exports now are cotton-based whereas 66-70% of world trade in textiles and apparel is MMF-based and technical textiles. The PLI incentives aim to boost investment in new capacities in man-made fibre (MMF) apparel, MMF fabrics, and 10 segments or products of technical textiles.

- India’s focus on the manufacture of textiles in the MMF sector is expected to help boost its ability to compete globally in the textiles market.

- Given that priority would be given for investment in aspirational districts, tier-three, tier-four towns and rural areas, the new scheme would promote balanced regional development.

- The textiles industry predominantly employs women, therefore, the scheme will empower women and increase their participation in the formal economy.

- In addition, priority will be given for investment in Aspirational Districts, Tier 3, Tier 4 towns, and rural areas and due to this priority, Industry will be incentivized to move to backward areas. This scheme will positively impact especially States like Gujarat, UP, Maharashtra, Tamil Nadu, Punjab, AP, Telangana, Odisha etc.

Rebate of State and Central Taxes and Levies (RoSCTL)

- RoSCTL was offered for embedded state and central duties and taxes that are not refunded through Goods and Services Tax (GST).

- It was introduced by the Ministry of Textiles and was available only for garments and made ups.

Amended Technology Upgradation Fund Scheme (ATUFS)

- The Technology Upgradation Fund Scheme was introduced by the Government in 1999 to facilitate new and appropriate technology for making the textile industry globally competitive and to reduce the capital cost for the textile industry.

- In 2015, the government approved “Amended Technology Upgradation Fund Scheme (ATUFS)” for technology upgradation of the textiles industry.

Samarth Scheme for Textile Sector

Samarth Scheme, also known as Scheme for Capacity Building in the Textile Sector (SCBTS) was launched in order to ensure steady supply of skilled manpower in the labour-intensive textile sector.

The objectives of Samarth Scheme for textile sector are:

- Provide demand driven, placement oriented National Skills Qualifications Framework (NSQF) compliant skilling programmes to create jobs in the organized textile and related sectors, covering the entire value chain of textile, excluding Spinning and Weaving.

- Promote skilling and skill upgradation in the traditional sectors of handlooms, handicrafts, sericulture and jute.

- Enable provision of sustainable livelihood either by wage or self-employment.

Technical Textiles

- The Technical Textiles segment is a new age textile, whose application in several sector of economy, including infrastructure, water, health and hygiene, defense, security, automobiles, aviation will improve the efficiencies in those sectors of economy.

- Government has also launched a National Technical Textiles Mission for promoting R&D efforts in that sector.

Silk Samagra

- The central sector scheme “Silk Samagra” provides R & D/ Seed support, technical and financial assistance for enhancing the quality and production of silk.

- The main focus of the scheme is to make India Atma nirbhar in production of international grade bivoltine silk and scale up the Automatic Reeling Machine. Brand “Indian Silk” is promoted through Product Development & Diversification to address the global market need.

- India’s traditional and culture bound domestic market and an amazing diversity of silk garments help the country to achieve a leading position in silk industry. India is the second largest producer of silk next to China and contributes about 32% of global silk production.

Jute-ICARE

- Jute-ICARE (Improved Cultivation and Advanced Retting Exercise) scheme has been implemented for improvement of quality and yield of raw jute production. Jute Raw Material Bank (JRMB) Scheme is for supplying jute raw materials at Mill Gate Price to MSME JDP units for production of jute diversified products,

Integrated Wool Development Programme (IWDP)

- Ministry of Textiles has approved rationalization and continuance of Integrated Wool Development Programme (IWDP) from 2021-22 to 2025-26 with total financial allocation of Rs. 126 Crore. ‘Wool Processing Scheme’ is for promotion of woolen industry.

North-East Region Textile Promotion Scheme (NERTPS)

- The NERTPS scheme was launched by the Union Textile Ministry. Under this intervention, each state now has one centre with three units having approximately 100 machines each.

- The broad objective of the North East Textile Promotion Scheme is to develop and modernise the textile sector in the North East Region by providing the required Government support in terms of raw material, seed banks, machinery, common facility centres, skill development, design and marketing support etc.

- The specific objectives of the scheme include increase in the value of textile production, technology upgradation, improvement in design capability, diversification of product lines and value addition, better access to domestic and export markets, clusterisation and improvement in labour productivity, market access & market promotion.

PowerTex India

- PowerTex India was launched by the Ministry of textiles as a comprehensive scheme for power loom sector development.

- PowerTex India scheme comprises new research and development in power loom textiles, new markets, branding, subsidies and welfare schemes for the workers.

- Under Pradhan Mantri Credit Scheme (PMCS) for powerloom weavers’ financial assistance, including margin money subsidy and interest reimbursement, will be given as against the credit facility under Pradhan Mantri Mudra Yojana to the decentralised power loom units.

- Under Solar energy scheme (SEC) for powerlooms financial subsidy for the installation of the Solar Photo Voltaic Plants will be provided to alleviate the problems of power cuts.

Scheme for Integrated Textile Parks (SITP)

- Scheme for Integrated Textile Parks (SITP) was launched in 2005 to provide the industry with world-class state of the art infrastructure facilities for setting up their textile units and to attract foreign investors to the domestic textile sector.

- Under the SITP, infrastructure facilities for setting up of textile units are developed in a Public-Private-Partnership (PPP) model.

- The Government of India grants upto 40% of the project cost, however, it grants upto 90% of the project cost for the first two projects (each) in the North Eastern States, Himachal Pradesh, Uttarakhand and Union Territory of Jammu & Kashmir and Union Territory of Ladakh.

-Source: PIB

Arunachal Apatani textile: GI Tag sought

Context:

An application seeking Geographical Indication (GI) tag for the Arunachal Pradesh Apatani textile product has been filed by a firm.

Relevance:

Prelims, GS-I: Art and Culture, GS-III: Intellectual Property Rights

Dimensions of the Article:

- Apatani Textile

- Geographical indication in textile industry

- GI Tag

- Geographical Indications Registry (GIR)

Apatani Textile

- The Apatani weave comes from the Apatani tribe of Arunachal Pradesh living at Ziro, the headquarters of lower Subansiri district.

- Aaptani are a tribal group of people living in the Ziro valley in Arunachal Pradesh. They speak a local language called Tani and worship the sun and the moon.

- The Apatani community weaves its own textiles for various occasions, including rituals and cultural festivals and only women folk are engaged in weaving.

- The woven fabric of this tribe is known for its geometric and zigzag patterns and also for its angular designs.

- The tribe predominantly weaves shawls known as jig-jiro and jilan or jackets called supuntarii.

- The people here use different leaves and plant resources for organic dying the cotton yarns in their traditional ways.

Geographical indication in textile industry

- GI proved to be a significant aspect when it comes to the Indian textile industry. With the changing economic structure of the world, the textile industry has also been affected and came into the limelight.

- Continuous evolving and expansion of business across the globe has made it necessary for the textile market/industry to protect its indigenous identity & to safeguard from infringers and/or false users taking advantage of the local and ancient weavers who have been working in maintaining the heritage and rich culture of Indian textile and handloom crafts.

- Being an important sector to flourish the Indian economy, the Textile and handloom industry needs significant protection both in domestic and international markets.

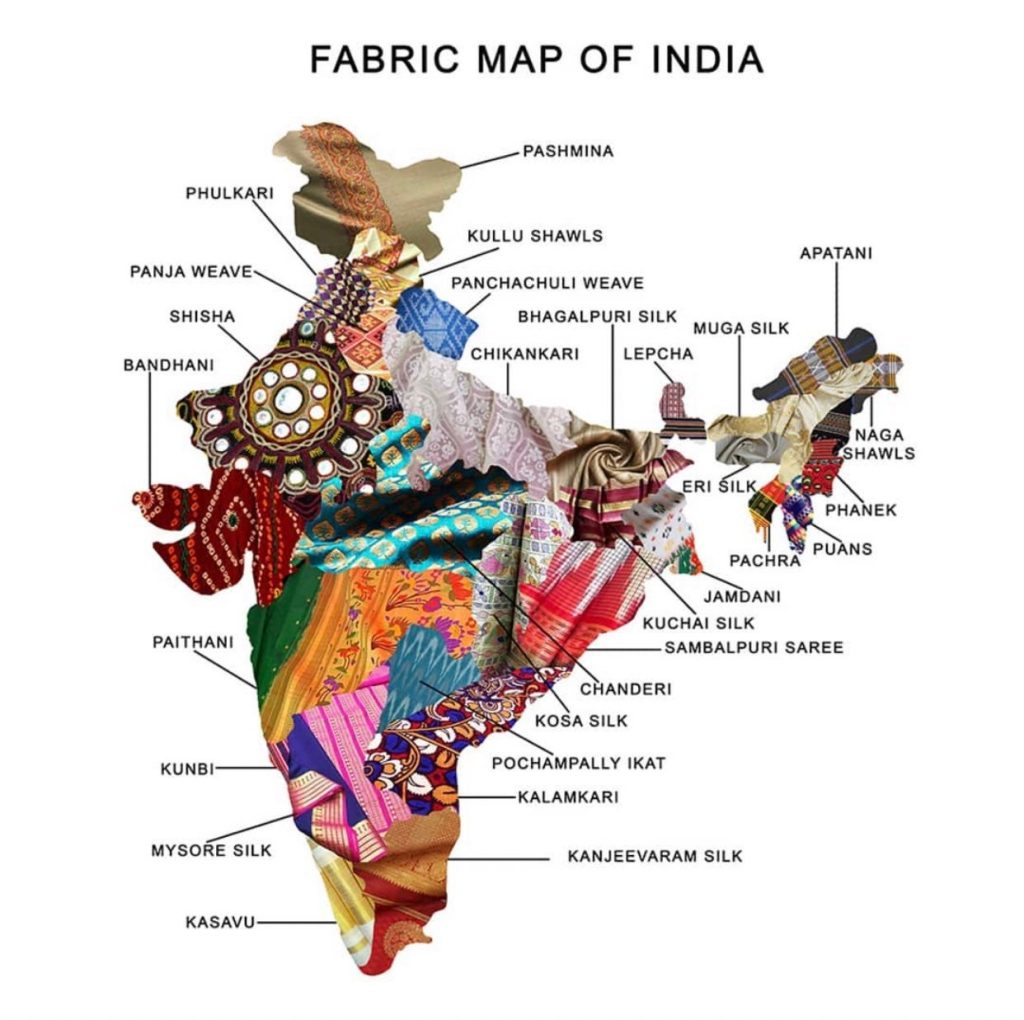

- Some of the examples of textile GI in India are Pochampalli saree from Andhra Pradesh, Mysore Silk from Karnataka, Muga Silk from Assam, Kanjeevaram Sarees from Tamil Nadu, Paithani Saree & Fabrics from Maharashtra, Orissa Ikat from Odisha, Chanderi Sari from Madhya Pradesh, Bhagalpur Silk from Bihar, Banarasi Sarees & Brocades from Uttar Pradesh, Phulkari from Punjab, Kullu Shawl from Himachal Pradesh, Kashmir Pashmina from Jammu & Kashmir.

- Arani Silk, Kovai Cora Cotton, Salem Silk from Tamil Nadu, Molakalmuru Saree, Navalgund Durries from Karnataka, Nakshi Kantha, Solapur Terry Towel & Chaddar from Maharashtra are some of the latest GIs in the textile industry.

GI Tag

- A geographical indication (GI) is a name or sign used on certain products which corresponds to a specific geographical location or origin (e.g., a town, region, or country).

- India, as a member of the World Trade Organization (WTO), enacted the Geographical Indications of Goods (Registration and Protection) Act, 1999 has come into force with effect from 15 September 2003.

- GIs have been defined under Article 22 (1) of the WTO Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) Agreement as: “Indications which identify a good as originating in the territory of a member, or a region or a locality in that territory, where a given quality, reputation or characteristic of the good is essentially attributable to its geographic origin.”

- The GI tag ensures that none other than those registered as authorised users (or at least those residing inside the geographic territory) are allowed to use the popular product name.

- Darjeeling tea became the first GI tagged product in India, in 2004–2005.

- GI protection systems restrict the use of the GIs for the purpose of identifying a particular type of product, unless the product and/or its constituent materials and/or its fabrication method originate from a particular area and/or meet certain standards.

- Sometimes these laws also stipulate that the product must meet certain quality tests that are administered by an association that owns the exclusive right to license or allow the use of the indication.

Geographical Indications Registry (GIR)

- As per the Geographical Indication of Goods (Registration and Protection) Act, 1999, association of persons or producers can apply for GIs for specific products supported by required documents.

- The Controller General of Patents, Designs & Trade Marks (CGPDT), (under the Dept. of Industrial Policy and Promotion of Ministry of Commerce and Industry) is the ‘Registrar of Geographical indications’.

- The CGPDT directs and supervises the functioning of the Geographical Indications Registry (GIR).

-Source: The Hindu

Centre notifies Consumer Protection (Direct Selling) Rules, 2021

Context:

Central Government in exercise of the powers by the Consumer Protection Act, 2019 has notified the Consumer Protection (Direct Selling) Rules, 2021.

Relevance:

GS-III: Indian Economy, GS-II: Governance (Government Policies and Initiatives)

Dimensions of the Article:

- About the Consumer Protection (Direct Selling) Rules, 2021

- What is Electronic Commerce (e-commerce)?

- E-commerce in India

About the Consumer Protection (Direct Selling) Rules, 2021

- These Rules apply to all goods and services bought or sold through direct selling, all models of direct selling, all direct selling entities offering goods and services to consumers in India, all forms of unfair trade practices across all models of direct selling and also to also to a direct selling entity which is not established in India, but offers goods or services to consumers in India.

- The rules lay down duties and obligations of both direct selling entities and their direct sellers to “safeguard the interest of consumers’’.

- It directed State governments to set up a mechanism to monitor or supervise the activities of direct sellers and direct selling entities.

- However, the direct sellers as well as the direct selling entities using e-commerce platforms for sale shall comply with the requirements of the Consumer Protection (e-Commerce) Rules, 2020.

- Direct selling companies will need to establish an adequate grievance redressal mechanism.

- Direct selling companies or their direct sellers cannot persuade consumers to make a purchase based upon the representation that they can reduce or recover the price by referring prospective customers to the direct sellers for similar purchases.

- These new rules bring clarity in the marketplace and would give impetus to the direct selling industry, which is already providing livelihood to over 70 lakh Indians, in which more than 50% are women.

What is Electronic Commerce (e-commerce)?

- Electronic commerce or e-commerce (sometimes written as eCommerce) is a business model that lets firms and individuals buy and sell things over the internet.

- E-commerce, which can be conducted over computers, tablets, or smartphones may be thought of like a digital version of mail-order catalog shopping.

- Nearly every imaginable product and service is available through e-commerce transactions, including books, music, plane tickets, and financial services such as stock investing and online banking.

E-commerce in India

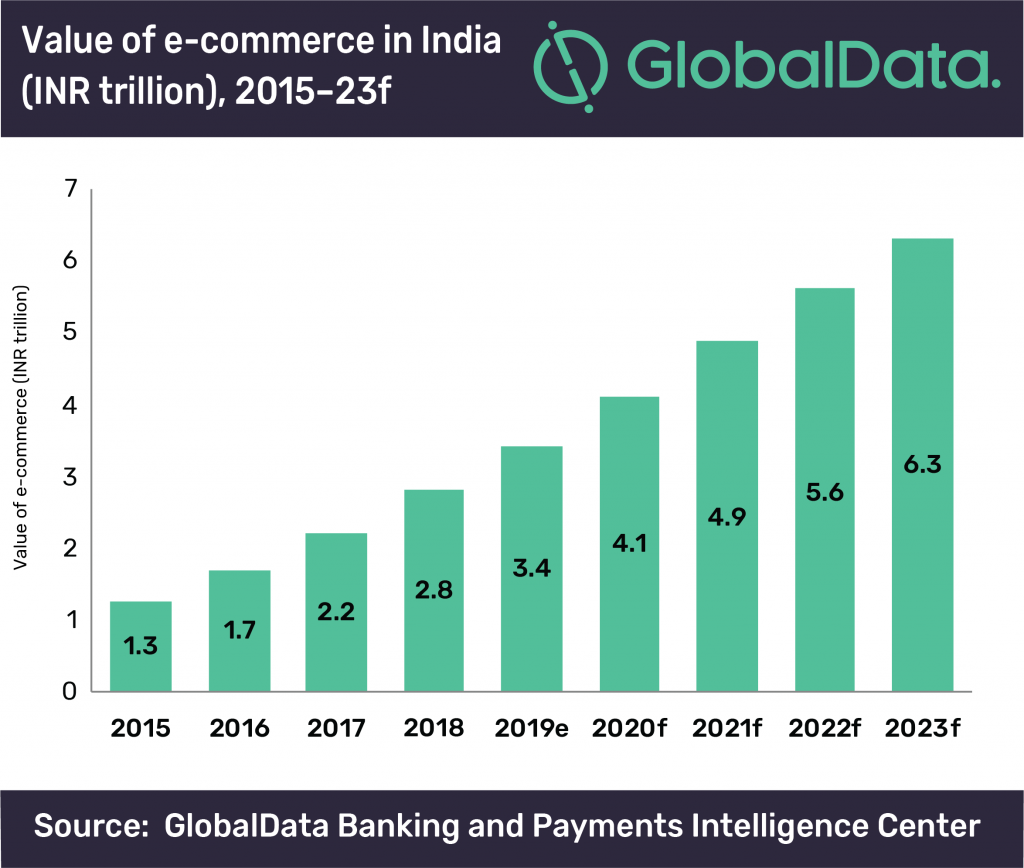

- Propelled by rising smartphone penetration, the launch of 4G networks and increasing consumer wealth, the Indian e-commerce market is expected to grow to US$ 200 billion by 2026 from US$ 38.5 billion in 2017.

- India’s e-commerce revenue is expected to jump from US$ 39 billion in 2017 to US$ 120 billion in 2020, growing at an annual rate of 51%, the highest in the world.

- The Indian e-commerce industry has been on an upward growth trajectory and is expected to surpass the US to become the second-largest e-commerce market in the world by 2034.

-Source: PIB

Defence Ministry notifies positive indigenisation list of subsystems

Context:

Following the two positive indigenisation lists barring import of 209 major platforms and systems, the Defence Ministry notified a list of another 2,500 subsystems and components and 351 more imported items to be made locally in the next three years.

Relevance:

GS-III: Industry and Infrastructure, GS-III: Indian Economy (Foreign Trade), GS-III: Science and Technology (Indigenization of technology & development of new technology)

Dimensions of the Article:

- Initiatives under the AatmaNirbhar Bharat Scheme in defence

- Lists for indigenization

- Other steps for Indigenization

- More about the Change in Defence Exports and Imports in India

Initiatives under the AatmaNirbhar Bharat Scheme in defence

The Government has taken several policy initiatives and brought in reforms to promote indigenisation and self-reliance in defence manufacturing, under AatmaNirbhar Bharat Mission in the defence sector.

Lists for indigenization

- Ministry of Defence has notified a ‘First Positive Indigenisation list’ and ‘2nd Positive Indigenisation list’ of more than 100 items each in 2021, for which there would be an embargo on the import beyond the timelines indicated against them.

- The Third positive indigenisation list of subsystems and components notified in 2021 included a list of another 2,500 subsystems and components and 351 more imported items to be made locally in the three years from 2022 to 2025.

- These lists are a part of the MoD’s efforts to achieve self-reliance in manufacturing and minimise imports by the Defence Public Sector Undertakings (DPSUs).

- The items in the list would only be procured from Indian industry after the timelines indicated in the list – DPSUs will work in close coordination with local industrial supply chain to ensure strict adherence to the stipulated timelines.

- This offers a great opportunity to the Indian defence industry to manufacture these items using their own design and development capabilities to meet the requirements of the Indian Armed Forces.

Other steps for Indigenization

- SRIJAN portal to promote indigenisation was launched in 2020 listing over 10 thousand items (which were earlier imported) displayed on the portal for indigenization.

- More than 1500 components & spares have been indigenised in the year 2020-21 as a result of efforts of indigenisation by DPSUs, OFB & SHQs through their own process of indigenisation (In-house, Make-II & Other than Make-II).

- Defence Procurement Procedure (DPP) 2016 has been revised as Defence Acquisition Procedure (DAP)-2020, which is driven by the tenets of Defence Reforms announced as part of ‘AatmaNirbhar Bharat Abhiyan’.

- In order to promote indigenous design and development of defence equipment ‘Buy (Indian-IDDM (Indigenously Designed, Developed and Manufactured))’ category has been accorded top most priority for procurement of capital equipment. The ‘Make’ Procedure of capital procurement has been simplified. There is a provision for funding up to 70% of development cost by the Government to Indian industry under Make-I category. In addition, there are specific reservations for MSMEs under the ‘Make’ procedure.

- The Government of India has enhanced FDI in Defence Sector up to 74% through the Automatic Route for companies seeking new defence industrial license and up to 100% by Government Route.

- An innovation ecosystem for Defence titled ‘Innovations for Defence Excellence (iDEX)’ has been launched in 2018 aimed at creation of an ecosystem to foster innovation and technology development in Defence and Aerospace. iDEX engages Industries including MSMEs, startups, individual innovators, R&D institutes and academia and provide them grants/funding and other support to carry out R&D which has potential for future adoption for Indian defence and aerospace needs.

- Government has notified the ‘Strategic Partnership (SP)’ Model in May, 2017, which envisages establishment of long-term strategic partnerships with Indian entities through a transparent and competitive process, wherein they would tie up with global Original Equipment Manufacturers (OEMs) to seek technology transfers to set up domestic manufacturing infrastructure and supply chains.

- An Inter-Governmental Agreement (IGA) on ‘Mutual Cooperation in Joint Manufacturing of Spares, Components, Aggregates and other material related to Russian/Soviet Origin Arms and Defence Equipment’ was signed in 2019 to enhance the After Sales Support and operational availability of Russian origin equipment currently in service in Indian Armed Forces.

More about the Change in Defence Exports and Imports in India

Public sector driven

Among arms producers, India has four companies among the top 100 biggest arms producers of the world. The largest Indian arms producers are:

- Indian ordnance factories (37th rank)

- Hindustan Aeronautics Limited (HAL) (38th)

- Bharat Electronics Limited (BEL)

- Bharat Dynamics Limited (BDL)

All four of these companies are public sector enterprises and account for the bulk of the domestic armament demand.

Explaining falling imports

Growing indigenization is not the sole reason for falling imports. Its is also because of the cancellation of some big-ticket items

- India cancelled the India-Russia joint venture for the development of the advanced Su-57 stealth Fifth Generation Fighter Aircraft (FGFA) in 2018 due to delays and not having the actual “5th gen” capabilities

- In 2015, we also reduced the size of the original acquisition of 126 Rafale Medium Multi-Role Combat Aircraft (MMRCA) from Dassault to 36 aircraft

- Delays in the supplies of T-90 battle tanks, and Su-30 combat aircraft from Russia and submarines from France, in 2009-13 and 2014-18, also depressed imports.

SMEs not the favorites

SMEs still face stunted growth because India’s defence industrial model is at odds with global trends in that it tends to create disincentives for the private sector.

- Governments, including the incumbent, have tended to privilege Defence Public Sector Units (DPSUs) over the private sector, despite ‘Make in India’.

- This model is highly skewed, undermining the growth of private players and diminishes the strength of research and development.

Export trends

The trends look positive on the export front. Between 2012 and 2019, Indian defence exports, both Public and private, have seen a surge

The sharp rise in defence export products can be attributed to the measures introduced by Government

- In 2014, the government delisted or removed several products that were restricted from exports.

- It dispensed with the erstwhile No Objection Certificate (NOC) under the DPP restricting exports of aerospace products, several dual-use items and did away with two-thirds of all products under these heads.

- Small naval crafts account for the bulk of India’s major defence exports. However, export of ammunition and arms remain low.

Speaking of volume

- As a percentage of total Indian trade, defence-related exports for the fiscal years 2017-18 and 2018-19 were 0.8 and 0.73%, respectively.

- Thus, from a volume and value standpoint, Indian defence exports, while showing a promising upward trend, still remain uncompetitive globally.

-Source: The Hindu