Contents

- MGNREGA scheme: Rs. 10,000 crores more

- Bring in three-rate GST structure

- Govt. to revisit ‘criteria’ for determining EWS

- NFHS-5: Women don’t outnumber men in India

MGNREGA scheme: Rs. 10,000 crores more

Context:

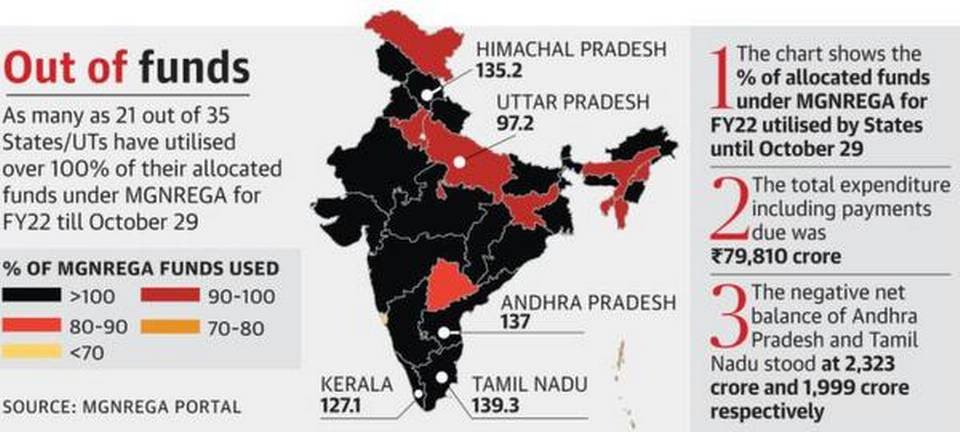

The Finance Ministry has allocated additional funds of ₹10,000 crore as an interim measure for the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) scheme after it ran out of funds allocated in the budget, according to the Ministry of Rural Development (MoRD).

Relevance:

GS-II: Social Justice and Governance (Health and Poverty related issues, Government Interventions and Policies, Issues arising out of the design and implementation of Government Policies)

Dimensions of the Article:

- Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA)

- About the recent MGNERGA funds shortage

- About the Pending wages problem

Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA)

- Mahatma Gandhi National Rural Employment Guarantee Act, MGNREGA, is an Indian labour law and social security measure that aims to guarantee the ‘right to work’. This act was passed in September 2005.

- It aims to enhance livelihood security in rural areas by providing at least 100 days of wage employment in a financial year to every household whose adult members volunteer to do unskilled manual work.

- It covers all districts of India except the ones with 100% urban population.

- MGNREGA is to be implemented mainly by gram panchayats (GPs). The involvement of contractors is banned.

- Apart from providing economic security and creating rural assets, NREGA can help in protecting the environment, empowering rural women, reducing rural-urban migration and fostering social equity, among others.

How MGNREGA came to be?

- In 1991, the P.V Narashima Rao government proposed a pilot scheme for generating employment in rural areas with the following goals:

- Employment Generation for agricultural labour during the lean season.

- Infrastructure Development

- Enhanced Food Security

- This scheme was called the Employment Assurance Scheme which later evolved into the MGNREGA after the merger with the Food for Work Programme in the early 2000s.

Features of MGNREGA

- It gives a significant amount of control to the Gram Panchayats for managing public works, strengthening Panchayati Raj Institutions.

- Gram Sabhas are free to accept or reject recommendations from Intermediate and District Panchayats.

- It incorporates accountability in its operational guidelines and ensures compliance and transparency at all levels.

Objectives of MGNREGA

- Provide 100 days of guaranteed wage employment to rural unskilled labour

- Increase economic security

- Decrease migration of labour from rural to urban areas.

About the recent MGNERGA funds shortage

- According to its own financial statement, the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) scheme shows a negative net balance of ₹8,686 crore.

- This means that payments for MGNREGA workers as well as material costs will be delayed, unless States dip into their own funds.

- Activists say the Centre is condemning workers to “forced labour” by delaying wage payments at a time of economic distress. However, the Centre is now accusing many States of “artificially creating demand” for work on the ground.

- However, the scheme’s 2021-22 budget was set at just ₹73,000 crore, with the Centre arguing that the nationwide lockdown was over and that supplementary budgetary allocations would be available if money ran out.

- Also, MGNREGA data shows that 13% of households who demanded work under the scheme were not provided work.

About the Pending wages problem

- Recently, the Ministry of Finance allocated additional funds of ₹10,000 crore for the Mahatma Gandhi NREGA as an interim measure.

- In the meanwhile, more than ₹1,170 crore worth of wage payments for MGNREGA workers are still pending.

- 13% of households which demanded work had failed to get the same, adding that the unmet demand is as high as 20% in Gujarat, Telangana and Bihar.

- In its statement, the MoRD acknowledged that the MGNREGA is a demand-driven scheme, meaning that its funding must increase to accommodate increases in demand.

-Source: The Hindu

Bring in three-rate GST structure

Context:

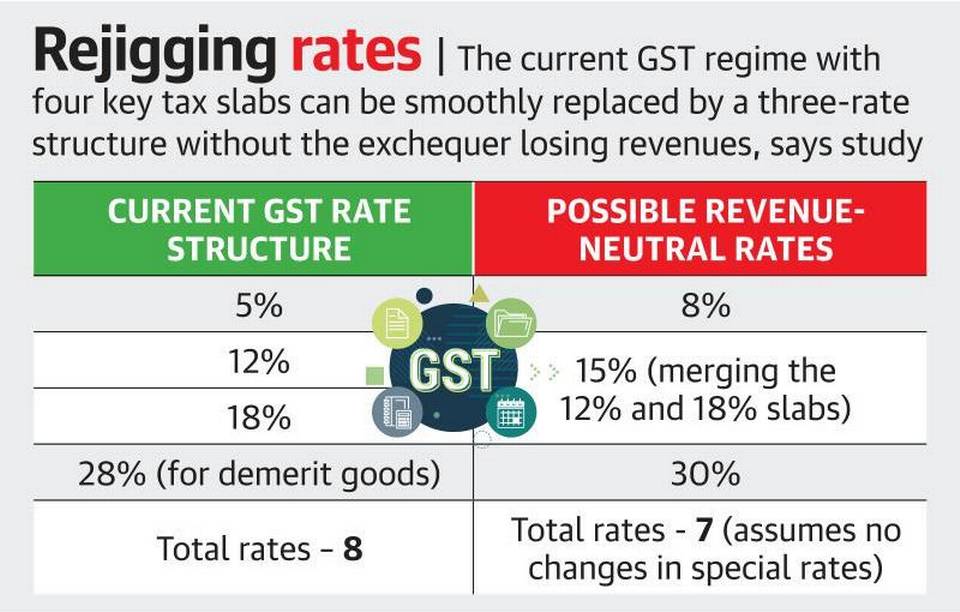

The Government can rationalise the GST rate structure without losing revenues by rejigging the four major rates of 5%, 12%, 18% and 28% with a three-rate framework of 8%, 15% and 30%, as per a National Institute of Public Finance and Policy (NIPFP) study.

Multiple rate changes since the introduction of the GST regime in July 2017 have brought the effective GST rate to 11.6% from the original revenue neutral rate of 15.5% according to the Finance Minister.

Relevance:

GS-II: Social Justice (Government Interventions and Policies, Issues arising out of the design and implementation of Government Policies)

Dimensions of the Article:

- GST and GST Council

- The findings of the NIPFP

- What are the key decisions made by GST Council?

About GST, GST Council

The findings of the NIPFP

The GST Council has tasked a Group of Ministers, headed by Karnataka CM Basavaraj S. Bommai, to propose a rationalisation of tax rates and a possible merger of different tax slabs by December to shore up revenues.

Understanding the numbers

- The findings of the NIPFP, an autonomous think tank backed by the Finance Ministry, show that merging the 12% and 18% GST rates into any tax rate lower than 18% may result in revenue loss.

- The NIPFP study proposes that the GST Council may consider a three-rate structure by adopting 8%, 15% and 30% for revenue neutrality.

- The nature of rate changes has also meant that over 40% of taxable turnover value now falls in the 18% tax slab, thus any move to dovetail that slab with a lower rate will trigger losses to the tax kitty that need to be offset by marginal hikes in other remaining major rates — 5% and 28%.

- The 28% rate is levied on demerit goods such as tobacco products, automobiles and aerated drinks, along with additional GST compensation cess.

- If the revenue loss from merging the 12% and 18% slabs were to be met by just hiking the rate on demerit or sin goods, the highest GST rate would have to be raised to almost 38%. Alternatively, the lowest standard rate will have to be raised from 5% to about 9%.

- Currently, the GST regime levies eight different rates, including zero for essential goods and special rates of 0.25% on diamonds, precious stones and 3% on gems and jewellery.

Conclusions of the study

- The NIPFP paper assumes these rates remain unchanged after noting that raising rates on ‘high-value low volume goods’ like precious stones and jewellery ‘may encourage unaccounted (undisclosed) transactions and therefore revenue leakages’.

- The results are indicative given the limitations of data, but the methodology developed in this paper could be useful for any future analysis of restructuring of the GST rate structure.

- The GST Council may consider placing some aggregate data in the public domain to help policy research as binding data limitations hinder meaningful research of the GST regime.

What are the key decisions made by GST Council?

- On Covid-19 Treatment: Existing concessional rates for Covid-19 medicines: Remdesivir (5 per cent), Tocilizumab (nil), Amphotericin B (nil), and anti-coagulants like Heparin (5 per cent) have been extended till December 2021. Along with this, a reduction of GST rate to 5 per cent on more Covid-19 treatment drugs like Itolizumab, Favipiravir etc., was also extended. However, the concessional tax for medical equipment will end on September 2021 as decided previously.

- On other medicines: The Council also decided to remove GST on the import of muscular atrophy drugs like Zolgensma and Viltepso, which cost crores of rupees. The GST rate for Keytruda, used for the treatment of cancer, has been cut to 5 per cent from 12 per cent.

- On Fortified rice: The Council also cut GST rates on fortified rice kernels to 5 per cent from 18 per cent.

- On Biodiesel: The Council also cut GST rates on bio-diesel for blending in diesel to 5 per cent from 12 per cent.

- On Ores and related: GST on ores and concentrates of metals such as iron, copper, aluminum, and zinc has been increased from 5 per cent to 18 per cent, and that on specified renewable energy devices and parts from 5 per cent to 12 per cent.

- On Packaging and other waste generating products: Cartons, boxes, bags, and packing containers of paper will now attract a uniform 18 per cent tax in place of the 12 per cent and 18 per cent rates. Waste and scrap of polyurethanes and other plastics will also see tax going up to 18 per cent from 5 per cent currently.

- On Soft-drinks: The rate for carbonated fruit beverages and carbonated beverages with fruit juice will attract a GST rate of 28 per cent, plus compensation cess of 12 per cent.

- On inclusion of fuel under GST: The Council discussed the issue only because the Kerala High Court had asked it, but felt it was not the right time to include petroleum products under GST.

- On inverted duty structure: The Council will also look at rate rationalisation under the inverted duty structure, and compliance measures through e-way bill and composition schemes. The Council has decided to set up a GoM to examine the issue of correction of inverted duty structure for major sectors; rationalise the rates and review exemptions from the point of view of revenue augmentation.

- Latest Decision On Compensation cess mechanism

- The Council also decided to put an end date of June 2022 to the compensation mechanism, as mandated in law.

- The levy of compensation cess will continue from July 2022 onwards till March 2026 to service the borrowing, which had been resorted to in order to bridge the compensation gap in the years 2020-21 and 2021-22.

- The debt for making compensation payments to states is estimated to be around Rs 2.7 lakh crore.

- In the previous GST Council meeting, it had been decided that beyond July 2022, the collection of cess would be for “payment of loans taken”. Beyond July 2022, the cess that the government collecting, as agreed in the 43rd Council meeting, is for the purpose of repaying the loans given to states since 2020.

- Latest Decision On e-commerce operators

- Effective January 1 2022, the Council has decided to make e-commerce operators engaged in restaurant services liable for payment of tax. This will essentially shift the responsibility of paying the 5 per cent GST to the aggregators from the restaurants.

- As a result of this, the restaurants will also have to mandatorily register themselves as is done by e-commerce sellers.

-Source: The Hindu

Govt. to revisit ‘criteria’ for determining EWS

Context:

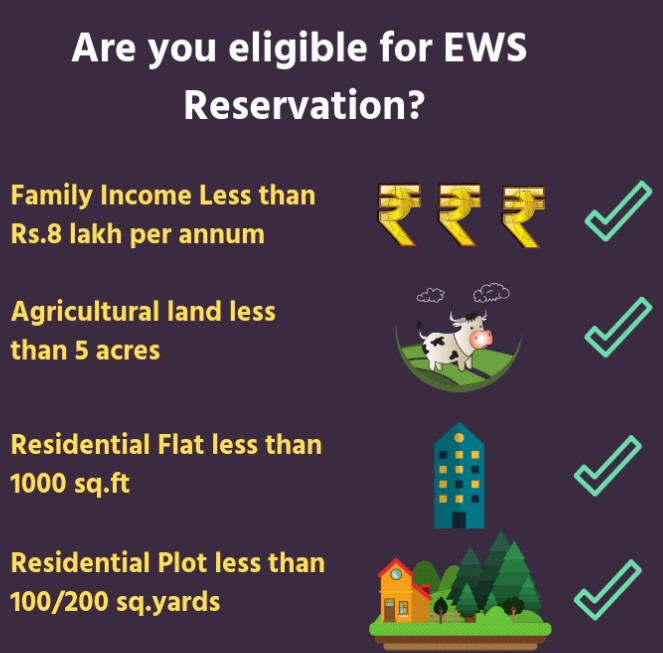

The Government informed the Supreme Court that it has taken a “considered decision” to revisit the “criteria” for determining Economically Weaker Sections (EWS) to provide them reservation.

Relevance:

GS-II: Social Justice and Governance (Social Sector & Social Services, Education and Health related Issues, Government Policies and initiatives)

Dimensions of the Article:

- EWS Reservation

- About the tussle between Govt. and SC about EWS

- About the SC order on criteria for EWS

EWS Reservation

- The economic reservation was introduced in the Constitution by amending Articles 15 and 16 and adding clauses empowering the State governments to provide reservation on the basis of economic backwardness.

- Article 15 of the Constitution prohibits discrimination against any citizen on the grounds of race, religion, caste, sex, or place of birth.

- However, the government may make special provisions for the advancement of socially and educationally backward classes, or for Scheduled Castes and Scheduled Tribes.

- The 103rd Amendment Bill seeks to amend Article 15 to additionally permit the government to provide for the advancement of “economically weaker sections”.

- Further, up to 10% of seats may be reserved for such sections for admission in educational institutions. (Such reservation will not apply to minority educational institutions.)

- The reservation of up to 10% for “economically weaker sections” in educational institutions and public employment will be in addition to the existing reservation (Even if it breaches the 50% reservation limit rule.)

- The central government will notify the “economically weaker sections” of citizens on the basis of family income and other indicators of economic disadvantage.

About the tussle between Govt. and SC about EWS

- The SC asked for the government to reveal the logic and study before zeroing in on the “exact figure” of ₹8 lakh as the annual income limit to identify the EWS.

- The Union Government has taken a considered decision to revisit the criteria for determining the economically weaker sections in terms of the provisions of the Explanation to Article 15 of the Constitution inserted by the Constitution (103rd Amendment) Act 2019 – according to SC.

- The court was hearing a case filed by NEET aspirants challenging a July 29 notification announcing 27% quota to OBCs and 10% reservation to EWS in the All India Quota (AIQ) category.

About the SC order on criteria for EWS

- The Supreme Court had earlier raised several questions about this criterion and made a prima facie observation that it appeared to be arbitrary, while hearing a batch of petitions related to NEET-AIQ.

- The Government assured the court that the NEET counselling would be deferred for four weeks till a decision was taken on the EWS quota.

- In a previous hearing, the apex court had expressed its annoyance at the Government for not filing an affidavit explaining how it reached the ₹8 lakh figure to identify the EWS category.

- The court had even threatened to “stay the Government notification fixing ₹8 lakh for determining the EWS”.

-Source: The Hindu

NFHS-5: Women don’t outnumber men in India

Context:

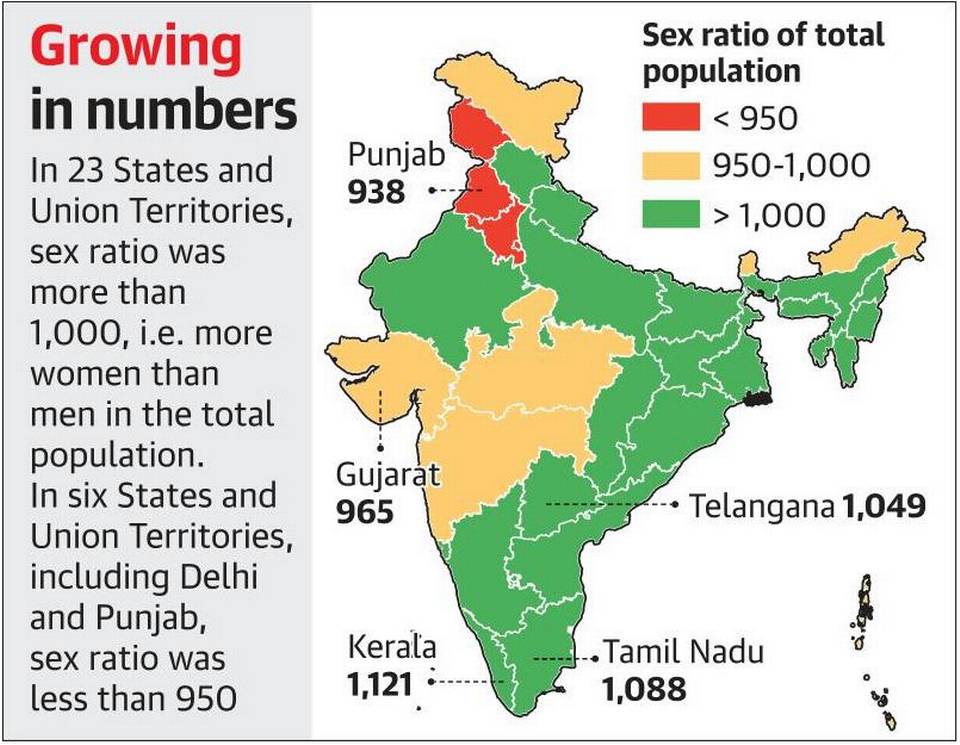

There are 1,020 women per 1,000 men in India according to the recently released Fifth Edition of the National Family Health Survey (NFHS-5). Such a sex ratio has not been recorded in any of the previous four editions of the NFHS.

But demography experts say it is not the time to rejoice yet as the figures do not give an accurate picture of India’s sex ratio.

Relevance:

GS-I: Indian Society (Population and Associated Issues), GS-II: Polity and Governance (Government Policies and Interventions, Issues arising out of the design and implementation of policies)

Dimensions of the Article:

- What is National Family Health Survey-5 (NFHS-5)?

- Details and Highlights of the NFHS-5

- About the survey on NFHS-5 on women outnumbering men

What is National Family Health Survey-5 (NFHS-5)?

- The National Family Health Survey (NFHS) is a large-scale, multi-round survey conducted in a representative sample of households throughout India.

- The NFHS is a collaborative project of the International Institute for Population Sciences (IIPS), Mumbai, India; ORC Macro, Calverton, Maryland, USA and the East-West Center, Honolulu, Hawaii, USA.

- NFHS was funded by the United States Agency for International Development (USAID) with supplementary support from United Nations Children’s Fund (UNICEF).

- The Ministry of Health and Family Welfare (MOHFW), Government of India, designated IIPS as the nodal agency, responsible for providing coordination and technical guidance for the NFHS.

How often is the NFHS conducted?

- National Family Health Survey (NFHS) has been conducted five times so far with the latest survey being the fifth NFHS.

- NFHS-1 was conducted in 1992-93 – which collected extensive information on population, health, and nutrition, with an emphasis on women and young children.

- The Second National Family Health Survey (NFHS-2) was conducted in 1998-99 in all 26 states of India with added features on the quality of health and family planning services, domestic violence, reproductive health, anemia, the nutrition of women, and the status of women.

- The Third National Family Health Survey (NFHS-3) was carried out in 2005-2006 in 29 states of India funded by – USAID, DFID, the Bill and Melinda Gates Foundation, UNICEF, UNFPA, and MOHFW, GOI.

- The fourth National Family Health Survey (NFHS-4) was conducted in 2015 under the stewardship of the Ministry of Health and Family Welfare, and the survey included all 6 Union territories at that time.

Details and Highlights of the NFHS-5

The new survey shows that several states have either witnessed meagre improvements or sustained reversals on child (under 5 years of age) malnutrition parameters such as child stunting; child wasting; share of children underweight and child mortality rate.

Child Wasting

- Child Wasting reflects acute undernutrition and refers to children having low weight for their height.

- States such as Telangana, Kerala, Bihar, and Assam as well as the UT of J&K have witnessed an increase in Child wasting.

- Other states like Maharashtra and West Bengal have been stagnant on Child Wasting status.

Child Mortality

- Infant Mortality Rate (the number of deaths per 1000 live births for children under the age of 1) and Under 5 Mortality Rate data is mostly stagnant.

- Several big states, Gujarat, Maharashtra, West Bengal, Telangana, Assam and Kerala, have seen an increase in Underweight Children issue.

- Under 5 mortality was observed to have a decline of about 33% over 10 years.

- NFHS-5 and NFHS-4 are about five years apart, but we are seeing very little progress in many states.

- In Maharashtra, the under-5 mortality rate is basically the same in NFHS-4 and 5, and in Bihar, it reduced by just 3% over five years

- Over 60% of child mortality is explained by child malnutrition, which is the central problem and needs to be addressed.

Population Control

- India’s population is stabilizing, as the total fertility rate (TFR) has decreased across majority of the states.

- Of 17 states analyzed in the fifth round of National Family Health Survey (NFHS), except for Bihar, Manipur and Meghalaya, all other states have a TFR of 2.1 or less, which implies that most states have attained replacement level fertility, an analysis by the Population Foundation of India (PFI) has said.

- All 17 states have witnessed an increase in the use of modern contraceptives of family planning.

- Male engagement in family planning continues to be limited and disappointing as seen by the low uptake of condoms and male sterilisation across states.

Child Marriages

- There has been an increase in child marriages in Tripura (40.1 per cent from 33.1 per cent in 2015-16), Manipur (16.3 per cent from 13.7 per cent in 2015-16) and Assam (31.8 per cent from 30.8 per cent in 2015-16), while states like West Bengal (41.6 per cent) and Bihar (40.8 per cent) still have high prevalence of child marriages.

- States such as Manipur, Andhra Pradesh, Himachal Pradesh and Nagaland have also shown increase in teenage pregnancies.

Anaemia

- Anaemia among women remains a major cause of concern. In all the states, anaemia is much higher among women compared to men.

- Female sterilisation continues to dominate as the modern method of contraception in states like Andhra Pradesh (98 per cent), Telangana (93 per cent), Kerala (88 per cent), Karnataka (84 per cent), Bihar (78 per cent) and Maharashtra (77 per cent).

Spousal Violence

- While spousal violence has generally declined in most of the states and UTs, it has witnessed an increase in five states, namely Sikkim, Maharashtra, Himachal Pradesh, Assam and Karnataka.

- Karnataka witnessed the largest increase in spousal violence, from 20.6 per cent in NFHS 4 to 44.4 per cent in NFHS-5.

- Sexual violence has increased in five states (Assam, Karnataka, Maharashtra, Meghalaya and West Bengal), as per the data.

Urban-rural Gender Gaps in Internet Use

- There is an urban-rural gap as well as gender divide with respect to the use of the Internet in several states and union territories.

- On average, less than 3 out of 10 women in rural India and 4 out of 10 women in urban India ever used the Internet.

- An average 42.6% of women ever used the Internet as against an average of 62.16% among the men.

- The percentage of women, who ever used the Internet, significantly dropped in rural India.

About the survey on NFHS-5 on women outnumbering men

- For the first time since the NFHS began in 1992, the proportion of women exceeded men: there were 1,020 women for 1,000 men. In the last edition of the survey in 2015-16, there were 991 women for every 1,000 men.

- However, sex ratio at birth for children born in the last five years only improved from 919 per 1,000 males in 2015-16 to 929 per 1,000, underscoring that boys, on average, continued to have better odds of survival than girls.

- All of these States and UTs, however, showed improvements in the population increase of women. Most States and Union Territories (UTs) had more women than men, the NFHS-5 shows.

- States that had fewer women than men included Gujarat, Maharashtra, Arunachal Pradesh, Haryana, Madhya Pradesh, Punjab and Union territories such as Jammu & Kashmir, Chandigarh, Delhi, Andaman and Nicobar islands, Dadra and Nagar Haveli, and Ladakh.

- A State-wise breakup of the NFHS data also shows that India is on its way to stabilising its population, with most States and UTs having a Total Fertility Rate (TFR) of less than two.

- A TFR of less than 2.1, or a woman on average bearing two children over a lifetime, suggests that an existing generation of a people will be exactly replaced. Anything less than two suggests an eventual decline in population over time.

- Only six States: Bihar, Meghalaya, Manipur, Jharkhand and Uttar Pradesh have a TFR above two.

- Bihar has a TFR of three which, however, is an improvement from the 3.4 of the NFHS-4. Again, much like the broader trend towards feminisation, the TFR in all States has improved in the last five years.

- India is still poised to be the most populous country in the world with the current projection by the United Nations population division forecasting that India’s population will peak around 1.6 to 1.8 billion from 2040-2050.

-Source: The Hindu, Down to Earth Magazine