Contents

- Inflation remains above 6% for second month

- Lightning: Biggest natural disaster-linked killer in India

- RBI Retail Direct scheme

Inflation remains above 6% for second month

Context:

After touching a six-month high in May 2021, India’s retail inflation was virtually unchanged in June 2021.

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, Fiscal Policy, Taxation)

Dimensions of the Article:

- What is Inflation?

- Types of Inflation based on rate of Increase

- About the Latest inflation data

What is Inflation?

- Inflation refers to the consistent rise in the prices of most goods and services of daily or common use, such as food, clothing, housing, recreation, transport, consumer staples, etc. Inflation measures the average price change in a basket of commodities and services over time.

- A moderate level of inflation is required in the economy to ensure that production is promoted. Excess Inflation is indicative of the decrease in the purchasing power of a unit of a country’s currency. This could ultimately lead to a deceleration in economic growth.

- In India, inflation is primarily measured by two main indices — WPI (Wholesale Price Index) and CPI (Consumer Price Index) which measure wholesale and retail-level price changes, respectively.

Types of Inflation based on rate of Increase

There are four main types of inflation, categorized by their speed. They are creeping, walking, galloping, and hyperinflation.

I. Creeping Inflation

- Creeping or mild inflation is when prices rise 3% a year or less. According to the Federal Reserve, when prices increase 2% or less, it benefits economic growth.

- This kind of mild inflation makes consumers expect that prices will keep going up. That boosts demand. Consumers buy now to beat higher future prices. That’s how mild inflation drives economic expansion.

II. Walking Inflation

- When prices rise by more than 3% but less than 10% per annum (i.e., between 3% and 10% per annum), it is called as Walking Inflation.

- It is harmful to the economy because it heats-up economic growth too fast.

- People start to buy more than they need to avoid tomorrow’s much higher prices. This increased buying drives demand even further so that suppliers can’t keep up and neither can the wages. As a result, common goods and services are priced out of the reach of most people.

III. Galloping Inflation

- When inflation rises to 10% or more (i.e., prices rise by double- or triple-digit inflation rates like 30% or 400% or 999% per annum), it wreaks absolute havoc on the economy. It is also referred as jumping inflation.

- Money loses value so fast that business and employee income can’t keep up with costs and prices.

- Foreign investors avoid the country, depriving it of needed capital. The economy becomes unstable, and government leaders lose credibility.

IV. Hyperinflation

- Hyperinflation refers to a situation where the prices rise at an alarming high rate – i.e., more than 50% a month.

- The prices rise so fast that it becomes very difficult to measure its magnitude. However, in quantitative terms, when prices rise above 1000% per annum (quadruple or four-digit inflation rate), it is termed as Hyperinflation.

- Most examples of hyperinflation occur when governments print money to pay for wars.

- Examples of hyperinflation include Germany in the 1920s, Zimbabwe in the 2000s, and Venezuela in the 2010s.

- During a worst-case scenario of hyperinflation, value of national currency (money) of an affected country reduces almost to zero. Paper money becomes worthless and people start trading either in gold and silver or sometimes even use the old barter system of commerce.

V. Chronic Inflation

- If creeping inflation persist (continues to increase) for a longer period of time then it is often called as Chronic or Secular Inflation.

- Chronic Creeping Inflation can be either Continuous (which remains consistent without any downward movement) or Intermittent (which occurs at regular intervals).

- It is called chronic because if an inflation rate continues to grow for a longer period without any downturn, then it possibly leads to Hyperinflation.

VI. Moderate Inflation

- Concept of Creeping and Walking inflation clubbed together are called Moderate Inflation.

- When prices rise by less than 10% per annum (single digit inflation rate), it is known as Moderate Inflation.

- It is a stable inflation and not a serious economic problem.

VII. Running Inflation

- A rapid acceleration in the rate of rising prices is referred as Running Inflation.

- When prices rise by more than 10% per annum, running inflation occurs.

- Though economists have not suggested a fixed range for measuring running inflation, we may consider price rise between 10% to 20% per annum (double digit inflation rate) as a running inflation.

About the Latest inflation data

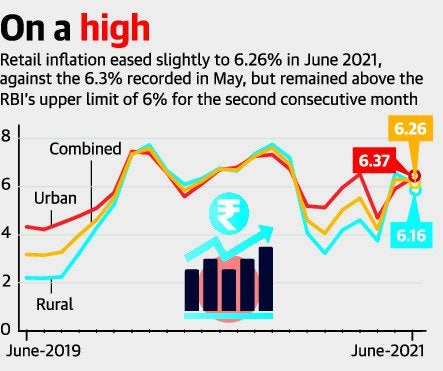

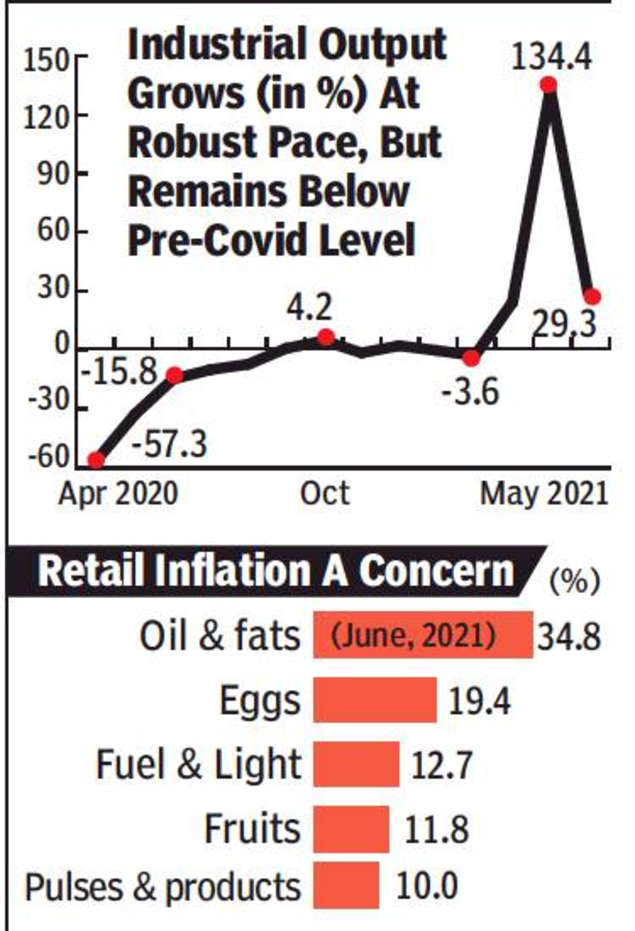

- For the second month in a row India’s retail inflation was virtually unchanged remaining above 6% which is out of the central bank’s comfort zone.

- Growth impulses remained fragile with the second COVID-19 wave hurting the recovery momentum.

- With petroleum product prices continuing to soar, fuel and light inflation hit more than 12% in June 2021 and Food inflation, which had flared up from just 2% in April to 5% in May, rose further, led by almost a 35% inflation rate for oils and fats.

- Economists expect the Reserve Bank of India (RBI) to revisit its inflation estimate of 5.1% for 2021-22 and stressed that lack of fiscal policy action to cool prices could precipitate a faster unwinding of RBI’s growth-supporting approach to interest rates.

- Persistently sticky retail prices for fuel and food translated into little respite for citizens, as inflation measured by the Consumer Price Index (CPI) declined by just four basis points (1 basis point equals 0.01%) from May 2021.

- Beyond the monthly swings, inflation continues to stay above the mid-point (4%) of the inflation target since late 2019. If the CPI inflation remains entrenched above the 6% upper threshold from July-August 2021, a preponement of rate normalization by the RBI can’t be ruled out.

-Source: The Hindu

Lightning: Biggest natural disaster-linked killer in India

Context:

Nearly 68 were reportedly struck dead by lightning on a single day in Uttar Pradesh, Rajasthan and Madhya Pradesh, according to reports from States in July 2021.

Relevance:

GS-III: Disaster Management, GS-I: Geography (Climatology, Important Geophysical Phenomenon)

Dimensions of the Article:

- What is Lightning?

- More about Clouds that generate lightning and how they are formed

- What happens when lightning strikes Earth’s Surface?

- About Lightning Strikes in India

What is Lightning?

- Lightning is a natural ‘electrical discharge of very short duration and high voltage between a cloud and the ground or within a cloud’, accompanied by a bright flash and sound, and sometimes thunderstorms.

- In simple words, it is a very rapid and massive discharge of electricity in the atmosphere.

- It happens as a result of the difference in electrical charge between the top and bottom of a cloud, or between 2 clouds or between clouds and the ground.

- Inter cloud or intra cloud (IC) lightning are visible and harmless.

- Cloud to ground (CG) lightning is harmful as the ‘high electric voltage and electric current’ leads to electrocution.

More about Clouds that generate lightning and how they are formed

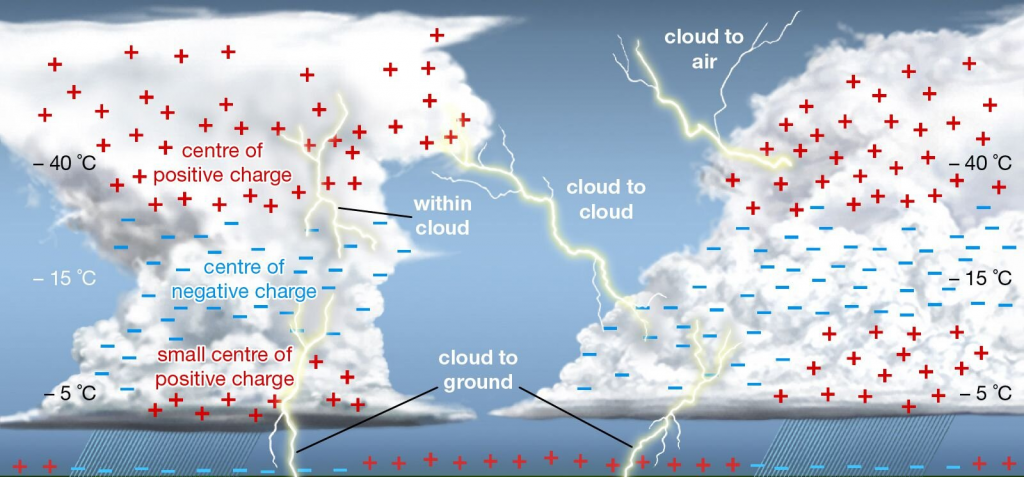

- The lightning-generating clouds are typically about 10-12 km in height, with their base about 1-2 km from the Earth’s surface. The temperatures at the top range from -35°C to -45°C.

- As water vapour moves upwards in the cloud, it condenses into water due to decreasing temperatures. A huge amount of heat is generated in the process, pushing the water molecules further up.

- As they move to temperatures below zero, droplets change into small ice crystals. As they continue upwards, they gather mass, until they become so heavy that they start descending.

- It leads to a system where smaller ice crystals move upwards while larger ones come down. The resulting collisions trigger release of electrons, in a process very similar to the generation of electric sparks. The moving free electrons cause more collisions and more electrons leading to a chain reaction.

- The process results in a situation in which the top layer of the cloud gets positively charged while the middle layer is negatively charged.

- In little time, a huge current, of the order of lakhs to millions of amperes, starts to flow between the layers.

What happens when lightning strikes Earth’s Surface?

- The Earth is a good conductor of electricity. While electrically neutral, it is relatively positively charged compared to the middle layer of the cloud. As a result, an estimated 20-25% of the current flow is directed towards the Earth. It is this current flow that results in damage to life and property.

- Lightning has a greater probability of striking raised objects on the ground, such as trees or buildings.

- Lightning Conductor is a device used to protect buildings from the effect of lightning. A metallic rod, taller than the building, is installed in the walls of the building during its construction.

- The most lightning activity on Earth is seen on the shore of Lake Maracaibo in Venezuela.

About Lightning Strikes in India

- The Home Ministry’s statistics consistently cited lightning as the biggest natural disaster-linked killer in India.

- Several thousand thunderstorms occur over India every year. Each can involve several — sometimes more than a hundred — lightning strikes.

- Occurrences of lightning are not tracked in India. There is simply not enough data for scientists to work with.

- Lightning is the biggest contributor to accidental deaths due to natural causes.

- In 2019, an analysis by Skymet reported that five States accounted for half the lightning strikes that year, led by Odisha with 9,37,462 strikes or about 16% of the cloud-to-ground strikes. There were 20 million lightning strikes in that period with over 72% of them being instances of “in-cloud” lightning.

-Source: The Hindu

RBI Retail Direct scheme

Context:

The Reserve Bank of India (RBI) announced the ‘RBI Retail Direct’ scheme, a one-stop solution to facilitate investment in government securities (G-secs) by individual investors.

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, Mobilization of resources)

Dimensions of the Article:

- About the ‘RBI Retail Direct’ scheme

- Why was this needed?

- Benefits of the RBI Retail Direct Scheme

About the ‘RBI Retail Direct’ scheme

- Under the scheme, retail investors [Retail Investors = individuals / non-professional investor who buys and sells securities or funds that contain a basket of securities such as mutual funds and Exchange Traded Funds (ETFs)] will have the facility to open and maintain the ‘Retail Direct Gilt Account’ [Gilt account is debited or credited with treasury bills or government securities instead of money] (RDG Account) with the RBI.

- It is a one-stop solution to facilitate investment in G-secs by individual investors. RBI seeks to democratize the ownership of government debt securities beyond banks and managers of pooled resources such as mutual funds.

- RDG accounts can be opened through an online portal provided for the purpose of the scheme. The online portal will give registered users access to primary issuance of G-secs and access to Negotiated Dealing System-Order Matching system (NDS-OM).

Why was this needed?

- The G-sec market is dominated by institutional investors which are large market actors such as banks, mutual funds and insurance companies.

- So, there is no liquidity in the secondary market for small investors who would want to trade in smaller lot sizes because institutional investors trade in lot sizes of Rs 5 crore or more.

- There is no easy way for them to exit their investments. Thus, currently, direct G-secs trading is not popular among retail investors.

Benefits of the RBI Retail Direct Scheme

- It will make the process of G-sec trading smoother for small investors therefore it will raise retail participation in G-secs and will improve ease of access.

- This measure together with relaxation in mandatory Hold To Maturity (securities that are purchased to be owned until maturity) provisions will facilitate smooth completion of the government borrowing programme in 2021-22.

- Allowing direct retail participation in the G-Sec market will promote financialisation of a vast pool of domestic savings and could be a game-changer in India’s investment market.

-Source: The Hindu