Contents

- NITI Aayog and Mastercard report on e-Commerce

- Smuggling of uranium: ATS seizes 7kg uranium

- India variant of Covid Concerns and Classification

NITI Aayog and Mastercard report on e-Commerce

Context:

NITI Aayog and Mastercard released the ‘Connected Commerce: Creating a Roadmap for a Digitally Inclusive Bharat’ report on digital financial inclusion in India.

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, Mobilization of Resources, Financial Inclusion, Banking Sector)

Dimensions of the Article:

- What is Digital financial inclusion?

- Benefits of Digital Financial Inclusion

- Risks of Digital Financial Inclusion

- Highlights of the ‘Connected Commerce’ report

- Steps taken in India towards Digital Financial Inclusion (DFI)

- Way forwards suggested by the report

What is Digital financial inclusion?

- Digital financial inclusion involves the deployment of the cost-saving digital means to reach currently financially excluded and underserved populations with a range of formal financial services suited to their needs that are responsibly delivered at a cost affordable to customers and sustainable for providers.

- “Digital financial inclusion (DFI)” can be defined broadly as digital access to and use of formal financial services by excluded and underserved populations. Such services should be suited to customers’ needs, and delivered responsibly, at a cost both affordable to customers and sustainable for providers.

The essential components of digital financial inclusion are:

- Digital transactional platforms enable customers to make or receive payments and transfers and to store value electronically through the use of devices that transmit and receive transaction data and connect to a bank or non-bank permitted to store electronic value

- Devices used by the customers can either be digital devices (mobile phones, etc) that transmit information or instruments (payment cards, etc) that connect to a digital device such as a point-of-sale (POS) terminal.

- Retail agents that have a digital device connected to communications infrastructure to transmit and receive transaction details enable customers to convert cash into electronically stored value (“cash-in”) and to transform stored value back into cash (“cash-out”).

- Additional financial services via the digital transactional platform may be offered by banks and non-banks to the financially excluded and underserved — credit, savings, insurance, and even securities — often relying on digital data to target customers and manage risk.

Benefits of Digital Financial Inclusion

- Access to formal financial services – payments, transfers, savings, credit, insurance, securities, etc. Migration to account-based services typically expands over time as customers gain familiarity with — and trust in — a digital transactional platform. Government-to-person payments, such as conditional cash transfers, that can enable digital stored-value accounts may provide a path for the financially excluded into the financial system.

- Typically lower costs of digital transactional platforms — both to the provider and thereby the customer — allow customers to transact locally in irregular, tiny amounts, helping them to manage their characteristically uneven income and expenses.

- Additional financial services tailored to customers’ needs and financial circumstances are made possible by the payment, transfer, and value storage services embedded in the digital transaction platform itself, and the data generated within it.

- Reduced risks of loss, theft, and other financial crimes posed by cash-based transactions, as well as the reduced costs associated with transacting in cash and using informal providers.

- It can also promote economic empowerment by enabling asset accumulation and, for women in particular, increasing their economic participation.

Risks of Digital Financial Inclusion

- Novelty risks for customers due to their lack of familiarity with the products, services, and providers and their resulting vulnerability to exploitation and abuse.

- Agent-related risks due to the new providers offering services are not subject to the consumer protection provisions that apply to banks and other traditional financial institutions.

- Digital technology-related risks can cause disrupted service and loss of data, including payment instructions (for example, due to dropped messages), as well as the risk of a privacy or security breach resulting from digital transmittal and storage of data.

Highlights of the ‘Connected Commerce’ report

- The report identifies challenges in accelerating Digital Financial Inclusion (DFI) in India and provides recommendations for making digital services accessible to its 1.3 billion citizens.

- Lot of effort has been put to attain DFI and much success on the supply side of DFI has been seen (e-governance, the JAM trinity, Goods and Services Tax, Direct Benefit Transfer (DBT) schemes). However, the break in the digital financial flow comes at the last mile, where account holders mostly withdraw cash for their end-use.

- Agriculture, with its allied sectors, provides livelihood to a large section of the Indian population. Over the years, agriculture’s contribution to national GDP has declined from 34% in 1983-84 to just 16% in 2018-19. Most agri-techs have not succeeded in digitizing financial transactions for farmers or enabling formal credit at lower rates of interest by leveraging transaction data.

- Micro, Small and Medium Enterprises (MSMEs) have been a key growth driver for the Indian economy. According to a 2020 Report, the category employed some 110 million people, or over 40% of India’s non-farm workforce. The lack of proper documentation, bankable collateral, credit history and non-standard financials force them to access informal credit at interest rates that are double of those from formal lenders.

- The surge in digital transactions has increased the risk for possible security breaches, both for consumers and businesses.

- With the onset of the pandemic, there is an increasing need for transit systems to be further integrated with contactless payments in India. Globally, the trend is toward open-loop transit systems, with interoperable payment solutions allowing travelers to switch between different modes of transport with a connected payments network.

Steps taken in India towards Digital Financial Inclusion (DFI)

- Jan Dhan-Aadhar-Mobile (JAM) Trinity – a combination of Aadhaar, Pradhan Mantri Jan-Dhan Yojana (PMJDY), and a surge in mobile communication has reshaped the way citizens access government services.

- Reserve Bank of India (RBI) and National Bank for Agriculture and Rural Development (NABARD) have taken initiatives to promote financial inclusion in rural areas such as Opening of bank branches in remote areas, Issuing Kisan Credit Cards (KCC), Linkage of self-help groups (SHGs) with banks, Payment Infrastructure Development Fund (PIDF) scheme, etc.

- The National Payments Corporation of India (NPCI), digital payments have been made secure, compared to the past with the strengthening of the Unified Payment Interface (UPI).

- The Aadhar-enabled Payment System (AEPS) enables an Aadhar Enabled Bank Account (AEBA) to be used at any place and at any time, using micro-ATMs.

- The Reserve Bank of India has undertaken a project titled “Project Financial Literacy” with the objective to disseminate information regarding the central bank and general banking concepts to various target groups, including, school and college going children, women, rural and urban poor, defence personnel and senior citizens.

Way forwards suggested by the report

- For market players, it is critical to address the gap on the demand side by creating user-friendly digital products and services that encourage the behavioral transition from cash to digital.

- Strengthening the payment infrastructure to promote a level playing field for Non-Banking Financial Companies (NBFCs) and banks.

- Digitizing registration and compliance processes and diversifying credit sources to enable growth opportunities for MSMEs.

- Building information sharing systems, including a ‘fraud repository’, and ensuring that online digital commerce platforms carry warnings to alert consumers to the risk of frauds.

- Enabling agricultural NBFCs to access low-cost capital and deploy a ‘phygital’ (physical + digital) model for achieving better long-term digital outcomes. Digitizing land records will also provide a major boost to the sector.

- To make city transit seamlessly accessible to all with minimal crowding and queues, leveraging existing smartphones and contactless cards, and aim for an inclusive, interoperable, and fully open system.

-Source: PIB

Smuggling of uranium: ATS seizes 7kg uranium

Context:

The Maharashtra Anti-Terrorism Squad (ATS) arrested two persons under the Atomic Energy Act, 1962, with 7 kg natural uranium estimated to be worth around Rs 21 crore.

Relevance:

GS-III: Environment and Ecology (Environmental Pollution & Degradation), Mineral & Energy Resources

Dimensions of the Article:

- What exactly is uranium and what are its uses?

- Uranium Deposits in India

- Legislations regarding Regulation of Uranium

- Atomic Energy Act, 1962

- Atomic Energy Regulatory Board (AERB)

- Bhabha Atomic Research Centre

What exactly is uranium and what are its uses?

- Uranium occurs naturally in low concentrations in soil, rock and water and is commercially extracted from uranium-bearing minerals.

- Uranium that has a silvery grey metallic appearance is mainly used in nuclear power plants due to its unique nuclear properties.

- Depleted uranium is also used as shield against radiation in medical processes using radiation therapy and also while transporting radioactive materials.

- Though itself radioactive, uranium’s high density makes it effective in halting radiation. Its high density also makes it useful as counterweights in aircraft and industrial machinery.

Uranium Deposits in India

- In India, Uranium deposits occur in the Dharwar rocks.

- It occurs along the Singhbhum Copper belt (Jharkhand); Udaipur, Alwar and Jhunjhunu districts of Rajasthan, Durg district of Chhattisgarh, Bhandara district of Maharashtra and Kullu district of Himachal Pradesh.

- Significant quantities of reserves have been recently discovered in parts of Andhra Pradesh and Telangana between Seshachalam forest and Sresailam (Southern edge of Andhra to Southern edge of Telangana).

Legislations regarding Regulation of Uranium

- Since Uranium is a major mineral, it is managed by the Union Government under provisions of ‘The Mines & Minerals (Development and Regulation) Act, 1957 (MMDR Act)’.

- The policy and legislation relating to Major minerals are managed by the Ministry of Mines, but Uranium being an atomic mineral is managed by the Department of Atomic Energy (DAE).

- Many of these mineral deposits are found in rich forest reserves and thus approval of the Union Ministry of Environment, Forest and Climate Change becomes necessary.

Atomic Energy Act, 1962

- The Atomic Energy Act, 1962, was enacted to provide for the development, control and use of atomic energy for the welfare of the people of India and for other peaceful purposes.

- It provides the basic regulatory framework for all activities related to atomic energy programme and use of ionising radiation in India.

- The Atomic Energy Act refers to control over radioactive substance and special provisions for safety along with empowering the Regulatory Body Atomic Energy Regulatory Board (AERB) with administration of Factories Act 1948, including enforcement of its provisions, appointment of inspection staff and making of rules in the installations of Department of Atomic Energy (DAE).

- The Atomic Energy Regulatory Board (AERB) is the primary institution tasked to look at issues regarding everything related to nuclear safety constituted in 1983 by the President of India under the powers conferred in the Atomic Energy Act, 1962.

- Atomic Energy act of 1962, protects information related to nuclear establishment and empowers Department of Atomic Energy (DAE) to deny information.

Atomic Energy Regulatory Board (AERB)

- The main mission of the Atomic Energy Regulatory Board (AERB) is to ensure that the use of ionizing radiation and nuclear energy in India does not cause undue risk to health and the environment.

- The Atomic Energy Regulatory Board (AERB) was constituted under the provisions of Atomic Energy Act, 1962 and the regulatory authority of AERB is derived from the rules and notifications promulgated under the Atomic Energy Act and the Environmental (Protection) Act, 1986.

- Currently, the Board consists of a full-time Chairman, an ex officio Member, three part-time Members and a Secretary.

- AERB is supported by the Safety Review Committee for Operating Plants (SARCOP), Safety Review Committee for Applications of Radiation (SARCAR) and Advisory Committees for Project Safety Review (ACPSRs).

- AERB also receives advice from the Advisory Committee on Nuclear Safety (ACNS), composed of experts from AERB, DAE and institutions outside the DAE.

- The administrative and regulatory mechanisms which are in place ensure multi-tier review by experts available nationwide – who are from reputed academic institutions and governmental agencies.

Bhabha Atomic Research Centre

- Dr. Homi Jehangir Bhabha conceived the Nuclear Program in India. Dr Bhabha established the Tata Institute of Fundamental Research (TIFR) for carrying out nuclear science research in 1945.

- To intensify the effort to exploit nuclear energy for the benefit of the nation, Dr Bhabha established the Atomic Energy Establishment, Trombay (AEET) in January 1954 for a multidisciplinary research program essential for the ambitious nuclear program of India. AEET was renamed Bhabha Atomic Research Centre (BARC) in 1966.

-Source: Indian Express

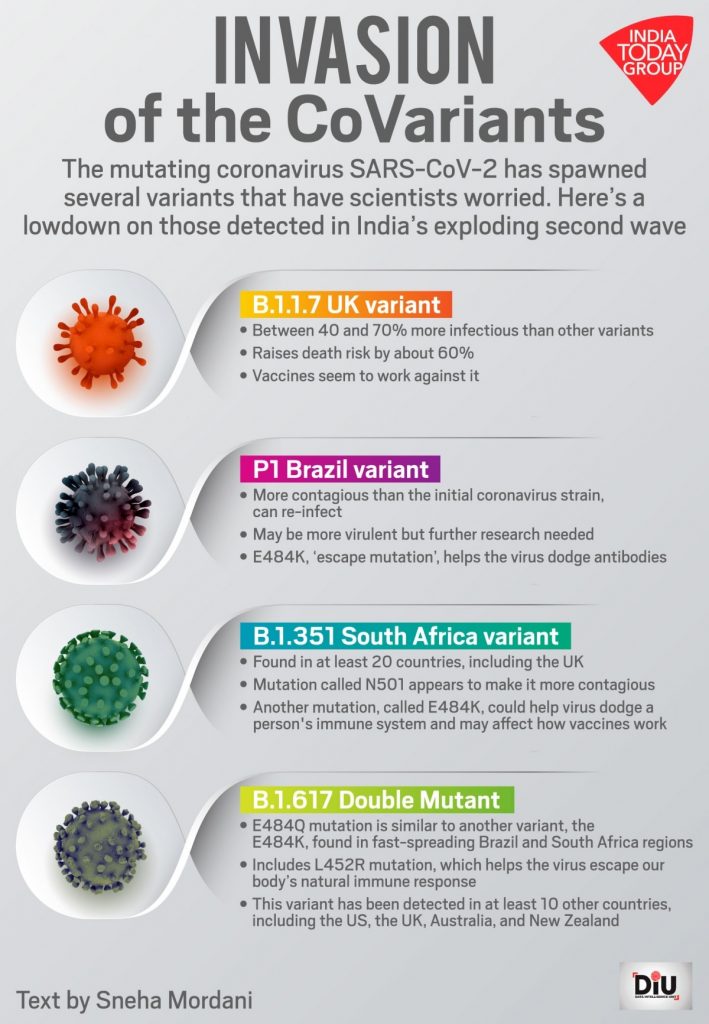

India variant of Covid Concerns and Classification

Context:

The World Health Organisation classified a coronavirus variant first identified in India as a “global variant of concern”.

This variant called B.1.617 was classified as a variant under investigation (VUI) by authorities in the UK earlier in May 2021 and it has already spread to more than 17 countries.

Relevance:

GS-III: Science and Technology

Dimensions of the Article:

- What is a variant and how do they emerge?

- How are variants of the coronavirus being classified?

- Is B.1.617 the reason for the current surge in India?

What is a variant and how do they emerge?

- Variants of a virus have one or more mutations that differentiate it from the other variants that are in circulation.

- While most mutations are deleterious for the virus, some make it easier for the virus to survive.

- The SARS-CoV-2 virus is evolving fast because of the scale at which it has infected people around the world. High levels of circulation mean it is easier for the virus to change as it is able to replicate faster.

How are variants of the coronavirus being classified?

Variants Under Investigation (VUI)

- Public Health England (PHE) says that if the variants of SARS-CoV-2 are considered to have epidemiological, immunological or pathogenic properties, they are raised for formal investigation.

- At this point, the variants emerging from the B.1.617 lineage are designated as VUI.

US Centers for Disease Control and Prevention (CDC) Classification

The US Centers for Disease Control and Prevention (CDC) classifies variants into three categories:

- Variant of Interest (VOI): A variant with specific genetic markers that have been associated with changes to receptor binding, reduced neutralization by antibodies generated against previous infection or vaccination, reduced efficacy of treatments, potential diagnostic impact, or predicted increase in transmissibility or disease severity. (B.1.617 variant with two mutations, referred to as E484Q and L452R).

- Variant of Concern (VOC): A variant for which there is evidence of an increase in transmissibility, more severe disease (e.g., increased hospitalizations or deaths), significant reduction in neutralization by antibodies generated during previous infection or vaccination, reduced effectiveness of treatments or vaccines, or diagnostic detection failures. (B.1.1.7 (UK variant), B.1.351 (South Africa Variant), P.1 (Brazil Variant), B.1.427, and B.1.429 variants).

- Variant of High Consequence (VHC): A variant of high consequence has clear evidence that prevention measures or medical countermeasures have significantly reduced effectiveness relative to previously circulating variants. (No examples so far).

Phylogenetic Assignment of Global Outbreak Lineages (PANGOLIN) Nomenclature

- Phylogenetic Assignment of Global Outbreak Lineages (PANGOLIN) was developed to implement the dynamic nomenclature of SARS-CoV-2 lineages, known as the Pango nomenclature.

- It uses a hierarchical system based on genetic relatedness – an invaluable tool for genomic surveillance.

- It uses alphabets (A, B, C, P) and numerals starting with 1. Variant lineages are at the emerging edge of the pandemic in different geographies. Lineage B is the most prolific.

Is B.1.617 the reason for the current surge in India?

- Recently, during the second wave of Covid-19 the Indian government said that this variant also called the “double mutant variant” could be linked to a surge in the cases of coronavirus seen in some states. Even so, the government said that the link was not “fully established”.

- Earlier, India’s Health Ministry had said that a new “double mutant variant” of the coronavirus had been detected in addition to many other strains or variants of concern (VOCs) found in 18 states in the country.

- B.1.617 was first designated as a VUI on April 1 by the UK health authorities who requested India to send samples of the B.1.617 strain to carry out wider studies on it and determine how effective existing vaccines are against it.

-Source: The Hindu, Indian Express