CONTENTS

- Transformation of India’s Fan Market

- Inclusion of India in JPMorgan’s GBI-EM Index

- Bima Sugam

- Annular Solar Eclipse

- Sea Urchins

- Galactic tides

Transformation of India’s Fan Market

Context:

India’s fan market is undergoing a transformative evolution, driven by changes in policy and a growing commitment to sustainable energy practices.

Relevance:

GS III: Indian Economy

Dimensions of the Article:

- Reasons for the Transformation of the Ceiling Fan Market in India

- Government Initiatives to Enhance Ceiling Fan Energy Efficiency

- UJALA Programme: Revolutionizing Energy-Efficient Lighting

- The Way Forward for Enhancing Ceiling Fan Energy Efficiency

Reasons for the Transformation of the Ceiling Fan Market in India

Sustainable Energy Commitment:

- India’s strong commitment to transitioning to cleaner and sustainable energy sources is a primary catalyst for the transformation of the fan market.

Climate Change Awareness:

- Growing awareness of climate change and its adverse effects is driving the need to reduce energy consumption and greenhouse gas emissions through more efficient appliances.

Emissions Reduction Goals:

- India’s target to reduce harmful emissions per unit of Gross Domestic Product (GDP) by 45% by 2030 (relative to 2005 levels) necessitates energy-efficient solutions in various sectors, including the fan market.

Household Electricity Consumption:

- Households in India account for nearly one-third of the country’s total electricity consumption, making energy efficiency in appliances like ceiling fans crucial for overall energy conservation.

Widespread Fan Usage:

- A 2020 survey by the Council on Energy, Environment, and Water (CEEW) revealed that ceiling fans are used by 90% of households in India, making them a significant contributor to electricity consumption.

Growth in Fan Usage:

- The India Cooling Action Plan (ICAP) projects a significant increase in the number of fans in use in India, from approximately 500 million to a billion by 2038, highlighting the growing demand for energy-efficient cooling solutions.

Cooling Demand Reduction Goals:

- The ICAP aims to reduce cooling demand across various sectors by 20-25% by 2037-38. The plan also targets a reduction in refrigerant demand by 25-30% and cooling energy requirements by 25-40% by 2037-38.

Regulatory Changes:

- Mandatory star ratings for ceiling fans and regulatory alterations are incentivizing manufacturers to produce more energy-efficient fan models, further contributing to the transformation of the ceiling fan market.

Government Initiatives to Enhance Ceiling Fan Energy Efficiency

Star Rating Program:

- The Bureau of Energy Efficiency (BEE), India’s energy efficiency regulator under the Union Ministry of Power, has implemented the Standards and Labelling (S&L) program, commonly known as the ‘star-rating’ program, which mandates the labeling of ceiling fans based on their energy efficiency.

- This program informs consumers about a fan’s energy performance through star ratings, allowing them to make informed choices.

- It serves as an incentive for manufacturers to produce more energy-efficient fans to achieve higher star ratings, promoting energy conservation.

Energy Efficiency Services Limited (EESL):

- EESL is addressing the cost challenge of ‘5-star’ rated fans, which are typically more expensive than unrated fans.

- EESL has planned a demand aggregation program aimed at selling 10 million ‘5-star’ ceiling fans at affordable prices.

- This initiative mirrors the successful approach used for LED lamps under the Unnat Jyoti by Affordable Light Emitting Diode (LED) for All (UJALA) program, with the goal of transforming the ceiling fan market by making energy-efficient options more accessible to consumers.

UJALA Programme: Revolutionizing Energy-Efficient Lighting

Program Inception:

- Launched in 2015 as the LED-based Domestic Efficient Lighting Programme (DELP).

- The primary objective is to promote efficient energy usage encompassing consumption, savings, and lighting.

Leadership by EESL:

- Spearheaded by the Energy Efficiency Services Limited (EESL), a prominent agency in India’s energy efficiency initiatives.

World’s Largest Zero Subsidy Programme:

- The UJALA program has evolved to become the world’s largest zero subsidy domestic lighting initiative.

- It addresses critical concerns such as high electrification costs and the environmental impact of inefficient lighting practices.

Objective:

- Initially aimed to replace 77 million incandescent bulbs with energy-efficient LED bulbs.

Price Reduction and Energy Savings:

- A remarkable achievement was the significant reduction in the retail price of LED bulbs, dropping from INR 300-350 to an affordable INR 70-80, making energy-efficient lighting accessible to the masses.

- The program has also yielded substantial energy savings, with a recorded annual energy savings of 47,778 million kWh as of January 5, 2022.

The Way Forward for Enhancing Ceiling Fan Energy Efficiency

- Technology-Agnostic Policy: Maintain a technology-agnostic policy that accommodates various fan technologies, recognizing their trade-offs and advantages.

- Diverse Technologies under Single Framework: Allow manufacturers to offer different technologies under a single procurement framework, promoting healthy competition and cost-effectiveness.

- Balance Price Reduction and Quality: Manage the balance between reducing fan prices and maintaining product quality to ensure long-term reliability and performance.

- Avoid Quality Compromises: Be cautious of intense price pressure that could lead to the introduction of lower-quality fans with higher failure rates, as this can undermine consumer trust.

- Market-Driven Pace: Allow market actors to determine the pace of price reduction, fostering consumer confidence in the adoption of new energy-efficient technology.

- Domestic Manufacturing Capacity: Encourage the development of high-quality domestic manufacturing capacity for high-efficiency fans, creating jobs and supporting the domestic economy.

- Economies of Scale: Leverage India’s vast domestic market to achieve economies of scale for fan products and components, making them more cost-effective.

- Export Opportunities: Explore opportunities for fan exports to countries enforcing minimum energy performance standards, expanding market reach and export revenue.

- Strengthen Standard and Labeling Program: Allocate resources to enhance the standard and labeling program to ensure the authenticity of energy performance labels, promoting transparency.

- Market Monitoring: Utilize market monitoring powers to ensure that compliant products reach consumers, while non-compliant models are swiftly removed from the market.

- Lower Entry Barriers: Lower barriers to selling new energy-efficient fan models in the market, encouraging manufacturers to innovate and offer efficient options.

-Source: The Hindu

Inclusion of India in JPMorgan’s GBI-EM Index

Context:

JPMorgan Chase & Co. is set to include India in its Government Bond Index-Emerging Markets (GBI-EM) index starting in June 2024. This decision anticipates a substantial influx of investments into India’s government bonds. Consequently, this move is likely to expand the investor base and has the potential to result in the appreciation of the Indian Rupee.

Relevance:

GS III: Inclusive Growth

Dimensions of the Article:

- The JPMorgan Government Bond Index-Emerging Markets (GBI-EM) Index

- India’s Inclusion in the JPMorgan GBI-EM Index

- Significance of India’s Inclusion in GBI-EM Index

- Challenges of India’s Inclusion in GBI-EM Index

- Way Forward

The JPMorgan Government Bond Index-Emerging Markets (GBI-EM) Index

- The JPMorgan GBI-EM Index is a widely recognized benchmark index tracking the performance of Sovereign Bonds denominated in local currencies, issued by emerging market countries.

- It serves as a comprehensive gauge of the fixed income market in emerging economies, aiding investors in assessing their performance.

Composition:

- This index encompasses government bonds from a variety of emerging market nations.

- Eligibility criteria determine the inclusion of bonds, and the composition may evolve over time.

India’s Inclusion in the JPMorgan GBI-EM Index

Identification of Eligible Bonds:

- JPMorgan has identified 23 Indian government bonds, collectively valued at USD 330 billion, as meeting the eligibility criteria for inclusion in the GBI-EM.

Weight in Indices:

- India’s presence in the GBI-EM is poised to attain the maximum weight threshold of 10% in the GBI-EM Global Diversified index and approximately 8.7% in the GBI-EM Global index.

Significance:

- With India’s local bonds becoming part of the GBI-EM index and its suite of related indices, these benchmarks influence approximately USD 236 billion in global funds, according to JPMorgan.

Significance of India’s Inclusion in GBI-EM Index

- Attracting Global Investors:

- India’s inclusion in the GBI-EM index positions the country as a highly desirable investment destination for global investors.

- Substantial Inflows:

- This move is anticipated to attract significant investments, with potential inflows estimated at USD 45-50 billion over the next 12-15 months.

- Alleviating Financing Constraints:

- Inclusion in the index provides an alternative source of funds, which can help alleviate financing constraints related to India’s fiscal and current account deficits.

- Reducing Risk Premia and Costs:

- India’s risk premia and funding costs are expected to structurally decrease, enhancing economic stability. Risk premia reflect the return on a risky asset compared to a risk-free asset.

- Corporate Sector Benefits:

- The inclusion is likely to lower the entire yield curve, reducing corporate financing costs, stimulating investment, and fostering business growth.

- Banking Sector Advantages:

- Banks will face less pressure to absorb government bonds, enabling them to allocate more resources for lending to the private sector and promoting economic expansion.

- Infrastructure Development Boost:

- India’s infrastructure development initiatives receive a boost with a sustainable source of long-term financing through government securities.

- Rupee Appreciation:

- The inclusion is expected to lead to the appreciation of the Indian rupee due to increased investor confidence, enhancing the attractiveness of India as an investment destination.

- Integration into Global Markets:

- Integration into global markets, along with ongoing reforms and increased market access, promotes market development and encourages long-term capital inflows.

- Innovation in Financial Products:

- This move sets the stage for the introduction of innovative financial products, enhancing India’s financial markets.

- Parity with Other Economies:

- India is poised to reach a maximum weightage of 10% in the GBI-EM Global Diversified Index, putting it on par with other prominent economies like China, Brazil, Indonesia, and Malaysia in terms of index representation.

Challenges of India’s Inclusion in GBI-EM Index

- Market Volatility:

- Inclusion may introduce volatility in local debt markets, particularly during global economic turmoil or uncertainty, necessitating effective market management and stabilization by the Reserve Bank of India (RBI).

- Balancing Monetary Policy:

- RBI must carefully manage its monetary policy decisions to balance the impact of increased foreign investment with the goal of ensuring domestic economic stability and growth.

- Geo-Political Risks:

- High foreign holding of debt exposes Indian markets to external macro-economic shocks and geopolitical risks, as seen in instances like Russia’s exclusion from international currency markets, highlighting the potential impact of geopolitics on financial flows.

- Exchange Rate Challenges:

- Inclusion may impact the value of the domestic currency, posing challenges in managing exchange rates to maintain competitiveness for exports.

- Greater Scrutiny and Fiscal Responsibility:

- India may face increased scrutiny regarding government finances, necessitating greater transparency and fiscal responsibility in managing the fiscal deficit.

- Tax Treatment for Foreign Investors:

- Unresolved tax treatment for foreign investors could deter potential investors, requiring clear and favorable tax policies to attract foreign capital into Indian government bonds.

- Market Stability and Capital Flows:

- The behavior of foreign investors, especially during global economic shifts, could result in sudden surges or withdrawals of funds, impacting market stability and capital flows.

Way Forward

- Resolve Operational Challenges:

- Address operational challenges related to custody, settlement, and tax implications to facilitate smooth participation of foreign investors.

- Strengthen Regulatory Environment:

- Strengthen the regulatory environment to ensure market integrity, transparency, and investor protection, encouraging long-term participation.

- Enhance Economic Fundamentals:

- Strengthen India’s economic fundamentals to better withstand global economic shifts and fluctuations, minimizing risks associated with external factors.

-Source: Indian Express

Bima Sugam

Context:

Recently, the Insurance Regulatory and Development Authority of India (IRDAI) has formed a steering committee to act as the apex decision-making body for the creation of its ambitious ‘Bima Sugam’ online platform.

IRDAI says Bima Sugam is an electronic marketplace protocol which would universalise and democratize insurance. This protocol will be connected with India Stack.

Relevance:

GS III: Indian Economy

Dimensions of the Article:

- Bima Sugam: Simplifying and Digitizing the Insurance Marketplace

- IRDAI: The Regulatory Authority for Insurance

- India Stack: Unlocking Digital Infrastructure for Transformation

Bima Sugam: Simplifying and Digitizing the Insurance Marketplace

Bima Sugam is an online platform that serves as a one-stop solution for insurance needs, offering various schemes from multiple companies.

Key Features:

- Diverse Insurance Options: Customers can select the most suitable insurance scheme from a range of choices offered by different insurance companies.

- Comprehensive Coverage: Bima Sugam caters to all insurance requirements, including life, health, and general insurance like motor and travel coverage.

- Digital Transformation: The platform aims to simplify and digitize the entire insurance process, encompassing policy purchases, renewals, claim settlements, agent services, and policy portability.

- Customer Assistance: Bima Sugam provides support and guidance to customers for all their insurance-related queries and needs.

- Single Window Management: The proposed platform acts as a single window for policyholders to manage their insurance coverage efficiently.

- End-to-End Solutions: It offers complete end-to-end solutions for customers’ insurance requirements, covering purchase, service, and claims settlement.

- Real-Time Data Access: Insurance companies can access validated and authentic data from various sources in real-time, enhancing efficiency.

- Intermediary Support: The platform serves as an interface for intermediaries and agents to sell policies and offer services to policyholders, reducing paperwork.

- Ownership Structure: Life insurance and general insurance companies each own a 47.5% stake in Bima Sugam, with brokers and agent bodies holding a 2.5% stake.

IRDAI: The Regulatory Authority for Insurance

IRDAI, established in 1999, is a statutory regulatory body overseeing the insurance sector with a focus on customer protection.

Key Information:

- Statutory Body: IRDAI operates under the IRDA Act 1999 and falls under the purview of the Ministry of Finance.

- Regulatory Role: Its primary role is to regulate and foster the development of the insurance industry while monitoring insurance-related activities.

- Powers and Functions: The authority’s powers and functions are defined by the IRDAI Act, 1999, and the Insurance Act, 1938. It ensures compliance with industry regulations and safeguards the interests of insurance customers.

India Stack: Unlocking Digital Infrastructure for Transformation

India Stack is a collection of APIs (Application programming interface) designed to provide a digital infrastructure that addresses India’s challenges in delivering presence-less, paperless, and cashless services.

Key Objectives:

- Solving Complex Problems: India Stack enables governments, businesses, startups, and developers to tackle complex issues by providing digital solutions.

- Economic Primitives: It aims to unlock essential economic elements, including identity, data, and payments, on a massive scale within the population.

Features:

- Lower Transaction Costs: Digital transactions facilitated by India Stack often have lower transaction costs compared to traditional methods. This cost reduction benefits businesses, consumers, and the government, making transactions more efficient and affordable.

- Economic Growth and Social Development: India Stack seeks to bridge wealth gaps and create an efficient and resilient digital economy that drives both economic growth and social development.

Key Components:

- Aadhaar: This component is a unique biometric-based identification system that forms a fundamental part of India Stack, providing a robust and secure way to verify individuals’ identities.

- Unified Payments Interface (UPI): UPI is a platform for instant digital payments, making it easier for people to transact digitally, simplifying the payment process.

- Digital Locker: Digital Locker offers secure storage for personal documents, enhancing the convenience and security of accessing important paperwork and certificates.

-Source: The Hindu

Annular Solar Eclipse

Context:

The Annular solar eclipse will occur on October 14 and will be visible across different parts of the world.

Relevance:

GS-I Geography

Dimensions of the Article:

- Solar eclipse

- Types of Solar Eclipse

- Significant observations during solar eclipses

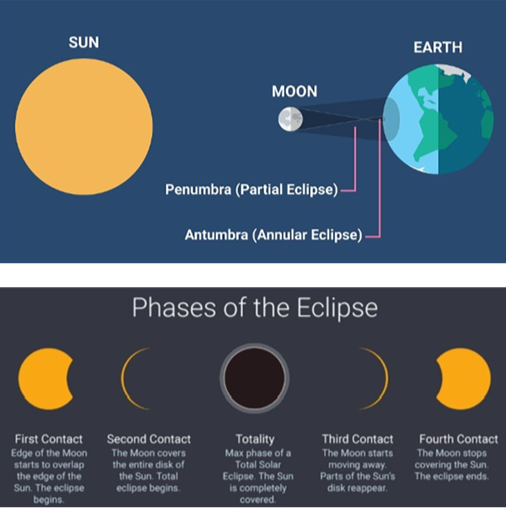

Solar eclipse

- A solar eclipse occurs when a portion of the Earth is covered in a shadow cast by the Moon which fully or partially blocks sunlight.

- This occurs when the Sun, Moon and Earth are aligned.

- Such alignment coincides with a new moon (syzygy) indicating the Moon is closest to the ecliptic plane.

- The Sun’s distance from Earth is about 400 times the Moon’s distance, and the Sun’s diameter is about 400 times the Moon’s diameter. Because these ratios are approximately the same, the Sun and the Moon as seen from Earth appear to be approximately the same size: about 0.5 degree of arc in angular measure.

Types of Solar Eclipse

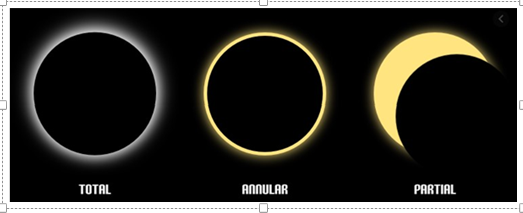

Total Solar Eclipse:

- During a total solar eclipse, the Moon completely covers the Sun from view as seen from a specific location on Earth.

- The sky darkens significantly, and the Sun’s outer atmosphere, known as the solar corona, becomes visible as a bright halo around the obscured Sun.

- Total solar eclipses are rare and can only be observed from a limited geographic area along the eclipse’s path of totality.

Partial Solar Eclipse:

- In a partial solar eclipse, the Moon partially covers the Sun, obscuring only a portion of the Sun’s disk.

- This type of eclipse is visible over a broader geographic region than a total eclipse since it occurs when the Moon partially passes in front of the Sun.

Annular Solar Eclipse:

- An annular solar eclipse occurs when the Moon is near its apogee (farthest from Earth) in its elliptical orbit, causing it to appear smaller than the Sun.

- As a result, the Moon does not completely cover the Sun, and a ring of the Sun’s outer edge, known as the “ring of fire” or annulus, remains visible around the Moon.

- Annular eclipses create a unique and visually striking spectacle.

Hybrid Solar Eclipse (Annular-Total Eclipse):

- A hybrid eclipse is a rare event where an eclipse appears as a total eclipse from some locations on Earth’s surface and as an annular eclipse from others.

- The type of eclipse experienced depends on the viewer’s location within the eclipse’s path.

Why does the Solar Eclipse not occur during every new moon?

- If the Moon were in a perfectly circular orbit, a little closer to the Earth, and in the same orbital plane, there would be total solar eclipses every new moon.

- However, since the Moon’s orbit is tilted at more than 5 degrees to the Earth’s orbit around the Sun, its shadow usually misses Earth.

What are the factors that affect the duration of the eclipse?

- The Moon being almost exactly at perigee (making its angular diameter as large as possible).

- The Earth being very near aphelion (furthest away from the Sun in its elliptical orbit, making its angular diameter nearly as small as possible).

- The midpoint of the eclipse being very close to the Earth’s equator, where the rotational velocity is greatest.

- The vector of the eclipse path at the midpoint of the eclipse aligning with the vector of the Earth’s rotation (i.e. not diagonal but due east).

- The midpoint of the eclipse being near the subsolar point (the part of the Earth closest to the Sun).

Significant observations during solar eclipses

- A total solar eclipse provides a rare opportunity to observe the corona (the outer layer of the Sun’s atmosphere). Normally this is not visible because the photosphere is much brighter than the corona.

- Eclipses may cause the temperature to decrease by up to 3 °C.

- There is a long history of observations of gravity-related phenomena during solar eclipses, especially during the period of totality.

- Confirmation of Einstein’s theory: The observation of a total solar eclipse of 1919, helped to confirm Einstein’s theory of general relativity. By comparing the apparent distance between stars in the constellation Taurus, with and without the Sun between them, Arthur Eddington stated that the theoretical predictions about gravitational lenses were confirmed.

Precautions to take while viewing Solar eclipse

- Looking directly at the photosphere of the Sun (the bright disk of the Sun itself), even for just a few seconds, can cause permanent damage to the retina of the eye, because of the intense visible and invisible radiation that the photosphere emits.

- This damage can result in impairment of vision, up to and including blindness.

- The retina has no sensitivity to pain, and the effects of retinal damage may not appear for hours, so there is no warning that injury is occurring.

- Under normal conditions, the Sun is so bright that it is difficult to stare at it directly, however, during an eclipse, with so much of the Sun covered, it is easier and more tempting to stare at it.

- Special eye protection or indirect viewing techniques are used when viewing a solar eclipse.

- It is safe to view only the total phase of a total solar eclipse with the unaided eye and without protection.

-Source: The Hindu

Sea Urchins

Context:

The Red Sea’s spectacular coral reefs face a new threat, marine biologists warn—the mass death of sea urchins that may be caused by a mystery disease.

Relevance:

GS III: Species in News

Dimensions of the Article:

- Sea Urchins: Fascinating Echinoderms of the Ocean

Sea Urchins: Fascinating Echinoderms of the Ocean

- Sea urchins are a group of marine invertebrates belonging to the echinoderms, a phylum known for its spiny-skinned animals.

- Echinoderms also include well-known marine creatures such as starfish and sea cucumbers.

Physical Characteristics and Habitat:

- Sea urchins are easily recognizable by their spherical to somewhat flattened bodies covered in spines.

- They inhabit oceans worldwide, ranging from shallow coastal waters to deep-sea environments.

- These creatures predominantly reside on the ocean floor, often clinging to hard surfaces, and employ tube feet or spines for locomotion.

- Among them, Sperostoma giganteum, found in the deep waters off Japan, holds the distinction of being the largest urchin, albeit known from a single specimen.

Distinctive Features:

- Sea urchins exhibit a distinctive radial arrangement of organs, with five bands of pores running from the mouth to the anus over their internal skeleton, known as the test.

- These pores house tube feet, which are slender, extendable appendages, sometimes equipped with suckers.

- Sea urchins possess a robust exoskeleton called the test, composed of interlocking plates or ossicles, often adorned with movable spines.

- Long, mobile spines and pedicellariae, pincer-like organs that may contain poison glands, emerge from nodules on the test.

Feeding Habits:

- Sea urchins are primarily herbivorous, with a diet centered on algae and plant material.

- They employ specialized mouthparts, referred to as Aristotle’s lantern, to scrape algae and other food sources from rocks or the seafloor.

- Their feeding behavior plays a crucial role in maintaining the balance of underwater ecosystems by controlling algae growth in marine environments.

-Source: The Hindu

Galactic Tides

Context:

Just as the earth’s oceans at their shores, the universe’s galaxies also experience tides, but on a much larger scale.

Relevance:

GS III: Science and Technology

Dimensions of the Article:

- Galactic Tides: Gravitational Forces Within Galaxies

Galactic Tides: Gravitational Forces Within Galaxies

Galactic tides refer to tidal forces experienced by objects within the gravitational field of a galaxy, such as the Milky Way.

- Causes: Galactic tides are generated by gravitational interactions among celestial objects within a galaxy, including stars and gas clouds.

- Effects of Galactic Tides: These tidal forces exert a profound influence on various aspects of a galaxy’s evolution and dynamics.

- Reshaping Galaxy Structure: Galactic tides can reshape the structure of a galaxy by inducing the formation of tidal tails and bridges, altering its overall appearance.

- Promoting Star Formation: They can play a role in promoting star formation within galaxies by triggering the gravitational collapse of gas and dust clouds.

- Disrupting Smaller Systems: Galactic tides can disrupt smaller star systems or objects within a galaxy, leading to their fragmentation or dispersion.

- Orbital Changes: The tidal forces also affect the orbits of individual stars within a galaxy, resulting in long-term changes in the galaxy’s overall structure.

- Interactions Between Proximate Galaxies: Galactic tides influence how neighboring galaxies interact with one another, determining whether they merge, collide, or maintain their separation.

- Observations in Andromeda: For instance, in the case of the Andromeda galaxy, researchers have observed tidal streams near its edges, which are believed to be signatures of dwarf galaxies that were once captured and subsequently absorbed by Andromeda.

- Effects on Supermassive Black Holes: Galactic tides also impact the behavior of supermassive black holes located at the centers of galaxies, leading to events that alter their interactions with nearby stars and celestial objects.

-Source: The Hindu