Content :

- Flawed food regulations fuel the obesity crisis

- Income levels of salaried class have stagnated in recent years

- What is behind the rise of quick commerce?

- India second-largest arms importer after Ukraine in 2020-24, says SIPRI

- SEBI may rejig short-selling norms

- Looking for a potent cosmic particle accelerator? There’s one near earth

Flawed food regulations fuel the obesity crisis

The Rising Obesity Crisis in India

- Statistics: 1 in 4 Indian adults are obese; 1 in 4 are diabetic or pre-diabetic (NFHS-5).

- Government Response: Government has called for action against obesity; Economic Survey 2025 suggests a ‘health tax’ on ultra-processed foods (UPFs).

Relevance : GS 2(Health)

Failure of Food Regulations

- Weak Labelling Laws:

- The Food Safety and Standards Authority of India (FSSAI) has not enforced labelling and advertising regulations proposed in 2017.

- No front-of-pack (FoP) warning labels exist on HFSS (high fat, sugar, salt) foods.

- Flawed Indian Nutrition Rating (INR) System (2022):

- Modelled on Australia’s unsuccessful ‘health star’ rating.

- Misleading ratings: UPFs like biscuits, soft drinks, and corn flakes receive 2-3 stars despite being unhealthy.

- FSSAI ignored its own 2021 draft regulation recommending traffic light warning labels and bowed to industry pressure.

Advertising and Regulatory Gaps

- Ineffective Advertisement Restrictions:

- Four existing laws to curb HFSS advertising remain weak and ambiguous.

- Consumer Protection Act (2019): Defines misleading ads but does not mandate disclosure of sugar/salt/fat content.

- HFSS and UPFs lack clear definitions and threshold limits under FSSAI rules.

- Impact of Weak Advertising Laws:

- UPFs are widely marketed, especially targeting children.

- Global evidence: Chile’s black warning labels cut UPF consumption by 24%.

. The Way Forward

- Scrap the INR system and introduce mandatory ‘high in’ warning labels as per WHO/NIN guidelines.

- Define HFSS and UPFs with clear sugar, salt, and fat limits.

- Strengthen advertising laws:

- Amend existing laws or create a unified law banning HFSS/UPF ads.

- Launch a public awareness campaign on UPF risks in multiple languages.

Income levels of salaried class have stagnated in recent years

Context : Findings from PLFS Data

- Salaried Class Stagnation: Real wages for salaried workers have stagnated since 2019. In June 2024, they were 1.7% lower than in June 2019.

- Casual Labour Wages Rise: Wages for casual labour increased by 12.3% in real terms since 2019, despite a dip during the pandemic.

- Self-Employment Struggles: Wages for self-employed workers declined by 1.5% in real terms compared to 2019. The share of self-employed workers has increased.

Relevance : GS 3(Income , Economy)

Expert Opinions on Stagnation

- Labour Market Mismatch: Overqualified workforce and lack of well-paying jobs (Anamitra Roychowdhury).

- Skill Deficit: Need for skill development at all levels (Arvind Virmani).

- Low Private Investment: Depressed demand leads to fewer jobs and wage stagnation (Rahul Menon).

Sector-wise Wage Trends

- Salaried Workers

- Wages increased by 2% in June 2020 but dipped by 6% in 2021 and 1% in 2022.

- Declining returns to higher education; employment growth lacks quality.

- Casual Labour

- Real wages rose by over 12% in rural areas and 11.4% in urban areas.

- Growth in casual labour not a net positive due to irregularity and job insecurity.

- Self-Employed Workers

- Rural self-employed wages increased by 3.02%, but urban wages fell by 5.2%.

- Increase in unpaid helpers in household enterprises (from 15.9% in 2019-20 to 19.4% in 2023-24).

- Higher self-employment share is a sign of distress rather than growth.

Macroeconomic Implications

- Weak Consumption Demand: Wage stagnation affects demand, slowing economic growth.

- Policy Impact: Demonetisation and GST led to economic shocks affecting wages.

- Government Response: Budget changes in tax slabs suggest an attempt to address low domestic demand.

Future Outlook

- Private investment remains weak, making wage recovery uncertain.

- Without wage growth, consumption-driven economic growth may remain sluggish.

What is behind the rise of quick commerce?

What is driving the rise of Q-commerce?

- Q-commerce gained popularity during the COVID-19 lockdown as consumers sought rapid delivery services.

- Despite the end of lockdowns, the model has persisted due to convenience, urban demand, and changes in consumer behavior.

- The availability of low-cost, employable manpower in India has boosted operational efficiency.

- Platforms benefit from economies of scale, making it easier to distribute perishable or frozen products without high infrastructure costs.

Relevance : GS 3(Economy , Commerce)

How does Q-commerce function?

- Q-commerce is a subclass of e-commerce that delivers products within 10–20 minutes.

- It relies on dark stores (warehouses dedicated to online order fulfillment) to ensure proximity to customers.

- Unlike traditional retail, Q-commerce leverages customer data from mobile apps to:

- Personalize shopping experiences.

- Predict demand trends (e.g., seasonal or demographic influences).

- Optimize inventory management.

How do dark stores facilitate Q-commerce?

- Dark stores are strategically located mini-warehouses ensuring quick deliveries.

- They eliminate the need for in-person shopping, making fulfillment efficient.

- Their placement in urban centers enables hyper-local distribution.

How does customer data enhance the shopping experience?

- Q-commerce apps track user behavior to offer personalized recommendations.

- Data helps platforms plan inventory efficiently, stocking high-demand products in advance.

- Dynamic pricing and discounts can be optimized based on purchasing patterns.

Market Growth & Economic Impact

- The Indian Q-commerce market was valued at $3.34 billion in 2024 and is projected to reach $9.95 billion by 2029 (Grant Thorton Bharat).

- The sector saw a 76% YoY growth in FY 2024.

- Increased brand visibility benefits retailers and manufacturers, enhancing consumer engagement.

Challenges & Concerns from Traditional Retailers

- Allegations of Anti-Competitive Practices:

- The All-India Consumer Products Distribution Federation (AICPDF) has filed complaints against Blinkit, Zepto, and Swiggy Instamart with the Competition Commission of India (CCI).

- Accusations include predatory pricing, deep discounting, and the use of venture capital funding to eliminate competition.

- Impact on Traditional Retailers:

- Local kirana stores and distributors claim they cannot compete with artificially lowered prices.

- Concerns over data-driven differential pricing, which may disadvantage certain customers.

- Call for Regulation:

- Traditional retail associations demand a level playing field to ensure fair competition.

Conclusion

- Q-commerce has revolutionized shopping habits in urban India, offering speed and convenience.

- The sector is experiencing rapid growth but faces regulatory scrutiny over pricing strategies.

- Balancing innovation with fair competition remains a key challenge in India’s evolving retail landscape.

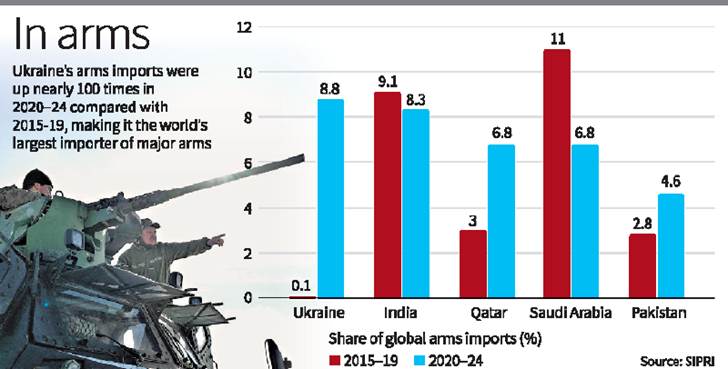

India second-largest arms importer after Ukraine in 2020-24, says SIPRI

Context : Global Arms Imports:

- Ukraine became the largest arms importer globally (2020-24), with a 100-fold rise from 2015-19 due to the ongoing war.

- India ranked second-largest despite a 9.3% decline in imports compared to 2015-19.

- China dropped out of the top 10 arms importers for the first time since 1990-94, reflecting its domestic industrial growth.

Relevance : GS 3(Internal Security)

- India’s Arms Suppliers & Trends:

- Russia remains India’s top supplier, but its share dropped to 36% (from 55% in 2015-19 & 72% in 2010-14).

- France emerged as a key supplier, with India receiving 28% of French arms exports, the highest share among all nations.

- India continues to import major military platforms, including Rafale jets & Scorpene-class submarines, with more deals lined up (e.g., 26 Rafale-M jets & three submarines).

- Pakistan’s Growing Imports:

- Pakistan’s arms imports increased by 61% (2015-19 to 2020-24).

- China dominates as Pakistan’s supplier, providing 81% of total imports (up from 74% in 2015-19).

- Global Arms Export Trends:

- USA expanded its share in global arms exports to 43%.

- Russia’s arms exports declined by 64%, now comprising 7.8% of global exports.

- France became the 2nd largest arms exporter (9.6%), surpassing Russia.

- Italy climbed to 6th place, with a 4.8% share in exports.

- European Arms Build-up:

- European arms imports surged by 155% (2015-19 to 2020-24) due to security concerns post-Ukraine war.

- France’s arms exports to European nations tripled (187%), mainly due to combat aircraft deliveries to Greece, Croatia, and arms supplies to Ukraine post-2022 invasion.

- At least 35 countries have supplied weapons to Ukraine since 2022, accounting for 8.8% of global imports.

- Global Arms Transfer Trends:

- Overall arms transfers remained stable (compared to 2015-19 and 2010-14), with regional variations.

- Major importers like Saudi Arabia, India, and China saw declines due to policy changes, domestic production, or geopolitical factors.

Key Takeaways

- India remains one of the largest arms importers, diversifying suppliers beyond Russia.

- France’s rise as a key defense partner for India signals strategic shifts.

- Pakistan-China defense ties continue to strengthen, with Beijing dominating Pakistan’s imports.

- European arms trade is surging, driven by the Ukraine conflict and NATO’s security concerns.

- Russia’s declining arms exports reflect its geopolitical and economic challenges post-Ukraine war.

Relevance for India

- Strategic Shift: Reduced dependence on Russia, increasing reliance on Western suppliers like France.

- Self-reliance Push: India’s focus on domestic defense production (e.g., Make in India, Atmanirbhar Bharat) may explain the decline in imports.

- Geopolitical Impact: The growing Indo-French defense partnership aligns with India’s broader global security and strategic interests.

SEBI may rejig short-selling norms

SEBI is considering revamping short-selling norms to expand access, remove disclosure requirements, and address settlement challenges.

Relevance : GS 3(Economy )

Broader Short-Selling Access: SEBI is considering allowing short selling for all stocks, except those in the trade-to-trade (T2T) segment.

Removal of Disclosure & Penalty Norms: The regulator may scrap the requirement for upfront short-sale disclosures and penalties imposed by exchanges.

Current Short-Selling Regulations:

- Investors can sell stocks without owning them but must settle the transaction.

- Only stocks in the Futures & Options (F&O) segment are allowed for short selling.

Observations by SEBI:

- Non-institutional investors are already engaging in short selling for non-F&O stocks by squaring off positions within the same day.

Impact of Direct Payout of Securities:

- Strategies like buy-today-sell-tomorrow (BTST) may be affected.

- Stocks purchased in earlier settlements but awaiting delivery may not be counted as short sales.

Expected Regulatory Changes:

- Removal of weekly scrip-wise short-sale disclosure requirement.

- Elimination of penalties for settlement failures at the exchange level, reducing double charges.

Rationale Behind the Move:

- Advancements in clearing and settlement infrastructure (like the Securities Lending and Borrowing Mechanism) make disclosure norms redundant.

- Ensuring a level playing field for brokers by removing the need for real-time access to clients’ demat accounts.

Next Steps: A consultation paper on the proposed changes is expected soon.

Looking for a potent cosmic particle accelerator? There’s one near earth

Scientists discovered that Earth’s bow shock acts as a natural particle accelerator, boosting electrons to near-light speeds. This finding helps explain cosmic ray acceleration and suggests planetary shock interactions may contribute to high-energy particles across the universe.

Relevance : GS 3(Science and Technology)

- Discovery of High-Energy Particles:

- Data from NASA’s MMS, THEMIS, and ARTEMIS missions (2017) revealed an unusual large-scale phenomenon upstream of Earth’s bow shock (where the solar wind meets Earth’s magnetosphere).

- Electrons in the Earth’s foreshock (leading region of the bow shock) were found with 500 keV of energy, moving at 86% the speed of light—far above the usual 1 keV energy levels.

Scientific Significance

- Shock Waves as Natural Particle Accelerators:

- The study, published in Nature Communications, shows that collisionless shock waves (formed in plasma) act as powerful cosmic particle accelerators.

- These waves can energize electrons without direct collisions, using electromagnetic interactions instead.

- Such processes could be responsible for generating high-energy cosmic rays observed across the universe.

- Resolving the “Electron Injection Problem”:

- A major puzzle in astrophysics is how electrons get their first acceleration to 50% the speed of light before further boosting.

- The study identifies multiple plasma acceleration mechanisms occurring in Earth’s foreshock as a potential solution.

Broader Implications

- Connection to Cosmic Phenomena:

- Similar shock waves are found near pulsars, magnetars, black holes, and supernovae.

- The findings suggest planetary systems with massive magnetic fields (e.g., gas giants orbiting close to stars) might produce relativistic electrons via the same process.

- Raises the possibility that some cosmic rays originate not just from supernovae but also from planetary shock interactions.

Future Research Directions

- Further validation required from stellar astrophysics and particle acceleration communities.

- Studying other planetary systems to see if they exhibit similar particle acceleration mechanisms.