Contents:

- NCBC recommends inclusion of 7 castes and sub-castes in OBC list

- Malabar exercise 2024

- RBI keeps benchmark interest rate unchanged

- PM to visit Laos for ASEAN-India summit

- WWF: Global wildlife numbers declined by 73%

- Human-leopard conflict

NCBC recommends inclusion of 7 castes and sub-castes in OBC list

Context:

The National Commission for Backward Classes (NCBC) Wednesday recommended the inclusion of seven castes and sub-castes from the Maharashtra state in the Central list of Other Backward Classes (OBC).

Relevance:

GS II: Polity and Governance

Dimensions of the Article:

- About Other Backward Class (OBC)

- About National Commission for Backward Classes

About Other Backward Class (OBC):

- OBC refers to socially and educationally backward classes of citizens.

- The Supreme Court has ruled that the creamy layer, i.e., socially and economically advanced individuals within the OBC category, should be excluded from reservations.

Role of National Commission for Backward Classes (NCBC):

- NCBC is a statutory body responsible for reviewing requests for caste inclusion in the Central OBC list.

- The commission forms a Bench to examine proposals and forwards its decisions to the Union government.

- Once approved by the cabinet, legislation is enacted, and the President notifies the changes.

Constitutional Provisions:

- Article 15(4) empowers the state to make special provisions for the advancement of socially and educationally backward classes, including OBCs.

- These provisions include reservation of seats in educational institutions, financial assistance, scholarships, and housing.

- Article 16(4) allows the state to enact laws for the reservation of appointments or posts in favor of OBCs.

Achievements of the Union Government:

- Since 2014, the government has added 16 communities to the Central OBC list in Himachal Pradesh, Bihar, Jharkhand, Madhya Pradesh, and Jammu and Kashmir.

- The 105th Amendment to the Constitution affirms states’ rights to maintain their own OBC lists, preserving the benefits for 671 State OBC communities.

About National Commission for Backward Classes

- 102nd Constitution Amendment Act, 2018 provides constitutional status to the National Commission for Backward Classes (NCBC).

- It has the power to look into welfare claims and programmes for socially and academically disadvantaged groups.

- Prior to this, the Ministry of Social Justice and Empowerment was responsible for the NCBC as a statutory organisation.

Background of NCBC

- Two Backward Class Commissions were appointed in 1950s and 1970s under Kaka Kalelkar and B.P. Mandal respectively.

- Kaka Kalelkar commission is also known as the First Backward Classes Commission.

- The Supreme Court ordered the government to establish a permanent committee to consider, investigate, and recommend the inclusion and exclusion of various Backward Classes for the purpose of benefits and protection in the Indra Sawhney case of 1992.

- The National Commission for Backward Classes Act, passed by parliament in 1993 in accordance with these directives, established the NCBC.

- The 123rd Constitution Amendment bill of 2017 was presented in Parliament in order to better protect the interests of underprivileged groups.

- The National Commission for Backward Classes Act, 1993, was repealed by a different law that was approved by Parliament, making the 1993 Act obsolete.

- The bill got the President assent in August 2018 and provided the constitutional status to NCBC.

Composition:

- The Commission consists of:

- Chairperson

- Vice-Chairperson

- Three other Members in the rank and pay of Secretary to the Govt of India.

- Their condition of service and tenure of office has been notified by the Ministry of Social Justice and Empowerment.

- NCBC is headquartered in Delhi.

Constitutional Provisions

- Article 340 deals with the need to, inter alia, identify those “socially and educationally backward classes”, understand the conditions of their backwardness, and make recommendations to remove the difficulties they face.

- 102nd Constitution Amendment Act inserted new Articles 338 B and 342 A.

- The amendment also brings about changes in Article 366.

- will be required if the list of backward classes is to be amended.

NCBC- Powers and Functions

- The commission investigates and monitors all matters relating to the safeguards provided for the socially and educationally backward classes under the Constitution or under any other law to evaluate the working of such safeguards.

- It participates and advises on the socio-economic development of the socially and educationally backward classes and to evaluate the progress of their development under the Union and any State.

- It presents to the President, annually and at such other times as the Commission may deem fit, reports upon the working of those safeguards. The President laid such reports before each House of Parliament.

- Where any such report or any part thereof, relates to any matter with which any State Government is concerned, a copy of such report shall be forwarded to the State Government.

- NCBC has to discharge such other functions in relation to the protection, welfare and development and advancement of the socially and educationally backward classes as the President may, subject to the provisions of any law made by Parliament, by rule specify.

- It has all the powers of a civil court while trying a suit.

-Source: The Hindu, The Indian Express

Malabar exercise 2024

Context:

Vice Admiral Rajesh Pendharkar recently observed that the Indian Ocean Region (IOR) and the Indo-Pacific Region (IPR) are becoming increasingly vital for global security and economic stability.

- He made the above statement while addressing representatives of the three friendly navies of the U.S., Japan and Australia before the commencement of the Harbour Phase of Malabar-2024.

Relevance:

GS III: Security Challenges

About Malabar naval exercise

- The Malabar naval exercise is a bilateral naval exercise between India and the US Navy that started in 1992.

- The exercise was expanded into a trilateral format with the inclusion of Japan in 2015.

- In 2020, the Australian Navy joined the Malabar Exercise, making it a quadrilateral naval exercise.

- The first Malabar Exercise in the Bay of Bengal took place in 2007.

- The aim of the Malabar Exercise of India, the US, Japan and Australia is to coordinate for a free, open, and inclusive Indo-Pacific.

- The exercise takes place annually in the Indian Ocean and Pacific Oceans alternatively.

- The Malabar Exercise includes a diverse range of activities such as fighter combat operations and maritime interdiction operations.

-Source: The Hindu, The Indian Express

RBI keeps benchmark interest rate unchanged

Context:

The Reserve Bank of India (RBI) maintained its repo rate at 6.50% for the tenth successive monetary policy review since April 2023.

Relevance:

GS III- Indian Economy

Dimensions of the Article:

- Details

- What is the repo rate?

- Why is the repo rate such a crucial monetary tool?

- How does the repo rate work?

- What impact can a repo rate change have on inflation?

- Recent Monetary Policy and RBI Decisions

- Instruments of Monetary Policy

- About Monetary Policy Committee (MPC)

Details:

- Following the Monetary Policy Committee (MPC) meeting, RBI Governor announced the decision to keep the policy repo rate steady at 6.5% for the tenth time in a row.

- Other key rates also remained unchanged, with the standing deposit facility (SDF) rate at 6.25% and both the marginal standing facility (MSF) rate and the bank rate at 6.75%.

- The MPC has decided to change the stance of monetary policy to neutral while remaining unambiguously focused on a durable alignment of inflation with the target, alongside supporting growth.

What is the repo rate?

- The repo rate is one of several direct and indirect instruments that are used by the RBI for implementing monetary policy.

- Specifically, the RBI defines the repo rate as the fixed interest rate at which it provides overnight liquidity to banks against the collateral of government and other approved securities under the liquidity adjustment facility (LAF).

- In other words, when banks have short-term requirements for funds, they can place government securities that they hold with the central bank and borrow money against these securities at the repo rate.

- Since this is the rate of interest that the RBI charges commercial banks such as State Bank of India and ICICI Bank when it lends them money, it serves as a key benchmark for the lenders to in turn price the loans they offer to their borrowers.

Why is the repo rate such a crucial monetary tool?

- According to Investopedia, when government central banks repurchase securities from commercial lenders, they do so at a discounted rate that is known as the repo rate.

- The repo rate system allows central banks to control the money supply within economies by increasing or decreasing the availability of funds.

How does the repo rate work?

- Besides the direct loan pricing relationship, the repo rate also functions as a monetary tool by helping to regulate the availability of liquidity or funds in the banking system.

- For instance,

- When the repo rate is decreased,

- Banks may find an incentive to sell securities back to the government in return for cash. This increases the money supply available to the general economy.

- When the repo rate is increased,

- Lenders would end up thinking twice before borrowing from the central bank at the repo window thus, reducing the availability of money supply in the economy.

- When the repo rate is decreased,

- Since inflation is, in large measure, caused by more money chasing the same quantity of goods and services available in an economy, central banks tend to target regulation of money supply as a means to slow inflation.

What impact can a repo rate change have on inflation?

- Inflation can broadly be: mainly demand driven price gains, or a result of supply side factors that in turn push up the costs of inputs used by producers of goods and providers of services, thus spurring inflation, or most often caused by a combination of both demand and supply side pressures.

- Changes to the repo rate to influence interest rates and the availability of money supply primarily work only on the demand side by making credit more expensive and savings more attractive and therefore dissuading consumption.

- However, they do little to address the supply side factors, be it the high price of commodities such as crude oil or metals or imported food items such as edible oils.

Instruments of Monetary Policy

There are several direct and indirect instruments that are used for implementing monetary policy.

- Repo Rate: The (fixed) interest rate at which the Reserve Bank provides overnight liquidity to banks against the collateral of government and other approved securities under the liquidity adjustment facility (LAF).

- Reverse Repo Rate: The (fixed) interest rate at which the Reserve Bank absorbs liquidity, on an overnight basis, from banks against the collateral of eligible government securities under the LAF.

- Liquidity Adjustment Facility (LAF): The LAF consists of overnight as well as term repo auctions. Progressively, the Reserve Bank has increased the proportion of liquidity injected under fine-tuning variable rate repo auctions of range of tenors. The aim of term repo is to help develop the inter-bank term money market, which in turn can set market based benchmarks for pricing of loans and deposits, and hence improve transmission of monetary policy. The Reserve Bank also conducts variable interest rate reverse repo auctions, as necessitated under the market conditions.

- Marginal Standing Facility (MSF): A facility under which scheduled commercial banks can borrow additional amount of overnight money from the Reserve Bank by dipping into their Statutory Liquidity Ratio (SLR) portfolio up to a limit at a penal rate of interest. This provides a safety valve against unanticipated liquidity shocks to the banking system.

- Corridor: The MSF rate and reverse repo rate determine the corridor for the daily movement in the weighted average call money rate.

- Bank Rate: It is the rate at which the Reserve Bank is ready to buy or rediscount bills of exchange or other commercial papers. The Bank Rate is published under Section 49 of the Reserve Bank of India Act, 1934. This rate has been aligned to the MSF rate and, therefore, changes automatically as and when the MSF rate changes alongside policy repo rate changes.

- Cash Reserve Ratio (CRR): The average daily balance that a bank is required to maintain with the Reserve Bank as a share of such per cent of its Net demand and time liabilities (NDTL) that the Reserve Bank may notify from time to time in the Gazette of India.

- Statutory Liquidity Ratio (SLR): The share of NDTL that a bank is required to maintain in safe and liquid assets, such as, unencumbered government securities, cash and gold. Changes in SLR often influence the availability of resources in the banking system for lending to the private sector.

- Open Market Operations (OMOs): These include both, outright purchase and sale of government securities, for injection and absorption of durable liquidity, respectively.

- Market Stabilisation Scheme (MSS): This instrument for monetary management was introduced in 2004. Surplus liquidity of a more enduring nature arising from large capital inflows is absorbed through sale of short-dated government securities and treasury bills. The cash so mobilised is held in a separate government account with the Reserve Bank.

About Monetary Policy Committee (MPC)

- The Monetary Policy Committee (MPC) is the body of the RBI, headed by the Governor, responsible for taking the important monetary policy decisions about setting the repo rate.

- Repo rate is ‘the policy instrument’ in monetary policy that helps to realize the set inflation target by the RBI (at present 4%).

Membership of the MPC

- The Monetary Policy Committee (MPC) is formed under the RBI with six members.

- Three of the members are from the RBI while the other three members are appointed by the government.

- Members from the RBI are the Governor who is the chairman of the MPC, a Deputy Governor and one officer of the RBI.

- The government members are appointed by the Centre on the recommendations of a search-cum-selection committee which is to be headed by the Cabinet Secretary.

Objectives of the MPC

Monetary Policy was implemented with an initiative to provide reasonable price stability, high employment, and a faster economic growth rate.

The major four objectives of the Monetary Policy are mentioned below:

- To stabilize the business cycle.

- To provide reasonable price stability.

- To provide faster economic growth.

- Exchange Rate Stability.

-Source: The Hindu, The Indian Express

PM to visit Laos for ASEAN-India summit

Context:

The prime Minister of India will visit Laos on October 10-11 to attend the 21st ASEAN-India and the 19th East Asia Summits that are being hosted by Laos.

Relevance:

GS II: International Relations

Dimensions of the Article:

- About Association of Southeast Asian Nations (ASEAN)

- East Asia Summit (EAS)

- India and its Role in the East Asia Summit (EAS)

About Association of Southeast Asian Nations (ASEAN)

The Association of Southeast Asian Nations (ASEAN) is a regional intergovernmental organization comprising Ten Countries in Southeast Asia.

Members of ASEAN

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Brunei

- Vietnam

- Laos

- Myanmar

- Cambodia

ASEAN’s Objectives:

- To promote intergovernmental cooperation and facilitates economic, political, security, military, educational, and sociocultural integration among its members and other countries in Asia.

- To maintain close and beneficial cooperation with existing international and regional organisations.

- To promote regional peace and stability through abiding respect for justice and the rule of law and adherence to the principles of the United Nations Charter.

- To accelerate economic growth, social progress and cultural development for a prosperous and peaceful community of Southeast Asian Nations.

A major partner of Shanghai Cooperation Organisation, ASEAN maintains a global network of alliances and dialogue partners and is considered by many as the central union for cooperation in Asia-Pacific.

- The motto of ASEAN is “One Vision, One Identity, One Community”.

- ASEAN is headquartered in Jakarta, Indonesia.

- 8th August is observed as ASEAN Day.

- In 1967 ASEAN was established with the signing of the ASEAN Declaration (Bangkok Declaration) by its founding fathers: Indonesia, Malaysia, Philippines, Singapore and Thailand.

- Chairmanship of ASEAN rotates annually, based on the alphabetical order of the English names of Member States.

- ASEAN is the 3rd largest market in the world – larger than EU and North American markets.

ASEAN Plus Three

ASEAN Plus Three is a forum that functions as a coordinator of co-operation between the ASEAN and the three East Asian nations of China, South Korea, and Japan.

ASEAN Plus Six

- further integration to improve existing ties of Southeast Asia was done by the larger East Asia Summit (EAS), which included ASEAN Plus Three as well as India, Australia, and New Zealand.

- The group became ASEAN Plus Six with Australia, New Zealand, and India, and stands as the linchpin of Asia Pacific’s economic, political, security, socio-cultural architecture, as well as the global economy.

- This group acted as a prerequisite for the planned East Asia Community which was supposedly patterned after the European Community (now transformed into the European Union).

ASEAN-India Trade in Goods Agreement (AITIGA)

- The ASEAN-India Trade in Goods Agreement was signed and entered into force in 2010.

- Under the Agreement, ASEAN Member States and India have agreed to open their respective markets by progressively reducing and eliminating duties on more than 75% coverage of goods.

ASEAN-India Trade in Services Agreement (AITISA)

- The ASEAN-India Trade in Services Agreement was signed in 2014.

- It contains provisions on transparency, domestic regulations, recognition, market access, national treatment and dispute settlement.

ASEAN-India Investment Agreement (AIIA)

- The ASEAN-India Investment Agreement was signed in 2014.

- The Investment Agreement stipulates protection of investment to ensure fair and equitable treatment for investors, non-discriminatory treatment in expropriation or nationalisation as well as fair compensation.

ASEAN-India Free Trade Area (AIFTA)

- The ASEAN–India Free Trade Area (AIFTA) is a free trade area among the ten member states of the Association of Southeast Asian Nations (ASEAN) and India.

- The free trade area came into effect in 2010.

- The ASEAN–India Free Area emerged from a mutual interest of both parties to expand their economic ties in the Asia-Pacific region.

- India’s Look East policy was reciprocated by similar interests of many ASEAN countries to expand their interactions westward.

- The signing of the ASEAN-India Trade in Goods Agreement paves the way for the creation of one of the world’s largest FTAs – a market of almost 1.8 billion people with a combined GDP of US $ 2.8 trillion.

- The AIFTA will see tariff liberalisation of over 90% of products traded between the two dynamic regions, including the so-called “special products,” such as palm oil (crude and refined), coffee, black tea and pepper.

East Asia Summit (EAS)

- The East Asia Summit (EAS) was established in 2005 as an initiative led by the Association of Southeast Asian Nations (ASEAN).

- It serves as a leader-led forum in the Indo-Pacific region, bringing together key partners to address strategic political, security, and economic issues.

Principles and Values:

- The EAS operates based on the principles of openness, inclusiveness, respect for international law, and the centrality of ASEAN as the driving force behind the forum.

Proposal and First Summit:

- The idea of an East Asia Grouping was first proposed by then Malaysian Prime Minister Mahathir Mohamad in 1991.

- The first EAS summit was held in Kuala Lumpur, Malaysia, on 14 December 2005.

Membership:

- The EAS comprises 18 members, including the 10 ASEAN countries and eight dialogue partners.

- ASEAN countries: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam.

- Dialogue partners: Australia, China, India, Japan, New Zealand, Republic of Korea, Russia, and the United States.

Summit Timing and Supportive Meetings:

- The EAS is typically held alongside ASEAN Leaders’ meetings in the fourth quarter of each year.

- It is supported by various ministerial and senior officials’ meetings, addressing various sectors like foreign affairs, economy, defense, and education.

Priority Areas of Cooperation:

- The EAS focuses on six priority areas of cooperation: environment and energy, education, finance, global health issues and pandemic diseases, natural disaster management, and ASEAN connectivity.

Broad Range of Topics:

- In addition to the priority areas, the EAS also covers other topics of common interest and concern, such as trade and investment, regional architecture, maritime security, non-proliferation, counterterrorism, and cyber security.

India and its Role in the East Asia Summit (EAS)

Founding Member and Active Participant:

- India has been a founding member of the East Asia Summit since its establishment in 2005.

- It has consistently participated in all EAS meetings and activities, showcasing its commitment to regional cooperation.

Enhancing Act East Policy:

- India sees the EAS as a crucial platform to strengthen its Act East Policy, which aims to deepen engagement and foster stronger ties with East and Southeast Asian nations.

- Through the EAS, India seeks to enhance economic, political, and strategic partnerships with ASEAN and other countries in the region.

Unveiling Indo-Pacific Oceans Initiative (IPOI):

- During the EAS in Bangkok in November 2019, India unveiled the Indo-Pacific Oceans Initiative (IPOI).

- The IPOI is a strategic initiative aimed at forging partnerships to create a secure and stable maritime domain in the Indo-Pacific region.

Contributions to EAS Cooperation:

- India actively contributes to various fields of cooperation within the EAS framework.

- Its contributions encompass areas like disaster management, renewable energy, education, health, connectivity, maritime security, and counterterrorism.

-Source: The Hindu, The Indian Express

WWF: Global wildlife numbers declined by 73%

Context:

According to the World Wide Fund (WWF) for Nature’s Living Planet Report (LPR) 2024, there has been a 73% decline in the average size of monitored wildlife populations from 1970-2020.

Relevance:

GS III: Environment and Ecology

Dimensions of the Article:

- Key findings of the Report

- What is the Living Planet Index?

- About WWF

Key findings of the report:

- The Nature’s Living Planet Report (LPR) 2024 says that there is a decline in the average size of ‘monitored wildlife populations’ in just 50 years (1970-2020).

- The report also noted the decline in population of three vulture species in India between 1992 and 2002.

- It noted strongest decline in freshwater populations (85 per cent) followed by terrestrial (69 per cent) and marine populations (56 per cent) among the 34,836 monitored wildlife populations of 5,495 vertebrate species of amphibians, birds, fish, mammals and reptiles.

- The report finds that habitat loss and degradation and overharvesting, driven primarily by our global food system are the dominant threats to wildlife populations around the world, followed by invasive species, disease and climate change.

- Significant declines in wildlife populations negatively impact the health and resilience of our environment and push nature closer to disastrous tipping points– critical thresholds resulting in substantial and potentially irreversible change.

What is the Living Planet Index?

- It works as an indicator of biodiversity health. It measures the state of the world’s biological diversity based on the population trends of vertebrate species.

- UN Convention on Biological Diversity (CBD) has adopted LPI as the indicator of progress towards the convention’s 2011-12 target to take actions to halt biodiversity loss.

- Institute of Zoology (ZSL) manages the Living Planet Index.

What does the Living Planet Index not monitor?

- The numbers of species lost or extinct

- Percentage of species declining

- Percentage of populations or individuals lost

About WWF:

- It is an international non-governmental organization

- It is the world’s largest conservation organization

- Founded in 1961

- Headquarter — Gland (Switzerland).

- Aim : Wilderness preservation & the reduction of human impact on the environment

Objectives:

- Conserving the world’s biological diversity

- Ensuring that the use of renewable natural resources is sustainable

- Promoting the reduction of pollution and wasteful consumption

-Source: The Hindu, The Times of India

Human-leopard conflict

Context:

A 40 year old women was killed in leopard attack in Junnar forest of Pune district. This incident marks the seventh death from human-leopard conflict in the Junnar forest division since March and the second in this village.

Relevance:

GS3- Biodiversity and Conservation

Dimensions of the Article:

- Rising Human-Wildlife Interactions in India

- About the Indian Leopard

- Way Forwards to prevent Man – Animal Conflicts

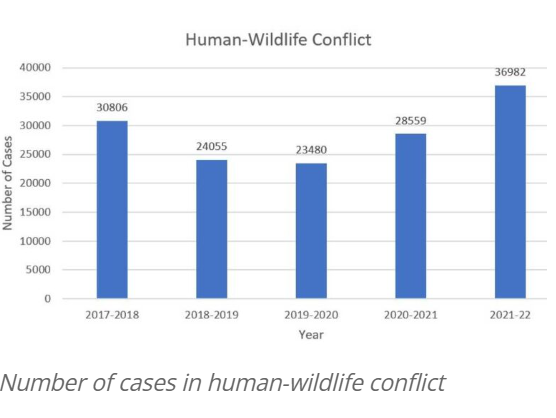

Rising Human-Wildlife Interactions in India:

In India, the increasing occurrence of human-wildlife interactions is undeniable. Given the inevitability of conflicts with wildlife, it’s crucial to seek better solutions beyond reactive capture and relocation, which have often proven unsustainable or even harmful to the animals involved.

About the Indian Leopard:

Scientific Name: Panthera pardus

Overview:

- Leopards, characterized by their elusive and nocturnal nature, exhibit variations in size and color influenced by their habitat.

- Known for their adept climbing skills, they often seek refuge in trees to conceal their prey and avoid competition.

Geographical Distribution:

- Belonging to the cat family, leopards inhabit a diverse range of regions, including Asia, sub-Saharan Africa, Southern Russia, and the Indian subcontinent.

- The Indian leopard, scientifically identified as Panthera pardus fusca, is prominently found across the Indian subcontinent.

Habitat:

Leopards showcase notable adaptability in terms of their habitat preferences and dietary needs. They are commonly spotted in agro-pastoral landscapes, plantations, and in close proximity to human settlements, encompassing both rural and urban areas.

Conservation Status:

- Leopards are classified as ‘Vulnerable’ on the IUCN Red List and are listed under Appendix I of CITES.

- The Wildlife Protection Act of 1972 designates them under Schedule I, acknowledging their need for stringent protection measures.

Population in India:

- According to the ‘Status of Leopards in India, 2018’ report released by the Ministry of Environment, Forest and Climate Change (MoEF&CC), there was a remarkable “60% increase in the population count of leopards in India compared to the 2014 estimates.”

- The ‘Status of Leopards in India, 2022’ report, published by the Union Environment Ministry on February 29, reveals an approximate leopard count of 13,874 in India, marking an increase from the 2018 figure of 12,852.

Associated Concerns:

Man-Animal Conflict:

Leopards in India inhabit a variety of landscapes, ranging from dense forests to urban areas. However, their proximity to human settlements often results in conflicts, as leopards enter villages in search of food or territory, leading to attacks on livestock and occasionally on humans. Such encounters pose significant threats to both leopard populations and human communities.

Poaching:

Moreover, poaching remains a profitable enterprise, with influential individuals anonymously employing locals; it is crucial to identify and hold them accountable.

Climate Change and other Issues:

Climate change exacerbates these challenges by modifying natural habitats and prey availability. Additionally, forest fragmentation, biodiversity loss, and other changes contribute to the stress on leopard populations.

Way Forwards to prevent Man – Animal Conflicts

- Surveillance- Increased vigilance and protection of identified locations using hi-tech surveillance tools like sensors can help in tracking the movement of animals and warn the local population.

- Improvement of habitat- In-situ and ex-situ habitat conservation measures will help in securing animals their survival.

- Re-locating of animal habitats away from residential and commercial centres will serve to minimize animal-man conflict for illegal and self-interested motives

- Awareness Programmes- To create awareness among people and sensitize them about the Do’s and Don’ts in the forest areas to minimize the conflicts between man and animal.

- Training programs– Training to the police offices and local people should be provided for this purpose forest department should frame guidelines.

- Boundary walls- The construction of boundary walls and solar fences around the sensitive areas to prevent the wild animal attacks.

- Technical and financial support- For the development of necessary infrastructure and support facilities for immobilization of problematic animals through tranquilization, their translocation.

- Part of CSR- Safeguarding Tiger corridors, building eco-bridges and such conservation measures can be part of corporate social responsibility.

-Source: The Hindu, The Indian Express