Context:

The development of Bitcoin and thousands of other cryptocurrencies in a little over a decade has changed the definition of money – due to which a parallel universe of alternative financial services has come into existence, allowing crypto businesses to move into traditional banking territory.

Relevance:

GS-III: Indian Economy (Banking, Money, Monetary Policy), GS-III: Science and Technology (Developments in Science and Technology, Application of Technology in Daily life, Blockchain technology)

Dimensions of the Article:

- What are cryptocurrencies?

- How are they different from actual currency?

- Alternative Services Offered by Cryptocurrencies

- About Decentralized Finance: An alternative finance ecosystem

What are cryptocurrencies?

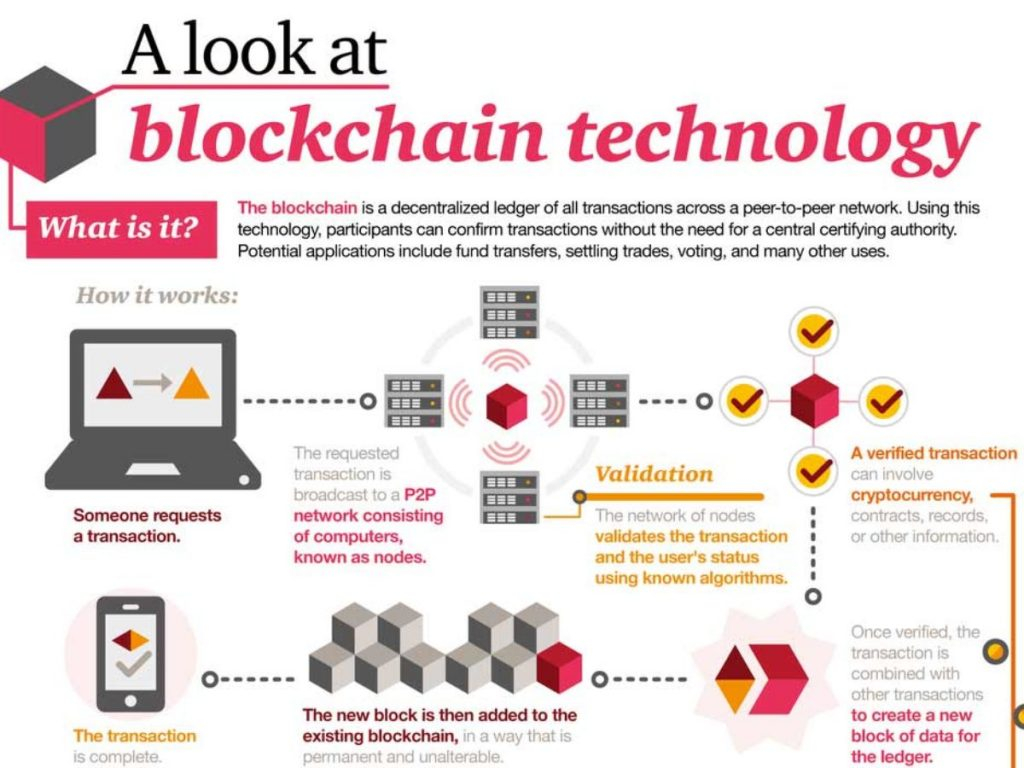

- Cryptocurrencies are e-currencies that are based on decentralized technology and operate on a distributed public ledger called the blockchain.

- Blockchain records all transactions updated and held by currency holders.

- The technology allows people to make payments and store money digitally without having to use their names or a financial intermediary such as banks.

- Cryptocurrency units such as Bitcoin are created through a ‘mining’ process which involves using a computer to solve numerical problems that generate coins.

- Bitcoin was one of the first cryptocurrencies to be launched and was created in 2009.

How are they different from actual currency?

- The Main difference is that unlike actual currencies cryptocurrencies are not issued by Governments.

- Actual money is created or printed by the government which has a monopoly in terms of issuing currency. Central banks across the world issue paper notes and therefore create money and assign paper notes their value.

- Money created through this process derives its value via government fiat, which is why the paper currency is also called fiat currency.

- In the case of cryptocurrencies, the process of creating the currency is not monopolized as anyone can create it through the mining process.

How do cryptocurrencies derive their value?

- Any currency has its value if it can be exchanged for goods or services and if it is a store of value (it can maintain purchasing power over time).

- Cryptocurrencies, in contrast to fiat currencies, derive their value from exchanges.

- The extent of involvement of the community in terms of demand and supply of cryptocurrencies helps determine their value.

Alternative Services Offered by Cryptocurrencies

- Most notably, lending and borrowing are the primary kind of services offered by Cryptocurrencies.

- Investors can earn interest on their holdings of digital currencies – often a lot more than they could on cash deposits in a bank – or borrow with crypto as collateral to back a loan.

- However, it is important to note that Deposits are not guaranteed – along with which Cyberattacks, extreme market conditions, or other operational or technical difficulties could lead to a temporary or permanent halt on withdrawals or transfers.

About Decentralized Finance: An alternative finance ecosystem

- Decentralized finance, or DeFi, loosely describes an alternative finance ecosystem where consumers transfer, trade, borrow and lend cryptocurrency, theoretically independently of traditional financial institutions and the regulatory structures.

- The DeFi movement aims to “disintermediate” finance, using computer code to eliminate the need for trust and middlemen from transactions.

- DeFi platforms are structured to become independent from their developers and backers over time and to ultimately be governed by a community of users.

Benefits

- Innovators argue that crypto fosters financial inclusion. Consumers can earn unusually high returns on their holdings, unlike at banks.

- Crypto finance gives people long excluded by traditional institutions the opportunity to engage in transactions quickly, cheaply and without judgment. As crypto backs their loans, the services generally require no credit checks, although some take customer identity information for tax reporting and anti-fraud purposes. On a DeFi protocol, users’ personal identities are generally not shared, since they are judged solely by the value of their crypto.

-Source: Indian Economy