Focus: GS-III Indian Economy

Introduction, How Indirect tax varies from Direct tax

- Direct taxes are progressive in nature – the rich pay at a higher rate than the poor – and a fall in share of direct taxes in total revenue entails retrogression in the tax burden.

- Indirect taxes do not make the distinction between rich and the poor in a sense that Petrol is sold at the same rate whether it is meant for a motorcycle or an expensive car, and the tax paid for that is the same.

Two Crucial contradictions in Indian Economy

- India’s political economy landscape has two basic contradictions. Agriculture produces less than 15% of the GDP, but employs more than 40% of workers.

- Just a little over 50 million of India’s 400 million workers pay income taxes.

Recent Developments

- In July 2019, finance minister imposed a surcharge on the super-rich, which took the peak income tax rate to 42.7%.

- Towards the end of 2019, the government announced a major reduction in corporate tax rates, which it then estimated would lead to a revenue loss of Rs 1.45 lakh crore.

- The share of direct taxes in the Centre’s gross total revenue came down by 2.5% points from the 2018-19 level.

Reading the Data:

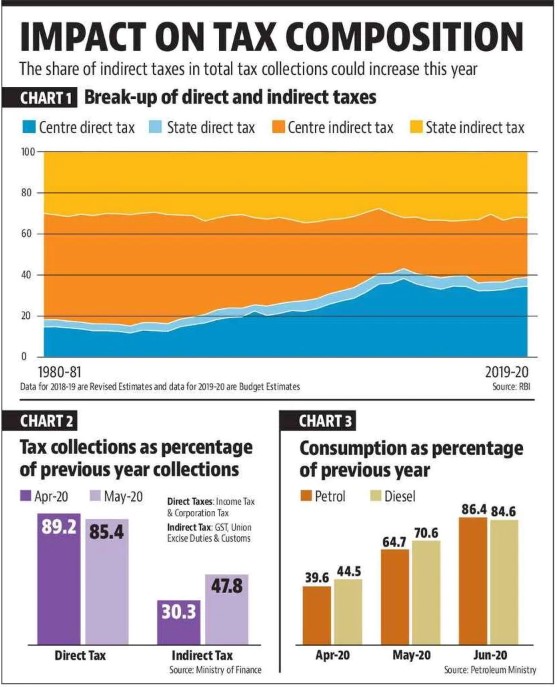

- RBI data shows that direct taxes, which include income tax and corporate tax, had a share of less than 40% in total tax revenue of the centre and states.

- The share of direct taxes increased sharply in the decade preceding the 2008 financial crisis.

- The share of direct taxes reached a peak in 2009-10 and has stagnated at a slightly lower value since.

How will the pandemic affect this distribution?

- A comparison on a year on year basis shows direct taxes suffered a bigger shortfall in comparison to indirect taxes in the first two months of the fiscal year.

- Total collection of corporate tax and income tax in April and May was almost 15% less than the collection in the same months of 2019, and similarly, collection of the Goods and Services Tax (GST), customs and excise duties, three major indirect tax heads is more than 50% less than that in 2019.

- While indirect tax collections vis-a-vis previous year’s collections improved in May, direct tax numbers seem to have followed the reverse trend.

Recovery in sight?

- Both the central and state governments have increased taxes on petrol and diesel rather than passing the advantage of low crude prices to the consumers.

- With petrol and diesel consumption inching back to normal levels, governments will make a windfall in taxes.

- Companies might have held back on lay-offs and pay-cuts in the early months of the lockdown, and as the lockdown was not short-lived as the companies would have hoped for – this means that outlook on profits and salaries, and therefore direct tax collections, will worsen overtime.

-Source: Hindustan Times