Focus: GS-III Agriculture, Indian Economy

Why in news?

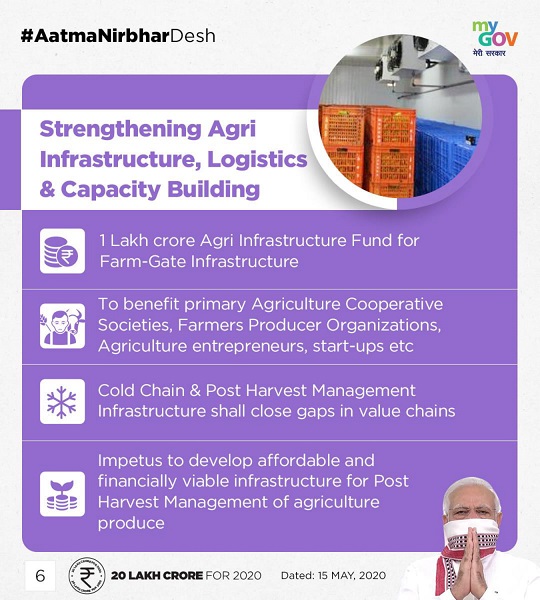

Prime Minister launched a new Central Sector Scheme of financing facility under the Agriculture Infrastructure Fund of Rs. 1 Lakh Crore.

Highlights of the Agriculture Infrastructure Fund

- Agriculture Infrastructure Fund is a pan India central sector scheme to inject formal credit into farm and farm-processing based activities.

- The Aim is to provide medium – long term debt financing facility for investment in viable projects for post-harvest management Infrastructure and community farming assets.

- The fund was initially announced during the Third Tranche of Aatmanirbhar Bharat Economic Stimulus Package

- This scheme provides a good opportunity for start-ups in agriculture to avail the benefits and scale their operations, thereby creating an ecosystem that reaches farmers in every corner of the country.

Details of the Agriculture Infrastructure Fund

- The Agriculture Infrastructure Fund is a medium – long term debt financing facility for investment in viable projects for post-harvest management infrastructure and community farming assets through interest subvention and credit guarantee.

- The Agriculture Infrastructure Fund will be financed and managed by the National Bank for Agriculture and Rural Development (NABARD).

- Financing will be provided by banks and financial institutions as loans to Primary Agricultural Credit Societies (PACS), Marketing Cooperative Societies, Farmer Producers Organizations (FPOs), Self Help Group (SHG), Farmers, Joint Liability Groups (JLG), Multipurpose Cooperative Societies, Agri-entrepreneurs and Central/State agencies or Local Bodies sponsored by Public Private Partnership Projects.

- The funds will be provided for setting up of cold stores and chains, warehousing, silos, assaying, grading and packaging units, e-marketing points linked to e-trading platforms and ripening chambers, besides PPP projects for crop aggregation sponsored by central/state/local bodies.

- A credit guarantee coverage will be available for eligible borrowers from the scheme under Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme for a loan up to Rs. 2 crores.

- The fund will be managed and monitored through an online Management Information System (MIS) platform. It will enable all the qualified entities to apply for loan under the Fund.

What is a Centrally Sector Scheme?

- Under Central sector schemes, it is 100% funded by the Union government and implemented by the Central Government machinery.

- Central sector schemes are mainly formulated on subjects from the Union List.

- In addition, the Central Ministries also implement some schemes directly in States/UTs which are called Central Sector Schemes but resources under these Schemes are not generally transferred to States.

How is it different from Centrally Sponsored Schemes?

- Under Centrally Sponsored Scheme (CSS) a certain percentage of the funding is borne by the States in the ratio of 50:50, 70:30, 75:25 or 90:10 and the implementation is by the State Governments.

- Centrally Sponsored Schemes are formulated in subjects from the State List to encourage States to prioritise in areas that require more attention.

National Bank for Agriculture and Rural Development (NABARD)

- NABARD is a development bank focussing primarily on the rural sector of the country.

- It is a statutory body established in 1982 under Parliamentary act; National Bank for Agriculture and Rural Development Act, 1981.

- NABARD is the Apex banking institution to provide finance for Agriculture and rural development which is Headquartered at Mumbai.

- It is responsible for the development of the small industries, cottage industries, and any other such village or rural projects.