Context:

The International Labour Organisation’s observation of lagging job growth due to the rise in automation and artificial intelligence, jobless growth, and unemployment in India has sparked widespread debate about implementing universal basic income as a safety net.

Example 1: World Economic Forum’s Future of Jobs Report 2023 projects 83 million job losses due to AI and another economic driver over the next five years.

Example 2: In June 2024, the unemployment rate in India rose to 9.2%, according to data from the Centre for Monitoring Indian Economy (CMIE).

Relevance: GS2 ( Social justice ), GS3 ( Indian Economy ).

Practice question: Discuss how universal basic income can act as an efficient social net. Explain its advantages and disadvantages highlighting implementational challenges. (250 words ).

History :

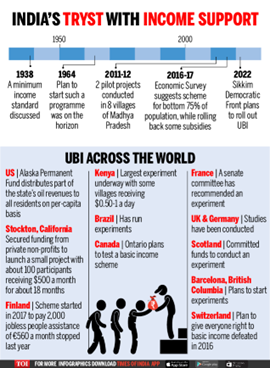

- The earliest mention is traced back to 16th-century philosopher Thomas More’s work Utopia(1516), where he describes guaranteed income for everyone in the society.

- Madhya Pradesh Pilot: Conducted by the Self-Employed Women’s Association (SEWA) in 2011-2012, this pilot provided Rs 200 per month to each adult in selected villages.

- 2016-17: The Economic Survey mentions UBI as a potential policy, and advocates UBI as an alternative tool to various welfare schemes to address poverty in India.

Debate of feasibility and desirability :

Pro-Feasibility Arguments:

- JAM Infrastructure: The Jan-Dhan, Aadhaar, and Mobile (JAM) infrastructure is already established, which can facilitate the direct transfer of UBI benefits efficiently.

- Pilot Programs: Experiments like SEWA’s pilot in Madhya Pradesh have demonstrated positive outcomes in poverty reduction, suggesting UBI’s potential for scalability.

Anti-Feasibility Arguments:

- High Fiscal Cost: may require 3.5% to 11% of GDP annually which is higher than annual spending on public health.

- Infrastructure Gaps: Digital connectivity, especially in rural areas, is uneven, which could hinder smooth implementation and delivery.

Pro-Desirability Arguments:

- Poverty Alleviation: By providing a social security net for the poor.

- Economic Stability: especially for the informal sector involved, which lacks institutional social security.

- Social Equity: UBI promotes inclusive growth, ensuring all citizens, regardless of employment, have a minimum income.

- Ex: Dpsp’s Article 38: state to minimise inequalities in income, status, facilities, and opportunities

- Simplification of Welfare: inefficient welfare schemes can be replaced

Anti-Desirability Arguments:

- Work Disincentives: A guaranteed income might reduce people’s motivation to work, leading to decreased labour participation.

- Inflation Risk: Injecting cash into the economy could fuel inflation, particularly for essential goods.

- Dependency Culture: This may increase dependency, discouraging individuals from seeking employment or self-sufficiency.

- Resource Misallocation: UBI is not targeted, meaning wealthier individuals also benefit, which may be an inefficient use of resources compared to targeted programs.

Features of Universal Basic Income (UBI)

- Unconditional: UBI is provided without any conditions or means-testing.

- Regular Payments: distributed monthly / annually ensuring steady income.

- Individual-Based: individuals are recognized for payments rather than household, promoting individual financial security

- Universality in Coverage: it will be provided universally rather than to specific groups like women, the elderly, etc.

- Monetary support: should cover basic living expenses, and should be provided in cash, not in the kind.

EX: The public distribution system(PDS) is not considered UBI as it provides support in-kind.

- Complementary to Existing Programs: UBI can be designed to complement existing welfare schemes.

- Simplification: UBI aims to simplify the welfare schemes by addressing complexities and preventing duplication of schemes.

State and Central Income Transfer Schemes in India

- Rythu Bandhu Scheme (RBS): Launched in Telangana in early 2018, providing unconditional payments of ₹4,000 per acre to farmers.

- Krushak Assistance for Livelihood and Income Augmentation (KALIA): Odisha’s initiative targets farmers, providing financial aid to small, marginal farmers, and landless agricultural labourers.

- Pradhan Mantri Kisan Samman Nidhi (PM-KISAN): Launched in 2018-19, initially for small landholding farmers, later expanded to all farmers. Provides ₹6,000 per year, excluding income taxpayers and non-farming entities.

Concerns and Counter-arguments :

- Wealth Distribution: The notion of providing basic income to the wealthy is often contested. However, in advanced economies, individuals pay taxes and receive government support in various forms. The net impact on their income, considering taxes, is minimal.

- Financial Feasibility: Large-scale UBI proposals can be costly (3.5%-11% of GDP). Funding such initiatives would require cutting existing programs or significantly raising taxes.

- Alternative Approach: A limited universal income transfer pegged at 1% of GDP could provide approximately ₹144 per month per person. This is more feasible and similar to PM-KISAN’s scale.

Implementation Challenges:

- Cash-out Points (COPs): Ensuring access to COPs is crucial for smooth disbursement.

- Network and Biometric Authentication: Addressing failures in these systems is essential to prevent exclusion.

- Electronic Payment Devices: Ensuring the reliability of these devices is critical for last-mile delivery of benefits.

Hybrid Model Proposal :

- Modified UBI as a Base: A limited universal income transfer as a foundational policy, complemented by other targeted transfer policies, when appropriate.

Example: Combining with MGNREGA, which provides 100 days of employment but may exclude those unable to work, such as the elderly or disabled.

- Complementary Transfers: The COVID-19 pandemic demonstrated the need for both income and in-kind transfers. Income helps during supply chain disruptions, while food access is vital when people lack purchasing power.

Conclusion :

Drawing inspiration from the Alaska Permanent Fund, which has successfully provided annual dividends to residents and reduced poverty, a well-structured UBI could provide a financial safety net for all citizens.

By ensuring a basic level of income for everyone, UBI has the potential to alleviate economic insecurity, promote social equity, and foster inclusive growth in India.