CONTENTS

- Fighting Fraud in Aadhaar-enabled Payment System (AePS) with Artificial Intelligence

- Commission Submits OBC Sub-Categorisation Report to President

- National Nursing and Midwifery Commission Bill 2023

- National Dental Commission Bill 2023

- Challenges Faced by UDAN Regional Connectivity Scheme

- PM SVANidhi

- Seven Unique Indian Crafts Receive Geographical Indication Tags

- Offshore Areas Minerals (Development and Regulation) Amendment Bill, 2023

Fighting Fraud in Aadhaar-enabled Payment System (AePS) with Artificial Intelligence

Context:

As more frauds related to the Aadhaar-enabled Payment System (AePS) come to the fore, the Unique Identification Authority of India (UIDAI), has turned to artificial intelligence-based systems in a bid to limit the cases.

Relevance:

GS II: Polity and Governance

Dimensions of the Article:

- Aadhar Act, 2016

- Aadhaar-enabled Payment System (AePS)

- Rise in Aadhaar-enabled Payment Frauds and UIDAI’s AI-based Solutions

- Unique Identification Authority of India (UIDAI)

Aadhar Act, 2016:

- The Aadhaar Act, passed in March 2016, provides legal support to the Aadhaar unique identification number project in India.

Objectives:

- To establish a legal basis for the Aadhaar unique identification number system.

- To facilitate targeted delivery of subsidies and services to individuals in India through Aadhaar numbers.

Major Features of the Act:

- Eligibility: Every resident of India is entitled to obtain an Aadhaar number.

- Information to be Submitted: Biometric (photograph, fingerprint, iris scan) and Demographic (name, date of birth, address) information.

- Use of Aadhaar Number: Aadhaar numbers can be used to verify the identity of individuals receiving subsidies or services. Public and private entities can accept Aadhaar numbers as proof of identity for various purposes.

- Protection of Information: Biometric data is used only for enrolment and authentication purposes and is not shared publicly. Unauthorized access to the centralized database is punishable.

- Offences & Penalties: Unauthorized access to the Aadhaar database may result in imprisonment and a fine. The act specifies penalties for unauthorized disclosure of information.

Aadhaar-enabled Payment System (AePS)

Identity Verification and Banking Access:

- AePS enables bank customers to use their Aadhaar number as their identity to access their Aadhaar-enabled bank accounts.

- Customers can perform basic banking transactions using this service.

Basic Banking Transactions:

- AePS allows customers to perform various banking activities, including:

- Balance enquiry

- Cash withdrawal

- Remittances through a Business Correspondent.

Mandatory Requirements: To avail AePS, customers must meet the following criteria:

- Possess a Bank Account with a Bank participating in AePS.

- Link their Aadhaar to the respective bank account.

Biometric Authentication:

- Transactions under AePS are completed using the customer’s biometric authentication.

- This ensures secure and reliable access to banking services.

Rise in Aadhaar-enabled Payment Frauds and UIDAI’s AI-based Solutions:

Increasing Financial Crimes:

- The number of financial crimes reported in India surged from 2.62 lakhs in 2020-21 to 6.94 lakhs in 2022.

- Limited awareness about cyber frauds leads to underreporting to authorities.

UIDAI’s AI-based Solutions:

- Aadhaar Fingerprint Technology: Launched in February 2023, it uses finger minutiae and image to verify liveness of fingerprints.

- Preventing Fake Fingerprints: The technology identifies real/live fingers from cloned ones to prevent fraudulent activities.

Facial Recognition-based Authentication:

- Airtel Payments Bank collaborated with NPCI to introduce facial recognition-based authentication for Aadhaar-enabled payments.

Limits of Technological Measures:

- Challenges in AePS Fraud: Technology may fail to thwart frauds involving business correspondents (BCs) in the payment supply chain.

- Misrepresentation by BCs: BCs may manipulate transactions, misreporting higher amounts than paid to individuals without generating receipts.

- Fingerprint Cloning: Instances of fingerprint cloning may still pose challenges for AI-based technologies.

Unique Identification Authority of India (UIDAI):

- Establishment: UIDAI is a statutory authority established under the Aadhaar Act 2016.

- Purpose: It issues 12-digit Unique Identification numbers (UID) known as “Aadhaar” to all Indian residents.

- Responsibilities under Aadhaar Act 2016:

- Aadhaar Enrolment and Authentication

- Operation and Management of Aadhaar Life Cycle

- Policy, Procedure, and System Development for Aadhaar Issuance

- Authentication and Security of Identity Information and Records

- Aadhaar Numbers Issued: As of November 30, 2022, UIDAI has issued over 135 crore Aadhaar numbers to Indian residents.

- Nodal Ministry: UIDAI operates under the Ministry of Electronics and Information Technology (MeitY).

Source: Indian Express

Commission Submits OBC Sub-Categorisation Report to President

Context:

A commission, led by Justice G Rohini, was appointed in 2017 to examine the sub-categorisation of Other Backward Classes (OBCs). Recently, the commission submitted its report to President Droupadi Murmu. However, the details of the report have not been disclosed publicly yet.

Relevance:

GS II: Polity and Governance

Dimensions of the Article:

- What is sub-categorisation of OBCs?

- G Rohini Commission: Investigating OBC Sub-Categorisation

- Challenges Faced by the G Rohini Commission:

What is sub-categorisation of OBCs?

- The idea is to create sub-categories within the larger group of OBCs for the purpose of reservation.

- OBCs are granted 27% reservation in jobs and education under the central government.

- This has been a legal debate for other reservation categories too: in September 2021, a Constitution Bench of the Supreme Court reopened the debate on sub-categorisation of Scheduled Castes and Scheduled Tribes for reservations.

- For OBCs, the debate arises out of the perception that only a few affluent communities among the over 2,600 included in the Central List of OBCs have secured a major part of the 27% reservation.

- The argument for creating sub-categories within OBCs is that it would ensure “equitable distribution” of representation among all OBC communities.

- It was to examine this that the Rohini Commission was constituted on October 2, 2017.

G Rohini Commission: Investigating OBC Sub-Categorisation

- The commission was established in 2017 under Article 340 of the Constitution with the approval of the President of India.

- Article 340 empowers the President to appoint a commission to investigate OBC issues and provide recommendations.

Terms of Reference:

- Investigate the inequitable distribution of reservation benefits among OBCs.

- Develop criteria and norms for sub-categorisation within OBCs using a scientific approach.

- Identify and classify respective castes, communities, and sub-castes in the Central List of OBCs.

- Review the entries in the Central List of OBCs and suggest changes if needed.

Data Analysis:

- The commission analyzed data of central government jobs and OBC admissions to higher education institutions.

- Findings revealed that 97% of jobs and seats went to 25% of OBC castes, with 10 OBC communities obtaining 24.95% of these opportunities.

- 983 OBC communities had zero representation in jobs and education, and 994 OBC sub-castes had a representation of only 2.68% due to limitations in updated population data.

Challenges Faced by the G Rohini Commission:

Lack of Data on OBC Population:

- The commission faced challenges due to the absence of data on the population of various OBC communities.

- This made it difficult to compare their representation in jobs and admissions accurately.

Request for All-India Survey:

- In December 2018, the commission asked the government for a budgetary provision to conduct an all-India survey to estimate the population of different OBCs.

- However, later, it decided not to undertake the survey at that stage.

Demand for Caste Census:

- OBC groups and most political parties, except the BJP central leadership, have been demanding a caste census.

- The Bihar legislature passed resolutions twice unanimously, calling for a caste census.

- The Patna High Court dismissed a challenge to the Bihar government’s decision to conduct a caste survey, allowing the exercise in the state.

Source: Indian Express

National Nursing and Midwifery Commission Bill 2023

Context:

Recently, the Lok Sabha passed National Nursing and Midwifery Commission Bill (NNMC), 2023.

Relevance:

GS II: Polity and Governance

Dimensions of the Article:

- Introduction to the NNMC Bill, 2023

- Key Features of the National Nursing and Midwifery Commission (NNMC) Bill, 2023

Introduction to the NNMC Bill, 2023:

- The National Nursing and Midwifery Commission (NNMC) Bill, 2023 is a significant healthcare legislation aimed at reforming and enhancing the nursing and midwifery professions in India.

- It proposes the establishment of the National Nursing and Midwifery Commission as a regulatory body to oversee these professions.

Creation of the National Nursing and Midwifery Commission (NNMC):

- The primary objective of the NNMC Bill is to establish the National Nursing and Midwifery Commission (NNMC) as the regulatory authority responsible for governing nursing and midwifery professionals in the country.

- This body will play a crucial role in setting standards, regulations, and guidelines to ensure the quality and effectiveness of nursing and midwifery services.

Repealing the Indian Nursing Council Act, 1947:

- As part of the reforms, the NNMC Bill proposes to repeal the existing Indian Nursing Council Act of 1947.

- This act is outdated and no longer aligned with the current needs and demands of the nursing and midwifery profession.

- Over the years, these professions have evolved significantly in terms of education, training, practice, and service standards.

- The NNMC Bill aims to replace the outdated act with a modern and comprehensive regulatory framework.

Key Features of the National Nursing and Midwifery Commission (NNMC) Bill, 2023:

National Nursing and Midwifery Commission (NNMC):

- Composition: The NNMC will be comprised of 29 members.

- Chairperson: The chairperson must hold a postgraduate degree in nursing and midwifery and possess 20 years of field experience.

- Ex-officio Members: The commission will include members from the Department of Health and Family Welfare, National Medical Commission, Military Nursing Services, and Directorate General of Health Services.

- Other Members: Additional members will be selected from nursing and midwifery professionals and charitable institutions.

- Functions: The NNMC will be responsible for framing policies and regulating standards for nursing and midwifery education. It will also oversee the uniform admission process for nursing and midwifery institutions, regulate these institutions, and establish standards for faculty in teaching institutions.

Autonomous Boards:

- Nursing and Midwifery Undergraduate and Postgraduate Education Board: This board will regulate education and examinations at the undergraduate and postgraduate levels.

- Nursing and Midwifery Assessment and Rating Board: This board will provide the framework for assessing and rating nursing and midwifery institutions.

- Nursing and Midwifery Ethics and Registration Board: This board will regulate professional conduct and promote ethics in the nursing and midwifery profession.

State Nursing and Midwifery Commissions:

- Establishment: State governments will constitute State Nursing and Midwifery Commissions.

- Composition: These commissions will consist of 10 members, including representatives from the health department and nursing/midwifery colleges.

- Functions: State Commissions will be responsible for enforcing professional conduct, maintaining state registers, issuing certificates of specialization, and conducting skill-based examinations.

Establishment of Institutions:

- Permission: New nursing and midwifery institutions or an increase in seats/postgraduate courses will require permission from the Assessment and Rating Board.

- Appeals Process: If approval is denied, an appeals process is available to the National Commission and the Central Government.

Practicing as a Professional:

- Enrollment: Individuals must be enrolled in the National or State Register to practice nursing or midwifery.

- Consequences of Non-compliance: Non-compliance may result in imprisonment or a fine.

Advisory Council:

- Composition: The Advisory Council will include representatives from each State and Union Territory, the Ministry of Ayush, University Grants Commission, National Assessment and Accreditation Council, Indian Council of Medical Research, and nursing/midwifery professionals.

- Role: The council will provide advice and support to the National Commission on nursing and midwifery education, services, training, and research.

Source: The Hindu

National Dental Commission Bill 2023

Context:

Recently, the Lok Sabha passed National Dental Commission bill, 2023.

Relevance:

GS II: Polity and Governance

Dimensions of the Article:

- National Dental Commission Bill, 2023

- Key Features of the National Dental Commission

National Dental Commission Bill, 2023:

About: The National Dental Commission Bill is a legislative proposal aimed at regulating and advancing the field of dentistry in India. It focuses on improving dental healthcare practices and services across the country.

Key Features:

Establishment of National Dental Commission (NDC):

- The bill seeks to create the National Dental Commission as the central regulatory body responsible for overseeing the dental profession.

Repeal of Dentists Act, 1948:

- The existing Dentists Act of 1948 will be abolished and replaced by the new National Dental Commission for more effective regulation.

Key Features of the National Dental Commission:

Composition of NDC:

- The National Dental Commission will consist of 33 members, headed by a highly experienced and distinguished dentist as the Chairperson.

- The Chairperson will be appointed by the central government based on the recommendation of a search-cum-selection committee chaired by the Cabinet Secretary.

- Ex-officio members of the commission will include Presidents of three autonomous Boards, Director General of Health Services, and the Chief of the Centre for Dental and Educational Research at AIIMS.

- Part-time members will include faculty members from government dental institutes and representatives from states and union territories.

Functions of NDC:

- The NDC will be responsible for regulating various aspects of dental education, institutions, research, and infrastructure.

- It will ensure admissions to dental courses through the National Eligibility-cum-Entrance Test (NEET).

Autonomous Boards:

- Under the NDC, three autonomous boards will be established to handle specific areas:

- Undergraduate and Postgraduate Dental Education Board: This board will determine education standards, develop curricula, and grant recognition to dental qualifications.

- Dental Assessment and Rating Board: Responsible for assessing compliance procedures for dental institutions, granting permissions for establishing new institutions, and conducting inspections and ratings.

- Ethics and Dental Registration Board: This board will maintain national registers of dentists and dental auxiliaries, handle license suspensions/cancellations, and regulate ethical standards and the scope of dental practice.

State Dental Councils:

- State Dental Councils will be established within a year, tasked with maintaining registers of dentists, addressing grievances, and implementing the provisions of the bill.

Entrance Examinations:

- Admission to the Bachelor of Dental Surgery program will be conducted through NEET.

- A National Exit Test (Dental) will be introduced for licensing and postgraduate admissions.

- Clearing the National (Exit) Test will grant a license to practice dentistry, but registration in the state/national register will be required before commencing practice.

Dental Advisory Council:

- The bill proposes the formation of the Dental Advisory Council, which will provide advice to the National Dental Commission on various aspects such as education, training, research, and equitable access to dental education.

- Ex-officio members of the Commission will also serve as ex-officio members of the Dental Advisory Council.

Source: The Hindu

Challenges Faced by UDAN Regional Connectivity Scheme

Context:

UDAN, a Regional Connectivity Scheme (RCS) of the Ministry of Civil Aviation is facing challenges due to many airports built under the scheme not being able to be operationalized. Despite the claims of building 74 airports, only 11 greenfield airports have become operational since May 2014.

Relevance:

GS II: Government policies and Interventions

Dimensions of the Article:

- About Ude Desh Ka Aam Naagrik (UDAN)

- Different Phases of the Scheme:

- Objectives

- Performance of the UDAN Scheme: Enhancing Air Connectivity

About Ude Desh Ka Aam Naagrik (UDAN):

Nodal: Ministry of Civil Aviation (MoCA)

- It is a regional airport development and “Regional Connectivity Scheme” (RCS) of the Union Government of India.

- The scheme envisages providing connectivity to un-served and under-served airports of the country through the revival of existing airstrips and airports.

Funding Pattern for the Scheme

Concession by Central Government, State Governments/UTs, and Airport Operators:

- The scheme aims to reduce the cost of operations on regional routes.

- The Central Government, State Governments/UTs, and airport operators will provide concessions to airlines operating on these routes.

Financial Viability Gap Funding (VGF) Support:

- VGF support will be provided to bridge the gap, if any, between the cost of airline operations and expected revenues on regional routes.

- The VGF will be a joint effort between the Ministry of Civil Aviation and the respective State Government.

VGF Sharing Ratios:

- The VGF support will be shared between the Ministry of Civil Aviation and the State Government in a ratio of 80:20.

- For States in the North-Eastern region and Union Territories, the VGF sharing ratio will be 90:10.

Different Phases of the Scheme:

UDAN 1.0

- Under this phase, 5 airlines companies were awarded 128 flight routes to 70 airports (including 36 newly made operational airports)

UDAN 2.0

- In 2018, the Ministry of Civil Aviation announced 73 underserved and unserved airports.

- For the first time, helipads were also connected under phase 2 of UDAN scheme.

UDAN 3.0

Key Features of UDAN 3 included:

- Inclusion of Tourism Routes under UDAN 3 in coordination with the Ministry of Tourism.

- Inclusion of Seaplanes for connecting Water Aerodromes.

- Bringing in a number of routes in the North-East Region under the ambit of UDAN.

UDAN 4.0:

- The 4th round of UDAN was launched in December 2019 with a special focus on North-Eastern Regions, Hilly States, and Islands.

- The airports that had already been developed by Airports Authority of India (AAI) are given higher priority for the award of VGF (Viability Gap Funding) under the Scheme.

- Under UDAN 4, the operation of helicopter and seaplanes is also been incorporated.

UDAN 5.0 Scheme

The 5th round of the scheme has introduced several changes, including:

- Focus on Category-2 and Category-3: The current round of the scheme is targeted towards Category-2 (20-80 seats) and Category-3 (>80 seats) aircraft.

- No restriction on stage length: The earlier cap of 600 km on stage length has been waived off, allowing airlines to operate flights on any distance between the origin and destination.

- Increased Viability Gap Funding (VGF) cap: The VGF to be provided will be capped at 600 km stage length for both Priority and Non-Priority areas, which was earlier capped at 500 km.

- Shorter deadline for commencement of operations: Airlines would be required to commence operations within 4 months of the award of the route. Earlier this deadline was 6 months.

Objective:

- To create affordable yet economically viable and profitable flights on regional routes so that flying becomes affordable to the common man even in small towns.

- To stimulate regional air connectivity and making air travel affordable to the masses.

- The scheme envisages providing connectivity to un-served and underserved airports of the country through the revival of existing air-strips and airports. The scheme is operational for a period of 10 years.

- UDAN is a market driven ongoing scheme where bidding rounds are conducted periodically for covering more destinations/stations and routes under the scheme.

- Interested airlines assess the demand on particular routes connecting these airports and submit their proposals at the time of bidding.

Performance of the UDAN Scheme

Growth in Connected Airports:

- Before the launch of the UDAN Scheme, India had only 76 airports connected by scheduled commercial flights since 1911.

- Since 2014, the number of operational airports has significantly increased to 141, demonstrating substantial growth in air connectivity.

Expansion of Routes:

- The UDAN Scheme has initiated 479 new routes, creating a network that reaches various regions across the country.

- As a result, air connectivity has been extended to more than 29 States and Union Territories, connecting previously underserved areas.

Passenger Outreach:

- The UDAN Scheme has had a notable impact on passenger accessibility and convenience.

- Over one crore passengers have availed the benefits of this scheme, enjoying improved air travel opportunities and enhanced connectivity.

Challenges to the RCS Scheme:

Commercial Viability of Routes:

- Some routes identified under UDAN are commercially unviable for airlines due to low demand, affecting profitability.

- 225 out of 479 launched routes have ceased operations.

Inadequate Airport Infrastructure:

- Remote regions lack adequate airport infrastructure, posing challenges for airlines.

- Upgradation and improvements are required to meet safety standards and handle increased air traffic.

Viability Gap Funding Issues:

- Subsidies and viability gap funding provided to airlines on selected routes faced challenges as some routes remained commercially unviable.

High Operating Costs:

- Airlines operating in remote areas face higher operating costs, including increased fuel expenses, maintenance costs, and logistical challenges.

Cap on Airfares:

- The cap on airfares for RCS flights can impact airlines’ revenue potential, discouraging them from operating on certain routes.

Lack of Awareness:

- Limited awareness among potential passengers about air travel options under UDAN can limit demand and utilization of regional air services.

Way Forward for UDAN Regional Connectivity Scheme:

- Government, aviation industry stakeholders, and local authorities should work together to address the challenges and find effective solutions.

- Invest in improving airport infrastructure in remote regions to handle increased air traffic and ensure safety standards.

- Ensure timely and efficient disbursement of subsidies and viability gap funding to airlines operating on selected routes.

- Identify and address operational challenges faced by airlines, such as high operating costs and logistical issues.

- Launch awareness campaigns to inform potential passengers about the availability and benefits of regional air travel under UDAN.

- Regularly monitor and evaluate the performance of routes and airports to identify any issues and make necessary improvements.

- Encourage innovation in the aviation sector to find innovative solutions to enhance connectivity and reduce operational costs.

- Re evaluate the airfare cap for RCS flights to strike a balance between affordability and airlines’ revenue sustainability.

-Source: The Hindu

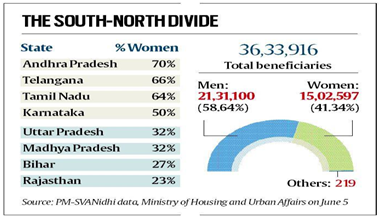

PM SVANidhi

Context:

The Union Housing and Urban Affairs Ministry recently set a new target for its PM SVANidhi scheme for street vendors

Relevance:

GS II- Government policies and interventions

Dimensions of the Article:

- PM Street Vendor’s Atmanitbhar Nidhi (PM SVANidhi)

- PM SVANidhi and SIDBI

- Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE)

- Performance of the Scheme on 3-year Completion

PM Street Vendor’s Atmanitbhar Nidhi (PM SVANidhi)

- PM SVANidhi is a Special Micro-Credit Facility.

- PM SVANidhi was launched by the Ministry of Housing and Urban Affairs for providing affordable Working Capital loan to street vendors to resume their livelihoods that have been adversely affected due to Covid-19 lockdown.

- Under the Scheme, the vendors can avail a working capital loan of up to Rs. 10,000, which is repayable in monthly instalments in the tenure of one year.

- The scheme promotes digital transactions through cash back incentives.

- Beneficiaries: 50 lakh Street Vendors.

- The Government of India has extended the PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi) Scheme beyond March, 2022 with the following provisions:

- Extension of lending period till December 2024;

- Introduction of 3rd loan of upto ₹50,000 in addition to 1st & 2nd loans of ₹10,000 and ₹20,000 respectively.

- To extend ‘SVANidhi Se Samriddhi’ component for all beneficiaries of PM SVANidhi scheme across the country

The eligible vendors are identified as per following criteria:

- Street vendors in possession of Certificate of Vending / Identity Card issued by Urban Local Bodies (ULBs);

- The vendors, who have been identified in the survey but have not been issued Certificate of Vending / Identity Card;

- Street Vendors, left out of the ULB led identification survey or who have started vending after completion of the survey and have been issued Letter of Recommendation (LoR) to that effect by the ULB / Town Vending Committee (TVC); and

- The vendors of surrounding development/ peri-urban / rural areas vending in the geographical limits of the ULBs and have been issued Letter of Recommendation (LoR) to that effect by the ULB / TVC.

PM SVANidhi and SIDBI

- Small Industries Development Bank of India (SIDBI) is the Implementation Agency for PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi)

- SIDBI will also manage the credit guarantee to the lending institutions through Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

- SIDBI will leverage the network of lending Institutions like Non-Bank Finance Companies (NBFCs), Co-operative Banks etc., for the Scheme implementation.

Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE)

- The Ministry of Micro, Small and Medium Enterprises, GoI and Small Industries Development Bank of India (SIDBI), established a Trust named Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) to implement the Credit Guarantee Fund Scheme for Micro and Small Enterprises.

- Beneficiaries: New and existing Micro and Small Enterprises engaged in manufacturing or service activity excluding Educational Institutions, Agriculture, Self Help Groups (SHGs), Training Institutions etc., are eligible.

- Fund and non-fund based (Letters of Credit, Bank Guarantee etc.) credit facilities up to Rs 200 lakh per eligible borrower are covered under the guarantee scheme provided they are extended on the project viability without collateral security or third-party guarantee.

Performance of the Scheme on 3-year Completion:

Beneficiary Demographics:

- In 10 states and UTs, primarily in the Southern and North-East regions, women constitute the majority of the beneficiaries.

- Kerala is an exception as it has implemented its own programs like Kudumbashree, which promotes women’s empowerment.

- The social fabric of these regions, such as matrilineal societies in Meghalaya, contributes to women outnumbering men as beneficiaries.

- In Meghalaya, where the youngest daughter inherits property and women are involved in operating enterprises, the scheme has had a significant impact.

Targeting Women’s Self-Help Groups (SHGs):

- In certain states, the scheme has specifically targeted women’s self-help groups (SHGs) as beneficiaries.

- Andhra Pradesh’s MEPMA (Mission for Elimination of Poverty in Municipal Areas) was already collaborating with SHGs and included them as beneficiaries of the scheme.

-Source: The Hindu

Seven Unique Indian Crafts Receive Geographical Indication Tags

Context:

The Geographical Indications Registry in Chennai has awarded Geographical Indication (GI) tags to seven products from different regions of India, showcasing the country’s diverse craftsmanship.

Relevance:

GS III: Indian Economy

Dimensions of the Article:

- New GI Tags for Indian Crafts

- Geographical Indications (GI) Tag

New GI Tags for Indian Crafts:

- ‘Jalesar Dhatu Shilp’ – Craft of Decorative Metal and Brassware from Jalesar, Uttar Pradesh.

- ‘Mankurad Mango’ (also known as ‘Malcorada’) – Unique Variety of Mangoes from Goa.

- ‘Goan Bebinca’ – Traditional Indo-Portuguese Pudding, the ‘Queen of Goan Desserts’.

- Rajasthan’s GI Tags:

- Udaipur Koftgari Metal Craft.

- Bikaner Kashidakari Craft.

- Jodhpur Bandhej Craft.

- Bikaner Usta Kala Craft.

Geographical Indications (GI) Tag

Definition and Importance:

- Geographical Indications of Goods indicate the country or place of origin of a product.

- They assure consumers of the product’s quality and distinctiveness derived from its specific geographical locality.

- GI tags are an essential component of intellectual property rights (IPRs) and are protected under international agreements like the Paris Convention and TRIPS.

Administration and Registration:

- Geographical Indications registration in India is governed by the Geographical Indications of Goods (Registration and Protection) Act, 1999.

- The registration and protection are administered by the Geographical Indication Registry under the Department of Industry Promotion and Internal Trade (DIPIT), Ministry of Commerce and Industry.

- The registration is valid for 10 years, and it can be renewed for further periods of 10 years each.

Significance and Examples:

- GI tags provide a unique identity and reputation to products based on their geographical origin.

- The first product in India to receive a GI tag was Darjeeling tea.

- Karnataka has the highest number of GI tags with 47 registered products, followed by Tamil Nadu with 39.

Ownership and Proprietorship:

- Any association, organization, or authority established by law can be a registered proprietor of a GI tag.

- The registered proprietor’s name is entered in the Register of Geographical Indication for the applied product.

- Protection and Enforcement:

- Geographical Indications protect the interests of producers and prevent unauthorized use of the product’s name or origin.

- Enforcement of GI rights helps maintain the quality and reputation of the products associated with their specific geographical regions.

Location of the Geographical Indications Registry:

- The Geographical Indications Registry is located in Chennai, India.

-Source: Indian Express

Offshore Areas Minerals (Development and Regulation) Amendment Bill, 2023

Context:

The Lok Sabha recently passed the Offshore Areas Minerals (Development and Regulation) Amendment Bill, 2023.

Relevance :

GS II: Polity and Governance

Dimensions of the Article:

- Offshore Areas Minerals (Development and Regulation) Amendment Bill, 2023

- Key Highlights

Offshore Areas Minerals (Development and Regulation) Amendment Bill, 2023:

- The Bill seeks to amend the Offshore Areas Mineral (Development and Regulation) Act, 2002.

- It is aimed at regulating mining activities in maritime zones of India.

Key Highlights:

Reservation of Offshore Areas:

- The government will have the authority to reserve offshore areas not held under any operating rights.

Composite Licence and Production Lease:

- The administering authority can grant a composite licence or production lease to the government or a government company.

Fixed Period for Production Lease:

- The provision for the renewal of production lease will be removed.

- A fixed period of fifty years for production lease will be provided, similar to the provisions of the Mines and Minerals (Development and Regulation) Act 1957.

Private Sector Participation through Auction:

- Production lease to the private sector will be granted only through auction by competitive bidding.

Operating Rights for Government Entities:

- Operating rights can be granted without competitive bidding to government entities or corporations in mineral-bearing areas reserved by the central government.

Atomic Minerals Allocation:

- In the case of atomic minerals, exploration licence or production lease will be granted only to a government or a government corporation.

Timelines for Commencement and Re-commencement:

- A four-year timeline will be introduced for the commencement of production and dispatch after the execution of the composite licence or production lease.

- A two-year timeline (extendable by one year) will be set for re-commencement of production and dispatch after discontinuation.

Conservation and Environmental Protection:

- The central government will be empowered to frame rules for the conservation and systematic development of minerals in offshore areas.

- Rules will also be formulated to prevent or control pollution caused by exploration or production operations, with a focus on protecting the environment.

-Source: Indian Express