CONTENT

- New policy of UPI for NRIs

- Judicial majoritarianism

- New tax regime

- Lab-grown diamonds

- Budget 2023: Conservation initiatives

- Pradhan Mantri Awas Yojana

- Unity mall

New Policy of UPI for NRIs

Context:

Recently, the National Payments Corporation of India (NPCI) paved the way for international (phone) numbers to be able to transact using UPI.

Relevance:

GS III: Indian Economy

Dimensions of the Article:

- UPI Transactions for Non-Resident Accounts

- Discussion on Merchant Discount Rate (MDR)

- What is Unified Payments Interface (UPI)?

- National Payments Corporation of India

UPI Transactions for Non-Resident Accounts

- The National Payments Corporation of India (NPCI) has allowed non-resident accounts such as Non-Resident External (NRE) and Non-Resident Ordinary (NRO) accounts with international numbers into the UPI payment system.

- The facility is currently available for users from ten countries – Singapore, Australia, Canada, Hong Kong, Oman, Qatar, the U.S., Saudi Arabia, UAE, and the U.K.

Definition of NRE and NRO Accounts:

- NRE accounts are used by non-residents to transfer earnings from foreign soil to India

- NRO accounts are used to manage income earned in India by non-residents such as rent, interest, pension, etc.

Benefits:

- The development allows NRIs to use the UPI payment method for making utility bill payments, purchases from e-commerce platforms, and payments to physical merchants who accept UPI QR payments when they travel to India.

Technological Changes:

- According to Deep Agrawal, Head of Payments at PhonePe, a significant number of systems will need to start understanding the international numbers for UPI transactions as all the internal systems and banks currently only understand India-based mobile numbers.

Discussion on Merchant Discount Rate (MDR)

- Definition: Merchant Discount Rate (MDR) is a charge recovered by the acquirer from the merchant to compensate the various service providers and intermediaries in the payment system.

- Current Status: Currently, no MDR charge is levied for RuPay-based debit card and UPI transactions.

- The NPCI has requested the incentivization of BHIM-UPI and RuPay debit card transactions to create a cost-effective proposition for ecosystem stakeholders, increase merchant acceptance, and encourage faster migration from cash payments to digital payments.

Concerns:

- The lack of MDR charge has raised concerns among stakeholders over cost recovery for the services they provide.

- The Reserve Bank of India (RBI) and various stakeholders have expressed concerns about the potential adverse impact of the zero MDR regime on the growth of the digital payment ecosystem.

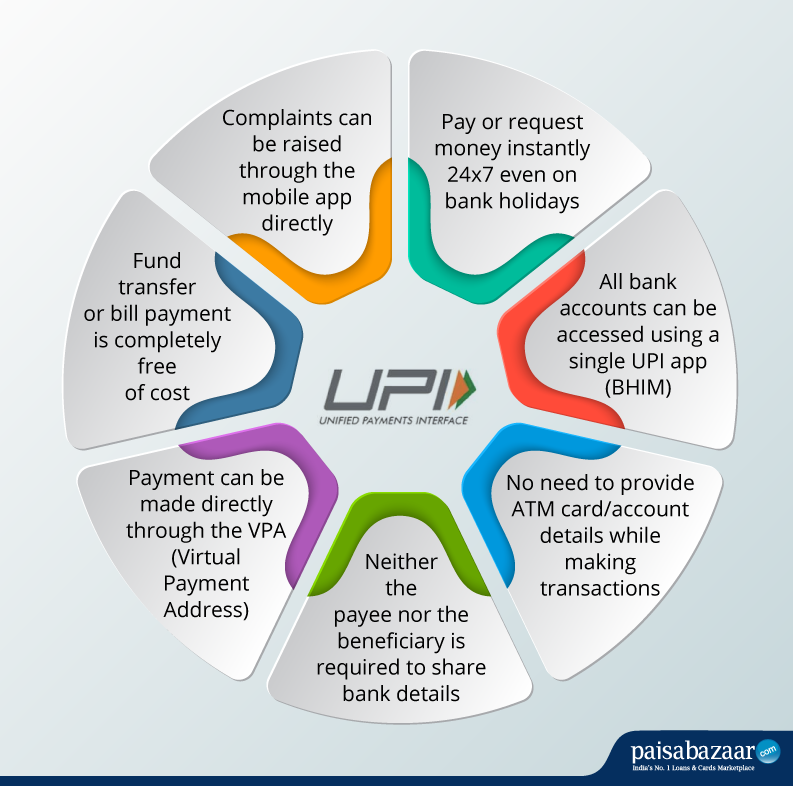

What is Unified Payments Interface (UPI)?

- Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood.

- UPI, which was introduced in 2016, has become one of the most used digital payments platforms in the country.

- The volume of UPI transactions has already reached ₹76 lakh crore in the current year, compared to ₹41 lakh crore in FY21 ,

- Advantages of UPI Includes – Immediate money transfer through mobile device round the clock 24*7 and 365 days.

- UPI Enables Single mobile application for accessing different bank accounts with Single Click 2 Factor Authentication – Aligned with the Regulatory guidelines yet provides for a very strong feature of seamless single click payment.

- It also features Virtual address of the customer for Pull & Push providing for incremental security with the customer not required to enter the details such as Card no, Account number; IFSC etc.

Where does UPI stand now?

- As of latest available data, 6,779.6 million transactions worth about ₹10.95 lakh crore have been facilitated using UPI.

- As per the DigiDhan dashboard maintained by the Ministry of Electronics and Information Technology, BHIM-UPI accounted for 52% of all digital payments in FY 2021-22. At present, it stands at 59.74%.

National Payments Corporation of India

- National Payments Corporation of India (NPCI), an umbrella organisation for operating retail payments and settlement systems in India, is an initiative of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007.

- It is a “Not for Profit” Company under the provisions of Section 25 of Companies Act 1956 (now Section 8 of Companies Act 2013), with an intention to provide infrastructure to the entire Banking system in India for physical as well as electronic payment and settlement systems.

-Source: The Hindu

Judicial Majoritarianism

Context:

As the recent majority judgment of the Supreme Court on demonetisation comes under criticism, the minority judgment by J. Nagarathna is being hailed for its challenge to the RBI’s institutional acquiescence to the Central government. This questions our blind acceptance of numerical majorities in judicial decision-making.

Relevance:

GS II: Polity and Governance

Dimensions of the Article:

- What is judicial majoritarianism?

- Heart of the Debate

What is judicial majoritarianism?

- As opposed to standard matters heard by Division Benches consisting of two judges, numerical majorities are of particular importance to cases which involve a substantial interpretation of constitutional provisions.

- In such cases, Constitutional Benches, consisting of five or more judges, are set up in consonance with Article 145(3) of the Constitution. Such Benches usually consist of five, seven, nine, 11 or even 13 judges.

- This is done to facilitate decision-making by ensuring numerical majorities in judicial outcomes.

- The requirement for a majority consensus flows from Article 145(5) of the Constitution which states that no judgment in such cases can be delivered except with the concurrence of a majority of the judges but that judges are free to deliver dissenting judgments or opinions.

Heart of the Debate:

The Role of Judges in Resolving Disagreements:

- Unlike representatives in legislative bodies who may rely on intuition or public opinion, judges are experts in law and are familiar with the arguments for and against a particular issue.

- Despite this, Jeremy Waldron raises the question of why judges still resort to head-counting to resolve disputes among them.

Differences in Judicial Decisions:

- All judges in a particular bench make their ruling based on the same set of arguments and written submissions.

- Differences in judicial decisions can be attributed to differences in the methodology and logic applied by judges or, as legal realists such as Jerome Frank suggest, to their own “judicial hunches,” which may be influenced by their personal experiences, perspectives, and biases.

- In such cases, it is possible that the majority may make methodological errors or be limited by their “judicial hunch.”

- Even a well-reasoned minority decision may not receive much weight in terms of its outcomes.

- There are several examples of meritorious dissents in constitutional history, such as the dissenting opinion of Justice H.R. Khanna in the case of A.D.M. Jabalpur v. Shivkant Shukla (1976) and the dissenting opinion of Justice Subba Rao in the case of Kharak Singh v. State of U.P. (1962).

Influence on the Rate of Dissent:

- The rate of dissent is subject to various influences, such as the political climate at the time.

- A study by Yogesh Pratap Singh, Afroz Alam, and Akash Chandra Jauhari (2016) found that the rate of judicial dissent during the Emergency in 1976 was only 1.27% compared to 10.52% in 1980.

- The study also found that the rate of dissent was lower when the Chief Justice was part of the bench compared to when the Chief Justice was not present.

- Such findings raise questions about the efficiency and desirability of head-counting procedures for determining questions of national and constitutional importance.

-Source: The Hindu

New Tax Regime

Context:

Finance Minister made five major announcements on personal income tax to benefit the “hard-working” middle class. She also said that while the new tax regime would be the default, tax payers could opt for the old one.

Relevance:

GS III: Indian Economy

Dimensions of the Article:

- Details

- New income tax slabs

- What is the new tax regime?

- Who is eligible for rebates under the old tax regime?

Details:

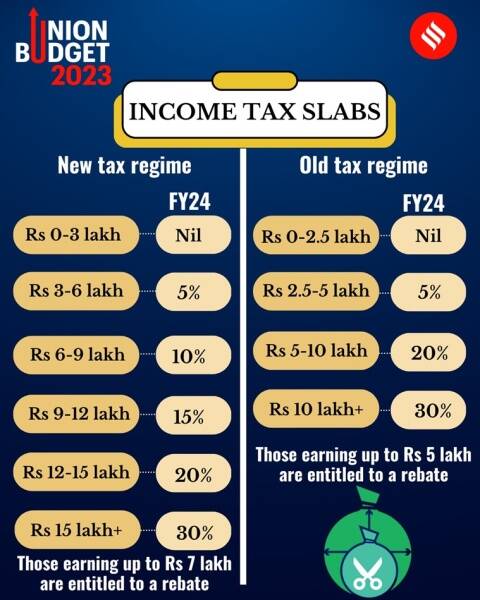

- FM proposed to raise the rebate limit from Rs 5 lakh to Rs 7 lakh in the new tax regime.

- Therefore, if an individual has opted for the new tax regime, he or she will not be required to pay any tax up to an annual income of Rs 7 lakh.

New income tax slabs

The new income tax slabs under the new tax regime are

- Rs 0-3 lakh: Nil

- Rs 3-6 lakh: 5 per cent

- Rs 6-9 lakh: 10 per cent

- Rs 9-12 lakh: 15 per cent

- Rs 12-15 lakh: 20 per cent

- Over Rs 15 lakh: 30 per cent

- The move is aimed at incentivising people to shift to the new tax regime, which has not seen much traction since launch in FY21.

What is the new tax regime?

Lower tax regime for individuals

- The lower tax regime for individuals was introduced in 2020 under Section 115BAC as a simpler alternative, without claiming any investment-related deductions or exemptions.

- This was expected to prove useful for individuals who were not in a position to invest and claim deductions. The new regime had more slabs than the previous one.

- However, this regime has not seen many takers so far, as it is considered more complicated.

More Slabs than the Old Regime:

- The new regime was designed to be useful for individuals who were not able to invest and claim deductions.

- However, the new regime has more slabs than the previous one, which only had three tax slabs of 10%, 20%, and 30%. As a result, this regime has not been well received so far, as it is considered more complicated.

Response to Criticism:

- In January, Finance Minister responded to criticism that the new voluntary income tax regime had removed the simplicity of the old one.

- She assured that the gains of simplicity from the old regime have not been reversed and that the new regime is aimed at removing harassment in the tax assessment process.

Parallel System with No Exemptions:

- Sitharaman explained that the old tax regime was full of exemptions, with every tax assessee having 7 to 10 exemptions.

- Despite this, the rate of 10%, 20%, and 30% continues even today.

- To keep the simplicity and not deny those who want to keep the old system, the old regime was kept intact while a parallel system was created with no exemptions but with simpler, more favorable rates.

- The reason for introducing seven slabs in the new regime was to provide simpler and lower rates for those with lower incomes.

Who is eligible for rebates under the old tax regime?

- Under this regime, people can cite investments, house rent, LTA, exemptions under Section 80C, etc. to reduce the amount of tax they have to pay.

- However, some experts believe this means a higher burden of compliance on taxpayers.

-Source: Indian express

Lab-Grown Diamonds

Context:

Finance Minister highlighted the government’s emphasis on lab-grown diamonds during her Budget speech. She announced a reduction in customs duty on seeds used in the production of lab-grown diamonds and the provision of a grant to Indian Institutes of Technology to promote the development of lab-grown diamonds in India.

Relevance:

GS III: Science and Technology

Dimensions of the Article:

- What are lab grown diamonds?

- How are LDGs produced?

- What are Lab-Grown Diamonds (LDGs) used for?

What are lab grown diamonds?

- Lab grown diamonds are diamonds that are produced using specific technology which mimics the geological processes that grow natural diamonds.

- They are not the same as “diamond simulants” – LDGs are chemically, physically and optically diamond and thus are difficult to identify as “lab grown.”

- While materials such as Moissanite, Cubic Zirconia (CZ), White Sapphire, YAG, etc. are “diamond simulants” that simply attempt to “look” like a diamond, they lack the sparkle and durability of a diamond and are thus easily identifiable.

- However, differentiating between an LDG and an Earth Mined Diamond is hard, with advanced equipment required for the purpose.

How are LDGs produced?

- The most common (and cheapest) is the “High pressure, high temperature” (HPHT) method.

- As the name suggests, this method requires extremely heavy presses that can produce up to 730,000 psi of pressure under extremely high temperatures (at least 1500 celsius).

- Usually graphite is used as the “diamond seed” and when subjected to these extreme conditions, the relatively inexpensive form of carbon turns into one of the most expensive carbon forms.

- Other processes include “Chemical Vapor Deposition” (CVD) and explosive formation that creates what are known as “detonation nanodiamonds”.

What are Lab-Grown Diamonds (LDGs) used for?

- LDGs have properties similar to natural diamonds, including their optical dispersion which gives them the diamond sheen.

- They are often used for industrial purposes in machines and tools due to their hardness and extra strength.

- LDGs have high thermal conductivity but negligible electrical conductivity which makes them valuable for electronics.

- With the depletion of natural diamonds, LDGs are becoming a replacement for the precious gemstone in the jewelry industry.

- The growth in production of LDGs does not affect India’s established diamond industry that involves polishing and cutting of diamonds.

-Source: Indian express

Budget 2023: Conservation Initiatives

Context:

Finance Minister budget speech introduced schemes and policies aimed at ecological conservation. Targeting an array of different issues, these schemes come with the promise of preserving India’s ecological health.

Relevance:

GS III: Environment and Ecology

Dimensions of the Article:

- MISHTI (Mangrove Initiative for Shoreline Habitats & Tangible Incomes)

- PM PRANAM (Prime Minister Programme for Restoration, Awareness, Nourishment and Amelioration of Mother Earth)

- Amrit Dharohar

MISHTI (Mangrove Initiative for Shoreline Habitats & Tangible Incomes)

- MISHTI is a new programme that will facilitate mangrove plantation along India’s coastline and on salt pan lands.

- The programme will operate through “convergence between MGNREGS, Campa Fund and other sources.

- This new programme will aim at intensive afforestation of coastal mangrove forests.

- India has such forests on both its Eastern and Western coasts with the Sundarbans in Bengal being one of the largest mangrove forests on the planet.

Importance of Mangroves

- Mangroves are not just some of the most bio-diverse locations in India, they also protect the coastlines from the vagaries of inclement weather.

- As climate change increases the incidence of extreme weather events across the world, mangrove plantations have shown to make coastal lands resilient, preventing flooding, land erosion and acting as a buffer for cyclones.

- Furthermore, they are also excellent carbon sinks. Mangrove trees can grow in saline waters, and can sequester up to four times more carbon than tropical rainforests.

PM PRANAM (Prime Minister Programme for Restoration, Awareness, Nourishment and Amelioration of Mother Earth)

- This programme will seek to incentivise states and union territories promoting alternative fertilisers and the balanced use of chemical fertilisers.

- The programme aims to ultimately bring down the government’s subsidy burden, which is estimated to reach Rs 2.25 lakh crore in 2022-23: 39 per cent higher than last year’s figure of Rs 1.62 lakh crore.

Bhartiya Prakritik Kheti Bio-Input Resource Centres

- To further facilitate the adoption of “natural farming,” 10,000 Bio-Input Resource Centres will be set-up, creating a national-level distributed micro-fertiliser and pesticide manufacturing network.

- This will impact over 1 crore farmers over the next three years, the finance minister said in her speech.

Impact of Chemical fertilisers :

- Chemical fertilisers revolutionised agriculture when they were introduced, more than half a century ago. However, they also pose multiple risks that are increasingly being understood by scientists.

- They are known to be a major source of water pollution – impacting both groundwater and rivers, ponds and lakes.

- Eutrophication caused by excessive use of chemical fertilisers is a death knell for fishes and other aquatic life, often covering lakes and ponds with a thick layer of algae and reducing the oxygen content in the water.

- Over a long period of time, they can also harm the soil, causing acidification, and hence have an impact on the land’s productivity.

- Lastly, studies have found a link between the excessive use of chemical fertilisers and incidence of cancer among farmers.

- The challenge for today’s scientists and policy makers is to slowly wean the agricultural economy of chemical fertilisers while maintaining the high yields that they provide.

Amrit Dharohar

- Three-year scheme aimed at preserving and enhancing the benefits of wetlands

- Emphasis on local communities as caretakers of the ecosystem

- Encourages optimal use of wetlands for the benefits of bio-diversity, carbon stock, eco-tourism, and local income generation

Importance of Wetlands

- Recognized by Prime Minister Narendra Modi as important ecosystems with a total of 75 Ramsar sites in India

- Ramsar sites designated as wetlands of international importance under the criteria of the Ramsar Convention on Wetlands (1971)

- Cover a total of 1,326,678 hectares in India and provide important habitats for a diverse range of flora and fauna, including endangered aquatic life and migratory birds

- 49 new sites have been added to the list since 2019, with 19 added in 2022

-Source: Indian express

Pradhan Mantri Awas Yojana

Context:

Giving a huge boost to affordable housing, the Union Budget presented increased the allocation for the Prime Minister Awas Yojana (PMAY) by 66%.

- Finance Minister also announced an Urban Infrastructure Development Fund (UIDF), which will be used to create urban infrastructure in Tier 2 and Tier 3 cities.

Relevance:

GS-II: Social Justice (Welfare Schemes, Government Policies and Interventions)

Dimensions of the Article:

- Pradhan Mantri Awas Yojana (PMAY- U: Housing for All – Urban)

- Pradhan Mantri Awaas Yojana- Gramin (PMAY-G)

Pradhan Mantri Awas Yojana (PMAY- U: Housing for All – Urban)

- The Pradhan Mantri Awas Yojana (Urban) Programme launched by the Ministry of Housing and Urban Poverty Alleviation (MoHUPA), in Mission mode envisions provision of Housing for All by 2022, when the Nation completes 75 years of its Independence.

- The Mission seeks to address the housing requirement of urban poor including slum dwellers through following programme verticals:

- Slum rehabilitation of Slum Dwellers with participation of private developers using land as a resource

- Promotion of Affordable Housing for weaker section through credit linked subsidy

- Affordable Housing in Partnership with Public & Private sectors

- Subsidy for beneficiary-led individual house construction /enhancement.

- The mission seeks to address the housing requirement of urban poor including slum dwellers. A slum is defined as a compact area of at least 300 people or about 60 – 70 households of poorly built congested tenements in unhygienic environment usually with inadequate infrastructure and lacking in proper sanitary and drinking water facilities.

- Mission will be implemented as Centrally Sponsored Scheme (CSS) except for the component of credit linked subsidy which will be implemented as a Central Sector Scheme.

- “Housing for All” Mission for urban area is being implemented during 2015-2022 and this Mission will provide central assistance to implementing agencies through States and UTs for providing houses to all eligible families/beneficiaries by 2022.

Coverage area

The Mission covers the entire urban area consisting of:

- Statutory Towns

- Notified Planning Areas

- Development Authorities

- Special Area Development Authorities

- Industrial Development Authorities or

- Any such authority under State legislation which is entrusted with the functions of urban planning & regulations

Pradhan Mantri Awaas Yojana- Gramin (PMAY-G)

- The Pradhan Mantri Awaas Yojana- Gramin (PMAY-G) was launched to achieve the objective of “Housing for All” by 2022. The erstwhile rural housing scheme Indira Awaas Yojana (IAY) was restructured to Pradhan Mantri Awaas Yojana-Gramin (PMAY-G).

- Ministry of Rural development is involved in the implementation of Pradhan Mantri Awaas Yojana- Gramin (PMAY-G).

- PMAY-G aims to provide a pucca house with basic amenities to all rural families, who are homeless or living in kutcha or dilapidated houses by the end of March 2022 and also to help rural people Below the Poverty Line (BPL) in construction of dwelling units and upgradation of existing unserviceable kutcha houses by providing assistance in the form of a full grant.

- People belonging to SCs/STs, freed bonded labourers and non-SC/ST categories, widows or next-of-kin of defence personnel killed in action, ex-servicemen and retired members of the paramilitary forces, disabled persons and minorities will be the target beneficiaries of the PMAY-G.

- The cost of unit assistance is shared between Central and State Governments in the ratio 60:40 in plain areas and 90:10 for North Eastern and hilly states.

-Source: The Hindu

Unity Mall

Context:

Finance Minister announced in the Budget that states would be encouraged to set up a “Unity Mall” in their capitals, their most prominent tourism centres, or their financial capitals.

Relevnace:

GS III: Indian Economy

Dimensions of the Article:

- What is a unity mall?

- What is ODOP?

- What is GI?

What is a unity mall?

- The FM did not specify what the “unity mall” would be, its physical or non-physical structure, or how it would work.

- However, she said that the unity malls would focus on the promotion and sale of the state’s own “ODOPs (one district, one product), GI products and other handicraft products, and for providing space for such products of all other States”.

Ekta Mall:

- Ekta Mall is operational near the Statue of Unity, located about 3.5 km away from the statue at Ekta Nagar in Kevadia.

- The Ekta Mall – Unity in Handicrafts Diversity is a showroom of handicrafts from different states of India.

- Spread over 35000 square-feet area of two floors, the mall has 20 emporiums dedicated to states’ traditional textiles and artisanal handicrafts.

What is ODOP?

- One District, One Product is an initiative by the government which aims to make regional products more accessible, while providing capital to those who produce them.

- Under the scheme, the State identifies the chief product for a district, and then offers support for its processing, storage and marketing.

- These products can be perishable agri produce, cereal-based products or food products like mango, potato, meat and fisheries.

- The scheme also supports traditional and innovative products including waste-to-wealth products, such as honey and herbal edible products.

What is GI?

- A geographical Indication (GI) tag is given to agricultural, natural or manufactured products that originate from a specific geographical area due to which they possess unique characteristics and qualities, according to the Agricultural and Processed Food Products Export Development Authority (APEDA).

- Essentially, the tag guarantees that the product is coming from that specific area. It’s kind of a trademark in the international market.

-Source: Indian express